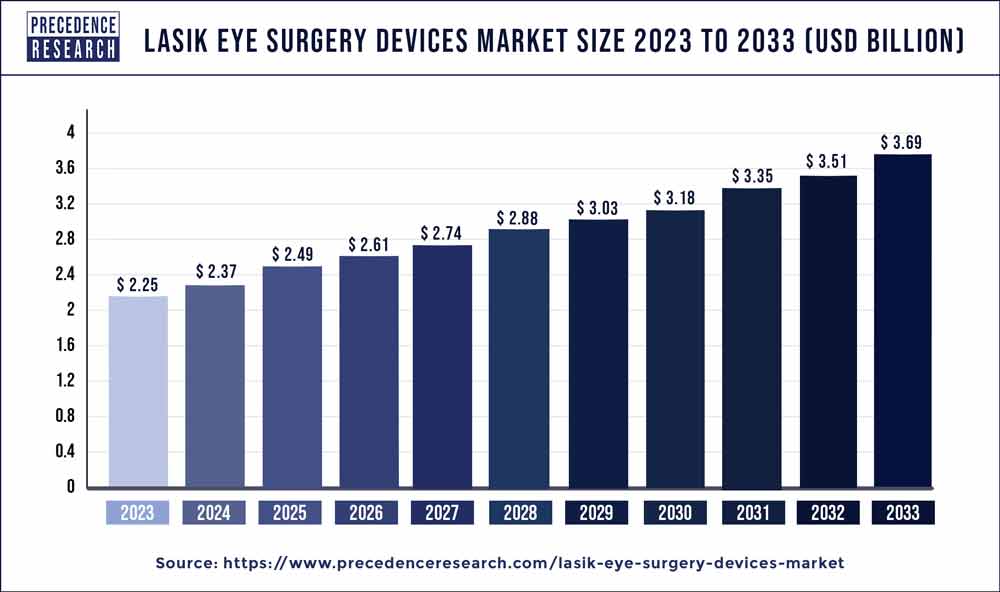

LASIK Eye Surgery Devices Market Size to Attain USD 3.69 Bn by 2033

The global LASIK eye surgery devices market size was valued at USD 2.25 billion in 2023 and is predicted to reach around USD 3.69 billion by 2033, growing at a CAGR of 5.07% from 2024 to 2033.

Key Points

- North America dominated the market with the largest share of 37% in 2023.

- Asia Pacific is expected to experience considerable growth over the forecast period.

- By product, the femtosecond laser segment held the largest share of the market in 2023.

- By product, the excimer laser system segment is predicted to be the fastest-growing segment over the forecast period.

- By end-use, the LASIK eye centers segment accounted for the largest market share in 2023.

- By end-use, the ambulatory surgical centers (ASCs) segment is the fastest-growing segment in the LASIK eye surgery devices market during the forecast period.

The LASIK (Laser-Assisted In Situ Keratomileusis) eye surgery devices market has experienced significant growth in recent years due to advancements in technology and increasing demand for corrective eye surgeries. LASIK surgery is a popular refractive surgery procedure used to correct vision problems such as myopia, hyperopia, and astigmatism by reshaping the cornea using a laser. The market for LASIK eye surgery devices encompasses a range of equipment and instruments used during the surgical procedure, including excimer lasers, microkeratomes, femtosecond lasers, and diagnostic devices. As the prevalence of vision disorders continues to rise globally, the LASIK eye surgery devices market is expected to witness further expansion in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3902

Growth Factors:

List of Contents

ToggleSeveral factors contribute to the growth of the LASIK eye surgery devices market. Technological advancements have led to the development of more precise and efficient laser systems, enhancing surgical outcomes and reducing the risk of complications. Additionally, increasing awareness about the benefits of LASIK surgery, such as reduced dependence on eyeglasses and contact lenses, has driven patient demand. Moreover, the growing aging population, coupled with the rising incidence of vision disorders, particularly among the elderly, has further fueled market growth. Furthermore, favorable reimbursement policies and healthcare infrastructure development in emerging economies have expanded access to LASIK surgery, driving market expansion in these regions.

