Healthcare Interoperability Solutions Market Size, Growth, Report 2033

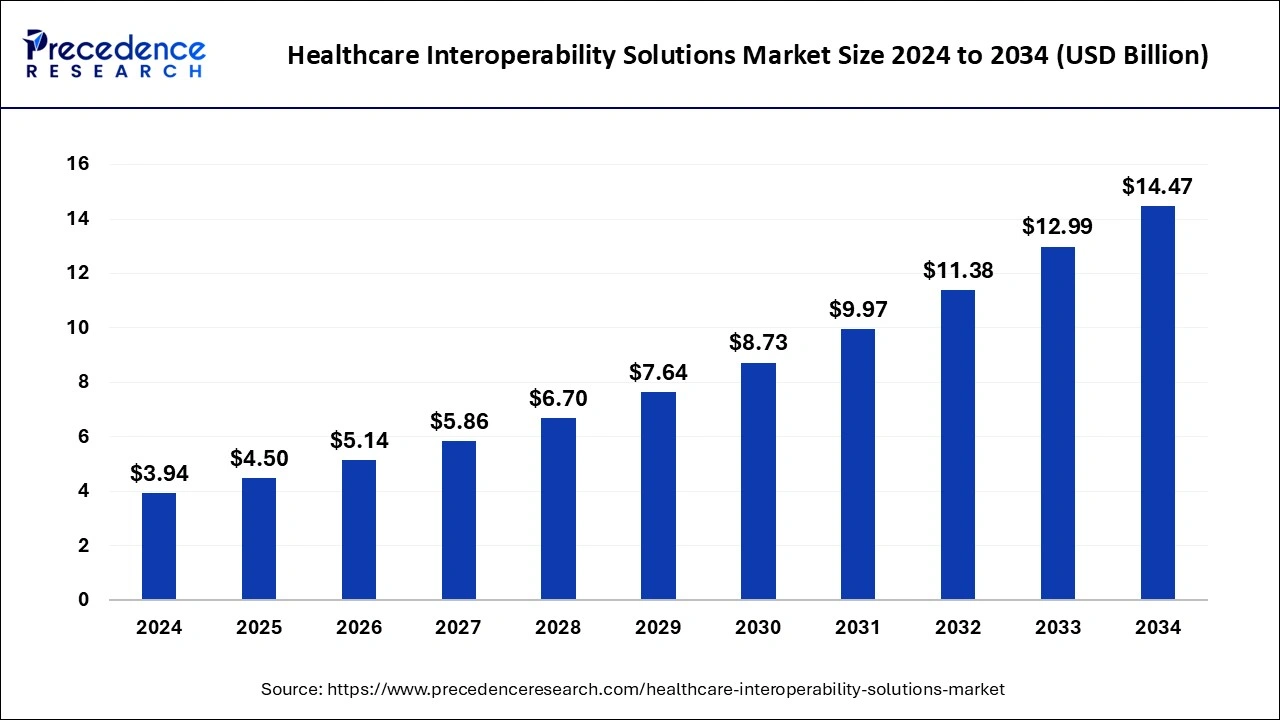

The global healthcare interoperability solutions market size is expected to increase USD 12.99 billion by 2033 from USD 3.45 billion in 2023 with a CAGR of 14.18% between 2024 and 2033.

Key Points

- The North America healthcare interoperability solutions market size was evaluated at USD 1.45 billion in 2023 and is expected to attain around USD 5.52 billion by 2033, poised to grow at a CAGR of 14.30% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 42% in 2023.

- Europe is expected to host the fastest-growing market during the forecast period.

- By type, the service segment has held a biggest revenue share of 56% in 2023.

- By type, the solution segment is expected to witness the fastest growth in the market during the forecast period.

- By level, the structural segment led the market in 2023.

- By level, the foundational segment is expected to grow rapidly in the market during the forecast period.

- By deployment method, the on-premise segment held the largest share of the market in 2023.

- By deployment method, the cloud-based segment is expected to grow rapidly in the market during the forecast period.

- By application, the diagnosis segment led the market in 2023.

- By application, the other segment is expected to expand rapidly in the market during the forecast period.

- By end use, the hospital segment has contributed more than 49% of revenue share in 2023.

- By end use, the ambulatory surgical centers segment is expected to grow rapidly in the market during the forecast period.

