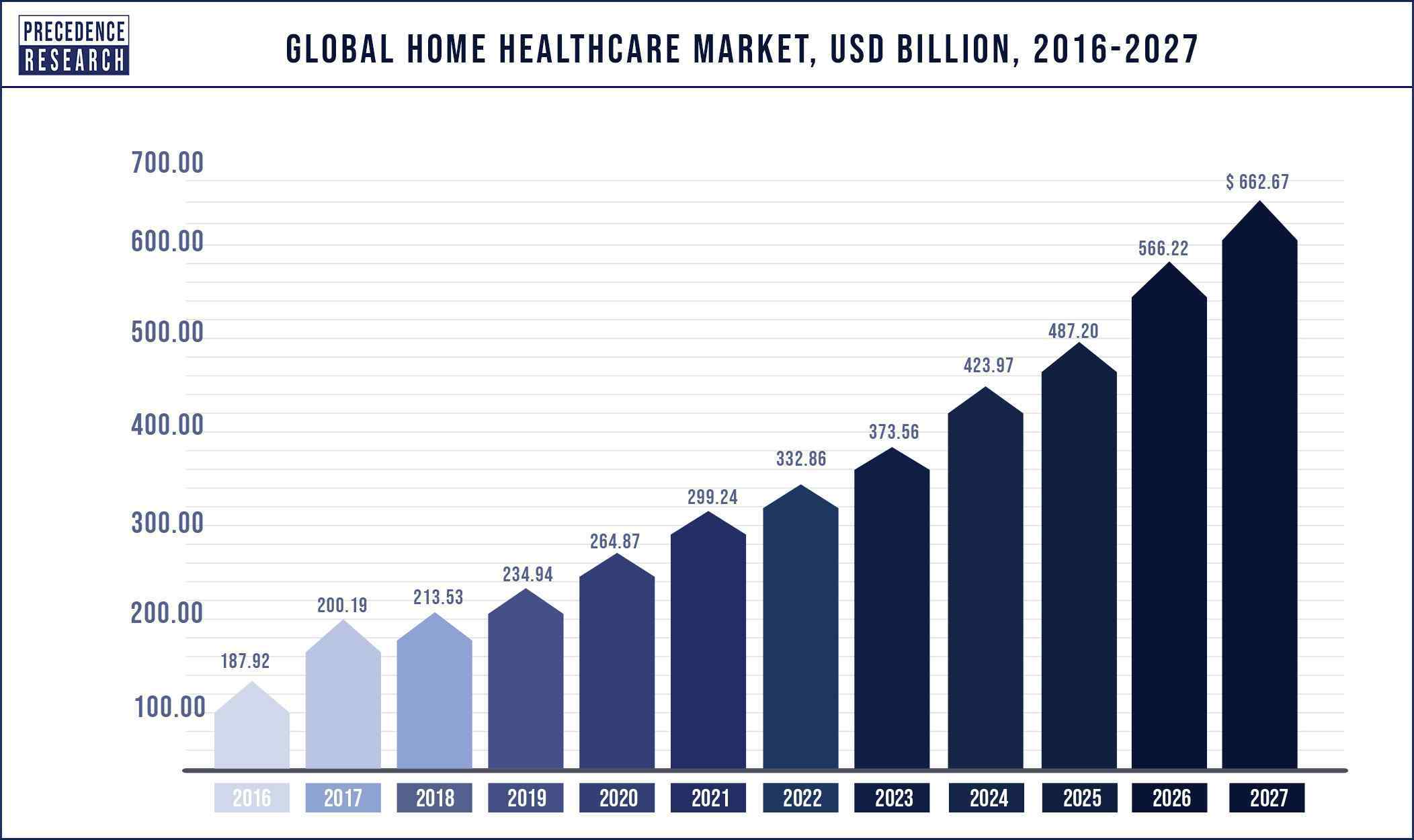

According to Precedence Research, The home healthcare market size garnered US$ 264.87 billion in 2020 and is expected to generate US$ 662.67 billion by 2030, manifesting a CAGR of 14.2% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The home healthcare market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1190

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers, novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the major players in the global home healthcare market include:

Manufacturers: –

- McKesson Medical-Surgical Inc.

- Fresenius Medical Care

- Becton, Dickinson And Company

- Arkray, Inc.

- Medline Industries, Inc.

- 3M Healthcare

- Baxter International Inc.

