Insulated Packaging Market Size to Worth USD 28.66 Bn by 2033

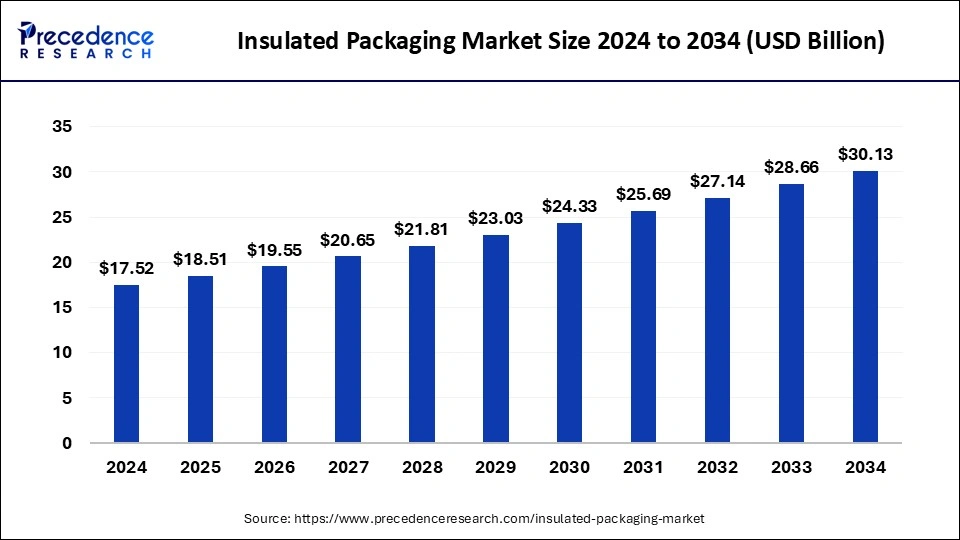

The global insulated packaging market size is expected to increase USD 28.66 billion by 2033 from USD 16.59 billion in 2023 with a CAGR of 5.62% between 2024 and 2033.

Key Points

- Asia Pacific dominated the insulated packaging market with the largest revenue share of 36% in 2023.

- North America is expected to grow at the highest CAGR in the market during the forecast period.

- By type, the rigid segment has contributed more than 40% of revenue share in 2023.

- By type, the flexible segment is expected to grow at the highest CAGR of 5.62% during the forecast period.

- By product, the corrugated cardboard segment has held the major revenue share of 29% in 2023.

- By product, the plastic segment is projected to grow at a solid CAGR of 6.22% during the forecast period.

- By application, the food & beverages segment has captured more than 27% of revenue share in 2023.

- By application, the pharmaceutical segment is expected to grow at the highest CAGR of 6.13% during the forecast period.

The insulated packaging market has witnessed significant growth over the past few years, driven by the increasing demand for temperature-sensitive products across various industries. Insulated packaging refers to packaging solutions designed to maintain the temperature of the packaged goods within a specific range, thereby ensuring the quality and safety of perishable and temperature-sensitive products during transportation and storage. This market encompasses a wide range of products, including insulated containers, boxes, bags, pouches, and liners, made from materials such as expanded polystyrene (EPS), polyurethane (PU), and vacuum-insulated panels (VIPs). The primary end-users of insulated packaging include the food and beverage industry, pharmaceuticals, healthcare, chemicals, and cosmetics.

Get a Sample: https://www.precedenceresearch.com/sample/4609

Growth Factors

Increasing Demand for Temperature-Sensitive Products

One of the major factors driving the growth of the insulated packaging market is the rising demand for temperature-sensitive products, particularly in the food and beverage and pharmaceutical industries. The growing consumption of frozen and chilled foods, coupled with the need for safe and efficient transportation of perishable goods, has fueled the demand for insulated packaging solutions. Additionally, the pharmaceutical industry’s increasing reliance on temperature-controlled logistics for the distribution of vaccines, biologics, and other temperature-sensitive drugs has further boosted the market.

Expansion of E-commerce and Online Food Delivery Services

The rapid expansion of e-commerce and online food delivery services has also significantly contributed to the growth of the insulated packaging market. Consumers are increasingly opting for online grocery shopping and food delivery services, which require reliable and efficient packaging solutions to ensure the quality and safety of perishable products during transit. Insulated packaging plays a crucial role in maintaining the temperature integrity of food and beverage products, thereby enhancing customer satisfaction and driving market growth.

Technological Advancements in Packaging Materials

Technological advancements in packaging materials and the development of innovative insulation technologies have further propelled the growth of the insulated packaging market. The introduction of advanced materials such as vacuum-insulated panels (VIPs) and phase change materials (PCMs) has improved the thermal performance and efficiency of insulated packaging solutions. These innovations have enabled manufacturers to develop lightweight, durable, and cost-effective packaging solutions that meet the stringent temperature requirements of various industries.

Region Insights

North America holds a significant share of the global insulated packaging market, driven by the strong presence of the food and beverage and pharmaceutical industries in the region. The United States, in particular, is a major market for insulated packaging, owing to the high demand for frozen and chilled foods, the extensive use of temperature-sensitive pharmaceuticals, and the robust growth of e-commerce and online food delivery services. Additionally, the presence of leading insulated packaging manufacturers and the growing focus on sustainable packaging solutions have further contributed to the market growth in North America.

Europe is another prominent market for insulated packaging, with countries such as Germany, France, and the United Kingdom leading the demand. The region’s stringent regulations on food safety and pharmaceutical logistics, coupled with the increasing adoption of sustainable and eco-friendly packaging solutions, have driven the growth of the insulated packaging market in Europe. The expanding e-commerce sector and the rising demand for temperature-sensitive products in the food and pharmaceutical industries have also played a crucial role in the market growth.

The Asia-Pacific region is expected to witness the highest growth rate in the insulated packaging market during the forecast period. Rapid urbanization, increasing disposable incomes, and changing consumer lifestyles have led to a surge in the demand for frozen and chilled foods in countries such as China, India, and Japan. The growing pharmaceutical industry and the increasing focus on improving healthcare infrastructure have also fueled the demand for insulated packaging solutions in the region. Additionally, the expansion of e-commerce and online food delivery services has further driven the market growth in Asia-Pacific.

Trends

Sustainability and Eco-friendly Packaging Solutions

One of the key trends in the insulated packaging market is the growing focus on sustainability and the development of eco-friendly packaging solutions. Consumers and regulatory authorities are increasingly demanding environmentally friendly packaging materials that reduce waste and minimize the environmental impact. As a result, manufacturers are investing in research and development to create sustainable insulated packaging solutions, such as recyclable and biodegradable materials, reusable packaging, and innovative insulation technologies.

Integration of Smart Packaging Technologies

The integration of smart packaging technologies is another notable trend in the insulated packaging market. Smart packaging solutions, such as temperature monitoring sensors, RFID tags, and IoT-enabled devices, are being increasingly adopted to enhance the performance and functionality of insulated packaging. These technologies provide real-time monitoring of temperature and other environmental conditions, ensuring the quality and safety of temperature-sensitive products throughout the supply chain. The use of smart packaging technologies also enables better traceability and transparency, enhancing supply chain efficiency and reducing the risk of product spoilage.

Customization and Personalization

Customization and personalization of insulated packaging solutions are gaining traction in the market, driven by the diverse requirements of different industries and applications. Manufacturers are offering customized packaging solutions tailored to the specific needs of their clients, such as custom sizes, shapes, and insulation properties. Personalized packaging solutions not only enhance the protection and performance of temperature-sensitive products but also improve brand differentiation and customer satisfaction.

Insulated Packaging Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 28.66 Billion |

| Market Size in 2023 | USD 16.59 Billion |

| Market Size in 2024 | USD 17.52 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Insulated Packaging Marke Dynamics

Drivers

Stringent Regulations on Food Safety and Pharmaceutical Logistics

Stringent regulations on food safety and pharmaceutical logistics are one of the key drivers of the insulated packaging market. Regulatory authorities across the globe have implemented strict guidelines to ensure the safe transportation and storage of perishable and temperature-sensitive products. Compliance with these regulations necessitates the use of reliable and efficient insulated packaging solutions that can maintain the required temperature range and prevent product spoilage. As a result, the demand for insulated packaging is expected to continue to rise in response to regulatory requirements.

Increasing Consumer Awareness and Demand for Quality Products

Increasing consumer awareness and demand for high-quality products are also driving the growth of the insulated packaging market. Consumers are becoming more conscious of the quality and safety of the products they purchase, particularly when it comes to food and pharmaceuticals. Insulated packaging plays a crucial role in preserving the freshness, quality, and efficacy of temperature-sensitive products, thereby meeting consumer expectations and driving market growth.

