Industrial Adhesives Market By Statistics and Growth Forecast 2021-2030

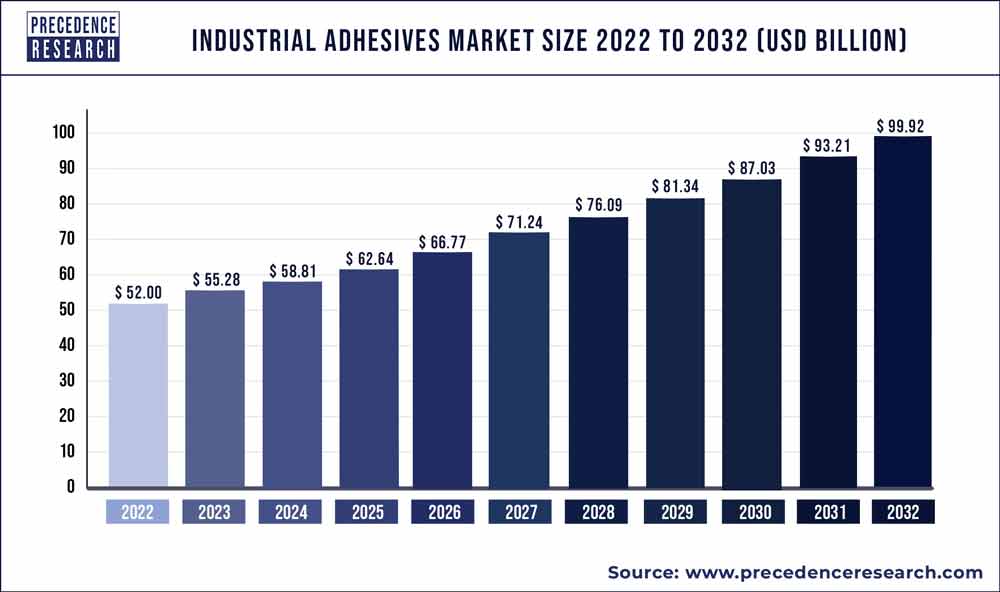

According to Precedence Research, The industrial adhesives market size garnered US$ 50.5 billion in 2020 and is expected to generate US$ 79.06 billion by 2030, manifesting a CAGR of 6.3% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The industrial adhesives market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Industrial adhesives are the chemical compounds that are particularly designed for joining two compounds. They are generally made from synthetic and natural materials and have their application in wide range of industries that include construction, packaging, automotive, medical, furniture, and many others.

Number of researches and advancements in the field of polymeric chemistry have extended the product portfolio in the industrial adhesives market.Various VAE (EVA) copolymers and advanced bonding technologies have attracted number of industrial adhesives manufacturers. Salient features of VAE copolymers as an adhesive material includes high strength,excellent bonding & curing,and elasticity. Further, advancements in the resin chemistry have opened up new paradigm for the various end-use industries to explore wide range of industrial adhesives product range.

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1336

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers, novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the major players in the global industrial adhesives market include:

- Cytec Industries Inc.

- Henkel AG & Co.

- Hitachi Chemical Company Ltd

- Sika AG

- 3M Company

- Mitsubishi Chemicals Corporation

- Bayer Product Science (Covestro)

- H.B Fuller

- DuPont de Nemours, Inc.

- Akzo Nobel

- Lord Corporation

- Avery Denison Group

- Ashland Inc.

- Toyo Polymer Co. Ltd.

- Adhesive Films Inc.

Industrial Adhesives Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Industrial Adhesives Growth Factors

Rising demand for advanced adhesive technologies particularly from paper packaging and automotive industry is the key trend that boosts the market growth for industrial adhesives in the coming years. Emerging aspects in the packaging industry such as renewable packaging solutions for food & beverages, pharmaceuticals, and cosmetics industry have created alluring opportunities for the market players.

Automotive is another significant application segment in the global industrial adhesives market that anticipated witnessing exponential growth over the forecast period owing to rising trend for light weight vehicles and high fuel efficiency. With rising global pollution governments of several countries have manifested strict laws for vehicle manufacturers to reduce the overall weight of the vehicles and adopt supportive technologies to improve the fuel efficiency. Adhesive products provide excellent bonding of auto body parts and consequently reduces the excess weight of hinges and other automobile components. This significantly drives the industrial adhesives market.