- Medtronic PLC

- Braun Melsungen AG

- ConvaTec Group PLC

- Molnlycke Health Care

- Acelity L.P.

- Hollister Inc.

- Others

Service Providers: –

- Sunrise Carlisle, LP

- Extendicare, Inc.

- Brookdale Senior Living, Inc.

- Home Health Services Ltd.

- Care UK Limited

- Kindred Healthcare, Inc.

- Genesis Healthcare Corp.

- Sompo Holdings, Inc.

- Home Instead Senior Care, Inc.

- Others

Home Healthcare Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Increasing healthcare expenditures are driving demand for low-cost home health services especially for long term care. Rapidly ageing population along with the growing trend of nuclear homes add boost to the market growth for home healthcare.

A range of medical services can be performed in the comfort of a patient’s own home to treat a disease or an injury. Home health care is typically less expensive, more convenient, and effective than treatment obtained in a hospital or skilled nursing facility (SNF). The possibilities for receiving home health care services for a patient are nearly limitless. Depending on the circumstances, care might range from nursing to specialized medical treatments such as diagnostic workups. The doctor will determine the treatment plan and any treatments that the patient may require at home. Depending on the patient’s health, home healthcare might last anywhere from a few days to several months.

Increased prevalence of chronic diseases and rapid rise in the older population

Almost every country in the globe is seeing an increase in the number of older people and the proportion of them in their population. In 2019, the world’s population of people aged 65 and up totaled 703 million. In 2050, the number of elderly people is expected to increase to 1.5 billion. The proportion of the world’s population aged 65 and up went from 6% in 1990 to 9% in 2019. By 2050, that percentage is expected to climb to 16%, implying that one in every six individuals on the planet would be 65 or older. Additionally, people in their old age are more prone to chronic diseases and require long-term medical care, fuelling the demand for home healthcare.

Global Home Healthcare Market, By Devices (US$ Bn) 2020-2027

| Devices | 2020 | 2021 | 2023 | 2025 | 2027 | CAGR % (2021-2027) | |

| Diagnostic & Monitoring Devices | 12.64 | 14.37 | 18.79 | 24.87 | 33.17 | 14.96 | % |

| Therapeutic Devices | 12.52 | 13.78 | 16.76 | 20.50 | 25.21 | 10.59 | % |

| Home Mobility Assist Devices | 19.05 | 20.60 | 23.97 | 27.70 | 31.81 | 7.51 | % |

| Total | 44.21 | 48.75 | 59.52 | 73.07 | 90.19 | 10.80 | % |

Increasing healthcare expenditures are fueling demand for low-cost home health care services

Healthcare costs are increasing all around the world due to advancements in technology, the complexity of procedures, multiple illnesses in patients, changing government policies, high insurance premiums, and limited coverage. For instance, healthcare costs have risen dramatically in the US over the past several decades. The American Medical Association (AMA) identified three key factors driving healthcare costs, viz., population growth, population aging, and rising prices. Besides these, disease prevalence or incidence of medical service utilization is other vital factors fueling healthcare costs as well. Moreover, the high insurance premiums, increasing medical costs, and government policies are factors driving the demand for home healthcare services and products. This is, in particular true, for patients suffering from long-term ailments. Moreover, home healthcare services are comparatively cheaper than in-facility care. The cumulative effect of these factors is driving the home healthcare market.

KEY HIGHLIGHTS OF THE STUDY

- The services segment is estimated to grow at the remarkable rate and accounted the largest share throughout the study period.

- Branded generics dominate the generic drugs market in 2020, however pure generics is anticipated to surpass branded generics by 2027.

- Asia Pacific region is projected to grow at the fastest CAGR during the forecast period owing to the rapid penetration of local players in the market.

- North America dominated the home healthcaremarket and is projected to retain its trend throughout the forecast period.

- Diagnostic &monitoring devices poised to grow at the fastest rate during the foresee future.

- Rehabilitation holds the leading position in services segment; however, telehealth is growing at the outstanding pace during the forecast period.

North America has the largest share of the home healthcare market, with the United States accounting for the majority of it

North America dominated the global home healthcare market in 2020 due to high patient awareness regarding the benefits of home care. Due to the growing aging population, government support, and the installation of a streamlined regulatory framework, North America dominated the long-term care industry in 2020. Medicaid accounts for over 60% of long-term care spending in the United States. One in every five Americans is anticipated to be at least 65 years old by 2050. With the adoption of the Patient Protection and Affordable Care Act, funding is expected to increase. The US accounted for the largest share of the North American market in 2020. The home healthcare business is one of the fastest-growing in the United States, and it is responsible for billions of dollars in savings by relocating treatment from traditional institutional settings to the patient’s home. For home health and hospice providers, the aging population provides significant tailwinds for patient volume and continuing growth.

