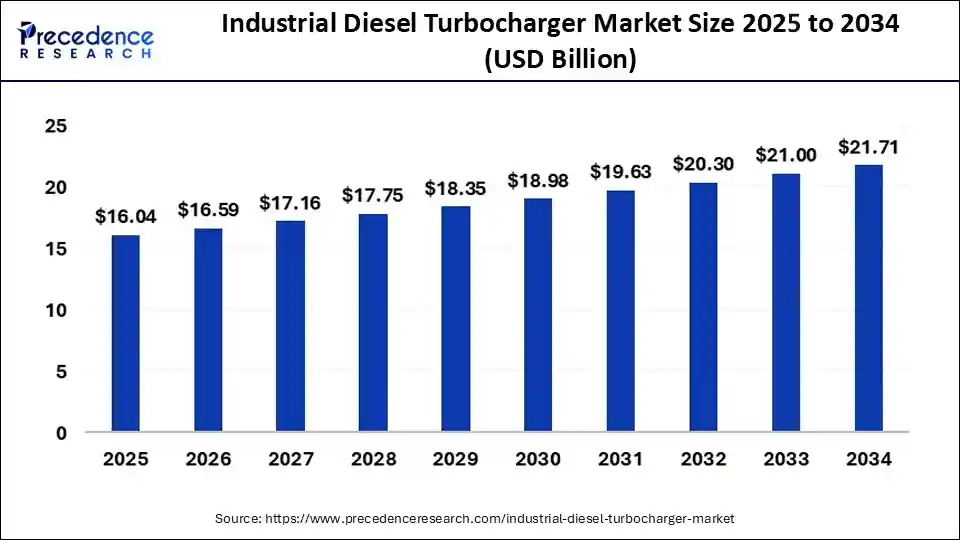

Industrial Diesel Turbocharger Market is projected to reach USD 21.71 billion by 2034

The global industrial diesel turbocharger market was valued at USD 15.51 billion in 2024 and is projected to reach approximately USD 21.71 billion by 2034, growing at a CAGR of 3.42%.

Industrial Diesel Turbocharger Market Key Insights

- Asia Pacific dominated the industrial diesel turbocharger market with the largest share of 40% in 2024.

- North America is expected to grow at a significant rate over the forecast period.

- By engine type, the diesel engines segment led the global market in 2024.

- By engine type, the internal combustion engine segment is estimated to grow fastest over the forecast period.

- By sales channel, the OEM sales segment held the largest market share in 2024..

- By sales channel, the direct sales segment is expected to grow at the fastest rate over the forecast period.

- By component type, the compressors segment dominated the market in 2024.

- By component type, the turbine segment is expected to grow rapidly over the projected period.

- By application, the power generation segment dominated the market in 2024.

- By application, the marine application segment is expected to grow at a significant rate over the forecast period.

The industrial diesel turbocharger market is witnessing steady growth, driven by increasing demand for fuel efficiency, engine performance enhancement, and stringent emission regulations. Turbochargers play a crucial role in boosting engine power while optimizing fuel consumption, making them essential for industries relying on heavy-duty diesel engines, including marine, construction, mining, agriculture, and power generation. As industries seek to improve operational efficiency and reduce carbon emissions, the adoption of turbocharging technology continues to rise.

In 2024, the market was valued at approximately USD 15.51 billion and is expected to grow to around USD 21.71 billion by 2034, at a CAGR of 3.42%. Technological advancements in turbocharger materials, aerodynamics, and hybrid turbo systems are further propelling market expansion. The rising focus on electrification and hybridization of diesel engines, along with the adoption of variable geometry turbochargers (VGTs) and two-stage turbocharging systems, is revolutionizing the industry.

With governments implementing stricter emission norms, turbochargers have become a critical solution for reducing NOx emissions and enhancing combustion efficiency in industrial diesel engines. Manufacturers are investing in lightweight and high-performance turbochargers to comply with evolving environmental regulations while ensuring optimal engine performance. The growing integration of smart turbochargers with real-time performance monitoring is further shaping the future of the market.

Sample Link: https://www.precedenceresearch.com/sample/5717

Market Drivers

The increasing demand for fuel-efficient and high-performance diesel engines is one of the key factors driving the industrial diesel turbocharger market. Industries such as power generation, marine transportation, and construction require robust engine systems that deliver maximum power output with minimal fuel consumption. Turbochargers help optimize combustion efficiency, making them a preferred choice for industrial applications.

