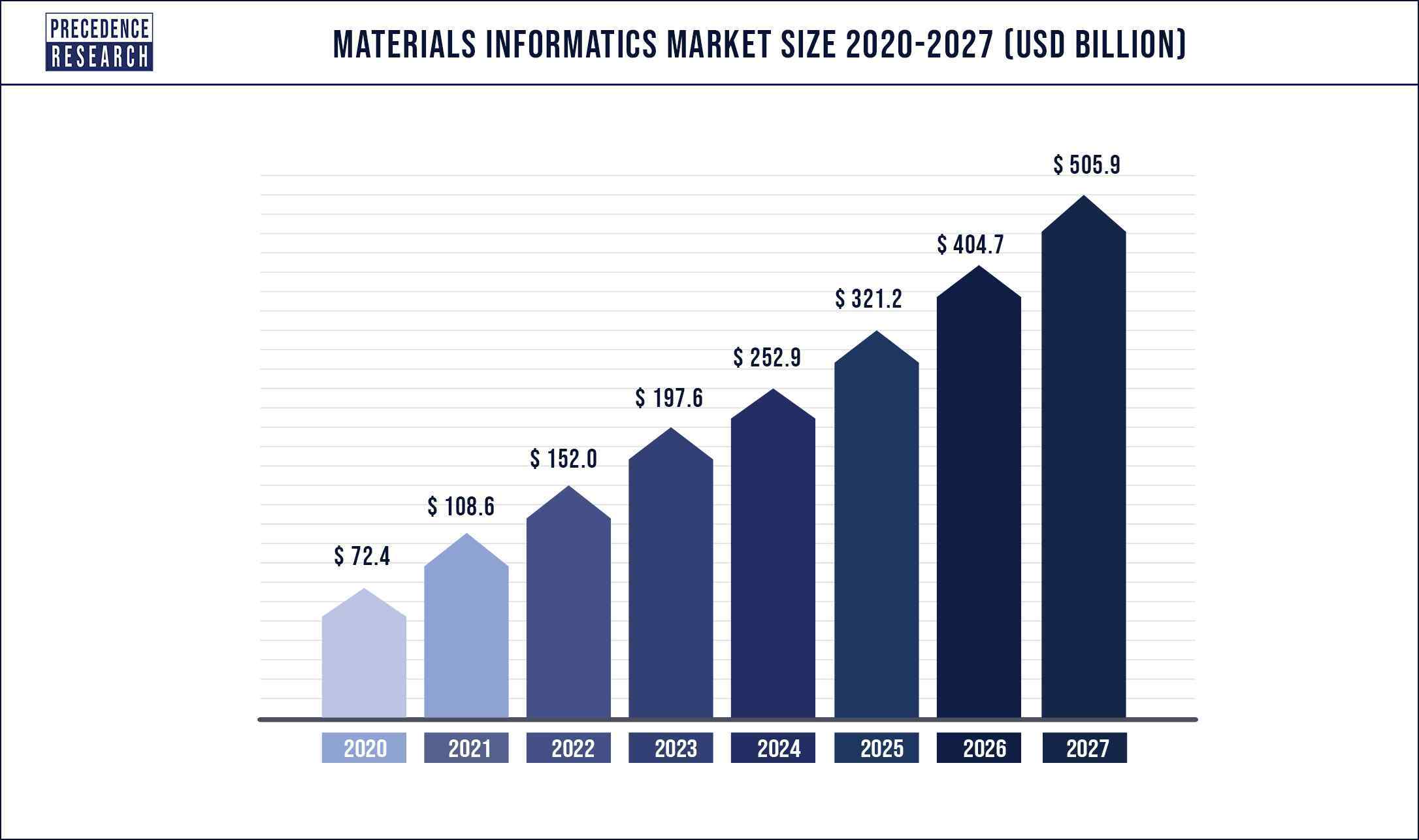

Materials Informatics Market to Grow Nearly 26.9% Through 2027

The global materials informatics market size is poised to be worth 505.9 million US$ by 2027. It is currently valued at around 152 million US$ but is growing at the rate of 29.2% every year.

