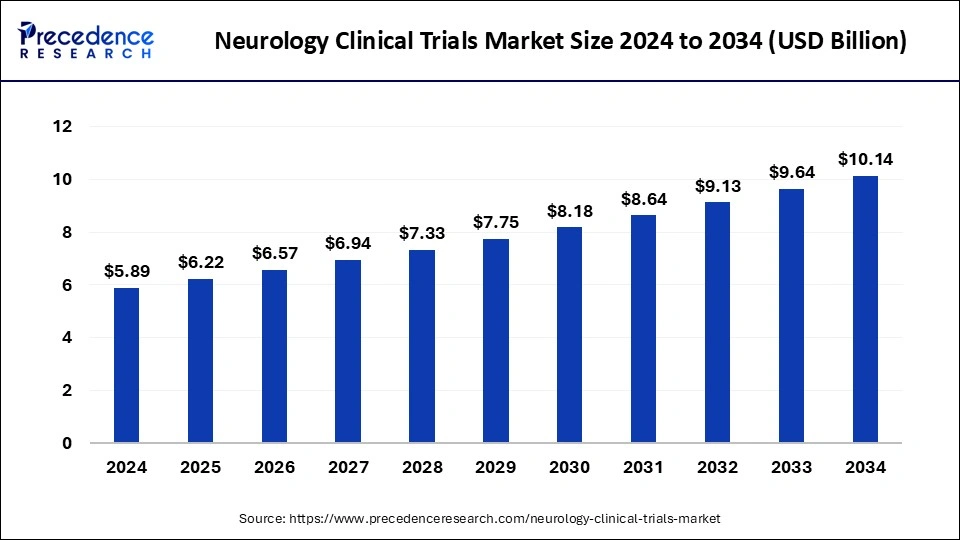

Neurology Clinical Trials Market Size to Surpass USD 9.64 Bn by 2033

The global neurology clinical trials market size reached USD 5.58 billion in 2023 and is projected to surpass around USD 9.64 billion by 2033, expanding at a CAGR of 5.62% from 2024 to 2033.

The Menstrual Health Apps market has witnessed substantial growth in recent years, driven by increasing awareness and adoption of digital health solutions among women worldwide. These apps cater to various aspects of menstrual health management, including cycle tracking, fertility monitoring, symptom management, and personalized health insights. The global market for menstrual health apps is segmented by region, with North America, Europe, Asia-Pacific, and other regions each demonstrating unique trends and opportunities.

Neurology Clinical Trials Market Key Points

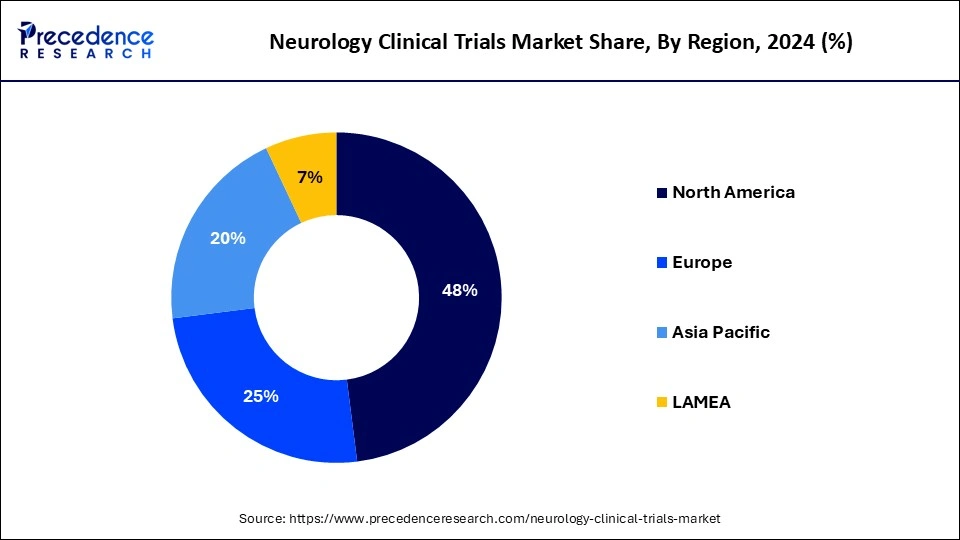

- North America dominated the neurology clinical trials market with the largest revenue share of 48% in 2023.

- Asia Pacific is estimated to grow at a solid CAGR of 5.93% during the forecast period of 2024-2033.

