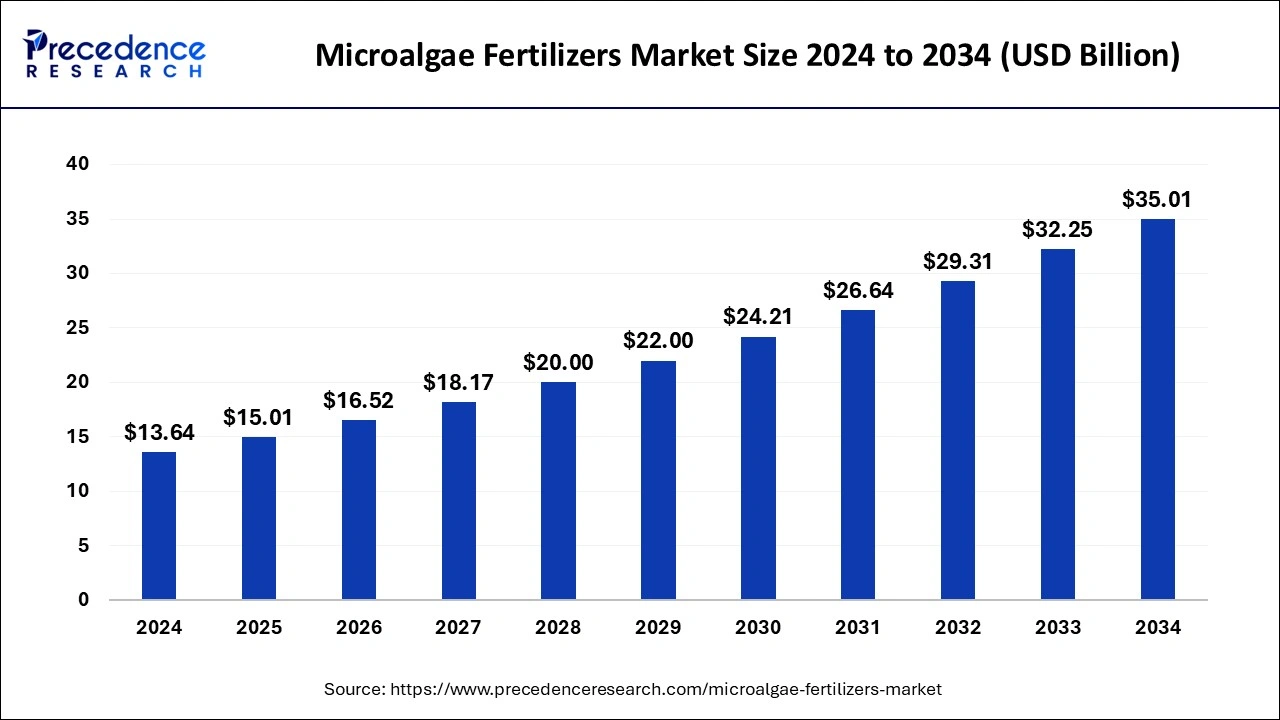

The global microalgae fertilizers market size is expected to increase USD 32.25 billion by 2033 from USD 12.40 billion in 2023 with a CAGR of 10.30% between 2024 and 2033.

Key Points

- Asia Pacific dominated the microalgae fertilizers market in 2023.

- Europe is another significantly growing region in the market during the forecast period.

- By species, the spirulina segment has held the largest market share of 31% in 2023.

- By application, the biofertilizers segment has contributed more than 36% of the market share in 2023.

The microalgae fertilizers market is gaining traction as a sustainable alternative to traditional chemical fertilizers in agriculture and horticulture. Microalgae-based fertilizers are derived from naturally occurring microalgae species rich in nutrients like nitrogen, phosphorus, potassium, and micronutrients. These fertilizers offer several benefits including improved soil health, enhanced nutrient uptake by plants, and reduced environmental impact compared to synthetic fertilizers. The market is witnessing significant growth driven by increasing demand for organic and eco-friendly agricultural inputs worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/4248

Growth Factors

Several factors contribute to the growth of the microalgae fertilizers market. Firstly, the rising awareness among farmers and consumers about the harmful effects of chemical fertilizers on soil health and the environment is driving the demand for sustainable alternatives. Microalgae-based fertilizers are viewed as eco-friendly solutions that promote soil fertility and reduce the risk of nutrient runoff into water bodies. Additionally, ongoing research and development in biotechnology have led to the development of efficient extraction methods and formulations, making microalgae fertilizers more cost-effective and scalable for commercial agriculture.

