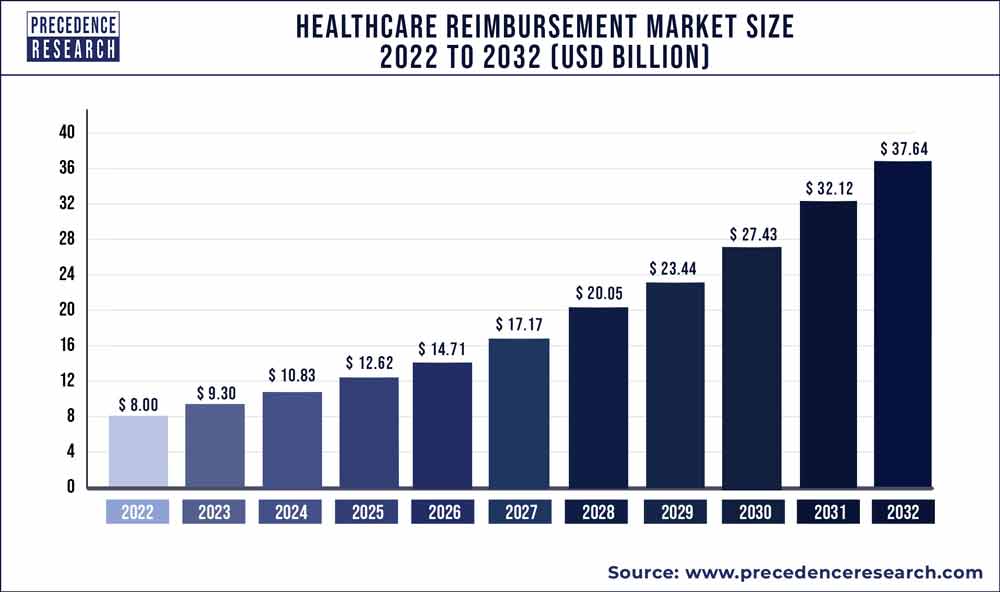

Healthcare Reimbursement Market Size to Touch US$ 17.63 Trillion By 2030

The healthcare reimbursement market size exceeded 4.75 trillion in 2021, grew to US$ 5.49 trillion USD in 2022, and is projected to reach US$ 17.63 trillion by 2030, growing at a CAGR of 15.7% every year, according to a 2021 study by Precedence Research, the Canada-based market Insight Company.

The base year for the study has been considered 2021, the historic year 2017 and 2020, the forecast period considered is from 2022 to 2030. The healthcare reimbursement market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Payment that clinics, diagnostic centers, medical doctors, and other medical care professionals receive for providing medical services to individuals is known as health-related reimbursement. Usually the cashless system is the optimum approach of processing claim and reimbursements. Throughout this, the covered by insurance patient goes to be able to the provider together with receives care. On discharge, the person walks out without paying any cash.

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1586

Typically the bills and important documents are submitted to be able to the TPA who also reimburses the clinic. Later the TPA in that case submits the very same to the insurance firm (be it typically the organizer or typically the insurance company) who also then reimburses the TPA. However, the TPA and the insurance provider needs to be able to monitor the volumes closely, in order that exactly where the patient possesses exceeded their restrictions, the balance funds is recovered via the patient on the time involving discharge.

Healthcare Reimbursement Market Scope

| Report Coverage | Details |

| Market Size by 2030 | USD 17.63 trillion |

| Growth Rate from 2022 to 2030 | CAGR of 15.7% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

Healthcare Reimbursement Market: Report Highlights

- Private hospitals were the leading segment in the healthcare reimbursement market in 2020. This is mainly because of increasing geriatric populace along with increasing number of surgical procedures.

- Private payers segment dominated the global healthcare reimbursement market. Due to the presence of a high number of private companies in the market, they are expected to stay dominant during the projected period.

Healthcare Reimbursement Market Dynamics

Driver

Increasing Demand for Insurance Policies Covering Entire Family Driving Market Growth

Although usage of telemedicine in the U.S. had already been least prior to COVID-19, interest in and application of telemedicine has broadened rapidly through the turmoil, as policymakers, health systems and insurance providers have looked for ways in order to deliver care to patients in their homes to limit transmitting of the story coronavirus. With growing with regard to telemedicine, several alteration have been made to telehealth coverage of entire family, coverage and setup, help to make telemedicine more highly accessible during the time of emergency.

Meanwhile, various commercial insurers have willingly addressed telemedicine in their reaction to Covid-19, concentrating on reducing or getting rid of cost sharing, increasing coverage of telemedicine and expanding in-network telemedicine providers. Well-being systems have swiftly adapted to put into action new telehealth programs or ramp upwards existing ones. This specific requires considerable financial and workforce investment, which may be more difficult for smaller or less-resourced practices.

Restraint

Fraudster Activities in Insurance Claims to Restraint Market Growth

There are several fraud activities through which consumers try to avail claims. Such activities include getting claims for items used for personal reasons; billing for travel and costs that never provided (canceled airline seat tickets, seminar or conference registration fees, college tuition reimbursement and professional dues payments), reimbursement for items that were never purchased (office items, gifts for clients).

Such factors pose threats for the companies. To avoid these, companies can keep a record of a travel reimbursement guidelines and policies that control this activity. Need of original documentation to be either posted with the reviews or maintained for a time framework for audit purposes. Initiating elegant review process in which a division manager or comparative reviews employees’ reviews. Payroll or prospecting should perform a cursory review as well. Awaiting a bigger problem to create will only be more difficult and costly to resolve later.