- By phase, the phase II segment has generated more than 47% of revenue share in 2023.

- By phase, the phase III segment is projected to expand at a CAGR of 5.62% during the forecast period.

- By indication, the epilepsy segment has recorded more than 23% of revenue share in 2023.

- By indication, the huntington’s disease segment growing at a CAGR of 6.04% during the forecast period.

- By study design, the interventional segment dominated the market with the biggest revenue share of 96% in 2023.

- By study design, the observational segment is expected to grow at a CAGR of 5.83% during the forecast period.

In North America, the adoption of menstrual health apps has been significantly propelled by the growing preference for personalized healthcare solutions and increasing smartphone penetration. The region benefits from a strong presence of key market players offering advanced features such as predictive analytics and integration with wearable devices. Moreover, favorable regulatory policies supporting digital health innovations contribute to market expansion.

- In April 2023, in Canada, there are more than 1000 brain disorders and diseases like brain cancer, epilepsy, Parkinson’s disease, Alzheimer’s disease, etc. The government of Canada is aware of the necessity of supporting the neuroscience community and its role in improving the brain health of Canadians.

- In February 2024, a phase I/ phase II clinical trial investigating an allogenic neural exosome AB126 derived from neural stem cells was launched by a biotechnology company, Aruna Bio (GA US), for the treatment of neurogenerative diseases.

Across Europe, there is a rising trend towards menstrual health awareness and the use of technology-driven solutions among women. Countries like the UK, Germany, and France are witnessing robust demand for apps that not only track menstrual cycles but also provide insights into reproductive health and overall well-being. Integration with electronic health records (EHRs) and advancements in artificial intelligence (AI) for personalized recommendations are driving market growth in the region.

In the Asia-Pacific region, rapid urbanization, increasing healthcare expenditure, and improving healthcare infrastructure are key factors driving the adoption of menstrual health apps. Countries such as China, India, and Japan are witnessing a surge in the use of smartphone applications for menstrual cycle tracking and fertility management. Moreover, cultural shifts towards open discussions on women’s health and wellness are creating a favorable environment for market expansion.

Neurology Clinical Trials Market Trends

- Increased Focus on Neurodegenerative Diseases: There is a growing emphasis on clinical trials targeting neurodegenerative diseases such as Alzheimer’s, Parkinson’s, and ALS (amyotrophic lateral sclerosis). These diseases pose significant challenges globally, driving increased investment in research and clinical trials.

- Advancements in Biomarkers and Imaging Techniques: Biomarkers and advanced imaging techniques are playing a crucial role in neurology clinical trials. They aid in early disease detection, patient stratification, and monitoring treatment responses, thereby enhancing trial outcomes and efficiency.

- Rise of Precision Medicine: Precision medicine approaches, which tailor treatments based on individual patient characteristics such as genetics, biomarkers, and demographics, are gaining traction in neurology clinical trials. This approach aims to improve therapeutic efficacy and patient outcomes.

- Focus on Rare Neurological Disorders: There is a growing interest in rare neurological disorders due to their significant unmet medical needs. Clinical trials targeting conditions like Huntington’s disease, rare forms of epilepsy, and others are increasing, driven by orphan drug incentives and patient advocacy.

- Shift towards Virtual and Decentralized Trials: The COVID-19 pandemic accelerated the adoption of virtual and decentralized trial methodologies in neurology. These approaches offer advantages such as broader patient recruitment, reduced trial costs, and increased patient participation convenience.

- Collaborations and Partnerships: Collaboration among pharmaceutical companies, biotech firms, academic institutions, and patient advocacy groups is on the rise. Such partnerships facilitate pooling of resources, expertise, and patient cohorts, accelerating trial timelines and enhancing data quality.

Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 9.64 Billion |

| Market Size in 2023 | USD 5.58 Billion |

| Market Size in 2024 | USD 5.89 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Phase, Study Design, Indication, Study Design, Phase, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Phase of Clinical Trials

Neurology clinical trials progress through several distinct phases, each serving specific purposes in the drug development process. Phase 1 trials are typically small-scale studies involving healthy volunteers or patients to primarily assess the safety profile and determine appropriate dosage levels of new treatments. These trials aim to understand how the drug is metabolized and excreted, identifying any potential side effects. Phase 2 trials expand to a larger group of patients afflicted with the targeted neurological condition. Their main objective is to gather preliminary data on the treatment’s efficacy and to further evaluate its safety profile in a more diverse population. Phase 3 trials are pivotal, involving a significantly larger patient cohort to confirm efficacy, monitor side effects comprehensively, and often compare the treatment against existing standards or placebos. These trials provide robust data required for regulatory approval. Finally, Phase 4 trials occur post-approval and focus on gathering additional information about long-term safety, optimal usage, and effectiveness in broader patient populations.