Stringent environmental regulations and emission standards are also pushing the adoption of turbochargers. Governments worldwide are enforcing policies to reduce carbon footprints, leading to a shift towards turbocharged diesel engines that offer better fuel efficiency and lower emissions. The integration of exhaust gas recirculation (EGR) systems and turbocharging technologies enables industries to meet Euro 6, EPA Tier 4, and BS-VI emission standards.

Technological advancements in turbocharger design and materials are further accelerating market growth. The development of lightweight, high-temperature-resistant materials, along with the implementation of variable geometry and twin-scroll turbochargers, enhances engine performance and durability. The increasing adoption of electric turbochargers (e-turbos) in industrial diesel engines is another significant trend, improving responsiveness and reducing turbo lag.

Opportunities

The growing shift towards hybrid and alternative fuel-powered diesel engines presents a significant opportunity for turbocharger manufacturers. With industries exploring biofuels, synthetic fuels, and LNG-powered diesel engines, turbocharging solutions tailored for alternative fuels are gaining traction. Innovations in turbocharging technology for hybrid diesel-electric powertrains are expected to open new revenue streams for market players.

The expansion of industrial activities in emerging economies is creating new opportunities for the industrial diesel turbocharger market. Rapid infrastructure development, urbanization, and the rising demand for power generation, mining, and heavy machinery in countries like India, China, and Brazil are driving the need for high-performance turbocharged diesel engines. The increasing adoption of turbochargers in large-scale power plants and marine vessels further strengthens market growth.

The integration of IoT and AI-driven turbocharger monitoring systems is another emerging opportunity. Smart turbochargers equipped with sensors and predictive maintenance algorithms allow industries to track real-time performance, reduce downtime, and improve operational efficiency. As the industrial sector moves towards automation and digitalization, the demand for connected turbocharging solutions is expected to rise.

Challenges

Despite its growth potential, the industrial diesel turbocharger market faces several challenges. One of the key issues is the high cost of advanced turbocharging technologies. The development and integration of next-generation turbochargers with hybrid systems, electric assistance, and variable geometry mechanisms require substantial investments, making them expensive for small-scale industrial operators.

Fluctuations in raw material prices, particularly steel, aluminum, and high-temperature alloys, impact production costs and profit margins for turbocharger manufacturers. The supply chain disruptions experienced in recent years due to geopolitical tensions, trade restrictions, and global semiconductor shortages have further affected market stability.

The increasing adoption of electric and hydrogen-powered industrial vehicles poses a long-term challenge to the market. As industries transition towards zero-emission powertrains, the demand for diesel turbochargers may decline over time. However, hybridization and dual-fuel engine advancements may help sustain demand for turbocharging technology in the near future.

Regional Insights

North America holds a significant share of the industrial diesel turbocharger market, driven by strong demand in the power generation, oil & gas, and construction industries. The region has stringent emission regulations that encourage industries to adopt fuel-efficient turbocharged diesel engines. The United States and Canada are investing in advanced turbocharging solutions to enhance industrial productivity and energy efficiency.

Europe is a key player in the market, with countries like Germany, the UK, and France focusing on sustainable industrial solutions and low-emission diesel technologies. The presence of leading turbocharger manufacturers and ongoing research in electric and hybrid turbocharging contribute to market expansion. The European Union’s strict carbon neutrality goals are also pushing industries to adopt advanced turbocharging systems.

The Asia-Pacific region is expected to witness the highest growth rate, fueled by industrialization, infrastructure development, and expanding manufacturing sectors. Countries like China, India, and Japan are investing heavily in power plants, marine transportation, and heavy-duty construction machinery, driving demand for industrial diesel turbochargers. The region’s growing focus on energy efficiency and emission reduction policies further supports market growth.

Latin America, the Middle East, and Africa are emerging markets with increasing adoption of industrial diesel engines in mining, oil & gas, and power generation applications. The rising demand for off-highway diesel-powered machinery and the expansion of maritime trade routes are boosting the demand for turbocharged engines in these regions. Government initiatives to modernize industrial fleets and reduce emissions will further drive growth.

Read Also: Plug-in Hybrid Electric Vehicles (PHEV) Market

Market Companies

- Cummins

- Turbo Energy

- KTT

- Kangyue

- BorgWarner

- K turbocharger

- Weichai Power

- Mitsubishi Heavy Industries