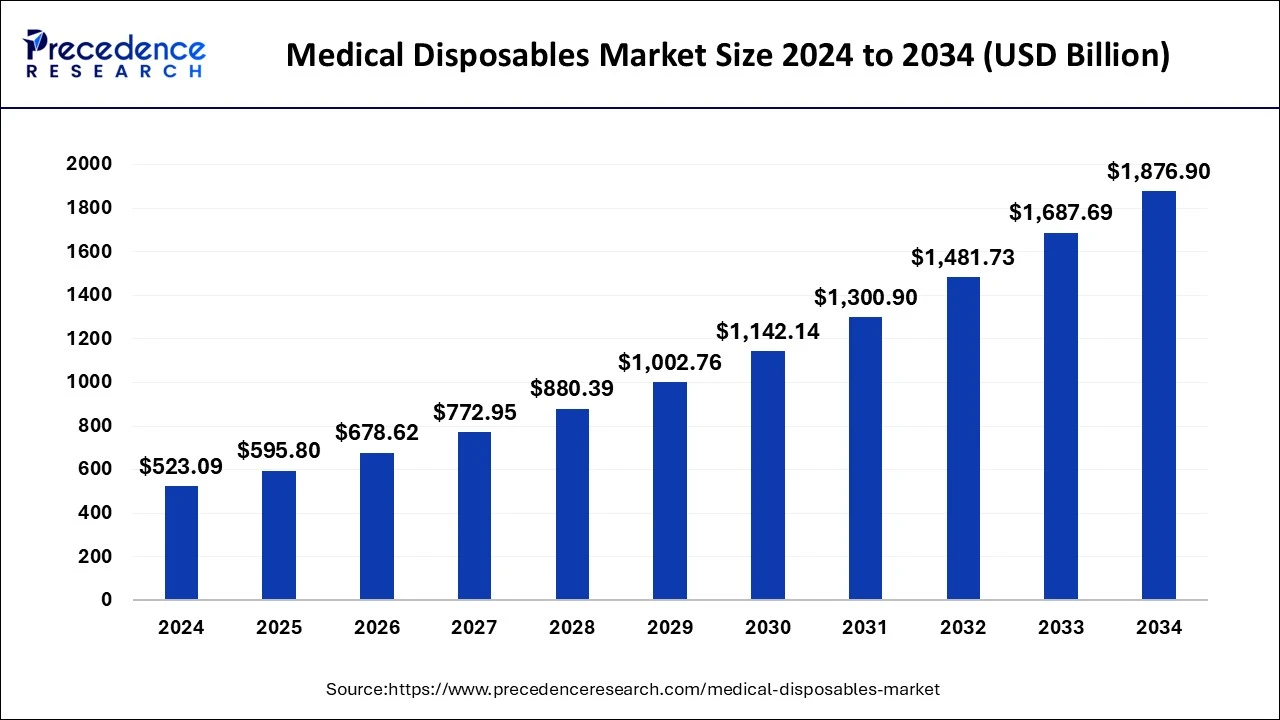

Medical disposables market to reach USD 1,876.90 billion by 2034.

The medical disposables market includes single-use items essential for medical procedures, such as syringes, gloves, catheters, and wound care products. With increasing healthcare demands, particularly in emerging economies, the market is experiencing significant growth. This surge is driven by advancements in healthcare infrastructure, the rise of chronic diseases, an aging population, and the growing preference for disposable products due to hygiene and infection control concerns. The market is expected to continue expanding due to the increased adoption of disposable medical devices and the ongoing need for infection prevention in healthcare settings.

Medical disposables Market Key Insights

- North America accounted for over 34.73% of the revenue share in 2024.

- The sterilization supplies segment held a 15% revenue share in 2024.

- The plastic resins segment contributed the largest revenue share of 59% in 2024.

- The hospital segment dominated the market with a revenue share of over 56% in 2024.

- The U.S. medical disposables market is expected to grow significantly from 2025 to 2034.

Medical disposables Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 595.80 Billion |

| Market Size by 2034 | USD 1,876.90 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 13.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and By Raw Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |