Low Speed Electric Vehicle Market Size, Share, Report by 2033

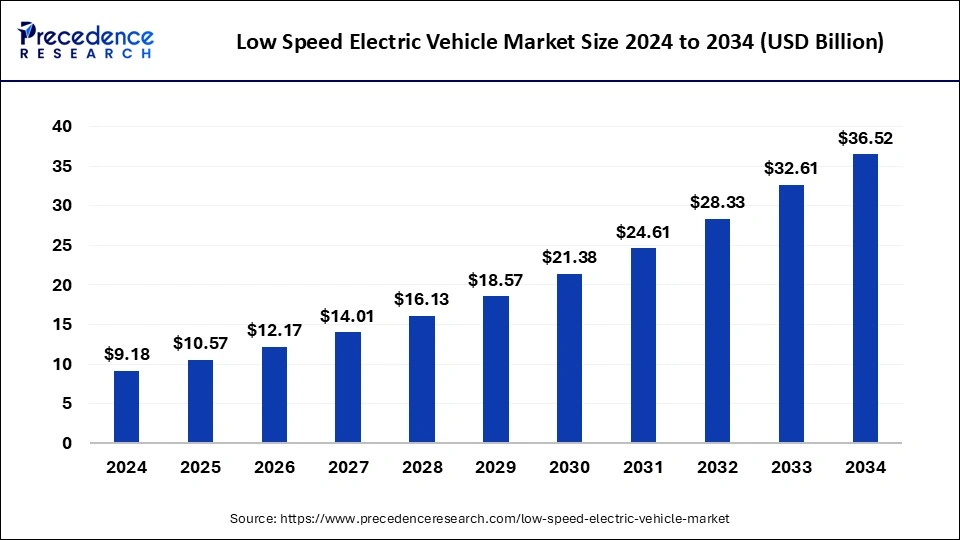

The global low speed electric vehicle market size is expected to increase USD 32.61 billion by 2033 from USD 7.98 billion in 2023 with a CAGR of 15.12% between 2024 and 2033.

Key Points

- Asia Pacific led the market with the largest share of the market in 2023.

- By vehicle type, the passenger segment projected the largest revenue in the market in 2023.

- By end-user, the golf courses segment dominated the market with the largest share in 2023.

The Low Speed Electric Vehicle (LSEV) market encompasses vehicles designed primarily for urban and short-distance transportation, characterized by their lower speeds and electric propulsion. These vehicles typically operate at speeds under 45 km/h (28 mph), offering a cost-effective and environmentally friendly alternative for various urban mobility needs.

Get a Sample: https://www.precedenceresearch.com/sample/4547

Growth Factors

The market for LSEVs has seen significant growth driven by increasing urbanization, rising awareness of environmental sustainability, and government initiatives promoting electric vehicles (EVs). Cost-effectiveness in operation and maintenance compared to traditional vehicles also fuels adoption, particularly in densely populated urban areas.

Regional Insights

Asia-Pacific dominates the LSEV market, driven by high demand in countries like China and India, where urban congestion and pollution issues incentivize adoption of eco-friendly transportation solutions. North America and Europe follow, with increasing regulatory support and consumer interest in sustainable mobility solutions contributing to market expansion.

Trends in the Low Speed Electric Vehicle Market

Key trends include technological advancements in battery efficiency and vehicle design, enabling longer ranges and improved performance. Integration of smart technologies for connectivity and enhanced user experience is also prevalent, catering to the evolving preferences of urban commuters.

Low Speed Electric Vehicle Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 32.61 Billion |

| Market Size in 2023 | USD 7.98 Billion |

| Market Size in 2024 | USD 9.18 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 15.12% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Vehicle Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Low Speed Electric Vehicle Market Dynamics

Drivers

The primary drivers include stringent emission regulations, government subsidies for electric vehicles, and the growing preference for zero-emission transportation solutions among environmentally conscious consumers. Additionally, advancements in battery technology and charging infrastructure enhance the feasibility and attractiveness of LSEVs.

Opportunities

Opportunities lie in expanding market reach beyond urban areas into suburban and rural regions, where affordable and eco-friendly transportation alternatives are increasingly valued. Collaborations between automotive manufacturers and technology firms present avenues for innovation and market growth, particularly in enhancing vehicle performance and user convenience.

Challenges

Challenges include limited range and speed capabilities compared to conventional vehicles, which may restrict widespread adoption, especially for long-distance travel or highway use. Additionally, concerns about charging infrastructure readiness and initial purchase costs remain barriers that need to be addressed to accelerate market penetration.

Read Also: Industrial Bulk Packaging Market Size to Worth USD 38.83 Bn by 2033

Low Speed Electric Vehicle Market Companies

- Textron Inc. (Textron Specialized Vehicles Inc.)

- HDK Electric Vehicle

- Star EV Corporation

- Polaris Inc.

- Yamaha Motor Co., Ltd.

- Bradshaw Electric Vehicles, Inc

- GARIA

- AGT Electric Cars

- Columbia Vehicle Group Inc.

- SpeedwaysElectric

Recent Developments

- In June 2024, Kandi America, a leading manufacturer of eUTVs and electric golf carts, launched three new electric go-karts specifically designed for off-roading fun.

- In June 2024, Motovolt Mobility Pvt. Ltd., a leading e-mobility brand in India, collaborated with Zevo, a technology-powered logistics solutions provider that uses efficiency and environmental sustainability in operations for the launch of 5,000 M7 electric scooters for urban mobility and last-mile delivery services.

- In January 2024, ICON EV and WiTricity announced the launch of 2024 ICON Low-Speed Vehicles (LSVs) with the feature of wireless charging. The launch will be unveiled at WiTricity’s display at the Las Vegas Consumer Electronics Show (CES) and will be available in the market in the summer of 2024.

- In June 2024, Zelio Ebikes, a trailblazing company in the EV two-wheeler space, revealed the introduction of the X Men low-speed electric scooter series, which is its newest product line. With five unique X Men scooter variations that are sure to appeal to a broad spectrum of customers, this reveal marks a considerable extension of Zelio Ebikes’ product line.

Segments Covered in the Report

By Vehicle Type

- Passenger Vehicles

- Heavy Duty Vehicles

- Utility Vehicles

- Off-Road Vehicles

By End-User

- Airports

- Residential and Commercial Premises

- Golf Courses

- Tourist Destinations

- Hotels and Resorts

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/