The prediction is from the market research company Precedence Research in their outlook summary for this decade. The report contains 150+ pages of detailed analysis. The base year for the study has been considered 2021, the historic year is 2017 to 2020, and the forecast period considered is from 2021 to 2027.

Materials informatics is the application of data centric methodologies to material science research and development. This can take many forms and affect every aspect of research and development. Materials informatics is primarily built on the use of data infrastructures and machine learning solutions to create novel materials, discover materials for a certain purpose, and optimize how they are tested.

Several applications and end user sectors have begun to apply comparable design techniques. The increased innovations in artificial intelligence driven solutions from other industries is due to the factors such as technological advancements, massive advancements in data infrastructures, and improved awareness and understanding of technologies.

In recent years, the application of materials informatics to find novel attractive materials has been successful. One significant example is the discovery of new super hard materials. The existing materials, such as osmium and rhenium, are utilized in abrasives and cutting tools, but they need high synthetic conditions or contain very rare elements.

The artificial intelligence has been proposed in almost every industry. Although material science research and development is behind the curve and faces numerous industry specific challenges, the opportunities are beginning to emerge, and the potential impact is considerable.

What Is Materials Informatics?

Until recently, applying cutting-edge computer science and data techniques like machine learning and advanced statistical analysis made sense only in data-rich industries where data is relatively cheap, structured, and plentiful. They include sectors that benefit the most from advances in big data, like financial services, insurance, and information technology. It is only in the last few years that these methods have been adapted for the more complex data environments familiar to materials R&D practitioners.

Materials informatics takes the study of computational systems—how information is processed and transformed—and applies it to the development of industrial materials like polymers and ceramics. The goal of the field is to use best practices learned from data-rich industries, including the collection and management of large datasets, the infrastructure needed to process and learn from them, and advanced machine learning techniques to make faster, more focused progress in new materials discovery and the development of existing materials.

Organizations up and down the materials value chain—from raw material suppliers and university research labs to aerospace OEMs and multinational polymer manufacturers—use materials informatics to drive innovation and jumpstart development on next-generation products. The same technology that powers fields like robotics and autonomous vehicles is now being used by R&D teams to make leaps in materials development faster than ever.

Global Materials Informatics Market News:

- In December 2021, Boston Micro Fabrication (BMF), a specialistcompany in microscale 3D printing systems and 4D Biomaterials, a UK-based companyspecialized in 3D printing materials announced the capability to print micro-scale geometries using 4Degra bioresorbable materials.

- In June 2018, Citrine Informatics and BASF announced to collaborate in order to apply Artificial Intelligence (AI) for accelerating the development of new environmental catalyst technologies. Citrine Informatics is an advanced platform that uses the power of AI for bringing new materials faster in the market.

Market Estimations Y-O-Y (2021-2027):

- Market Size Was Valued In 2021: US$ 108.6 Million

- Market Size Is Projected to Grow By 2022: US$ 152 Million

- Market Size Is Projected to Grow By 2023: US$ 197.6 Million

- Market Size Is Projected to Grow By 2024: US$ 252.9 Million

- Market Size Is Projected to Grow By 2025: US$ 321.2 Million

- Market Size Is Projected to Grow By 2026: US$ 404.7 Million

- Market Size Is Projected to Grow By 2027: US$ 505.9 Million

- Compound Annual Growth Rate (CAGR) from 2021 to 2027: 29.2 percent

Materials Informatics Market Scope

| Report Coverage | Details |

| Base Year | 2021 |

| Forecast Period | 2021 to 2027 |

| Top Players | BASF, Kebotix, AI Materia, Schrodinger, Citrine Informatics, Materials Zone Ltd. |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

Broadly speaking, materials informatics is the use of data-driven techniques to better understand the use, selection, development, and discovery of chemicals and materials.

It is perhaps the single most exciting part of the digital transformation age we live in, with the potential to completely alter our lives.

After all, the discovery of new materials usually heralds a new era in our civilization — think of the bronze, copper, iron, paper, and silicon ages.

The materials of the future could range from new plastics that are biodegradable, lightweight alloys such as the ones SpaceX is using for their rockets, to radical superconductors, and Nanomaterials.