Read Also: Composites Market to Exceed US$ 163.14 Billion by 2030

Opportunities

Favorable reimbursement policies May Offer Promising Growth Opportunities.

Providing Ideal reimbursement policies will expand care distribution models beyond physical medicine to include behavioral health, digital wellness therapies, dental treatment, nutrition, and pharmaceutical drug management. The global aging population and an expanding midsection class are major contributors to the chronic disease pandemic and surging health care costs.

This season will be a crucial year for identifying value for health care innovation and technology for digital health solutions catering to aged care and chronic conditions management to bending health care cost curve. Telemedicine in emerging marketplaces will become more mainstream and will seek to become a managed service provider rather than being simply a telemedicine system. In addition, telemedicine will turn towards the open public health space as well, with countries around the world like Singapore is testing the programs in a regulating sandbox.

Challenges

Reaching the poor consumers is the major challenge for the insurance companies mainly in the developing regions. The major task in the sustainable reimbursement design that would include poor consumers will be to identify the particular poor families. Along with some with particular interventions, the poor consumers’ lists can be refined to ensure that fake positives and fake negatives are reduced.

More important, this kind of schemes should not really be reduced in order to populist measures. To become a sustainable design, such schemes must be functional for in long run with full security and then along with a tapering security over the following five years. By doing this, the people can have faith inside the insurance scheme and provider and consumers may even also get straight into the habit of having health insurance.

Some of the major market players operating in the industry are as follows:

- UnitedHealth Group

- Aviva

- Allianz

- CVS Overall health

- BNP Paribas

- Aetna

- Nippon Life Insurance policies

- WellCare Health Ideas

- Agile Health Insurance

- Violet Cross Blue Cover Association.

Segments Covered in the Report

By Claim

- Fully Paid

- Underpaid

By Payers

- Private

- Public

By Service Provider

- Hospitals

- Diagnostic Labs

- Physician Office

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Reimbursement Market

5.1. COVID-19 Landscape: Healthcare Reimbursement Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Reimbursement Market, By Claim

8.1. Healthcare Reimbursement Market, by Claim Type, 2022-2030

8.1.1. Fully Paid

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Underpaid

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Healthcare Reimbursement Market, By Payers

9.1. Healthcare Reimbursement Market, by Payers, 2022-2030

9.1.1. Private

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Public

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Healthcare Reimbursement Market, By Service Provider

10.1. Healthcare Reimbursement Market, by Service Provider, 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Diagnostic Labs

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Physician Office

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Healthcare Reimbursement Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Claim (2017-2030)

11.1.2. Market Revenue and Forecast, by Payers (2017-2030)

11.1.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Claim (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Payers (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Claim (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Payers (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Claim (2017-2030)

11.2.2. Market Revenue and Forecast, by Payers (2017-2030)

11.2.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Claim (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Payers (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Claim (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Payers (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Claim (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Payers (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Claim (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Payers (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Claim (2017-2030)

11.3.2. Market Revenue and Forecast, by Payers (2017-2030)

11.3.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Claim (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Payers (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Claim (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Payers (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Claim (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Payers (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Claim (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Payers (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Claim (2017-2030)

11.4.2. Market Revenue and Forecast, by Payers (2017-2030)

11.4.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Claim (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Payers (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Claim (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Payers (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Claim (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Payers (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Claim (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Payers (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Claim (2017-2030)

11.5.2. Market Revenue and Forecast, by Payers (2017-2030)

11.5.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Claim (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Payers (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Service Provider (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Claim (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Payers (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Service Provider (2017-2030)

Chapter 12. Company Profiles

12.1. UnitedHealth Group

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Aviva

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Allianz

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CVS Overall health

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. BNP Paribas

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Aetna

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Nippon Life Insurance policies

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. WellCare Health Ideas

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Agile Health Insurance

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Violet Cross Blue Cover Association.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Why Buy this Report?

The purpose of Precedence Research’s healthcare reimbursement market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1586

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://precedenceresearchnews.wordpress.com

Frequently Asked Questions:

[sc_fs_multi_faq headline-0=”h6″ question-0=”What is the current size of healthcare reimbursement market?” answer-0=”According to Precedence Research, the global healthcare reimbursement market size was reached at US$ 4.75 trillion in 2021 and is anticipated to reach US$ 17.63 trillion by 2030. ” image-0=”” headline-1=”h6″ question-1=”What will be the CAGR of healthcare reimbursement market?” answer-1=”The global healthcare reimbursement market is expected to drive growth at a CAGR of 15.7% from 2022 to 2030. ” image-1=”” headline-2=”h6″ question-2=”Who are the major players operating in the healthcare reimbursement market?” answer-2=”The expansion of the healthcare sector is also contributing towards the growth and development of the healthcare reimbursement market. ” image-2=”” headline-3=”h6″ question-3=”Which are the driving factors of the healthcare reimbursement market?” answer-3=”The driving factors of the healthcare reimbursement market are UnitedHealth Group, Aviva, Allianz, CVS Overall health, BNP Paribas, Aetna, Nippon Life Insurance policies, WellCare Health Ideas, Agile Health Insurance, Violet Cross Blue Cover Association. ” image-3=”” headline-4=”h6″ question-4=”Which region will lead the global healthcare reimbursement market?” answer-4=”North America region dominated the market in 2021 and will lead the market over the forecast period. ” image-4=”” count=”5″ html=”true” css_class=””]