Mammography Systems Market Size to Cross USD 6.22 Bn by 2033

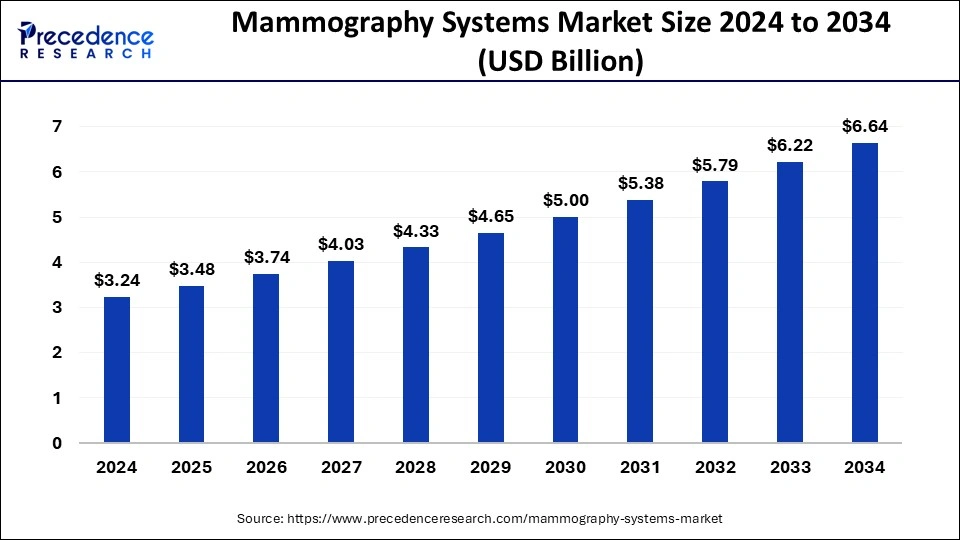

The global mammography systems market size surpassed USD 3.01 billion in 2023 and is estimated to be worth around USD 6.22 billion by 2033, growing at a CAGR of 7.53% from 2024 to 2033.

Key Points

- North America dominated the global mammography systems market share of 37% in 2023.

- Asia Pacific is expected to experience the fastest growth over the forecast period.

- Based on the product, the full-field digital mammography systems segment held the largest share of the market.

- Based on the product, the breast tomosynthesis systems segment is expected to show the fastest growth in the market.

- Based on technology, the 3D mammography systems segment is projected to witness the fastest growth in the forecasted period.

- Based on end-users, the ambulatory surgical centers segment is projected to uplift the market in the upcoming years.

The mammography systems market is a crucial component of the healthcare industry, primarily focusing on the diagnosis and screening of breast cancer in women. Mammography systems are specialized medical devices designed to produce high-quality images of the breast tissue, aiding in the early detection and diagnosis of breast abnormalities, including cancerous tumors. These systems utilize low-dose X-rays to capture detailed images of the breast, allowing healthcare professionals to identify any potential abnormalities or signs of cancer. With breast cancer being one of the most prevalent cancers among women worldwide, the demand for mammography systems continues to grow as early detection remains a key factor in improving patient outcomes and survival rates.

Get a Sample: https://www.precedenceresearch.com/sample/3964

Growth Factors:

Several factors contribute to the growth of the mammography systems market. One of the primary drivers is the increasing prevalence of breast cancer globally. As breast cancer rates continue to rise, particularly in developing countries, there is a growing need for advanced diagnostic tools such as mammography systems to facilitate early detection and intervention. Additionally, advancements in technology have led to the development of digital mammography systems, which offer higher resolution images and improved diagnostic accuracy compared to traditional analog systems. The shift towards digital mammography is further driving market growth, as healthcare facilities seek to upgrade their imaging capabilities to enhance patient care and outcomes.

Moreover, rising awareness among women about the importance of breast cancer screening and early detection has also contributed to the growth of the mammography systems market. Public health campaigns and initiatives aimed at promoting breast cancer awareness and encouraging regular screening have resulted in increased demand for mammography services, thereby fueling market expansion. Furthermore, favorable reimbursement policies and government initiatives aimed at improving access to breast cancer screening services have also played a significant role in driving market growth, particularly in emerging economies where healthcare infrastructure is rapidly evolving.

Region Insights:

The mammography systems market exhibits regional variations influenced by factors such as healthcare infrastructure, economic development, and regulatory frameworks. Developed regions such as North America and Europe dominate the market, driven by well-established healthcare systems, high awareness levels, and early adoption of advanced medical technologies. In these regions, government-funded screening programs and private sector investments in healthcare infrastructure contribute to the widespread availability and adoption of mammography systems.

In contrast, emerging economies in Asia Pacific, Latin America, and Africa present significant growth opportunities for the mammography systems market. Rapid urbanization, improving healthcare infrastructure, and increasing disposable incomes are driving the adoption of mammography systems in these regions. Moreover, rising healthcare expenditures, expanding insurance coverage, and growing awareness about breast cancer screening are further fueling market growth in emerging economies. However, challenges such as limited access to healthcare services in rural areas, inadequate trained personnel, and regulatory hurdles may hinder market penetration in these regions.