The healthcare interoperability solutions market is experiencing rapid growth driven by the increasing need for seamless exchange of patient information across various healthcare providers and systems. Interoperability solutions aim to enhance the efficiency of healthcare delivery by enabling different healthcare IT systems and software applications to communicate, exchange data, and use the information effectively. This market encompasses a wide range of technologies and services designed to overcome the barriers that traditionally hindered data sharing and integration in healthcare settings.

Get a Sample: https://www.precedenceresearch.com/sample/4453

Growth Factors

Several factors contribute to the growth of the healthcare interoperability solutions market. Firstly, government initiatives and regulations, such as the promotion of electronic health records (EHRs) and initiatives like Meaningful Use in the United States, have pushed healthcare providers towards adopting interoperable solutions. Secondly, the increasing adoption of healthcare IT systems and the digitization of healthcare data are driving the demand for interoperability solutions. Thirdly, the growing emphasis on patient-centric care and the need for coordinated healthcare delivery across different care settings further fuel the demand for interoperability solutions.

Region Insights

The healthcare interoperability solutions market exhibits varying dynamics across different regions. North America, particularly the United States, holds a dominant position due to early adoption of EHR systems and stringent regulations promoting interoperability. Europe follows closely, with countries like the UK and Germany focusing on integrating healthcare systems across the European Union. Asia-Pacific is expected to witness significant growth, driven by increasing healthcare expenditure, rapid adoption of healthcare IT solutions, and government initiatives to improve healthcare infrastructure.

Healthcare Interoperability Solutions Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 3.45 Billion |

| Market Size in 2024 | USD 3.94 Billion |

| Market Size by 2033 | USD 4.50 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 14.18% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, level, Deployment Method, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Healthcare Interoperability Solutions Market Dynamics

Drivers

Key drivers influencing the healthcare interoperability solutions market include technological advancements in healthcare IT, such as cloud computing and application programming interfaces (APIs), which facilitate data exchange and integration. Additionally, the shift towards value-based care models that require seamless information sharing among healthcare providers to improve patient outcomes and reduce costs is a significant driver. Moreover, the increasing prevalence of chronic diseases and the need for comprehensive patient data access contribute to the adoption of interoperability solutions.

Opportunities

The healthcare interoperability solutions market presents several opportunities for growth and innovation. Expansion of telehealth and remote patient monitoring services during the COVID-19 pandemic has accelerated the adoption of interoperability solutions to support virtual care delivery. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) technologies with interoperable systems holds promise for enhancing clinical decision-making and predictive analytics. Moreover, partnerships and collaborations between healthcare providers, IT vendors, and technology developers create opportunities for developing advanced interoperability solutions tailored to specific healthcare challenges.

Challenges

Despite the growth prospects, the healthcare interoperability solutions market faces several challenges. Interoperability standards and data governance issues remain significant hurdles, as healthcare systems often use different data formats and standards. Privacy and security concerns related to the sharing of sensitive patient information pose challenges in implementing interoperable solutions. Moreover, the complexity of integrating legacy IT systems with modern interoperability technologies can be a barrier for healthcare organizations. Additionally, the initial investment and ongoing costs associated with implementing interoperability solutions may deter smaller healthcare providers from adopting these technologies.

Read Also: IoT Security Market Size, Trends, Report By 2033

Healthcare Interoperability Solutions Market Companies

- Allscripts Healthcare Solutions

- InterSystems Corporation

- NextGen Healthcare Inc.

- Oracle Cerner

- Epic Systems

Recent Developments

- In February 2024, in order to help healthcare companies meet the requirements for Generative AI (Gen AI) solutions related to quality, trust, and reliability, CitiusTech, a leading provider of healthcare technology services and solutions, announced that it has introduced an industry-first solution.

- In April 2024, The Netsmart Marketplace is unveiled by Netsmart, a market leader in healthcare IT solutions and services for community-based providers. One of the biggest networks of technology and service providers is housed within the Netsmart Marketplace, providing a wide range of integrated products and services to support the changing demands of value-based healthcare delivery.

Segment Covered in the Report

By Type

- Service

- Solution

By level

- Structural

- Foundational

- Semantic

By Deployment Method

- On-premise

- Cloud-based

By Application

- Diagnosis

- Treatment

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/