Medical Gloves Market Size to Hit USD 185.89 Billion by 2033

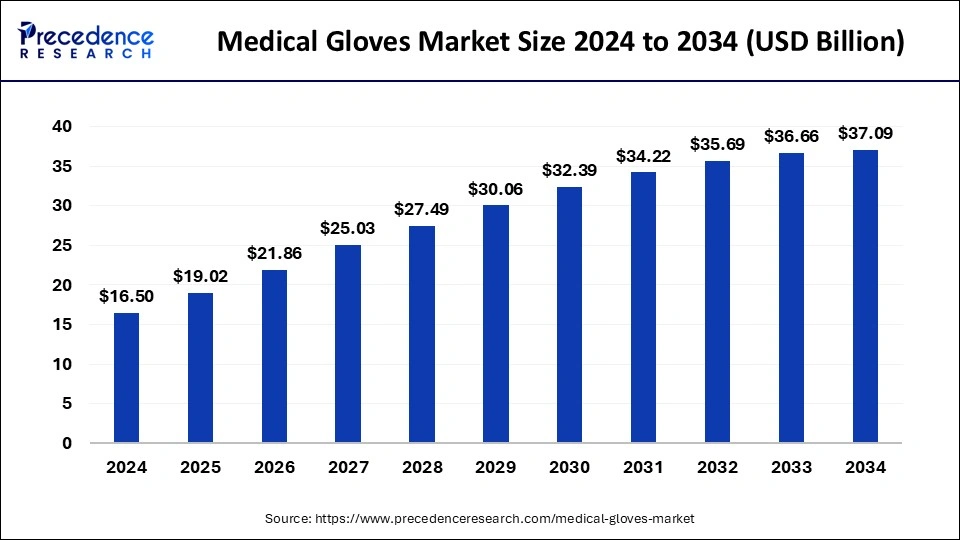

The global medical gloves market size surpassed USD 34.86 billion in 2023 and is projected to hit around USD 185.89 billion by 2033, growing at a CAGR of 18.22% from 2024 to 2033.

Key Points

- North America dominated the market, with the United States leading in terms of market share in 2023.

- Asia Pacific is observed to be the fastest-growing region in the market during the forecast period.

- By product, the nitrile gloves segment held the largest share of the market in 2023.

- By form, the powder-free gloves segment held the largest share of the medical gloves market in 2023.

- By application, the examination gloves segment led the market with the largest share in 2023.

- By usage, the disposable gloves segment held the largest market share in 2023.

- By sterility, the non-sterile gloves held the largest share of the market in 2023.

- By distribution channel, the brick-and-mortar stores segment held the largest market share in 2022 and dominated the medical gloves market globally.

- By an end-use, the hospital segment held the largest share and dominated the medical gloves market in 2023.

The medical gloves market encompasses a wide range of products, including latex gloves, nitrile gloves, vinyl gloves, and others. These gloves find extensive usage across hospitals, clinics, ambulatory surgical centers, diagnostic laboratories, and other healthcare facilities. With the growing emphasis on infection control and prevention, the demand for medical gloves has surged globally. Moreover, the advent of advanced manufacturing technologies has led to the production of gloves with superior strength, durability, and tactile sensitivity, further driving market growth.

Get a Sample: https://www.precedenceresearch.com/sample/3942

Growth Factors:

Several factors contribute to the robust growth of the medical gloves market. Firstly, increasing awareness regarding the importance of hand hygiene in healthcare settings has propelled the demand for medical gloves. Healthcare professionals and consumers alike are more cognizant of the risks associated with cross-contamination and infection transmission, thereby driving the adoption of gloves as a preventive measure. Additionally, stringent regulations mandating the use of gloves in healthcare facilities, coupled with the implementation of infection control protocols, have further bolstered market growth.

Furthermore, the COVID-19 pandemic has acted as a significant catalyst for the medical gloves market. The heightened focus on personal protective equipment (PPE) and infection control measures to curb the spread of the virus has led to an unprecedented surge in glove demand. Healthcare facilities worldwide have ramped up their glove procurement efforts to ensure adequate protection for frontline workers and patients, thereby driving market expansion.

