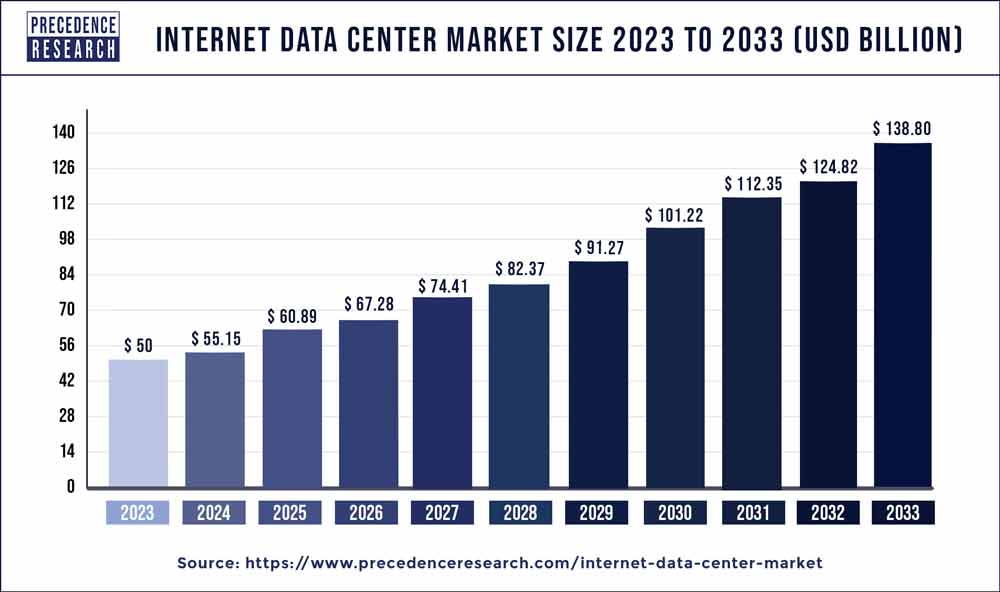

The global internet data center market size reached USD 50 billion in 2023 and is expected to surpass around USD 138.80 billion by 2033, growing at a CAGR of 10.80% from 2024 to 2033.

Key Takeaways

- North America dominated the market with a 43% market share in 2023.

- Asia-Pacific is expected to witness the fastest rate with a CAGR of 14.2% during the forecast period of 2024-2033.

- By end-use, the cloud service Provider (CSP) segment held the largest segment of 38% in the internet data center market in 2023.

- On the other hand, the e-commerce & retail segment is expected to grow at a significant rate of 15.2% during the forecast period.

- By service, the colocation segment held the largest share of 43% in 2023.

- By service, the content delivery network (CDN) segment is expected to grow at a notable rate of 10.3% during the forecast period.

- By deployment, the public segment held the largest share of 56% in 2023.

- By deployment, the hybrid segment is expected to grow at a significant CAGR of 16.2% during the forecast period.

- By enterprise size, the large enterprises segment held the dominating share of 86% in 2023.

- Whereas the small and medium-sized enterprises (SME) segment is expected to grow at a notable CAGR of 18.3% during the forecast period.

Overview:

The Internet Data Center (IDC) market has witnessed significant growth in recent years, driven by the increasing demand for data storage, processing, and management services. IDCs play a crucial role in supporting the digital infrastructure of various industries, including IT and telecommunications, banking and finance, healthcare, and e-commerce. These facilities provide the necessary infrastructure for storing, managing, and disseminating vast amounts of data generated by businesses and individuals worldwide. With the proliferation of cloud computing, big data analytics, Internet of Things (IoT) devices, and digital content consumption, the demand for IDC services is expected to continue its upward trajectory in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3746

Growth Factors:

Several factors contribute to the growth of the Internet Data Center market. Firstly, the rapid digitization of businesses and the adoption of cloud-based services drive the demand for data storage and processing capabilities. As organizations increasingly rely on digital platforms for their operations, they require robust IDC infrastructure to store and manage their data securely. Additionally, the growing popularity of online services such as streaming media, e-commerce, social networking, and gaming fuels the need for scalable and reliable IDC solutions to handle the surge in data traffic. Furthermore, emerging technologies like edge computing and 5G networks are expected to bolster the demand for edge data centers, which facilitate low-latency processing and improve user experiences for applications requiring real-time data processing.

