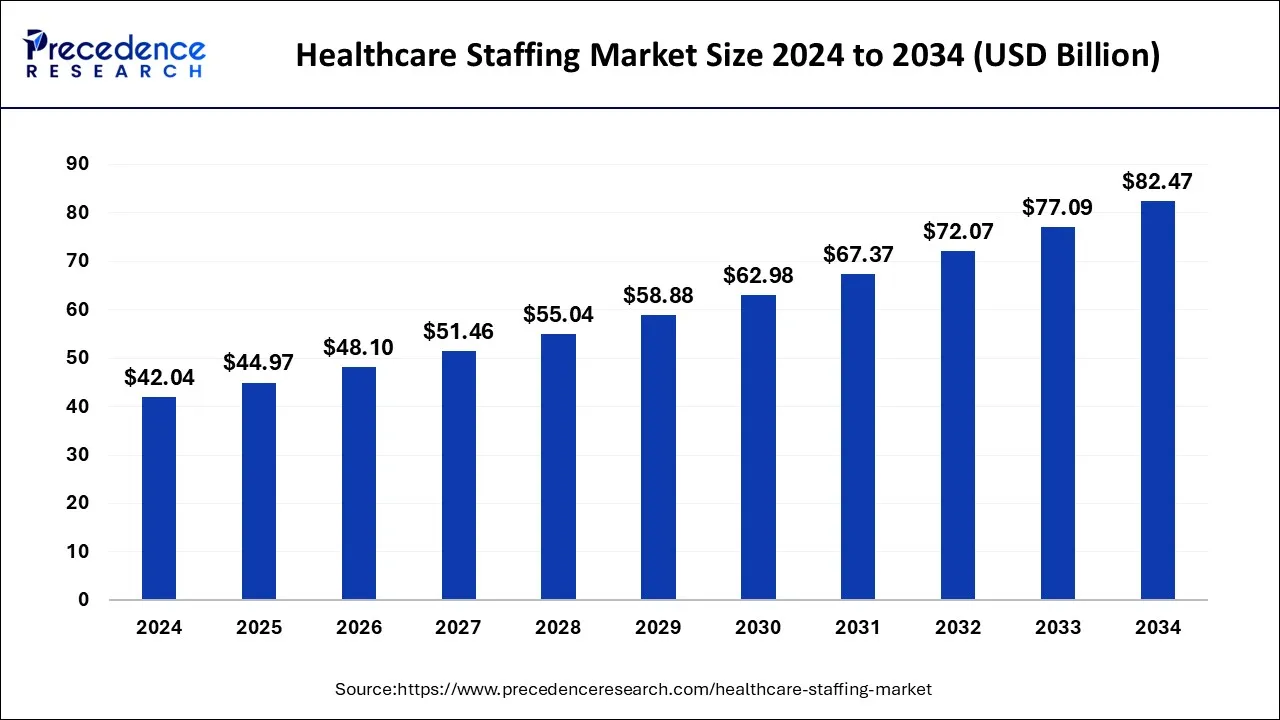

Healthcare Staffing Market to Reach USD 82.47 Bn by 2034.

List of Contents

ToggleThe global healthcare staffing market was valued at USD 42.04 billion in 2024 and is projected to reach USD 82.47 billion by 2034, growing at a CAGR of 5.39%.

The healthcare staffing market is experiencing significant growth, with North America holding the largest share of 57.90% in 2024. This growth is driven by the increasing demand for healthcare professionals, particularly in hospitals and other medical facilities. The Asia Pacific region is expected to witness robust growth with a CAGR of 7.8% during the forecast period, indicating rising investments and healthcare infrastructure development. The market is segmented by service types, with the travel nurse segment currently leading in market share, while the locum tenens service segment is projected to grow at the fastest rate. The hospital sector remains the largest end-user, highlighting the ongoing need for healthcare staffing solutions in medical institutions globally.

Healthcare Staffing Market Key Insights

- North America led the global healthcare staffing market with the largest share of 57.90% in 2024.

- Asia Pacific is anticipated to grow at a solid CAGR of 7.8% during the forecast period.

- The travel nurse segment held the highest market share by service type in 2024.

- The locum tenens service segment is projected to experience the fastest CAGR during the forecast period.

- The hospital segment was the leading end-user in the global healthcare staffing market in 2024.

Healthcare Staffing Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 44.97 Billion |

| Market Size by 2034 | USD 82.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.39% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service, By End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The healthcare staffing market is driven by several factors, including the increasing demand for healthcare professionals due to aging populations and the rise of chronic diseases. Additionally, the growth of healthcare infrastructure, particularly in emerging markets, has led to a higher demand for staffing solutions. The shortage of healthcare workers in many regions, especially in specialized fields, has further boosted the need for staffing services, including travel nurses and locum tenens professionals. Furthermore, the ongoing expansion of healthcare services, advancements in medical technology, and the growing emphasis on quality patient care are contributing to the increased demand for skilled healthcare personnel across various sectors.

Opportunities

- Expansion of healthcare infrastructure in emerging markets.

- Increased demand for specialized healthcare professionals, creating staffing opportunities.

- Growth in the telemedicine and home healthcare sectors, driving the need for healthcare workers.

- Advancements in healthcare technologies require specialized talent.

- Rising demand for travel nurses and locum tenens services to address workforce shortages

Challenges

- Shortage of qualified healthcare professionals in certain regions and specialties.

- High competition for talent, leading to increased recruitment costs.

- Regulatory and compliance challenges in different regions.

- Managing workforce turnover and maintaining staffing stability.

- The impact of economic downturns or pandemics on staffing demands and availability.

Regional Insights

North America dominates the global healthcare staffing market, accounting for the largest share of 57.90% in 2024. The region benefits from a well-established healthcare system and a high demand for healthcare professionals, particularly in hospitals and long-term care facilities. In contrast, Asia Pacific is expected to experience rapid growth, with a solid projected CAGR of 7.8% due to improvements in healthcare infrastructure and a growing need for skilled healthcare workers.

The demand for healthcare staffing services in countries like India and China is increasing as they work to expand their healthcare systems. Europe also contributes significantly to the market, driven by aging populations and a rising demand for healthcare professionals. Meanwhile, Latin America and the Middle East are witnessing growth in the sector as healthcare systems improve and private healthcare sectors expand.

Read Also: Medical Carts Market Size Analysis 2022 To 2030

Market Companies

- Almost Family

- Envision Healthcare Corporation

- inVentiv Health

- TeamHealth

- Maxim Healthcare Services, Inc.

- Cross Country Healthcare, Inc.

Recent Developments

Recent developments in the healthcare staffing market include a surge in the adoption of telehealth services, which has increased the demand for remote healthcare professionals. Additionally, many healthcare facilities are focusing on improving workforce management and flexibility by relying more on temporary and contract staffing services, such as travel nurses and locum tenens. There has also been a significant rise in the use of technology platforms to streamline the recruitment and placement of healthcare professionals. In response to the global shortage of healthcare workers, especially in specialized fields, several regions are introducing initiatives to attract and retain talent, including offering better compensation packages and implementing policies to ease the process of international healthcare worker certification. Moreover, the ongoing impact of the COVID-19 pandemic continues to influence demand patterns, with healthcare facilities facing greater pressure to meet staffing needs while ensuring staff safet

Segments Covered in the Report

By Service Type

- Travel Nurse Staffing

- Per Diem Nurse Staffing

- Locum Tenens Staffing

- Allied Healthcare Staffing

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- Private Sector

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa