Medical Tapes and Bandages Market Size, Share, Report by 2033

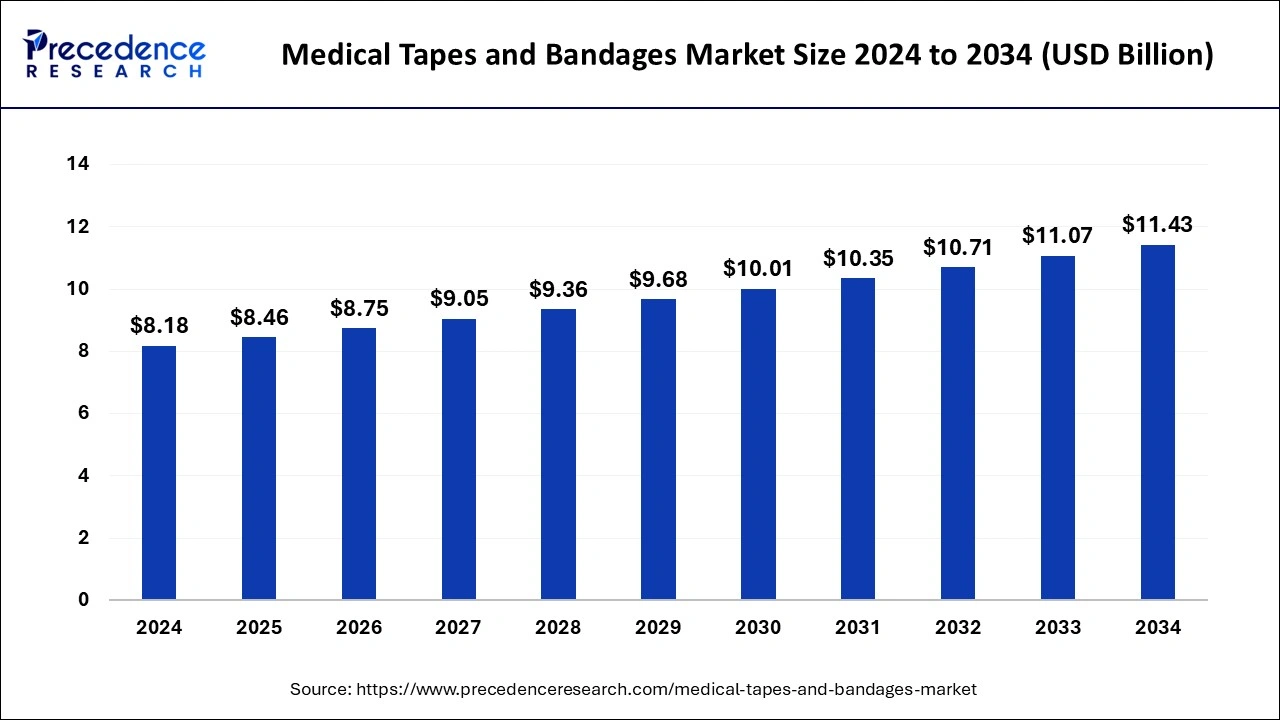

The global medical tapes and bandages market size is expected to increase USD 11.07 billion by 2033 from USD 7.91 billion in 2023 with a CAGR of 3.42% between 2024 and 2033.

Key Points

- The North America medical tapes and bandages market size reached USD 3.64 billion in 2023 and is expected to attain around USD 5.15 billion by 2033, poised to grow at a CAGR of 3.53% between 2024 and 2033.

- North America dominated the medical tapes and bandages market with the largest revenue share of 46% in 2023.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By product, the medical bandages segment has held the major revenue share of 58% in 2023.

- By application, the surgical wound segment has contributed more than 59% of revenue share in 2023.

- By end-use, the hospital segment has held the biggest revenue share of 29% of revenue share in 2023.

The medical tapes and bandages market is a critical segment of the global healthcare industry, providing essential products for wound care, surgical procedures, and various medical conditions. This market encompasses a wide range of products, including adhesive tapes, cohesive bandages, elastic bandages, and other specialized medical tapes designed to meet specific medical needs. Medical tapes and bandages are used in hospitals, clinics, ambulatory surgical centers, home healthcare settings, and by individual consumers. The market has been witnessing significant growth due to the increasing prevalence of chronic wounds, rising surgical procedures, and the growing elderly population.

Get a Sample: https://www.precedenceresearch.com/sample/4597

Growth Factors

Rising Prevalence of Chronic Wounds

One of the primary drivers of the medical tapes and bandages market is the rising prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. These wounds require long-term care and regular dressing changes, driving the demand for medical tapes and bandages. The increasing incidence of diabetes and obesity, which are major risk factors for chronic wounds, further fuels market growth.

Increase in Surgical Procedures

The growing number of surgical procedures worldwide is another crucial factor contributing to the market’s expansion. Surgeries often necessitate the use of medical tapes and bandages for wound closure, post-operative care, and infection prevention. As the global population ages and the prevalence of conditions requiring surgical intervention rises, the demand for these products is expected to continue growing.

Technological Advancements

Technological advancements in medical tapes and bandages have led to the development of innovative products with improved performance, enhanced comfort, and better patient outcomes. Advanced materials, such as silicone-based adhesives and hydrocolloid dressings, offer superior adhesion, moisture management, and reduced skin irritation. These innovations are driving market growth by meeting the evolving needs of healthcare providers and patients.