Precedence forecasts Inorganics materials capturing 50 % of the market share mainly attributed to several large industries such as electronics, chemicals, food, paper, and many other industries.

Electronic materials are the major application followed by Chemicals, Dyes, Food, Paper, and pulp.

North America leads the pack with Asia-Pacific (particularly Japan) catching up fast.

Materials Informatics Market – COVID-19 Impact Analysis:

- The spread of COVID-19 in the start of 2020 has disrupted the operation of several industries including material science and research sector as well

- During COVID-19, the focus of the government bodies along with the reputed companies had shifted towards the study of the COVID-19 virus, their features and cure that hampered the research on materials

- Further, country lockdown and social distancing norms have significantly impacted the industry operations across various sectors

Read Also:

US Dental Services Market Size Likely to Reach US$ 196.18 Billion by 2027: Precedence Research

Home Healthcare Market Size is Projected to Hit US$ 662.67 Billion by 2027

DNA Sequencing Market is Anticipated to Grow US$ 40.64 Bn By 2030

Blockchain IoT Market Size is Predicted to Hit US$ 19,740 Million by 2030

Scaffold Technology Market Size is Expected to Hit US$ 2.63 Billion by 2030

Generic Drugs Market Size is Projected to Hit US$ 574.63 Billion by 2027

Smart Healthcare Products Market Size is Anticipated to Hit US$ 85.37 Billion by 2030

Materials Informatics Market Highlights:

- North America dominated the global materials informatics market with the highest revenue share in the year 2020 owing to high technology penetration rate in the region

- The Asia Pacific anticipated to register the fastest growth rate over the forthcoming years due to rising internal research & development activity in the Asian companies

- Based on material, inorganics materials led the global materials informatics market with the highest revenue share of approximately 50% in the year 2020

- On the basis of application, electronics segment captured significant revenue share in the year 2020 because of the notable investments made for the internal R&D among the companies in the industry

North America has one of the largest chemical manufacturing sectors in the world. Despite the pandemic, global supply chain concerns, and unfavorable weather occurrences on the Gulf Coast, the American chemical sector grew in 2021, but the latter two factors did limit production. Chemicals and other commodities and materials were in high demand as a result of the post-lockdown expenditure spike. Excess savings, stimulus, and shifting demand patterns toward goods fueled a resurgence in demand across several chemicals-intensive end-use markets.

US

Strong demand for both commodity and specialty chemicals should keep prices stable throughout the year as the chemical sector enters 2022. As key industry companies focus on boosting capacity and expanding into new end markets through both organic and inorganic methods, the industry should see higher capital investment. However, due to raw material cost inflation, which is expected to continue strong through the first half of 2022, the industry may suffer margin constraints.

Sustainability and decarburization will likely be one of the most important areas of concentration for most US chemical businesses in 2022. Many chemical businesses are projected to expand their R&D spending and take advantage of advancements in decarburization and recycling technology to minimize their own and their customers’ carbon footprints and plastic waste. As a result, by 2022, more industry actors should have set targets and plans for reducing emissions and monetizing waste.

Canada

The manufacturing industry in Canada is involved in the transformation of materials or substances into new products, either physically or chemically. These items could be final goods for human consumption or semi-finished goods for use in manufacturing operations. Food, chemicals, petroleum, fabricated metal goods, machinery, transportation equipment, and other things are produced in Canada’s industries.

Mexico

Mexico’s economy continues to expand at a steady rate. Mexico’s economy has expanded at a rate of 2-3 percent per year since 2016, following a drop in production between 2016 and 2018. Mexico’s growing manufacturing industry are assisting in this expansion.

Part of the reason for this success is the proximity to the United States, such as the manufacturing border city of Matamoros, which allows factories there to benefit from strong trade agreements like the USMCA while also absorbing the manufacturing business needs of large industries in the United States.

Electronic component manufacture, such as circuit boards, wire harnesses, computers, and consumer electronics, is one of Mexico’s fastest expanding manufacturing areas, thanks to the Maquiladora’s skills. Companies searching for a cheaper alternative to their Chinese manufacturing operations are turning to Mexico for contract manufacturing partners who can create the same, if not better, electronic components.

