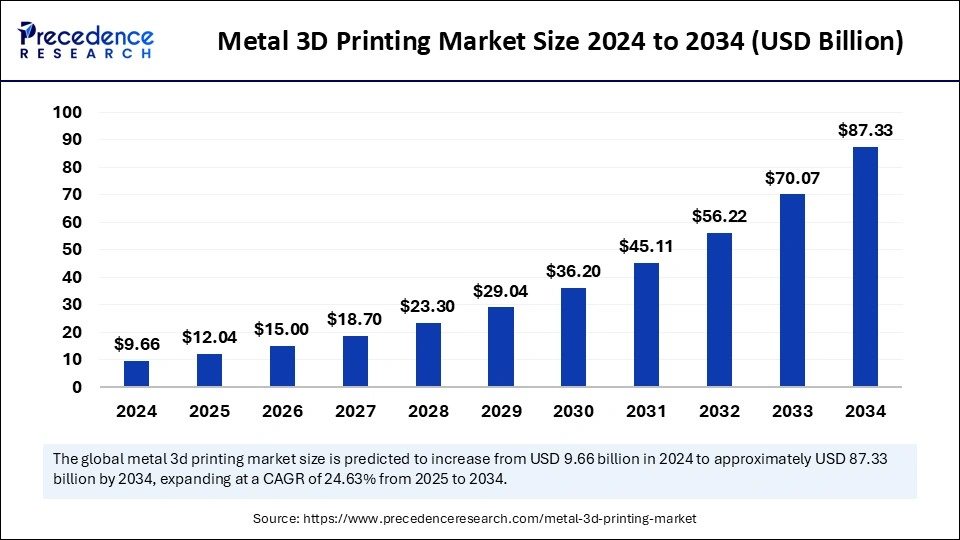

Metal 3D Printing Market to Reach USD 87.33 Bn by 2034

The global metal 3D printing market is set to expand from USD 9.66 billion in 2024 to USD 87.33 billion by 2034, With a CAGR of 24.63%

North America captured the highest market share of 34% in 2024.

Asia Pacific is poised to witness the fastest CAGR during the forecast period.

Europe is expected to see notable market growth in the coming years.

The Selective Laser Melting (SLM) technology segment held the leading share in 2024.

Electron Beam Melting (EBM) is anticipated to achieve substantial CAGR growth from 2025 to 2034.

Design software emerged as the top segment by software share in 2024.

Scanners software is forecast to register a noteworthy CAGR during the prediction timeframe.

Hardware contributed to 65% of the component market in 2024.

The services segment is forecasted to expand at the fastest rate among components.

Prototyping remained the dominant application segment in 2024.

The functional parts segment is expected to grow most rapidly among applications.

Industrial printers had the highest market share by printer type in 2024.

The desktop printer segment is projected to grow steadily at a solid CAGR.

Metal 3D Printing Market Overview

The Metal 3D Printing Market is undergoing a major transformation fueled by digitalization, supply chain disruption mitigation, and demand for customized, efficient production methods. Valued in billions, the market is set to grow at a double-digit CAGR over the next decade.

Metal additive manufacturing has evolved from prototyping to full-scale production, with diverse applications in aerospace, automotive, medical, and energy sectors.

Metal 3D Printing Market Drivers

Growing investments in aerospace and defense modernization are significantly driving the Metal 3D Printing Market. The technology’s ability to reduce waste and consolidate parts aligns with sustainability goals and lean manufacturing practices.

Additionally, the COVID-19 pandemic highlighted vulnerabilities in global supply chains, further propelling the adoption of localized, additive manufacturing solutions.

Metal 3D Printing Market Opportunities

There is a rising opportunity for service-based models where manufacturers offer 3D printing as a service, allowing smaller businesses to access high-end metal printing capabilities without heavy capital expenditure.

Expansion into consumer products, including luxury goods and high-performance sports equipment, is also gaining momentum. Research into multi-material metal printing and integration with IoT and robotics offers a new frontier for innovation and efficiency.

Metal 3D Printing Market Challenges

Challenges include material certification, repeatability of production outcomes, and maintenance of consistent quality across batches. Regulatory hurdles in sectors like healthcare and aviation can slow down the deployment of 3D printed metal parts.

Additionally, the cost competitiveness of traditional manufacturing for large-volume production still limits the scalability of metal 3D printing in some applications.

Metal 3D Printing Market Regional Insights

The United States dominates the global Metal 3D Printing Market with its early adoption and concentration of key players.

Europe’s emphasis on sustainable and smart manufacturing boosts its market strength, particularly in Germany, the Netherlands, and Scandinavia.

Asia-Pacific is growing rapidly, with government-backed initiatives in China and India aimed at becoming global leaders in additive manufacturing technologies. Africa and Latin America are slowly entering the market through strategic partnerships and pilot projects.

Metal 3D Printing Market Recent Developments

In recent months, key players have introduced compact desktop metal 3D printers aimed at SMEs, making the technology more accessible. There has also been a surge in partnerships between OEMs and software developers to improve design automation and simulation capabilities. The launch of recyclable titanium and aluminum powders has made headlines, addressing both cost and environmental concerns in production.

- In October 2024, Anugrah Cipta Mould Indonesia (ACMI) developed a novel additive manufacturing center to support its production of footwear moulds, along with multiple Farsoon 3D printing systems, including the FS200M dual-laser system and FS350M quad-laser system.

- In March 2025, the Bambu Lab H2D is an all-in-one desktop fused deposition modeling system comprising 3D printing, laser engraving, cutting, and plotting functionality. It launched its next-generation 3D printer.

- In November 2024, 3D Monotech, the 3D vertical of Monotech Systems Limited, a leading provider of advanced 3D printing solutions, announced the launching of the revolutionary Markforged FX10 3D printer in India, the world’s first metal and advanced composites 3D printer, to produce high-performance parts directly from digital designs, accelerating innovation and streamlining production processes.

Metal 3D Printing Market Companies

- Cognex Corporation

- Basler AG.

- Sick AG

- 3D Systems Corporation (U.S.)

- Stratasys Ltd.

- Renishaw plc

- General Electric Company

- Carpenter Technology Corporation

- Materialise NV

- Voxeljet AG

- Sandvik AB

- EOS GmbH Electro Optical Systems

Segment Covered in the Report

By Technology

- Selective Laser Sintering

- Direct Metal Laser Sintering

- Inkjet printing

- Electron Beam Melting

- Laser Metal Deposition

- Laminated Object Manufacturing

- Electron Beam Freeform Fabrication

- Selective Laser Melting

By Software

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

By Component

- Hardware

- Software

- Services

By Application

- Prototyping

- Tooling

- Functional Parts

By Printer Type

- Desktop Metal 3D Printer

- Industrial Metal 3D Printer

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Ready for more? Dive into the full experience on our website!