Home Healthcare Market, by Region, 2020 & 2027 (%)

| Region | 2020 | 2027 | ||

| North America | 51.6 | % | 49.83 | % |

| Europe | 20.01 | % | 18.68 | % |

| Asia Pacific | 19.47 | % | 21.64 | % |

| LATAM | 4.92 | % | 5.13 | % |

| MEA | 4.44 | % | 4.72 | % |

The home healthcare business is one of the fastest-growing in the United States, and it is responsible for billions of dollars in savings by relocating treatment from traditional institutional settings to the patient’s home. For home health and hospice providers, the aging population provides significant tailwinds for patient volume and continuing growth. By 2030, all baby boomers will have reached the age of 65, causing one out of every five Americans to be categorized as retirees. The home health business is primed for expansion, thanks to the high frequency of disease, the need for assistance among the elderly, and the desire to receive care in the comfort of one’s own home.

Chronic diseases are the biggest cause of death and disability in the United States. Approximately 45 percent of the population suffers from at least one chronic disease, which lowers the patient quality of life and raises healthcare demand. Patients with diabetes, congestive heart failure, or chronic obstructive pulmonary disease, for example, require close attention from registered nurses who assist them with daily activities, especially as their conditions progress.

Chronic-care patients make for the majority of healthcare spending in the United States (about 75%). Providers are looking for less expensive options to care as healthcare expenses and premiums for employer-sponsored family coverage plans continue to grow. Home healthcare services are a very cost-effective treatment alternative, costing an average of USD 47 per day against over USD 1,000 per day in an inpatient rehab hospital or long-term acute care facility. Provident anticipates a growth in the use of home-based care settings over traditional institutionalized settings as value-based care continues to drive considerable reform across the healthcare industry.

Home Healthcare MarketMarket Competitiveness and Business Outlook

The market is highly fragmented due to the existence of a large number of global and local competitors. In addition, foreign companies’ consolidation efforts are projected toincrease competition among rising and local market competitors. The report provides an extensive competitive analysis and profiles of the key market players, such as McKesson Medical-Surgical Inc., Fresenius Medical Care, Becton, Dickinson And Company, Arkray, Inc., Medline Industries, Inc., 3M Healthcare, Baxter International Inc., Medtronic PLC, Braun Melsungen AG, ConvaTec Group PLC, Molnlycke Health Care, Acelity L.P., Hollister Inc. and Others.

Home Healthcare Market Segments Covered

By Type

- Device

- Services

By Device

- Diagnostic & Monitoring Devices

- Therapeutic Devices

- Home Mobility Assist Devices

By Services

- Rehabilitation

- Telehealth

- Respiratory Therapy

- Infusion Therapy

- Unskilled Homecare

By Regional Outlook

- North America

- Europe

- Asia Pacific

- Middle East and Africa

Research Objective

- To provide a comprehensive analysis of the home healthcare industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global home healthcare market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the home healthcare

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Home Healthcare Market

5.1. COVID-19 Landscape: Home Healthcare Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Home Healthcare Market, By Type

8.1. Home Healthcare Market, by Type, 2021-2027

8.1.1. Device

8.1.1.1. Market Revenue and Forecast (2017-2027)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2017-2027)

Chapter 9. Global Home Healthcare Market, By Device

9.1. Home Healthcare Market, by Device, 2021-2027

9.1.1. Diagnostic & Monitoring Devices

9.1.1.1. Market Revenue and Forecast (2017-2027)

9.1.2. Therapeutic Devices

9.1.2.1. Market Revenue and Forecast (2017-2027)

9.1.3. Home Mobility Assist Devices

9.1.3.1. Market Revenue and Forecast (2017-2027)

Chapter 10. Global Home Healthcare Market, By Services

10.1. Home Healthcare Market, by Services, 2021-2027

10.1.1. Rehabilitation

10.1.1.1. Market Revenue and Forecast (2017-2027)

10.1.2. Telehealth

10.1.2.1. Market Revenue and Forecast (2017-2027)

10.1.3. Respiratory Therapy

10.1.3.1. Market Revenue and Forecast (2017-2027)

10.1.4. Infusion Therapy

10.1.4.1. Market Revenue and Forecast (2017-2027)

10.1.5. Unskilled Homecare

10.1.5.1. Market Revenue and Forecast (2017-2027)

Chapter 11. Global Home Healthcare Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2027)