Materials informatics – the use of data and AI methods to better understand the use, selection, development, and discovery of chemicals and materials – is one of the most visible and exciting ways in which digital transformation is impacting the chemicals and materials industry. The general hype surrounding AI has passed to MI, with startups raising millions over the past three years and leading players promising a revolution in the way that the industry operates.

Despite the hype, the actual role of these technologies remains somewhat murky, especially for the more disruptive approaches. The major reasons behind this include the lack of data volume, format, and infrastructure, as well as cultural resistance. That said, many global companies have set their materials informatics strategies by working with a startup, forming their own materials informatics division, or joining a consortium. These recent activities indicate strong momentum, which will continue at an accelerated speed.

There is no consensus on the “right” way of defining MI applications. Based on our research and conversations with key stakeholders, we divide materials informatics’s applications into two major types and believe this categorization is the simplest way of representing the materials informatics space. The two categories are optimization of existing chemical and/or material structures and discovery of wholly new chemicals and materials, including the synthetic route.

All optimization cases, regardless of the specific context, can be viewed as multivariable optimization problems where the goal is to find the best set of parameters corresponding to the features to be optimized, such as the type of chemicals/materials, processing, structure, properties, or performance. On the other hand, discovery cases often include the generation of new chemical structures with proposed synthetic routes to make them.

To understand the landscape of major players in these two applications, we listed major materials informatics players from corporates, small-to-medium enterprises (SMEs), and research institutes and broke down these players by geography. Through this analysis, we identified the general trend of materials informatics to help companies find the right direction for building a materials informatics strategy.

Some of the prominent market players profiled in the global materials informatics market:

Exabyte.io

Alpine Electronics Inc.

Phaseshift Technologies

Nutonian Inc.

Schrodinger

Citrine Informatics

Materials Zone Ltd.

BASF

Kebotix

AI Materia

The field is still nascent and one of the biggest problems they face is the acute shortage of machine-readable databases.

There just isn’t enough data to train useful algorithms. But material science is definitely on an ascendant, and data-driven methods could become standard in the future.

Analyst View:

The global material informatics market is highly competitive and opportunistic but still at its nascent phase. Increasing investment from established as well as startups have accelerated the pace of the market. Further, rising integration of advanced technologies such as ML and AI anticipated to again drive the market growth at a rapid rate during the forthcoming years.

The global materials informatics market research report classifies the market as follows:

By Material

- Organic Materials

- Inorganic Materials

- Hybrid Materials

By Technique

- Digital Annealer

- Deep Tensor

- Statistical Analysis

- Genetic Algorithm

By Application

- Chemical Industries

- Dyes

- Research and Development Agencies

- Material Science

- Food Science

- Electronics

- Paper & Pulp

Material Informatics Market Share, By Region, 2020 (%)

| Region | 2020 (%) |

| North America | 36.9% |

| Europe | 28.5% |

| Asia Pacific | 25.4% |

| Latin America | 5.2% |

| Middle East & Africa | 3.9% |

By Regional Outlook

- North America

- US

- Rest of North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.2.1. Primary Research

2.2.2. Secondary Research

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

3.2. Attractive Opportunities in Materials Informatics Market

Chapter 4. Market Variables and Scope

4.1. Introduction to E-bike

4.2. Market Classification and Scope

Chapter 5. COVID-19 Impact on Materials Informatics Market

5.1. COVID-19 Landscape: Materials Informatics Industry Impact

5.1.1. Pre-COVID Analysis on Materials Informatics Industry

5.1.2. Post-COVID Analysis on Materials Informatics Industry

5.2. COVIS-19 Impact: Global Major Government Policy

5.3. Market Trends and Materials Informatics Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.1.4. Market Challenges

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1. Company Market Share/Positioning Analysis

