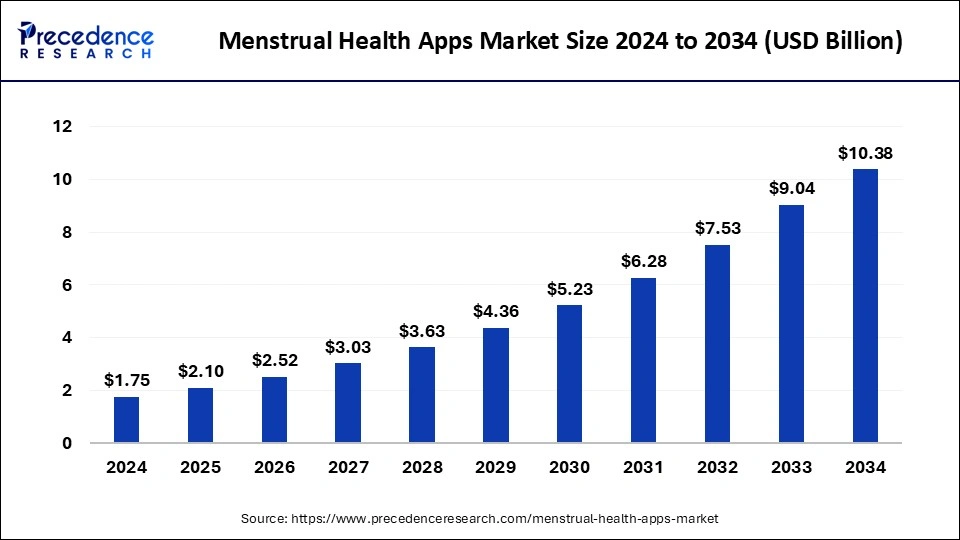

Menstrual Health Apps Market Size to Surpass USD 9.04 Bn by 2033

The global menstrual health apps market size reached USD 1.46 billion in 2023 and is estimated to surpass around USD 9.04 billion by 2033. at a remarkable CAGR of 20% over the forecast period 2024 to 2033.

The Autism and Menstrual Health Apps market is emerging to address specific challenges faced by individuals on the autism spectrum who also contend with menstrual health issues. These apps focus on providing solutions that help manage menstrual cycles, address sensory sensitivities, and support emotional well-being during this period. Market penetration varies across regions, with North America leading due to high awareness, advanced healthcare infrastructure, and supportive regulations. Europe follows with increasing adoption driven by initiatives integrating digital health solutions into autism care. In Asia-Pacific and Latin America, adoption is growing steadily alongside rising healthcare expenditure and a focus on personalized health management.

Regional Insights

The market for Autism and Menstrual Health Apps shows varying adoption rates across different regions. North America leads in terms of market penetration, driven by high awareness, advanced healthcare infrastructure, and supportive regulatory frameworks. Europe follows closely, characterized by increasing awareness and initiatives aimed at integrating digital health solutions into autism care. In Asia-Pacific and Latin America, adoption is growing steadily, supported by rising healthcare expenditure and a greater focus on personalized health management solutions.

Menstrual Health Apps Market Trends

- Rising Awareness and Focus on Women’s Health: There is a growing awareness among women about menstrual health management, which includes tracking cycles, symptoms, and overall well-being. This trend is bolstered by increasing conversations around women’s health issues and empowerment.

- Integration of Advanced Technologies: Menstrual health apps are increasingly incorporating advanced technologies such as artificial intelligence (AI) and machine learning (ML) algorithms. These technologies enhance the accuracy of predictions related to menstrual cycles, ovulation, and fertility windows, thereby improving user experience and efficacy.

- Personalization and Customization: Users are demanding more personalized features from menstrual health apps. This includes tailored insights based on individual health data, reminders for medication or contraceptive use, and the ability to track specific symptoms or moods throughout the cycle.

- Remote Monitoring and Telehealth Integration: The rise of telehealth services has prompted many menstrual health apps to integrate features that allow users to connect with healthcare professionals remotely. This facilitates better management of menstrual disorders, fertility concerns, and overall reproductive health.

- Expansion of App Functionality: Beyond basic cycle tracking, menstrual health apps are expanding their functionalities. They now offer resources such as educational content on reproductive health, nutritional advice, and lifestyle tips tailored to different phases of the menstrual cycle.

Menstrual Health Apps Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 9.04 Billion |

| Market Size in 2023 | USD 1.46 Billion |

| Market Size in 2024 | USD 1.75 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 20% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Platform, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Menstrual Health Apps Market Dynamics

Platform Segmentation

The Menstrual Health Apps Market is segmented by platform into mobile and desktop applications. Mobile applications dominate the market due to their convenience and widespread adoption among users. These apps are typically available on both Android and iOS platforms, offering features such as cycle tracking, symptom monitoring, fertility predictions, and reminders for menstrual health management. The mobile platform’s accessibility allows users to track their menstrual cycles on-the-go, enhancing user engagement and satisfaction.

Application Segmentation

In terms of application, the Menstrual Health Apps Market caters primarily to individual users and healthcare providers. Individual users utilize these apps for personal menstrual cycle tracking, fertility awareness, symptom management, and general health monitoring. These applications empower users to take control of their reproductive health, offering personalized insights and recommendations based on recorded data. Healthcare providers, on the other hand, utilize these apps to support patient care, facilitate remote monitoring, and provide personalized health advice. This dual application approach enhances market growth by addressing both individual and professional healthcare needs in menstrual health management.

Read Also: Autism Spectrum Disorder Treatment Market Size, Trends, Report by 2033

Recent Developments

- In February 2024, the Essence App raised US $600k to tackle menstrual health disparities in workplaces which aim to optimize women’s overall performance through AI-driven hormonal cycle support.

- In April 2023, a reproductive health app named ‘Clue’ raised 7 million euros to expand its product portfolio and announced a crowdfunding campaign to increase the involvement of its users in the development.

- In September 2021, women’s health application ‘Flo’ secured 450 million in funding to fuel the Research and Development (R&D) activities and increase their growth rate.

Menstrual Health Apps Market Companies

- Flo Health Inc.

- Glow, Inc.

- Biowink GmbH

- Planned Parenthood Federation of America Inc.

- Ovia Health

- MagicGirl

- Joii Ltd.

- Procter & Gamble

- Simple Design. Ltd.

- Cycles

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/