Region Insights

The adoption of microalgae fertilizers varies across regions based on agricultural practices, regulatory frameworks, and environmental concerns. In North America and Europe, where organic farming is increasingly popular, there is a growing market for microalgae-based fertilizers due to their natural origin and compliance with organic certification standards. Asia Pacific, with its large agricultural sector and increasing focus on sustainable farming practices, presents significant opportunities for market growth. Countries like China and India are investing in research and development of microalgae technologies for agriculture.

Microalgae Fertilizers Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.30% |

| Microalgae Fertilizers Market Size in 2023 | USD 12.40 Billion |

| Microalgae Fertilizers Market Size in 2024 | USD 13.64 Billion |

| Microalgae Fertilizers Market Size by 2033 | USD 32.25 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Species and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Microalgae Fertilizers Market Dynamics

Drivers

Several drivers are fueling the growth of the microalgae fertilizers market. Environmental sustainability is a primary driver, with consumers and regulators pushing for greener agricultural practices. Microalgae fertilizers contribute to soil health and reduce greenhouse gas emissions associated with chemical fertilizer production. Moreover, the efficacy of microalgae-based fertilizers in enhancing crop yield and quality is driving adoption among farmers seeking improved agricultural productivity. The growing market for organic and specialty crops also presents a favorable landscape for microalgae fertilizers.

Opportunities

The microalgae fertilizers market offers promising opportunities for innovation and market expansion. Research into optimizing microalgae strains for nutrient content and growth characteristics can lead to more efficient and scalable production processes. Collaborations between biotechnology companies, agriculture stakeholders, and research institutions can accelerate the development of novel microalgae formulations tailored for specific crops and soil conditions. Moreover, partnerships with organic farming associations and retailers can facilitate market penetration and consumer acceptance of microalgae-based fertilizers.

Challenges

Despite its growth prospects, the microalgae fertilizers market faces certain challenges. One key challenge is the scalability and cost-effectiveness of microalgae cultivation and extraction processes. Scaling up production while maintaining high nutrient content and purity levels is essential to meet the demands of commercial agriculture. Regulatory barriers related to novel agricultural inputs and organic certification standards also pose challenges for market entry and adoption. Additionally, educating farmers about the benefits and proper application of microalgae fertilizers is crucial to widespread adoption and market growth.

Read Also: Industrial Electric Vehicle Market Size, Trends, Report by 2033

Microalgae Fertilizers Market Recent Developments

- In July 2023, with an annual revenue of over $100 billion, NTT Corporation, a global technology corporation, has partnered with the Regional Fish Institute to develop a three-step plan for producing fish and shellfish in RAS facilities that have been fed on algae cultivated in-house.

- In July 2022, the creator of the “world’s first” Kelp Burger, AKUA, introduced Krab Cakes, their newest new product. One of the most nutrient-dense and sustainable food sources on the earth, kelp is harvested locally and farmed in the ocean by AKUA, which started off in 2019 with the creation of plant-based cuisine based on kelp jerky.

- In June 2022, Three US restaurants announced to carry Umaro Foods’ seaweed-based bacon, giving customers the opportunity to sample the brand’s novel protein for the first time.

Microalgae Fertilizers Market Companies

- Algaenergy

- Algatec

- Algtechnologies Ltd

- Allmicroalgae

- Cellana LLC

- Cyanotech Corporation

- Heliae Development, LLC

- Viggi Agro Products

- AlgEternal Technologies, LLC

- Tianjin Norland Biotech Co., Ltd

Segments Covered in the Report

By Species

- Spirulina

- Chlorella

- Euglena & Nanochloropsis

- Nostoc

- Special Type

By Application

- Biofertilizers

- Biocontrole

- Soil Microalgae

- Biostimulants

- Soil Conditioner

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/