7.2. Global Materials Informatics Market Revenue Analysis by Manufacturer (2015-2020)

7.3. Revenue Analysis for Top Five Players

7.4. Key Strategies Adopted by the Market Players

7.5. Vendor Landscape

7.5.1. List of Suppliers

7.5.2. List of Buyers

7.6. New Product Launches

7.7. Investment News

7.8. Agreements, Partnerships, Collaborations, and Joint Ventures

Chapter 8. Global Materials Informatics Market, By Material

8.1. Materials Informatics Market, by Material, 2017-2027

8.1.1. Global Materials Informatics Market Revenue, and Growth Rate Analysis by Material (2017-2027)

8.1.2. Global Materials Informatics Market Revenue Share (%) by Material in 2020 and 2027

8.1.3. Organic Materials

8.1.3.1. Market Revenue and Forecast (2017-2027)

8.1.4. Inorganic Materials

8.1.4.1. Market Revenue and Forecast (2017-2027)

8.1.5. Hybrid Materials

8.1.5.1. Market Revenue and Forecast (2017-2027)

Chapter 9. Global Materials Informatics Market, By Technique

9.1. Materials Informatics Market, by Technique, 2017-2027

9.1.1. Global Materials Informatics Market Revenue, and Growth Rate Analysis by Technique(2017-2027)

9.1.2. Global Materials Informatics Market Revenue Share (%) by Techniquein 2020 and 2027

9.1.3. Digital Annealer

9.1.3.1. Market Revenue and Forecast (2017-2027)

9.1.4. Deep Tensor

9.1.4.1. Market Revenue and Forecast (2017-2027)

9.1.5. Statistical Analysis

9.1.5.1. Market Revenue and Forecast (2017-2027)

9.1.6. Genetic Algorithm

9.1.6.1. Market Revenue and Forecast (2017-2027)

Chapter 10. Global Materials Informatics Market, By Application

10.1. Materials Informatics Market, by Application, 2020-2027

10.1.1. Global Materials Informatics Market Revenue, and Growth Rate Analysis by Application (2017-2027)

10.1.2. Global Materials Informatics Market Revenue Share (%) by Application in 2020 and 2027

10.1.3. Chemical Industries

10.1.3.1. Market Revenue and Forecast (2017-2027)

10.1.4. Dyes

10.1.4.1. Market Revenue and Forecast (2017-2027)

10.1.5. Research and Development Agencies

10.1.5.1. Market Revenue and Forecast (2017-2027)

10.1.6. Material Science

10.1.6.1. Market Revenue and Forecast (2017-2027)

10.1.7. Food Science

10.1.7.1. Market Revenue and Forecast (2017-2027)

10.1.8. Electronics

10.1.8.1. Market Revenue and Forecast (2017-2027)

10.1.9. Paper & Pulp

10.1.9.1. Market Revenue and Forecast (2017-2027)

Chapter 11. Global Materials Informatics Market, Regional Estimates and Trend Forecast