Mammography Systems Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.53% |

| Global Market Size in 2023 | USD 3.01 Billion |

| Global Market Size by 2033 | USD 6.22 Billion |

| U.S. Market Size in 2023 | USD 780 Million |

| U.S. Market Size by 2033 | USD 1,610 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Technology, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Mammography Systems Market Dynamics

Drivers:

Several drivers propel the growth of the mammography systems market. The increasing incidence of breast cancer worldwide is a primary driver, necessitating the use of mammography systems for early detection and diagnosis. Furthermore, technological advancements such as digital mammography, 3D mammography (tomosynthesis), and computer-aided detection (CAD) systems enhance diagnostic accuracy and improve patient outcomes, driving market growth.

Additionally, growing awareness about breast cancer screening, coupled with government initiatives and healthcare policies promoting early detection programs, contributes to market expansion. Moreover, the rising adoption of preventive healthcare measures and the availability of reimbursement for mammography screening further boost market demand. Furthermore, strategic collaborations between healthcare providers, equipment manufacturers, and research institutions facilitate the development and commercialization of innovative mammography systems, driving market growth.

Opportunities:

The mammography systems market presents numerous opportunities for growth and innovation. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning algorithms into mammography systems, hold promise for improving diagnostic accuracy and efficiency. AI-powered image analysis tools can assist radiologists in detecting and interpreting breast abnormalities, thereby reducing interpretation times and enhancing workflow efficiency.

Moreover, the expansion of screening programs in underserved regions and the introduction of mobile mammography units bring mammography services closer to communities lacking access to traditional healthcare facilities. Furthermore, the growing emphasis on personalized medicine and risk-based screening approaches presents opportunities for the development of tailored screening protocols and advanced imaging modalities tailored to individual patient needs.

Additionally, the increasing focus on patient-centric care and the adoption of value-based healthcare models drive the demand for innovative mammography systems that prioritize patient comfort, safety, and experience. Manufacturers can capitalize on these opportunities by investing in research and development to create next-generation mammography technologies that address unmet clinical needs and enhance patient outcomes.

Challenges:

Despite the growth prospects, the mammography systems market faces several challenges that may impede its expansion. Limited access to healthcare services, particularly in rural and remote areas, poses a significant barrier to the widespread adoption of mammography screening programs. Inadequate infrastructure, including the availability of trained personnel, imaging facilities, and equipment, hinders the delivery of mammography services in underserved regions.

Moreover, concerns regarding radiation exposure associated with mammography screening raise questions about its safety and potential risks, leading to hesitancy among some patients and healthcare providers. Addressing these concerns requires ongoing education and awareness campaigns to emphasize the benefits of early detection while ensuring adherence to established safety protocols and guidelines.

Furthermore, economic constraints, reimbursement issues, and budgetary constraints in healthcare systems may limit the adoption of advanced mammography technologies, particularly in resource-constrained settings. Additionally, regulatory complexities and compliance requirements pose challenges for manufacturers seeking to introduce new products to market, leading to delays in product approvals and market entry.

Read Also: Digital Genome Market Size to Surpass USD 109.74 Bn by 2033

Recent Developments

- In February 2023, the introduction of a new Global project on Breast Cancer with the objective of reducing mortality rates and improving treatment was announced by the World Health Organization (WHO). It targets to save millions of breast cancer cases by the year 2040. The newly launched project emphasizes three critical steps for health: early detection, timely diagnosis, and comprehensive management of breast cancer.

- In October 2023, Siemens Healthineers presented a novel mammography framework called Mammomat B. Brilliant with wide-angle tomosynthesis. This system utilizes Flying focal spot technology innovation for the first time in mammography. It was the first gadget from Siemens Healthineers that consolidated wide-angle tomosynthesis, the new detector, the newly evolved Flying Focus Spot tube, and the Premia computer-based intelligence recreation to upgrade image quality.

- In November 2022, Google Health announced a partnership with iCAD, a medical technology company, to incorporate its AI technology into breast imaging solutions. This was the first commercialization agreement for Google Health’s mammography AI models and allowed the technology to be used in real-life clinical settings.

Mammography Systems Market Companies

- Siemens Healthineer

- Planmed Oy

- NP JSC Amico

- Koninklijke Philips

- Konica Minolta

- Hologic

- Fujifilm Holdings Corporation

- Delphinus Medical Technologies

- Carestream Health, Inc.

- Canon Medical Systems Corporation (Toshiba Medical Systems Corp.)

- Analogic Corporation

- GE Healthcare

- Allengers Medical Systems Limited

- BET Medical

Segments Covered in the Report

By Product

- Analog Systems

- Full-Field Digital Mammography Systems

- Breast Tomosynthesis Systems

By Technology

- Screen Film

- 2D Mammography

- 3D Mammography

- Others

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/