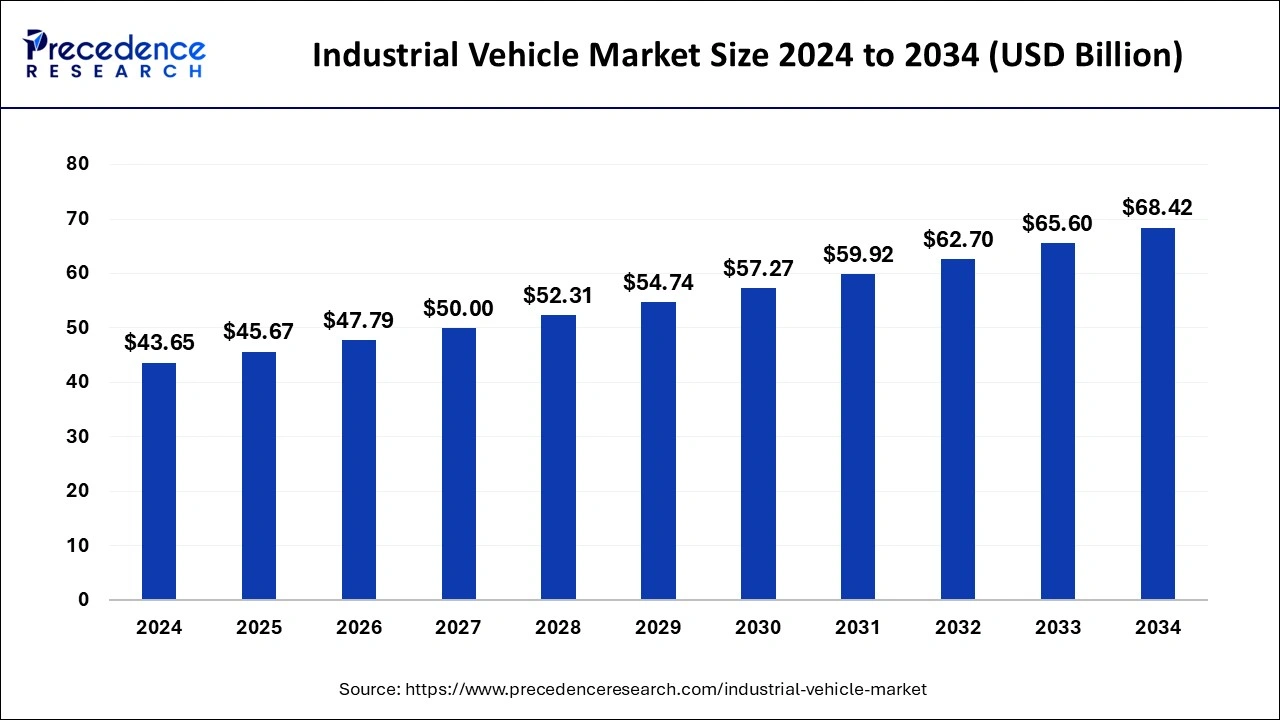

Industrial Vehicle Market Size to Attain USD 65.60 Bn by 2033

The global industrial vehicle market size was calculated at USD 41.72 billion in 2023 and is expected to attain around USD 65.60 billion by 2033, growing at a CAGR of 4.63% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the largest market share of 46% in 2023.

- North America is observed to expand at a rapid pace during the forecast period.

- By drive type, the ICE segment has held the major market share of 49% in 2023.

- By drive type, the battery-operated segment is expected to grow at a significant rate during the predicted timeframe.

- By the level of autonomy, the non/semi-autonomous segment held a significant share of the market in 2023.

- By the level of autonomy, the autonomous segment is observed to grow at a notable rate during the forecast period.

- By application, the manufacturing segment held the largest share of the market in 2023.

- By application, the warehousing segment is expected to grow fastest during the forecast period.

The industrial vehicle market encompasses a diverse range of vehicles used in various industries for material handling, transportation, and specialized tasks. This sector includes forklifts, aerial work platforms, cranes, excavators, and other heavy machinery essential for construction, manufacturing, logistics, and agriculture. The market is influenced by global economic trends, technological advancements, and evolving regulations aimed at safety and efficiency.