Medical Gloves Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 18.22% |

| Global Market Size in 2023 | USD 34.86 Billion |

| Global Market Size by 2033 | USD 185.89 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Form, By Application, By Usage, By Sterility, By Distribution Channel, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medical Gloves Market Dynamics

Drivers:

Several key drivers fuel the growth of the medical gloves market. Firstly, the rising prevalence of infectious diseases and the increasing incidence of hospital-acquired infections (HAIs) have underscored the importance of infection control measures, including the use of medical gloves. Healthcare facilities are increasingly prioritizing patient safety and infection prevention, driving the demand for gloves across various healthcare settings.

Moreover, the growing healthcare expenditure and investments in healthcare infrastructure, particularly in emerging economies, have contributed to market growth. As healthcare systems strive to enhance their capacity and capabilities to address public health challenges, the demand for medical gloves is expected to witness sustained growth.

Restraints:

Despite the positive growth trajectory, the medical gloves market faces certain challenges and restraints. One significant restraint is the potential for allergic reactions associated with latex gloves. Latex allergy remains a concern for both healthcare workers and patients, necessitating the adoption of alternative materials such as nitrile or vinyl gloves. Additionally, fluctuations in raw material prices, particularly for natural rubber latex, can impact the manufacturing costs of medical gloves, posing a challenge for market players.

Another restraint is the environmental impact associated with the disposal of single-use gloves. With the increasing focus on sustainability and environmental stewardship, there is growing pressure to develop biodegradable or eco-friendly alternatives to conventional medical gloves. Addressing these environmental concerns while maintaining the efficacy and safety of gloves poses a challenge for manufacturers.

Opportunities:

Despite the challenges, the medical gloves market presents numerous opportunities for growth and innovation. With the ongoing advancements in material science and manufacturing technologies, there is significant scope for the development of gloves with enhanced properties such as antimicrobial coatings, improved durability, and better tactile sensitivity. Manufacturers are increasingly investing in research and development activities to introduce innovative glove solutions that meet the evolving needs of healthcare professionals.

Moreover, the expanding healthcare infrastructure in emerging markets presents lucrative opportunities for market expansion. Countries experiencing rapid urbanization and economic development are witnessing increased healthcare spending and a greater emphasis on healthcare quality and safety standards. This provides a fertile ground for glove manufacturers to tap into new markets and establish strategic partnerships with healthcare providers.

Read Also: Kidney Stone Management Market Size to Cross USD 4.65 Bn by 2033

Region Insights:

The medical gloves market exhibits regional variations in terms of demand, supply, and regulatory landscape. North America and Europe are mature markets for medical gloves, characterized by stringent regulatory standards and a high level of awareness regarding infection control practices. The presence of established healthcare infrastructure and a strong emphasis on patient safety contribute to significant glove consumption in these regions.

In contrast, the Asia Pacific region presents substantial growth opportunities for the medical gloves market. Rapidly growing economies such as China, India, and Southeast Asian countries are witnessing a surge in healthcare investments and infrastructure development. Moreover, the increasing prevalence of infectious diseases and the rising healthcare expenditure in the region are driving the demand for medical gloves.

Recent Developments

- In January 2023, The Medicom group made an announcement that it planned to build a nitrile glove factory named as’ ManiKHeir’ by its subsidiary’ Kolmi-Hopen’, which is famous for its manufacturing of single-use medical devices for healthcare professionals.

- In November 2022, Vizient Inc. partnered with ‘Safe Source’ Direct to manufacture the chemo-rated nitrile gloves. The agreement is initiated by Vizient to increase the supply of critical medical supplies in various regions.

- In January 2020, in Canada, Medi-select, a distributor of medical and dental supplies, was acquired by Medline. This acquisition will be helpful to acquire a new customer in the country for Medi-select thus expanding a revenue growth of the market.

Medical Gloves Market Companies

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd.

- Cardinal Health

- Semperit AG Holding

- Rubberex

- Dynarex Corporation

- B. Braun Melsungen AG

Segments Covered in the Report

By Product

- Latex Gloves

- Nitrile Gloves

- Vinyl Gloves

- Neoprene Gloves

- Others

By Form

- Powdered Gloves

- Powder-Free Gloves

By Application

- Surgical Gloves

- Examination Gloves

By Usage

- Disposable Gloves

- Reusable Gloves

By Sterility

- Sterile Gloves

- Non-Sterile Gloves

By Distribution Channel

- E-Commerce

- Brick And Mortar Stores

By End-Use

- Hospitals

- Clinics

- Ambulatory Surgical Centres

- Diagnostics Centres

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/