Industrial Control Systems Security Market Size, Share, Report by 2033

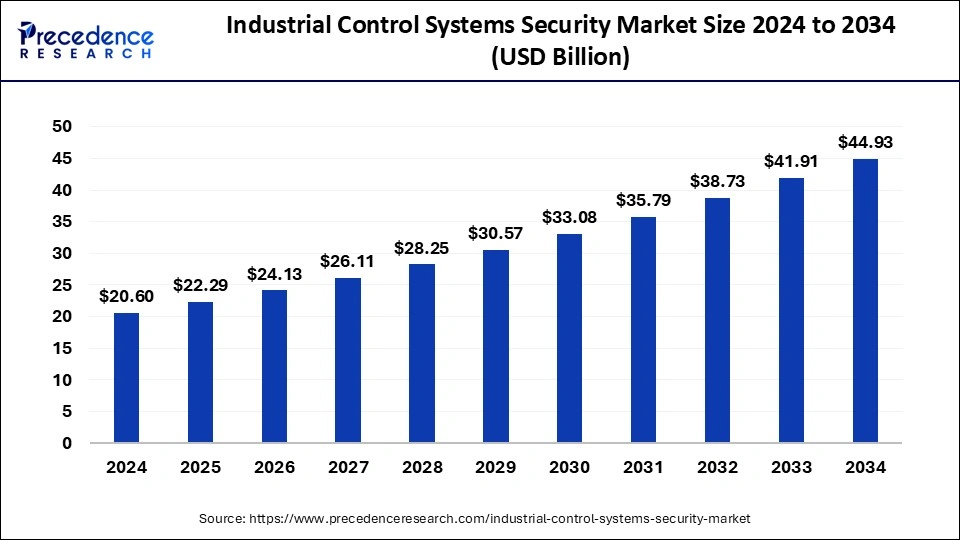

The global industrial control systems security market size is expected to increase USD 41.91 billion by 2033 from USD 19.04 billion in 2023 with a CAGR of 8.21% between 2024 and 2033.

Industrial Control Systems Security Market Statistics

- The North America industrial control systems security market size reached USD 6.47 billion in 2023 and is expected to attain around USD 14.46 billion by 2033, poised to grow at a CAGR of 8.37% between 2024 and 2033.

- North America dominated the industrial control systems security market with the major revenue share of 34% in 2023.

- Asia Pacific is expected to show the fastest growth in the market during the forecast period.

- By component, the solution segment has contributed more than 71% of revenue share in 2023.

- By component, the services segment is expected to grow at a solid CAGR of 8.62% during the forecast period.

- By solutions, the identity & access management (IAM) segment led the market in 2023.

- By solutions, the encryption segment is expected to grow at the fastest rate in the market over the forecast period.

- By services, in 2023, the professional services segment dominated the market.

- By services, the managed services segment is projected to grow at the fastest rate in the market during the forecast period.

- By end use, the energy & utilities segment held the largest share of the market in 2023.

- By end use, the automotive segment is expected to grow at the fastest rate in the market over the projected period.

Industrial Control Systems (ICS) are essential for managing, monitoring, and controlling industrial processes in sectors such as manufacturing, energy, utilities, and critical infrastructure. These systems integrate various types of equipment, such as Programmable Logic Controllers (PLCs), Supervisory Control and Data Acquisition (SCADA) systems, Distributed Control Systems (DCS), and Human-Machine Interfaces (HMIs). ICS security, therefore, refers to the protection of these systems from cyber threats, ensuring the uninterrupted operation of industrial processes.

The ICS security market has witnessed significant growth over the past decade due to the increasing incidence of cyber-attacks targeting critical infrastructure and industrial operations. With the rise of sophisticated threats such as ransomware, advanced persistent threats (APTs), and state-sponsored attacks, the demand for robust ICS security solutions has surged. These solutions encompass a range of technologies including firewalls, intrusion detection systems (IDS), intrusion prevention systems (IPS), security information and event management (SIEM), endpoint security, and network security.

Get a Sample: https://www.precedenceresearch.com/sample/4599

Growth Factors

Several key factors are driving the growth of the ICS security market:

Increasing Cyber Threats

The proliferation of cyber threats targeting industrial control systems has been a significant growth driver. High-profile attacks such as Stuxnet, Triton, and the Ukraine power grid attack have highlighted the vulnerabilities in ICS environments. These incidents have underscored the critical need for enhanced security measures to protect vital industrial operations.

Industrial IoT (IIoT) Adoption

The integration of Industrial Internet of Things (IIoT) devices in industrial operations has expanded the attack surface, making ICS environments more susceptible to cyber-attacks. The IIoT connects various devices and systems to the internet, increasing the potential entry points for cybercriminals. This has necessitated the implementation of robust security solutions to safeguard interconnected devices and ensure the integrity of industrial processes.

Regulatory Compliance

Governments and regulatory bodies worldwide have introduced stringent regulations and standards to enhance the security of critical infrastructure and industrial operations. Compliance with standards such as the NIST Cybersecurity Framework, IEC 62443, and the European Union’s NIS Directive has become mandatory for organizations, driving the adoption of ICS security solutions.

Technological Advancements

Advancements in cybersecurity technologies, such as machine learning, artificial intelligence, and blockchain, have significantly improved the effectiveness of ICS security solutions. These technologies enable real-time threat detection, predictive analytics, and automated incident response, enhancing the overall security posture of industrial control systems.