11.1. Global Materials Informatics Market Analysis by Regions (2017-2027)

11.2. North America

11.2.1. Market Revenue and Forecast, by Material(2017-2027)

11.2.2. Market Revenue and Forecast, by Technique(2017-2027)

11.2.3. Market Revenue and Forecast, by Application (2017-2027)

11.2.4. U.S.

11.2.4.1. Market Revenue and Forecast, by Material(2017-2027)

11.2.4.2. Market Revenue and Forecast, by Technique(2017-2027)

11.2.4.3. Market Revenue and Forecast, by Application (2017-2027)

11.2.5. Rest of North America

11.2.5.1. Market Revenue and Forecast, by Material(2017-2027)

11.2.5.2. Market Revenue and Forecast, by Technique(2017-2027)

11.2.5.3. Market Revenue and Forecast, by Application (2017-2027)

11.3. Europe

11.3.1. Market Revenue and Forecast, by Material(2017-2027)

11.3.2. Market Revenue and Forecast, by Technique(2017-2027)

11.3.3. Market Revenue and Forecast, by Application (2017-2027)

11.3.4. UK

11.3.4.1. Market Revenue and Forecast, by Material(2017-2027)

11.3.4.2. Market Revenue and Forecast, by Technique(2017-2027)

11.3.4.3. Market Revenue and Forecast, by Application (2017-2027)

11.3.5. Germany

11.3.5.1. Market Revenue and Forecast, by Material(2017-2027)

11.3.5.2. Market Revenue and Forecast, by Technique(2017-2027)

11.3.5.3. Market Revenue and Forecast, by Application (2017-2027)

11.3.6. France

11.3.6.1. Market Revenue and Forecast, by Material(2017-2027)

11.3.6.2. Market Revenue and Forecast, by Technique(2017-2027)

11.3.6.3. Market Revenue and Forecast, by Application (2017-2027)

11.3.7. Rest of Europe

11.3.7.1. Market Revenue and Forecast, by Material(2017-2027)

11.3.7.2. Market Revenue and Forecast, by Technique(2017-2027)

11.3.7.3. Market Revenue and Forecast, by Application (2017-2027)

11.4. APAC

11.4.1. Market Revenue and Forecast, by Material(2017-2027)

11.4.2. Market Revenue and Forecast, by Technique(2017-2027)

11.4.3. Market Revenue and Forecast, by Application (2017-2027)

11.4.4. India

11.4.4.1. Market Revenue and Forecast, by Material(2017-2027)

11.4.4.2. Market Revenue and Forecast, by Technique(2017-2027)

11.4.4.3. Market Revenue and Forecast, by Application (2017-2027)

11.4.5. China

11.4.5.1. Market Revenue and Forecast, by Material(2017-2027)

11.4.5.2. Market Revenue and Forecast, by Technique(2017-2027)

11.4.5.3. Market Revenue and Forecast, by Application (2017-2027)

11.4.6. Japan

11.4.6.1. Market Revenue and Forecast, by Material(2017-2027)

11.4.6.2. Market Revenue and Forecast, by Technique(2017-2027)

11.4.6.3. Market Revenue and Forecast, by Application (2017-2027)

11.4.7. Rest of APAC

11.4.7.1. Market Revenue and Forecast, by Material(2017-2027)

11.4.7.2. Market Revenue and Forecast, by Technique(2017-2027)

11.4.7.3. Market Revenue and Forecast, by Application (2017-2027)

11.5. MEA

11.5.1. Market Revenue and Forecast, by Material(2017-2027)

11.5.2. Market Revenue and Forecast, by Technique(2017-2027)

11.5.3. Market Revenue and Forecast, by Application (2017-2027)

11.5.4. GCC

11.5.4.1. Market Revenue and Forecast, by Material(2017-2027)

11.5.4.2. Market Revenue and Forecast, by Technique(2017-2027)

11.5.4.3. Market Revenue and Forecast, by Application (2017-2027)

11.5.5. North Africa

11.5.5.1. Market Revenue and Forecast, by Material(2017-2027)

11.5.5.2. Market Revenue and Forecast, by Technique(2017-2027)

11.5.5.3. Market Revenue and Forecast, by Application (2017-2027)

11.5.6. South Africa

11.5.6.1. Market Revenue and Forecast, by Material(2017-2027)

11.5.6.2. Market Revenue and Forecast, by Technique(2017-2027)

11.5.6.3. Market Revenue and Forecast, by Application (2017-2027)

11.5.7. Rest of MEA

11.5.7.1. Market Revenue and Forecast, by Material(2017-2027)

11.5.7.2. Market Revenue and Forecast, by Technique(2017-2027)

11.5.7.3. Market Revenue and Forecast, by Application (2017-2027)

11.6. Latin America

11.6.1. Market Revenue and Forecast, by Material(2017-2027)

11.6.2. Market Revenue and Forecast, by Technique(2017-2027)

11.6.3. Market Revenue and Forecast, by Application (2017-2027)

11.6.4. Brazil

11.6.4.1. Market Revenue and Forecast, by Material(2017-2027)

11.6.4.2. Market Revenue and Forecast, by Technique(2017-2027)

11.6.4.3. Market Revenue and Forecast, by Application (2017-2027)

11.6.5. Rest of LATAM

11.6.5.1. Market Revenue and Forecast, by Material(2017-2027)

11.6.5.2. Market Revenue and Forecast, by Technique(2017-2027)

11.6.5.3. Market Revenue and Forecast, by Application (2017-2027)

Chapter 12. Company Profiles

12.1. Exabyte.io

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.3.1. Company Revenue (2016-2020)