Opportunities

Emerging Markets

Emerging markets present significant growth opportunities for the insulated packaging market. Rapid economic development, urbanization, and changing consumer lifestyles in emerging economies such as China, India, Brazil, and South Africa have led to an increase in the demand for frozen and chilled foods, pharmaceuticals, and other temperature-sensitive products. The expansion of the middle-class population and the growing awareness of food safety and healthcare have further driven the demand for insulated packaging solutions in these markets. Additionally, the development of e-commerce and online food delivery services in emerging markets offers new opportunities for market growth.

Technological Innovations

Technological innovations in packaging materials and insulation technologies offer significant opportunities for the growth of the insulated packaging market. The development of advanced materials such as aerogels, bio-based polymers, and nanomaterials has the potential to revolutionize the insulated packaging industry by providing superior thermal performance, reduced weight, and enhanced sustainability. Additionally, the integration of smart packaging technologies and the development of innovative insulation solutions can further enhance the functionality and efficiency of insulated packaging, creating new opportunities for market growth.

Increasing Demand for Healthcare and Pharmaceutical Products

The increasing demand for healthcare and pharmaceutical products, particularly in the wake of the COVID-19 pandemic, presents significant opportunities for the insulated packaging market. The distribution of vaccines, biologics, and other temperature-sensitive pharmaceuticals requires reliable and efficient packaging solutions to ensure their safety and efficacy. The growing focus on healthcare infrastructure development and the increasing investment in the pharmaceutical industry are expected to drive the demand for insulated packaging solutions in the healthcare sector.

Challenges

High Cost of Insulated Packaging Solutions

One of the major challenges facing the insulated packaging market is the high cost of insulated packaging solutions. Advanced insulation materials and technologies can be expensive, which may limit their adoption, particularly among small and medium-sized enterprises. The high cost of insulated packaging can also impact the overall cost of the products, potentially affecting their competitiveness in the market. Manufacturers need to focus on developing cost-effective insulation solutions without compromising on performance to overcome this challenge.

Environmental Concerns and Regulatory Compliance

Environmental concerns and the need for regulatory compliance pose significant challenges to the insulated packaging market. The use of certain insulation materials, such as expanded polystyrene (EPS) and polyurethane (PU), has raised environmental concerns due to their non-biodegradable nature and potential impact on the environment. Regulatory authorities are increasingly imposing restrictions on the use of such materials, driving the need for sustainable and eco-friendly packaging solutions. Manufacturers need to invest in research and development to create environmentally friendly insulation materials that comply with regulatory requirements and meet consumer expectations.

Supply Chain Disruptions

Supply chain disruptions, such as those caused by the COVID-19 pandemic, can pose significant challenges to the insulated packaging market. The pandemic has highlighted the vulnerabilities in global supply chains, impacting the availability of raw materials, manufacturing processes, and distribution networks. Ensuring the continuity of supply chains and mitigating the risks of disruptions is crucial for the sustained growth of the insulated packaging market. Manufacturers need to adopt resilient supply chain

Read Also: Metal Organic Framework Market Size, Share, Report by 2033

Insulated Packaging Market Companies

- Deutsche Post DHL

- E.I. Du Pont De Nemours and Co.

- Amcor Limited

- Sonoco Products Company

- Huhtamaki OYJ

- Constantia Flexibles

- Greiner Group

- Innovia Films

- Sofrigam

- Winpak

- DHL

- Exeltainer

- American Aerogel Corporation

- Thermal Packaging Solutions

- TemperPack

- Insulated Products Corp.

- Davis Core & Pad Co.

- Cryopak

- DS Smith PLC

- Innovative Energy Inc.

Recent Developments

- In June 2024, ProActive Recyclable® FiberCool curbside recyclable insulated bag is now available thanks to a patent application from ProAmpac, a pioneer in material science and flexible packaging. Beyond a typical self-opening sack (SOS), FiberCool provides food and grocery delivery services with a temperature retention solution in addition to the ease of curbside recyclability.

- In January 2024, the first-ever grant contest has been launched by Thermal Custom Packaging (TCP), a company that specializes in insulated totes, phase change material cold packs, and customized storage for medical supplies. TCP wants to help first responders in their vital missions to safeguard people, property, evidence, and the environment.

- In September 2023, The phase-change material (PCM) technology company Pluss Advanced Technologies (PLUSS) announced the launch of two new temperature-controlled packaging solutions for the pharmaceutical industry: Celsure® XL Pallet Shipper series and Celsure® VIP Multi-Use Parcel Shipper series.

Segment Covered in the Report

By Type

- Rigid

- Flexible

- Semi-rigid

By Product

- Corrugated cardboard

- Metal

- Glass

- Plastic

- Others

By Application

- Cosmetic

- Pharmaceutical

- Industrial

- Food & beverages

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/