Study Design in Neurology Clinical Trials

Neurology clinical trials employ various study designs tailored to their specific research goals and the nature of the treatments being tested. Randomized Controlled Trials (RCTs) are the cornerstone, randomly assigning participants to different treatment groups to minimize bias and rigorously assess treatment efficacy. This design is crucial in establishing causal relationships between treatments and outcomes. Observational Studies play a significant role, particularly in assessing long-term outcomes or studying rare conditions where RCTs may be impractical or unethical. Crossover Trials allow participants to receive different treatments sequentially, serving as their own controls, thereby enhancing study efficiency and reducing variability. Open-label Trials, where both participants and researchers are aware of the treatment administered, are employed when blinding isn’t feasible or when ethical considerations favor transparency.

Indications in Neurology Clinical Trials

Neurology clinical trials span a wide spectrum of neurological indications, addressing diverse medical needs and conditions affecting the nervous system. Alzheimer’s Disease and Dementia trials focus on developing disease-modifying therapies, improving symptom management, and advancing early diagnostic tools to mitigate the disease burden. Multiple Sclerosis trials are geared towards testing new disease-modifying drugs, optimizing symptom management strategies, and exploring rehabilitative interventions to enhance patient quality of life. Parkinson’s Disease research emphasizes therapies aimed at slowing disease progression, managing motor and non-motor symptoms effectively, and developing innovative treatment approaches. Stroke clinical trials concentrate on acute interventions to minimize brain damage, rehabilitative strategies to facilitate recovery, and preventative measures to reduce the incidence and severity of strokes. Epilepsy trials explore novel antiepileptic medications, surgical interventions for drug-resistant cases, and the efficacy of new devices aimed at seizure management and control.

Neurology Clinical Trials Market Dynamics

Key drivers of growth in the menstrual health apps market include the increasing prevalence of menstrual disorders, rising awareness about the importance of menstrual health, and the convenience offered by digital solutions in tracking and managing menstrual cycles. Additionally, the shift towards proactive healthcare management and the growing emphasis on women-centric healthcare services contribute to market expansion.

Opportunities in the menstrual health apps market are abundant, with untapped potential in emerging markets, technological innovations in app functionalities, and strategic collaborations between app developers and healthcare organizations. Moreover, the growing acceptance of telehealth and remote patient monitoring solutions presents new avenues for market players to explore.

However, the market also faces challenges such as data privacy concerns, regulatory hurdles related to medical app certifications, and the need for continuous innovation to differentiate from existing apps. Ensuring user trust through robust security measures and navigating complex healthcare regulations across different regions remain critical challenges for stakeholders in the menstrual health apps market.

Read Also: Menstrual Health Apps Market Size to Surpass USD 9.04 Bn by 2033

Recent Developments

- In August 2023, the phase II RECOVER-NEURO clinical trial study to evaluate the combination of REMOTE-transcranial direct current stimulation (tDCS) and a brain training program for long covid was launched by Soterix Medical.

- In March 2024, an innovative and new pTau217 blood test, ALZpath Dx, was launched by a specialized clinical laboratory, Neurocode USA, Inc., that offers world-class testing solutions for neurological disorders. This new test may be used in the monitoring, screening, and diagnosis of Alzheimer’s disease. In the US, Neurocode is the first laboratory to make this test as LDT (laboratory-developed test) for clinical trials, clinical diagnostics use, and other research causes.

Neurology Clinical Trials Market Companies

- IQVIA

- Biogen

- Aurora Healthcare

- GlaxoSmithKline Plc.

- Icon Plc.

- Syneous Health

- Charles River Laboratories

- Med pace

- Covance

- Novartis AG

- Sanofi

- Merck & Co., Inc.

- AbbVie Inc.

- Teva Pharmaceutical Industries Ltd.

- Annovis Bio

- Athira Pharma, Inc.

- Zydus Group

- Eli Lilly and Company

- Eisai Co., Ltd.

- AstraZeneca

- Supernus Pharmaceuticals, Inc. (Adamas Pharmaceuticals)

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/