12.1.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.1.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.1.4. Revenue, and Gross Margin (2016-2020)

12.1.5. Recent Initiatives

12.2. Alpine Electronics Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.3.1. Company Revenue (2016-2020)

12.2.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.2.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.2.4. Revenue, and Gross Margin (2016-2020)

12.2.5. Recent Initiatives

12.3. Phaseshift Technologies

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.3.1. Company Revenue (2016-2020)

12.3.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.3.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.3.4. Revenue, and Gross Margin (2016-2020)

12.3.5. Recent Initiatives

12.4. Nutonian Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.3.1. Company Revenue (2016-2020)

12.4.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.4.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.4.4. Revenue, and Gross Margin (2016-2020)

12.4.5. Recent Initiatives

12.5. Schrodinger

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.3.1. Company Revenue (2016-2020)

12.5.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.5.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.5.4. Revenue, and Gross Margin (2016-2020)

12.5.5. Recent Initiatives

12.6. Citrine Informatics

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.3.1. Company Revenue (2016-2020)

12.6.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.6.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.6.4. Revenue, and Gross Margin (2016-2020)

12.6.5. Recent Initiatives

12.7. Materials Zone Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.3.1. Company Revenue (2016-2020)

12.7.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.7.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.7.4. Revenue, and Gross Margin (2016-2020)

12.7.5. Recent Initiatives

12.8. BASF

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.3.1. Company Revenue (2016-2020)

12.8.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.8.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.8.4. Revenue, and Gross Margin (2016-2020)

12.8.5. Recent Initiatives

12.9. Kebotix

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.3.1. Company Revenue (2016-2020)

12.9.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.9.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.9.4. Revenue, and Gross Margin (2016-2020)

12.9.5. Recent Initiatives

12.10. AI Materia

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.3.1. Company Revenue (2016-2020)

12.10.3.2. Market Share by Region in 2019/2020 (Revenue Share)

12.10.3.3. Market Share by Operating Segment in 2019/2020 (Revenue Share)

12.10.4. Revenue, and Gross Margin (2016-2020)

12.10.5. Recent Initiatives

Chapter 13. Analyst View

13.1. Market Suggestions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Buy this Premium Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1484

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333

Frequently Asked Questions:

[sc_fs_multi_faq headline-0=”h6″ question-0=”What is the CAGR of global materials informatics market?” answer-0=”The global materials informatics market is expected to drive growth at a CAGR of 29.2% between 2021 and 2027. ” image-0=”” headline-1=”h6″ question-1=”What is the current market size of the global materials informatics market?” answer-1=”According to Precedence Research, the global materials informatics market size was reached at USD 108.6 million in 2021 and is projected to surpass over USD 505.9 million by 2027. ” image-1=”” headline-2=”h6″ question-2=”Who are the leading players and their market statistics in the global materials informatics market?” answer-2=”The leading players in the global materials informatics market are Exabyte.io, Alpine Electronics Inc., Phaseshift Technologies, Nutonian Inc., Schrodinger, Citrine Informatics, Materials Zone Ltd., BASF, Kebotix, AI Materia. ” image-2=”” headline-3=”h6″ question-3=”Which are the driving factors of the materials informatics market?” answer-3=”The increased innovations in artificial intelligence driven solutions from other industries is due to the factors such as technological advancements, massive advancements in data infrastructures, and improved awareness and understanding of technologies. ” image-3=”” headline-4=”h6″ question-4=”Which region will lead the global materials informatics market?” answer-4=”North America dominated the global materials informatics market with the highest revenue share in the year 2020 owing to high technology penetration rate in the region. ” image-4=”” headline-5=”h6″ question-5=”Which region is anticipated to register the fastest growth rate in the materials informatics market?” answer-5=”The Asia Pacific anticipated to register the fastest growth rate over the forthcoming years due to rising internal research & development activity in the Asian companies. ” image-5=”” count=”6″ html=”true” css_class=””]