11.1.2. Market Revenue and Forecast, by Device (2017-2027)

11.1.3. Market Revenue and Forecast, by Services (2017-2027)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2027)

11.1.4.2. Market Revenue and Forecast, by Device (2017-2027)

11.1.4.3. Market Revenue and Forecast, by Services (2017-2027)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2027)

11.1.5.2. Market Revenue and Forecast, by Device (2017-2027)

11.1.5.3. Market Revenue and Forecast, by Services (2017-2027)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2027)

11.2.2. Market Revenue and Forecast, by Device (2017-2027)

11.2.3. Market Revenue and Forecast, by Services (2017-2027)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2027)

11.2.4.2. Market Revenue and Forecast, by Device (2017-2027)

11.2.4.3. Market Revenue and Forecast, by Services (2017-2027)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2027)

11.2.5.2. Market Revenue and Forecast, by Device (2017-2027)

11.2.5.3. Market Revenue and Forecast, by Services (2017-2027)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2027)

11.2.6.2. Market Revenue and Forecast, by Device (2017-2027)

11.2.6.3. Market Revenue and Forecast, by Services (2017-2027)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2027)

11.2.7.2. Market Revenue and Forecast, by Device (2017-2027)

11.2.7.3. Market Revenue and Forecast, by Services (2017-2027)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2027)

11.3.2. Market Revenue and Forecast, by Device (2017-2027)

11.3.3. Market Revenue and Forecast, by Services (2017-2027)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2027)

11.3.4.2. Market Revenue and Forecast, by Device (2017-2027)

11.3.4.3. Market Revenue and Forecast, by Services (2017-2027)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2027)

11.3.5.2. Market Revenue and Forecast, by Device (2017-2027)

11.3.5.3. Market Revenue and Forecast, by Services (2017-2027)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2027)

11.3.6.2. Market Revenue and Forecast, by Device (2017-2027)

11.3.6.3. Market Revenue and Forecast, by Services (2017-2027)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2027)

11.3.7.2. Market Revenue and Forecast, by Device (2017-2027)

11.3.7.3. Market Revenue and Forecast, by Services (2017-2027)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2027)

11.4.2. Market Revenue and Forecast, by Device (2017-2027)

11.4.3. Market Revenue and Forecast, by Services (2017-2027)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2027)

11.4.4.2. Market Revenue and Forecast, by Device (2017-2027)

11.4.4.3. Market Revenue and Forecast, by Services (2017-2027)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2027)

11.4.5.2. Market Revenue and Forecast, by Device (2017-2027)

11.4.5.3. Market Revenue and Forecast, by Services (2017-2027)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2027)

11.4.6.2. Market Revenue and Forecast, by Device (2017-2027)

11.4.6.3. Market Revenue and Forecast, by Services (2017-2027)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2027)

11.4.7.2. Market Revenue and Forecast, by Device (2017-2027)

11.4.7.3. Market Revenue and Forecast, by Services (2017-2027)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2027)

11.5.2. Market Revenue and Forecast, by Device (2017-2027)

11.5.3. Market Revenue and Forecast, by Services (2017-2027)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2027)

11.5.4.2. Market Revenue and Forecast, by Device (2017-2027)

11.5.4.3. Market Revenue and Forecast, by Services (2017-2027)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2027)

11.5.5.2. Market Revenue and Forecast, by Device (2017-2027)

11.5.5.3. Market Revenue and Forecast, by Services (2017-2027)

Chapter 12. Company Profiles

12.1. McKesson Medical-Surgical Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Fresenius Medical Care

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Becton, Dickinson And Company

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Arkray, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Medline Industries, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. 3M Healthcare

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Baxter International Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Medtronic PLC

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Braun Melsungen AG

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. ConvaTec Group PLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

12.11. Molnlycke Health Care

12.11.1. Company Overview

12.11.2. Product Offerings

12.11.3. Financial Performance

12.11.4. Recent Initiatives

12.12. Acelity L.P.

12.12.1. Company Overview

12.12.2. Product Offerings

12.12.3. Financial Performance

12.12.4. Recent Initiatives

12.13. Hollister Inc.

12.13.1. Company Overview

12.13.2. Product Offerings

12.13.3. Financial Performance

12.13.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s home healthcare market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1190

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com