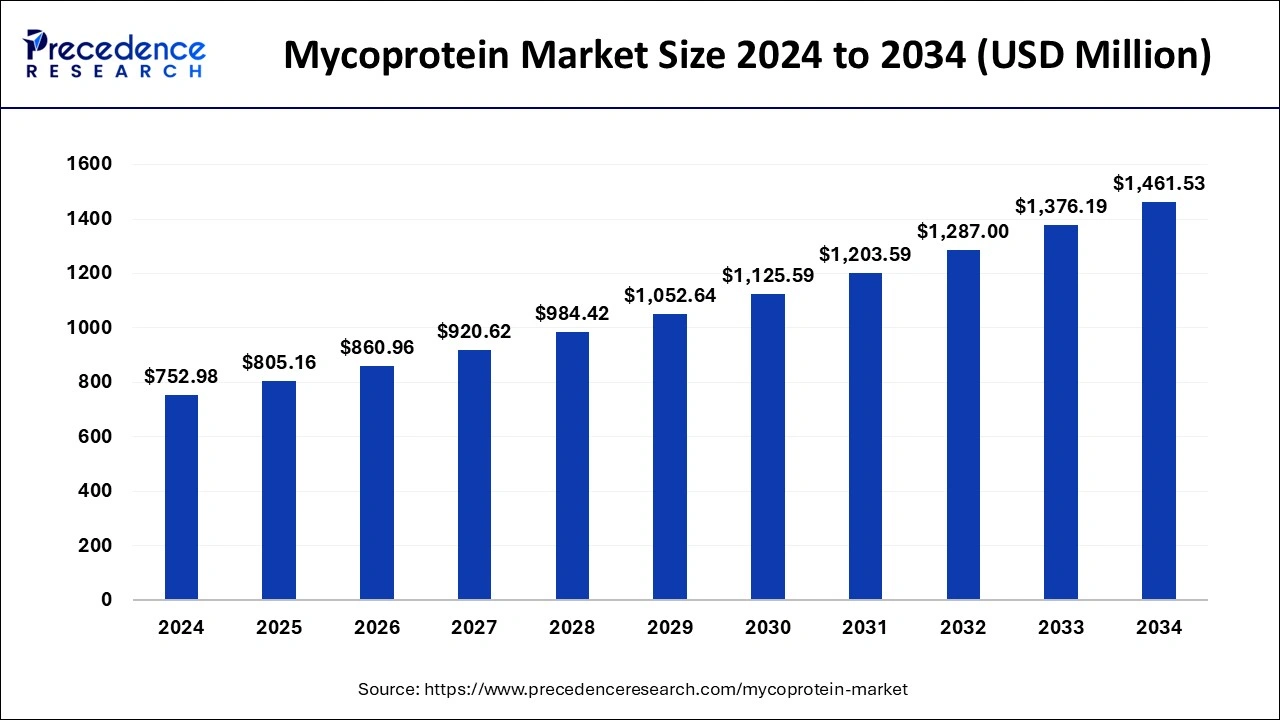

Mycoprotein Market Size to Attain USD 1,376.19 Mn by 2033

The global mycoprotein market size is expected to increase USD 1,376.19 million by 2033 from USD 704.18 million in 2023 with a CAGR of 6.93% between 2024 and 2033.

Key Points

- Asia Pacific dominated the mycoprotein market with the largest market share in 2023.

- North America is expected to grow at the fastest pace during the forecast period.

- By type, the food-grade mycoprotein segment dominated the market with the largest share in 2023.

- By type, the feed-grade mycoprotein segment is observed to grow at a notable rate during the forecast period.

- By form, the minced segment dominated the market with the largest share in 2023.

- By sales channel, the supermarket/hyper market segment dominated the market with the largest market share in 2023.

The mycoprotein market is experiencing significant growth due to rising consumer interest in plant-based protein sources and the increasing popularity of meat alternatives. Mycoprotein, derived from fungal sources like Fusarium venenatum, is gaining traction as a sustainable protein option with a low environmental impact. It is rich in essential amino acids and is being incorporated into various food products such as meat substitutes, snacks, and protein supplements.

Get a Sample: https://www.precedenceresearch.com/sample/4272

Growth Factors

Several factors are driving the growth of the mycoprotein market. Firstly, the growing demand for plant-based proteins among health-conscious consumers seeking alternatives to traditional meat products is a key driver. Additionally, concerns about sustainability and animal welfare are encouraging the adoption of mycoprotein-based products. Furthermore, innovations in food processing technologies are enhancing the texture and taste of mycoprotein, making it more appealing to a broader consumer base.

