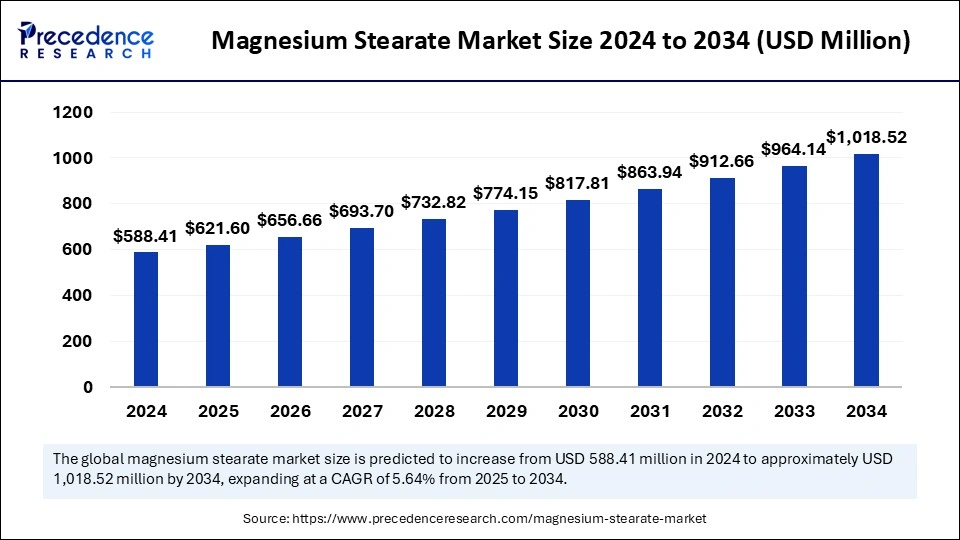

Magnesium Stearate Market Poised to Hit USD 1,018.52 Mn by 2034

Magnesium Stearate Market Key Takeaways

Asia Pacific accounted for the largest market share of 37% in 2024, leading the global magnesium stearate market.

North America is forecasted to grow at the fastest pace in the upcoming years.

Europe is anticipated to exhibit consistent growth throughout the forecast period.

By form, the powder segment held the dominant share in 2024, while the flakes segment is expected to expand considerably.

The pharmaceutical sector contributed the largest share by application in 2024, whereas the personal care segment is expected to grow notably over the forecast period.

Magnesium Stearate Market Overview

The Magnesium Stearate Market is expanding rapidly, driven by the increasing adoption of high-performance excipients in the pharmaceutical, food, and personal care industries. Magnesium stearate, known for its excellent lubricating, anti-caking, and stabilizing properties, is widely used to enhance the quality and consistency of products across these sectors.

The growing demand for high-quality generic drugs, functional foods, and advanced cosmetic formulations has amplified the need for magnesium stearate, positioning it as an indispensable ingredient in modern manufacturing processes.

Magnesium stearate usage continues to grow because it functions as a key ingredient that drives up the demand for pharmaceuticals and dietary supplements. Expanding cosmetics industry trends boost the market because magnesium stearate serves as an additive in several items, such as makeup formulations and personal care products. The market grows because pharmaceutical manufacturers use better production methods with rising efficiency and cost-effectiveness requirements.

Magnesium Stearate Market Drivers

The global pharmaceutical industry’s growth and innovation are driving the demand for magnesium stearate. As pharmaceutical companies seek to optimize tablet production processes, reduce manufacturing costs, and enhance product quality, the reliance on magnesium stearate as a reliable excipient continues to grow. The increasing prevalence of chronic diseases and the expanding aging population have also contributed to the rising demand for pharmaceutical formulations, boosting the magnesium stearate market.

The rising demand for functional foods and dietary supplements is another critical driver. Consumers are increasingly seeking nutrient-rich, fortified, and functional foods that offer health benefits beyond basic nutrition. Magnesium stearate plays a key role in maintaining the stability and consistency of these products, ensuring uniform dispersion of ingredients.

Magnesium Stearate Market Opportunities

The expansion of nutraceutical and wellness product categories presents significant growth opportunities for magnesium stearate manufacturers. As consumers become more health-conscious and prioritize preventive healthcare, the demand for dietary supplements and functional foods is expected to rise, creating a robust market for high-quality excipients.

The growing trend of customized and personalized healthcare solutions is also creating opportunities for magnesium stearate in specialized formulations. As the pharmaceutical industry shifts toward precision medicine and patient-centric therapies, the need for tailored excipients that enhance formulation performance is increasing.

Magnesium Stearate Market Challenges

Stringent regulatory requirements and quality standards continue to be a challenge for magnesium stearate manufacturers. Ensuring compliance with evolving regulations across different regions requires ongoing investment in quality assurance systems, product testing, and documentation.

Additionally, the volatility of raw material prices poses a challenge for magnesium stearate producers. The price fluctuations of stearic acid and magnesium salts, which are key raw materials in magnesium stearate production, can impact overall production costs and profit margins.

Magnesium Stearate Market Regional Insights

Asia Pacific leads the global magnesium stearate market, with strong demand from the pharmaceutical, food, and personal care industries in China, India, and Southeast Asia. The region’s low manufacturing costs, abundant raw materials, and growing consumer base contribute to its dominant market position.

North America remains a key market, driven by the region’s focus on high-quality pharmaceuticals, functional foods, and personal care products. The region’s stringent quality standards and regulatory framework create a favorable environment for premium-grade magnesium stearate.

Europe is experiencing steady growth, supported by increasing consumer preference for clean-label and sustainable products. The region’s emphasis on reducing environmental impact and promoting ethical sourcing is encouraging the adoption of biodegradable and plant-based magnesium stearate alternatives.

Magnesium Stearate Market Recent Developments

- In August 2023, Peter Greven, a leading producer of oleochemical additives and auxiliary products, entered China it purchased new manufacturing facilities for magnesium stearate production. Adding this new plant will enhance Peter Greven’s market position across all alkaline soaps and metallic soap esters and dispersions in China.

- In July 2023, Struktol launched an innovative magnesium stearate formulation for the market when the company operated as a multinational American entity focused on plastics and rubber process additives. The product resolves environmental and sustainability targets by using renewable degradable materials to deliver a sustainable solution.

Magnesium Stearate Market Companies

- Croda International

- Unichem

- AkzoNobel

- Wacker Chemie

- Merck

- Evonik

- The Dow Chemical Company

- Siltronic

- T. Vanderbilt Company

- Sumitomo Chemical

- BASF

- PQ Corporation

- Tolsa Group

- Solvay

Segments Covered in the Report

By Form

- Powder

- Flakes

By Application

- Pharmaceuticals

- Personal Care

- Food and Beverages

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!