Moreover, increasing penetration of electric vehicles and autonomous vehicles again trigger the growth of industrial adhesives market. Electric vehicles significantly propel the demand for high fuel efficiency and light vehicle components that forces manufacturers to increase application of adhesive products in place of conventional bonding agents.

In addition, aerospace industry is other most prominent industry that witnesses significant demand of industrial adhesives. This is mainly attributed to the custom formulations that has extended the avenues of adhesive developers particularly for the industrial applications. Other than this, changing food habits especially in the developing nations and the Asia Pacific region prominently drives the demand for packaging in food & beverages that in turn propel the market for industrial adhesives.

Industrial Adhesives Report Highlights

- The Asia Pacific is the most promising region in the global industrial adhesives market owing to accelerating growth in packaging and automotive industry

- By product, acrylic adhesives dominated the global industrial adhesives market with more than 40.1% of sales share in the year 2020

- Epoxy adhesives are largely used in the automotive sector and hence likely to witness profound growth in the upcoming years

- Based on application, packaging industry is the front-runner in the global industrial adhesives market with holding around half of the market share

- Footwear segment witnesses the fastest growth rate during the forecast period owing to changing customer preferences towards sports and designer shoes

Regional Snapshots

Based on geography, the global industrial adhesives market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The Asia Pacific leads the global market for industrial adhesives with nearly half of the revenue share in the year 2020. This is majorly attributed to the increasing construction activities, rising automotive sales, rising demand for packed & frozen foods, and many others. As per a report published by PwC on Capital Project and Infrastructure Spending: Outlook to 2025, the Asia Pacific infrastructure market anticipated to witness a growth of nearly 8% yearly over the next decade and approaching to a value of US$ 5.36 trillion by the year 2025.

Other than Asia Pacific, North America and Europe are the other significant regions that witness steady growths over the forthcoming years owing to prominent impact of packaging and automotive industry growth on GDP.

Industrial Adhesives Market Segments Covered

By Product

- Polyvinyl Acetate

- Acrylic

- Epoxy

- Ethyl Vinyl Acetate

- Polyurethane

- Others

By Application

- Packaging

- Automotive

- Electrical & Electronics

- Industrial Machinery

- Medical

- Footwear

- Furniture

- Others

By Geograpghy

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Research Objective

- To provide a comprehensive analysis of the industrial adhesives industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global industrial adhesives market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the industrial adhesives

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Industrial Adhesives Market

5.1. COVID-19 Landscape: Industrial Adhesives Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Industrial Adhesives Market, By Product

8.1. Industrial Adhesives Market, by Product Type, 2021-2030

8.1.1. Polyvinyl Acetate

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Acrylic

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Epoxy

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Ethyl Vinyl Acetate

8.1.4.1. Market Revenue and Forecast (2019-2030)

8.1.5. Polyurethane

8.1.5.1. Market Revenue and Forecast (2019-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Industrial Adhesives Market, By Application

9.1. Industrial Adhesives Market, by Application, 2021-2030

9.1.1. Electronics & Electrical

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Automotive

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Packaging

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Medical

9.1.4.1. Market Revenue and Forecast (2019-2030)

9.1.5. Industrial Machinery

9.1.5.1. Market Revenue and Forecast (2019-2030)

9.1.6. Footwear

9.1.6.1. Market Revenue and Forecast (2019-2030)

9.1.7. Furniture

9.1.7.1. Market Revenue and Forecast (2019-2030)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Industrial Adhesives Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2019-2030)

10.1.2. Market Revenue and Forecast, by Application (2019-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2019-2030)

10.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

Chapter 11. Company Profiles

11.1. Cytec Industries Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Henkel AG & Co.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Hitachi Chemical Company Ltd

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sika AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. 3M Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Mitsubishi Chemicals Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Bayer Product Science (Covestro)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. H.B Fuller

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. DuPont de Nemours, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Akzo Nobel

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s industrial adhesives market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1336

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com