Regional Insights

The mycoprotein market is witnessing robust growth across various regions. North America and Europe are leading markets due to the strong presence of health-conscious consumers and the popularity of vegetarian and vegan diets. In Asia Pacific, increasing awareness about plant-based diets and sustainability is driving market growth, especially in countries like China and India. Latin America and the Middle East are emerging markets with untapped potential for mycoprotein-based products.

Mycoprotein Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.93% |

| Mycoprotein Market Size in 2023 | USD 704.18 Million |

| Mycoprotein Market Size in 2024 | USD 752.98 Million |

| Mycoprotein Market Size by 2033 | USD 1,376.19 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Form, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Mycoprotein Market Dynamics

Drivers

Key drivers of the mycoprotein market include the rising global population, which is driving demand for sustainable protein sources. Additionally, government initiatives promoting healthy eating and sustainable food production are creating favorable conditions for market growth. The increasing prevalence of lifestyle-related health issues like obesity and cardiovascular diseases is also encouraging consumers to opt for healthier protein alternatives like mycoprotein.

Opportunities

The mycoprotein market presents several opportunities for expansion and innovation. There is scope for developing new mycoprotein-based products tailored to specific dietary needs and preferences. Collaborations between food manufacturers and research institutions can lead to breakthroughs in mycoprotein technology, improving its nutritional profile and taste. Furthermore, strategic partnerships with retailers and foodservice providers can expand market reach and accessibility.

Challenges

Despite its promising growth trajectory, the mycoprotein market faces certain challenges. One key challenge is scaling up production to meet increasing demand while maintaining quality standards and sustainability practices. Regulatory hurdles related to novel food approvals and labeling can also pose challenges for market expansion. Additionally, consumer perceptions and acceptance of mycoprotein products compared to traditional meat alternatives remain a barrier that needs to be addressed through education and marketing efforts.

Read Also: Medical Foam Market Size To Attain USD 59.03 Billion By 2033

Mycoprotein Market Recent Developments

- In April 2024, Edonia Parisian food tech startup raised the funding of €2 million in a pre-seed funding round for the production of sustainable, nutrient-dense, plant-based protein from microalgae.

- In May 2024, Walmart, America’s 20 years largest retailers are introducing the chef-inspired, high culinary quality, free-from and plant-basednew Bettergoods brand.

- In April 2024, Rival Foods, Dutch startup are producing the whole cuts of plant-based meat without binders with the use of “Shear Cell” technology.

- In March 2024, the billionaire Amazon founder Jeff Bezos initiated the investment of US$60 million from its Bezos Earth Fund established in 2020. The investment is initiated for improving the availability and quality of alternative proteins like plant-based meat.

- In May 2024, Waitrose, a leading supermarket chain in the UK, expanded the range PlantLiving with 12 more products for catering to the increasing demand for the less processed plant-based foods.

- In May 2024, THIS, cult-favorite plant-based meat challenges brand in UK is launching the first to the market chicken thigh SKU. The product will launch in the Tesco UK’s largest retailer.

- In April 2024, Plantaway, the company working on the realm of plant-based foods, announced to launch its latest range of plant-based gelatos made with the 100% of the plant-based ingredients, the flavored gelatos are completely dairy free and no added sugar.

- In April 2024, Nasoya, the developer of the plant-based foods revolution and the producers of number 1 brand in Tofu, expands its range of portfolio in new plant-based meat category with the introduction of Plantspired Plant-Based Chick’n.

- In April 2024, Alpro the Danone-owned brand has introduced the 6 SKUs including plant-based protein drinks, a yogurt substitute, and two bestselling variants, Almond No-Sugars, and Creamy Oat in a latest 500ml pack size.

Mycoprotein Market Companies

- Enough

- Tempty Foods

- The Better Meat Co.

- Quorn Foods

- Symrise

- Mycorena AB

- An ACME Group Company

- Bright Green Partners B.V.

- KIDEMIS GmbH

- Mycovation

- MycoTechnology, Inc.

Segments Covered in the Report

By Type

- Feed Grade Mycoprotein

- Food Grade Mycoprotein

By Form

- Minced

- Slices

By Sales Channel

- Supermarkets/Hyper Markets

- Convenience Stores

- Specialty Stores

- Online Stores

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/