Region Snashot

The LASIK eye surgery devices market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market, owing to the presence of well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and increasing healthcare expenditure. Europe follows closely, driven by a growing geriatric population and rising demand for minimally invasive surgical procedures. The Asia Pacific region is anticipated to witness rapid growth, attributed to improving healthcare facilities, rising disposable incomes, and increasing awareness about LASIK surgery. Latin America and the Middle East and Africa are also expected to contribute to market growth, driven by expanding healthcare access and growing demand for corrective eye surgeries.

LASIK Eye Surgery Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.07% |

| Global Market Size in 2023 | USD 2.25 Billion |

| Global Market Size by 2033 | USD 3.69 Billion |

| U.S. Market Size in 2023 | USD 620 Million |

| U.S. Market Size by 2033 | USD 1,020 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

SWOT Analysis:

- Strengths: The LASIK eye surgery devices market benefits from continuous technological advancements, improving surgical precision and patient outcomes. Additionally, increasing patient awareness and favorable reimbursement policies in key markets contribute to market growth.

- Weaknesses: High upfront costs associated with LASIK surgery devices may limit adoption, particularly in emerging economies where healthcare budgets are constrained. Moreover, concerns about potential complications and side effects may deter some patients from undergoing LASIK surgery.

- Opportunities: The growing aging population and rising prevalence of vision disorders present significant opportunities for market expansion. Moreover, untapped markets in emerging economies offer potential for growth, driven by increasing healthcare infrastructure development and rising disposable incomes.

- Threats: Intense competition among market players, coupled with stringent regulatory requirements, poses a threat to market growth. Additionally, alternative vision correction procedures such as implantable lenses and refractive lens exchange may pose competitive challenges to LASIK surgery devices.

Read Also: Animal Diagnostics Market Size to Cross USD 20.08 Bn by 2033

Recent Developments

- In January 2024, the FDA approved the Teneo Excimer Laser Platform (Bausch + Lomb Corporation) for laser-assisted in situ keratomileusis (LASIK), a vision correction surgery for myopia and myopic astigmatism (nearsightedness).

- In June 2023, ZEISS, a global optics and optoelectronic technology leader, launched its advanced medical devices, VISUMAX 800 and Quatera 700.

- In March 2023, Johnson & Johnson Vision, a part of Johnson & Johnson MedTech, announced the CE Mark approval for its advanced laser vision correction solution, the ELITA Femtosecond Laser System. This new laser enables surgeons to perform refractive correction for myopia, with or without astigmatism, through the SILK Procedure, a novel lenticular technique (Smooth Incision Lenticule Keratomileusis).

- In May 2022, Sohana Hospital, located in Mohali, India, introduced LASIK treatment to eliminate the need for spectacles. As per the source, the Contoura Vision LASIK surgery can be completed in under 10 minutes.

Competitive Landscape:

The LASIK eye surgery devices market is characterized by intense competition among key players, including Alcon Inc., Carl Zeiss Meditec AG, Johnson & Johnson Vision, Bausch Health Companies Inc., NIDEK Co., Ltd., and others. These companies compete based on product innovation, pricing strategies, and geographical expansion. Key strategies adopted by market players include mergers and acquisitions, strategic collaborations, and product launches to strengthen their market presence and gain a competitive edge. Additionally, focus on research and development activities to introduce advanced technologies and enhance product offerings remains crucial for sustaining growth in the highly competitive LASIK eye surgery devices market.

LASIK Eye Surgery Devices Market Companies

- Alcon, Inc. (Switzerland)

- Carl Zeiss Meditec AG (Germany)

- Johnson & Johnson Vision Care, Inc. (U.S.)

- Bausch + Lomb (U.S.)

- NIDEK CO., LTD. (Japan)

- SCHWIND eye-tech-solutions GmbH (Germany)

- Ziemer Ophthalmic Systems AG (Switzerland)

- Abbott Medical Optics (U.S.)

- Technolas Perfect Vision GmbH (Germany)

- AMO Manufacturing USA, LLC (U.S.)

- Topcon Corporation (Japan)

- Lumenis Ltd. (Israel)

- LensAR, Inc. (U.S.)

- ZEPTO Precision Cataract Surgery (U.S.)

- iVIS Technologies (Italy)

- Optovue, Inc. (U.S.)

- Beyeonics Surgical Ltd. (U.K.)

Segments Covered in the Report

By Product

- Excimer Laser

- Femtosecond Laser

By End-use

- LASIK Eye Centers

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/