Regional Insights

North America holds a significant share of the medical tapes and bandages market, primarily due to the well-established healthcare infrastructure, high healthcare expenditure, and the presence of major market players in the region. The United States, in particular, is a key market, driven by the high prevalence of chronic wounds, a large elderly population, and the increasing number of surgical procedures. Additionally, favorable reimbursement policies and the adoption of advanced wound care products contribute to market growth in this region.

Europe is another major market for medical tapes and bandages, with countries like Germany, the United Kingdom, and France leading the way. The region’s market growth is attributed to the high incidence of chronic wounds, a growing elderly population, and the increasing adoption of advanced wound care products. Government initiatives and funding for wound care management and the presence of established healthcare systems further support market expansion in Europe.

The Asia-Pacific region is expected to witness the fastest growth in the medical tapes and bandages market during the forecast period. This growth is driven by the increasing prevalence of chronic diseases, a growing elderly population, and rising healthcare expenditure in countries like China, India, and Japan. The expanding healthcare infrastructure, increasing awareness about advanced wound care products, and the presence of a large patient pool are also contributing factors. Additionally, the region’s improving economic conditions and government initiatives to enhance healthcare access are expected to boost market growth.

Medical Tapes and Bandages Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 11.07 Billion |

| Market Size in 2023 | USD 7.91 Billion |

| Market Size in 2024 | USD 8.18 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 3.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medical Tapes and Bandages Market Dynamics

Market Drivers

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and obesity is a significant driver of the medical tapes and bandages market. These conditions often lead to chronic wounds that require long-term care and regular dressing changes, driving the demand for medical tapes and bandages. The growing burden of chronic diseases is expected to continue fueling market growth.

Aging Population

The global aging population is another critical driver of the medical tapes and bandages market. Elderly individuals are more prone to chronic wounds, surgical procedures, and other medical conditions that require the use of medical tapes and bandages. As the population ages, the demand for these products is expected to increase, driving market growth.

Growing Number of Surgical Procedures

The increasing number of surgical procedures worldwide is a key driver of the medical tapes and bandages market. Surgeries often necessitate the use of medical tapes and bandages for wound closure, post-operative care, and infection prevention. The rising incidence of conditions requiring surgical intervention, such as cancer and cardiovascular diseases, is expected to continue driving market growth.

Market Opportunities

Technological Advancements and Product Innovation

Technological advancements and product innovation present significant opportunities for the medical tapes and bandages market. The development of advanced materials, such as silicone-based adhesives and hydrocolloid dressings, offers superior adhesion, moisture management, and reduced skin irritation. These innovations are meeting the evolving needs of healthcare providers and patients, creating opportunities for market growth.

Expanding Healthcare Infrastructure in Emerging Markets

The expanding healthcare infrastructure in emerging markets, such as Asia-Pacific, Latin America, and the Middle East, presents significant opportunities for the medical tapes and bandages market. Improving economic conditions, increasing healthcare expenditure, and government initiatives to enhance healthcare access are driving market growth in these regions. Market players can capitalize on these opportunities by expanding their presence and distribution networks in emerging markets.

Market Challenges

High Cost of Advanced Wound Care Products

The high cost of advanced wound care products, such as silicone-based adhesives and hydrocolloid dressings, poses a significant challenge to the medical tapes and bandages market. These products are often more expensive than traditional wound care products, which can limit their adoption, particularly in cost-sensitive markets. Market players need to address this challenge by developing cost-effective solutions and demonstrating the long-term cost savings associated with advanced wound care products.

Limited Reimbursement Policies

Limited reimbursement policies for advanced wound care products in some regions pose a challenge to market growth. Inadequate reimbursement can limit the adoption of these products by healthcare providers and patients, particularly in regions with constrained healthcare budgets. Market players need to work with policymakers and payers to improve reimbursement policies and demonstrate the value of advanced wound care products in improving patient outcomes and reducing overall healthcare costs.

Read Also: Equipment Monitoring Market Size to Worth USD 5.78 Bn by 2033

Major Players in the Medical Tapes and Bandages Market

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- 3M

- McKesson Corporation

- Ethicon Inc. (JOHNSON & JOHNSON)

- B. Braun Melsungen AG

- Paul Hartmann AG

- Coloplast

- Integra Lifesciences

- Medtronic Industries

Recent Developments

- In October 2023, the low-cyclic, higher-adhesion DuPont Liveo MG 7-9960 silicone soft skin adhesive (SSA) is a new product from technology-based materials and solutions supplier DuPont. The novel adhesive is intended for use in advanced wound care dressings, for attaching medical equipment to the skin for prolonged periods of time, and for gently removing them.

- In July 2023, the Evonik firm JeNaCell introduced the epicite balancing wound dressing to the German market. The dressing, which will be available in June 2023, is especially well-suited and ideal for treating chronic wounds with low to medium exudation, including soft tissue lesions, diabetic foot ulcers, venous leg ulcers, arterial leg ulcers, and pressure ulcers.

Segments Covered in the Report

By Product

- Medical Tapes

- Fabric Tapes

- Acetate

- Viscose

- Cotton

- Silk

- Polyester

- Other Fabric Tape

- Paper Tapes

- Plastic Tapes

- Propylene

- Other Plastic Tapes

- Other Tapes

- Fabric Tapes

- Medical Bandages

- Muslin Bandage Rolls

- Elastic Bandage Rolls

- Triangular Bandage Rolls

- Orthopedic Bandage Rolls

- Elastic Plaster Bandages

- Other Bandages

By Application

- Surgical Wound

- Traumatic Wound

- Ulcer

- Sports Injury

- Burn Injury

- Others Injury

By End-use

- Hospitals

- Ambulatory Surgery Center

- Clinics

- Retail

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/