Regional Insights

The ICS security market exhibits varying trends and growth patterns across different regions:

North America is a leading region in the ICS security market, driven by the presence of a large number of critical infrastructure facilities and significant investments in cybersecurity. The United States, in particular, has been at the forefront of adopting advanced ICS security solutions due to its focus on protecting critical infrastructure from cyber threats. Additionally, government initiatives and regulations, such as the Cybersecurity and Infrastructure Security Agency (CISA) and the Critical Infrastructure Protection Act, have further bolstered the market.

Europe is another prominent region in the ICS security market, characterized by a strong regulatory framework and proactive cybersecurity measures. The European Union’s NIS Directive mandates the implementation of robust cybersecurity measures for operators of essential services, driving the demand for ICS security solutions. Countries such as Germany, the United Kingdom, and France have also been investing heavily in securing their industrial infrastructure.

The Asia-Pacific region is experiencing rapid growth in the ICS security market, fueled by increasing industrialization, urbanization, and the adoption of IIoT technologies. Countries such as China, Japan, and South Korea are leading the charge in implementing ICS security solutions to protect their burgeoning industrial sectors. Additionally, the growing awareness of cyber threats and government initiatives to enhance cybersecurity have further propelled market growth.

Industrial Control Systems Security Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 41.91 Billion |

| Market Size in 2023 | USD 19.04 Billion |

| Market Size in 2024 | USD 20.60 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 8.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Solutions, Services, Type, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industrial Control Systems Security Market Dynamics

Market Drivers

Growing Awareness of Cyber Threats

The increasing awareness of cyber threats and their potential impact on industrial operations is a major driver of the ICS security market. Organizations are becoming more cognizant of the need to protect their critical infrastructure from cyber-attacks, leading to the widespread adoption of ICS security solutions.

Digital Transformation

The digital transformation of industrial operations, driven by the adoption of IIoT, cloud computing, and big data analytics, has increased the complexity and interconnectedness of ICS environments. This transformation has necessitated the implementation of robust security measures to safeguard industrial processes and data.

Government Initiatives

Government initiatives and regulatory mandates aimed at enhancing cybersecurity in critical infrastructure are driving the demand for ICS security solutions. Governments worldwide are investing in cybersecurity frameworks and standards to protect their industrial sectors from cyber threats.

Increasing Incidents of Cyber-Attacks

The rising incidence of cyber-attacks targeting industrial control systems has underscored the vulnerabilities in ICS environments. High-profile attacks such as the Colonial Pipeline ransomware attack and the SolarWinds supply chain attack have highlighted the need for enhanced security measures, driving market growth.

Market Opportunities

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies in ICS security solutions offers significant opportunities for market growth. AI and ML can enhance threat detection, predictive analytics, and automated incident response, improving the overall security posture of industrial control systems.

Expansion of IIoT

The expansion of Industrial Internet of Things (IIoT) technologies in industrial operations presents opportunities for the ICS security market. As more devices and systems become interconnected, the need for robust security solutions to protect IIoT environments will increase, driving market growth.

4. Emerging Markets

Emerging markets in regions such as Asia-Pacific, Latin America, and the Middle East and Africa present significant opportunities for the ICS security market. These regions are experiencing rapid industrialization and digital transformation, driving the demand for robust security solutions to protect critical infrastructure.

Market Challenges

Complexity of ICS Environments

The complexity and heterogeneity of ICS environments pose significant challenges for implementing effective security measures. Industrial control systems often comprise a mix of legacy and modern technologies, making it difficult to ensure comprehensive security across the entire infrastructure.

Lack of Skilled Workforce

The shortage of skilled cybersecurity professionals with expertise in ICS security is a major challenge for the market. Organizations struggle to find qualified personnel to manage and secure their industrial control systems, hindering the implementation of robust security measures.

Read Also: Medical Tapes and Bandages Market Size, Share, Report by 2033

Industrial Control Systems Security Market Companies

- ABB Group

- BAE Systems

- Cisco Systems

- Check Point

- DarkTrace

- Fortinet

- Honeywell International Inc.

- IBM Corporation

- Kaspersky Labs

- Microsoft Corporation

- Nozomi Networks

- Palo Alto

- Siemens AG

- Trend Micro Incorporated

- Yokogawa Electric Corporation

Recent Developments

- In March 2024, the Smart Factory Automation World (SFAW) event in Seoul will showcase cutting-edge automation technologies such as robotics and digital factory solutions. More than 450 companies from nine countries will convene at the COEX Convention & Exhibition Center to present their latest innovations to an anticipated audience of over 70,000 visitors.

- In October 2023, Rockwell Automation, Inc. (NYSE: ROK) and Microsoft Corp. announced an expansion of their longstanding partnership to expedite the design and development of industrial automation using generative artificial intelligence (AI).

- In May 2024, Fortinet announced the launch of a new generation firewall (NGFW) appliance featuring industry-leading security and networking performance, positioned to serve as a cornerstone for modern campuses. Built on the Fortinet operating system and incorporating the 5G Fortinet security processing unit (SP5).

Segments Covered in the Report

By Component

- Solution

- Services

By Solutions

- Anti-malware/Antivirus

- Firewall

- Encryption

- Identity and Access Management (IAM)

- Security and Vulnerability Management

- Security Information and Event Management (SIEM)

- Distributed Denial-of-Service (DDoS)

- Intrusion detection systems (IDS)/Intrusion Prevention System (IPS)

- Others

By Services

- Professional Services

- Managed Services

By Type

- Endpoint

- Application

- Network

- Database

By End Use

- Energy & Utilities

- Manufacturing

- Power

- Transportation Systems

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/