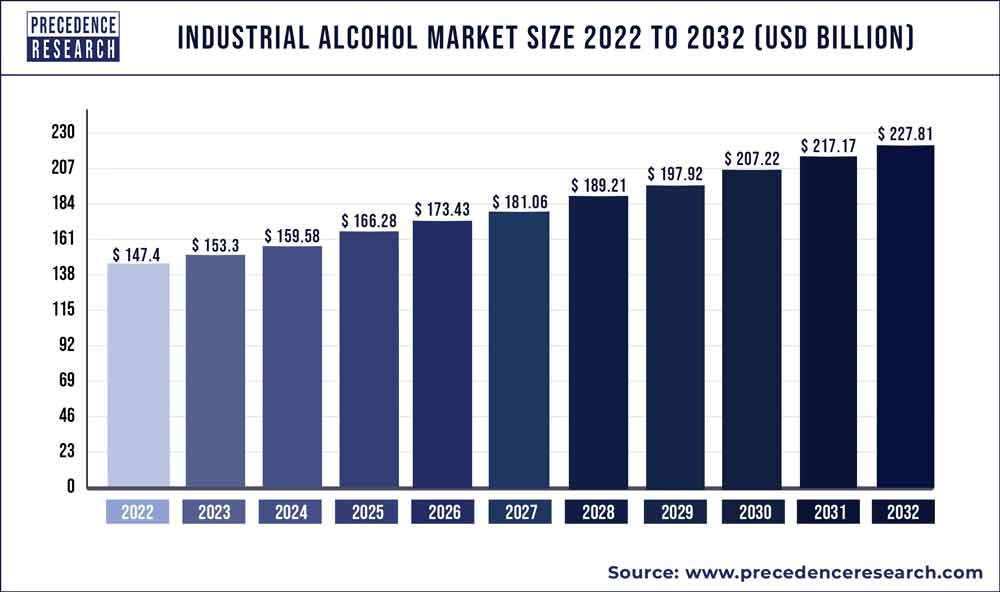

The industrial alcohol market size accounted for USD 141 billion in 2021 and is expected to reach around USD 257.9 billion by 2030, manifesting at a CAGR of 6.94% from 2022 to 2030. The growing demand for biofuels among end users for energy security and the rising need for affordable feedstock in the chemical sector are what are driving the global market for industrial alcohols.

Industrial Alcohol Market Key Takeaways:

- By product, U.S. industrial alcohol market was valued at USD 46.7 billion in 2021

- By type, the ethyl alcohol manufacturing applications segment accounted 52% market share of around in 2021 and is projected to grow at a CAGR of 8.1% from 2022 to 2030.

- By source, corn source segment contributed 31% revenue share in 2021 and is projected to grow at a CAGR of 8.8% from 2022 to 2030.

- By application, transportation fuels & fuel additives segment has contributed market share of over 42% in 2021.

- Asia Pacific region has garnered highest market share of over 37% in 2021.

The main component of industrial alcohol is ethanol, usually referred to as ethyl alcohol. It is a flammable, volatile liquid that is utilized extensively as a biofuel worldwide. It comes from a variety of sources, including grains, molasses, and corn. Sugarcane fermentation is one of the most traditional methods for making ethanol.

In several commercial uses in the chemical, personal care, energy, and pharmaceutical industries, it functions as both a reagent and a solvent. Other than for beverages, some alcohols have other uses. Additionally, having multiple functions promotes adoption in a variety of end-use applications. Additionally, ethanol, the most manufactured and consumed alcohol, is used widely as a biofuel around the world. The fermentation of sugars extracted from wheat, corn, sugar beets, sugar cane, and molasses results in the production of these fuels. In addition, it serves as a gasoline substitute in petrol engines. Methanol, benzyl alcohol, and isopropyl alcohol are just a few of the alcohols that are employed in the manufacturing of food items, flavorings, and adhesives.

Download Access to a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/1895

Industrial Alcohol Market Dynamics

Drivers

The growing demand for biofuels among end users for energy security and the rising need for affordable feedstock in the chemical sector are what are driving the global market for industrial alcohols. For transportation, bioethanol is frequently utilized as a biofuel to lessen the impact of greenhouse gases.

Alternative fuel technologies are desired because of the deteriorating energy security, rising fuel costs, and rising CO2 emission levels. The use of leftovers like molasses and sugar beet pulp is necessary to reduce greenhouse gases emissions. Significant benefits include lower trash disposal costs. Additionally, the product’s affordability lowers the cost of ethanol production.