Internet Data Center Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.80% |

| Global Market Size in 2023 | USD 50 Billion |

| Global Market Size by 2033 | USD 138.80 Billion |

| U.S. Market Size in 2023 | USD 15.05 Billion |

| U.S. Market Size by 2033 | USD 42.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service, By Deployment, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Internet Data Center Market Dynamics

Drivers:

Several drivers propel the growth of the Internet Data Center market. Firstly, the proliferation of smartphones, tablets, and other connected devices has led to an exponential increase in data generation and consumption. This trend is further amplified by the rising popularity of bandwidth-intensive applications such as high-definition video streaming, virtual reality, and augmented reality. Moreover, the ongoing digital transformation initiatives across various industries drive the migration of IT workloads to cloud-based environments, leading to increased demand for IDC services. Additionally, the need for enhanced data security, compliance with regulatory requirements, and business continuity planning encourages organizations to invest in modern IDC infrastructure equipped with advanced security features, redundant power supplies, and disaster recovery capabilities.

Restraints:

Despite the favorable market dynamics, the Internet Data Center market faces certain challenges that could hinder its growth. One of the primary restraints is the high initial capital expenditure required for building and maintaining IDC infrastructure. Setting up a data center facility involves substantial investments in land, construction, cooling systems, power distribution, networking equipment, and security measures. Moreover, the ongoing operational expenses related to electricity consumption, maintenance, and staffing add to the overall cost of IDC ownership. Additionally, the scarcity of skilled personnel capable of managing complex data center operations poses a challenge for IDC operators, especially in regions experiencing a talent shortage in the IT and telecommunications sectors.

Opportunities:

Despite the challenges, the Internet Data Center market presents lucrative opportunities for vendors, service providers, and investors alike. One significant opportunity lies in the adoption of modular and prefabricated data center solutions, which offer faster deployment times, scalability, and cost-efficiency compared to traditional brick-and-mortar data center construction. These modular data centers cater to the needs of small and medium-sized enterprises (SMEs) seeking to establish their presence in the digital economy without incurring substantial upfront costs. Moreover, the increasing demand for colocation services, where multiple tenants share data center infrastructure and operational expenses, presents a viable business model for IDC providers to capitalize on economies of scale and maximize revenue generation.

Read Also: Next Generation Memory Market Size to Cross USD 38.34 Bn by 2033

Recent Developments

- In September 2023, Google, Microsoft, Schneider Electric, and Danfoss jointly unveiled a collaborative initiative known as the Net Zero Innovation Hub for Data Center. This groundbreaking project is developed in partnership with the Danish Data Center Industry. The proposed location for this innovative center is Fredericia, Denmark.

- In November 2020, the United States Immigration & Customs Enforcement Agency invested over USD 100 million in cloud services, utilizing the Amazon Web Services and Microsoft Azure cloud environments.

- In January 2020, Vapor IO announced its ambitious plans to establish 36 edge data center sites across the United States by 2021.

Internet Data Center Market Companies

- Alibaba Cloud (China)

- Amazon Web Services, Inc. (United States)

- AT&T Intellectual Property (United States)

- Lumen Technologies (CenturyLink) (United States)

- China Telecom Americas, Inc. (United States)

- CoreSite (United States)

- CyrusOne (United States)

- Digital Realty (United States)

- Equinix, Inc. (United States)

- Google Cloud (United States)

- IBM (United States)

- Microsoft (United States)

- NTT Communications Corporation (Japan)

- Oracle (United States)

- Tencent Cloud (China)

Segments Covered in the Report

By Service

- Hosting

- Colocation

- CDN

- Others

By Deployment

- Public

- Private

- Hybrid

By Enterprise Size

- Large Enterprises

- SMEs

By End-use

- CSP

- Telecom

- Government/Public Sector

- BFSI

- Media & Entertainment

- E-commerce & Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/