Get a Sample: https://www.precedenceresearch.com/sample/4277

Growth Factors

The growth of the industrial vehicle market is driven by several key factors. Firstly, increasing industrialization and infrastructure development across regions fuel demand for construction and material handling equipment. Additionally, the rise of e-commerce and logistics activities necessitates efficient warehousing and distribution solutions, boosting the demand for forklifts and warehouse vehicles. Moreover, advancements in electric and autonomous vehicle technologies are transforming the industry, promoting sustainable and smart solutions.

Region Insights

The industrial vehicle market exhibits varying trends across regions. Developed economies like North America and Europe are characterized by a strong presence of established manufacturers and stringent safety regulations, favoring the adoption of advanced equipment. Emerging markets in Asia-Pacific and Latin America experience robust growth driven by infrastructure investments and expanding manufacturing sectors, creating opportunities for market expansion and localization.

Industrial Vehicle Market Scope

| Report Coverage | Details |

| Industrial Vehicle Market Size in 2023 | USD 41.72 Billion |

| Industrial Vehicle Market Size in 2024 | USD 43.65 Billion |

| Industrial Vehicle Market Size by 2033 | USD 65.60 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.63% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Drive Type, By Level of Autonomy, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industrial Vehicle Market Dynamics

Drivers

Several drivers propel the industrial vehicle market forward. The need for operational efficiency and productivity enhancement in industries drives investments in modernized equipment. Environmental concerns push the adoption of electric and hybrid vehicles, reducing emissions and operational costs. Moreover, the integration of telematics and IoT technologies enables real-time monitoring and predictive maintenance, enhancing vehicle performance and lifespan.

Opportunities

The industrial vehicle market offers promising opportunities for innovation and expansion. Growing demand for automation and robotics in manufacturing and logistics opens avenues for autonomous and semi-autonomous vehicles. Emerging markets present untapped potential for market penetration and partnerships with local players. Furthermore, the shift towards rental and leasing models in equipment procurement offers a flexible approach for customers and suppliers.

Challenges

Despite growth prospects, the industrial vehicle market faces notable challenges. Economic uncertainties and geopolitical factors can impact investment decisions and market dynamics. Regulatory complexities related to emissions standards and safety regulations require continuous adaptation by manufacturers. Additionally, the high upfront cost of advanced technologies and concerns about cybersecurity pose challenges to widespread adoption.

Read Also: Serverless Architecture Market Size to Attain USD 106.12 Bn by 2033

Industrial Vehicle Market Recent Developments

- In June 2023, Hangcha announced the launch of the XE series electric forklifts to the global market. This is an adaptable, durable, comfortable, and affordable material handling solution that can go anywhere and do anything. The XE series covers from 1.5-3.8t, with a battery capacity of up to 80V/608Ah.

- In May 2024, Volvo CE secured an order from the Swedish Defense Materiel Administration (FMV) for 81-wheel loaders. The order is the first procurement in a seven-year framework agreement signed earlier this year and valued at USD 110 million that will enhance collaboration and strengthen the security of supply, both in times of peace and crises, thereby safeguarding people, resources, and societies. Volvo CE will be supplying a variety of wheel loaders and attachments and the machines will be produced at its plants in Arvika, Sweden, and Konz in Germany which specialize in the production of wheel loaders.

Industrial Vehicle Market Companies

- Anhui Heli Co. Ltd

- Crown Equipment Corporation

- Hangcha Forklift

- Hyster-Yale Materials Handling

- Jungheinrich

- Konecranes

- Daifuku

- Ross Electric Vehicles

- SSI SCHAEFER

- Taylor-Dunn

- Hyster-Yale Group, Inc.,

- Jungheinrich AG

- Kion Group AG

- Mitsubishi Heavy Industries, Ltd.

- Toyota Industries Corporation

- Doosan Corporation

- Hyundai Construction Equipment

- Polaris Inc.

Segments Covered in the Report

By Drive Type

- ICE

- Battery-Operated

- Gas-Powered

By Level of Autonomy

- Non/Semi-Autonomous

- Autonomous

By Application

- Manufacturing

- Warehousing

- Freight and Logistics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/