Restraints

Due to water contamination and depletion, the manufacture of industrial alcohol using fossil fuels has a substantial negative impact on the environment. As raw ingredients, many hazardous compounds are needed for the production of alcohol. The ecology is harmed when these dangerous substances are then discharged into the atmosphere. The manufacturing of industrial alcohol is constrained by the strict government laws regarding environmental issues, which also restricts the market’s expansion. Additionally, it is anticipated that the high cost of isopropyl and isobutyl synthesis will somewhat restrain market expansion.

Opportunities

The demand for alcohol in fuel and other applications is rising as a result of changing lifestyles, expanding economies, and a trend toward the use of renewable resources in developing economies. In the upcoming years, it is anticipated that the demand for alcoholic beverages like ethyl alcohol and isobutyl alcohol will significantly increase in developing nations like China, India, and those in the Middle East and Africa.

This demand is anticipated to be fueled by rising alcohol consumption across a variety of industries and the expanding popularity of cleaner energy technology. In terms of production, labor, and processing costs, these areas also offer a cost advantage. High demand and low production costs are two important factors that are anticipated to help alcohol providers.

Challenges

The use of alcohols is restricted by many governments in the food and pharma industry and certain regulations needs to be followed by producers is the challenges that can hinder the market growth. A corporation must deal with the evolving rules pertaining to, among other things, infrastructure improvements, immigration reform, pricing policy, and environmental protection. This is known as the compliance burden. Companies may face the pullout from the market if they are unable to meet these new and evolving regulations.

Also Read: Antimicrobial Coatings Market: Fundamental Knowledge 2022-30

Recent Developments

- To generate FCC Grade alcohol for local and international markets, Green Plains Wood River LLC developed a separate 25-million-gallon plant designed and built by ICM, Inc. The company plans to update the manufacturing process over the next four to six months to produce USP Grade alcohol. With this development, the business will be able to produce more at Wood River, further demonstrating its dedication to meeting the growing demand from customers for high-purity alcohol.

Industrial Alcohol Market Scope

| Report Coverage | Details |

| Market Size in 2022 | USD 150.78 Billion |

| Market Size by 2030 | USD 257.9 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 6.94% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Type, Source, Application, Geography |

Regional Snapshots

The fastest-growing region in the world with the highest ethanol consumption is Asia-Pacific that can be linked to the product’s rising level of adoption in the energy and food sectors. Due to numerous government efforts and rising foreign investments in the industrial sector, the region’s economies are fast developing. A major producer of ethanol, China supports the monitoring of the food industry’s demand for additives and fuel. The rising demand for food, which has been fueled by the growing population, has also increased the desire for alcohol, which is said to be what is driving the market’s expansion.

Industrial Alcohol Market Report Highlights

- On the basis of type, the ethyl alcohol segment is the leading segment and is expected to make the largest contribution to the industrial alcohol market. This can be attributed to the product’s high demand even though it can be easily obtained from various sources, including biomass, corn, wheat, and barley. As a result of its high energy level, it is a renewable fuel that is combined with gasoline. Regardless of the source, ethanol is manufactured and comes in a variety of forms with the same chemical characteristics.

- On the basis of source, corn source led the market. This can be related to the product’s high demand as a renewable source for energy production. Globally, the ethanol industry’s expansion has caused a boom in corn distiller oil, which is utilized as a fuel for biodiesel or as animal feed. The majority of companies that make ethanol from corn have generated corn distillers oil. In the byproducts sector, corn-based ethanol production is also booming.

- On the basis of application, the highest growth is projected for the fuel segment during the forecasted period. The market is expanding due to the rising use of alcohol as a solvent and reactant in the manufacture of chemical intermediates. Due to its high-octane rating and capacity to lower pollutants when combined with gasoline, ethyl alcohol is in higher demand in the fuel sector. It is anticipated that it will maintain its supremacy in the upcoming years as a result of the constantly expanding global automobile industry. The demand for gasoline-powered automobiles has grown dramatically in the Asia Pacific and Europe areas.

Why should you invest in this report?

If you are aiming to enter the global industrial alcohol market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for industrial alcohol are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030 so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Industrial Alcohol Market Players

- Cargill Inc.

- Cristalco SAS

- MGP Ingredients Incorporated

- Grain Millers Inc.

- The Andersons Inc.

- Birla Sugar

- Greenfield Specialty Alcohols

- Flint Hills Resources

- Sigma Aldrich

- BASF

Segments covered in the report

By Type

- Ethyl Alcohol

- Methyl Alcohol

- Isopropyl Alcohol

- Others

By Source

- Molasses

- Sugar

- Grains

- Corn

By Application

- Food Ingredient

- Transportation Fuel & Fuel Additives

- Chemical Intermediates

- Pharmaceutical

- Personal Care

- Detergent & Cleaning Chemicals

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1895

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com