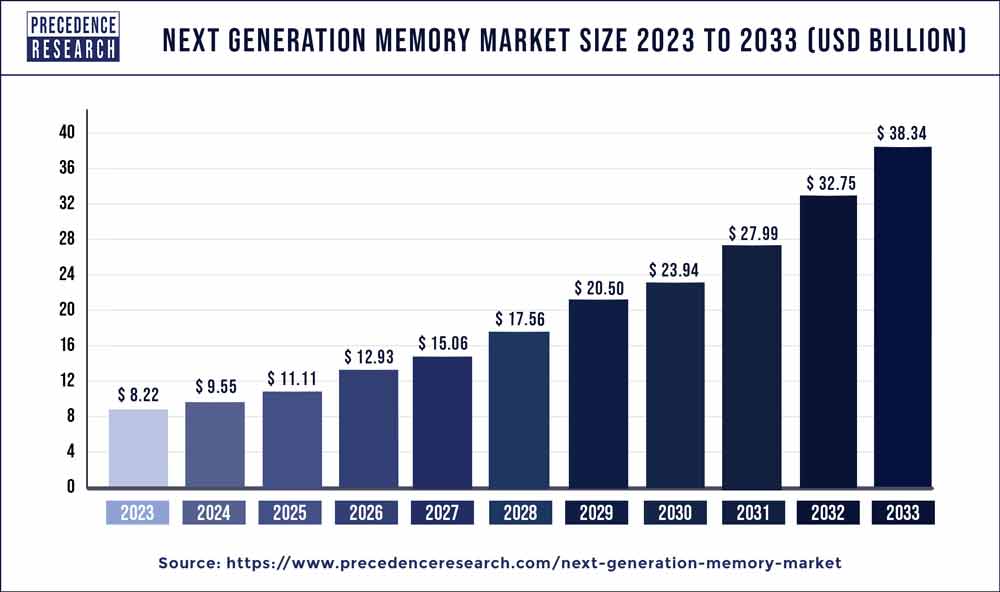

Next Generation Memory Market Size to Cross USD 38.34 Bn by 2033

The global next generation memory market size was estimated at USD 8.22 billion in 2023 and is projected to reach around USD 38.34 billion by 2033, notable at a CAGR of 16.70% from 2024 to 2033.

Key Takeaways

- Asia-Pacific held the largest share of 51% in 2023.

- North America is expected to grow at a CAGR of 25.1% during the forecast period.

- By technology, the non-volatile memory segment held the largest share of 76% in 2023.

- By wafer size, the 300mm segment held the largest share of 61% of the market in 2023.

- By wafer size, the 200mm segment is expected to grow at a significant rate during the forecast period.

- By application, the BFSI segment held the largest share of the market by contributing 32% in 2023.

Overview:

The next-generation memory market is poised for significant growth in the coming years, driven by advancements in technology and increasing demand for high-performance, low-power memory solutions. Next-generation memory refers to emerging memory technologies that aim to overcome the limitations of traditional memory solutions like DRAM (Dynamic Random Access Memory) and NAND flash. These new memory technologies offer improved speed, density, endurance, and energy efficiency, making them suitable for a wide range of applications spanning from consumer electronics to data centers and artificial intelligence.

Get a Sample: https://www.precedenceresearch.com/sample/3747

Growth Factors:

Several factors contribute to the growth of the next-generation memory market. Firstly, the exponential growth of data generated by various applications, such as big data analytics, artificial intelligence, and Internet of Things (IoT), is driving the demand for higher-capacity and faster memory solutions. Next-generation memories, such as MRAM (Magneto-Resistive Random Access Memory), PCM (Phase Change Memory), and RRAM (Resistive Random Access Memory), offer the potential to meet these demands with their improved performance characteristics.

Furthermore, the increasing adoption of advanced technologies like 5G networks, autonomous vehicles, and edge computing is fueling the need for memory solutions that can handle the requirements of these applications efficiently. Next-generation memories offer lower latency and higher bandwidth compared to traditional memory technologies, making them well-suited for these emerging use cases.

Additionally, the growing demand for non-volatile memory solutions that can retain data even when power is turned off is propelling the adoption of next-generation memories. Unlike traditional volatile memories like DRAM, next-generation memories provide persistent storage, enhancing reliability and data integrity in critical applications such as enterprise storage and automotive systems.

Moreover, advancements in semiconductor manufacturing processes enable the production of next-generation memory chips with higher densities and lower costs. This scalability and cost-effectiveness make next-generation memories increasingly attractive for both consumer and enterprise markets, driving further adoption and market growth.

Next Generation Memory Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 16.70% |

| Global Market Size in 2023 | USD 8.22 Billion |

| Global Market Size by 2033 | USD 38.34 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology, By Wafer Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Next Generation Memory Market Dynamics

Drivers:

Several key drivers are influencing the expansion of the next-generation memory market. One of the primary drivers is the need for faster and more energy-efficient memory solutions in data-intensive applications. Next-generation memories offer significant performance improvements over conventional memory technologies, enabling faster data access and processing while consuming less power.

Furthermore, the increasing demand for high-performance computing (HPC) and artificial intelligence (AI) applications is driving the adoption of next-generation memory solutions. These applications require large amounts of data to be processed quickly, and traditional memory technologies often struggle to keep up with the demands. Next-generation memories, with their superior performance characteristics, are better suited to meet the requirements of HPC and AI workloads, driving their adoption in these sectors.

Moreover, the proliferation of connected devices and the Internet of Things (IoT) is creating a massive demand for memory solutions that can handle the data generated by these devices efficiently. Next-generation memories offer higher capacities and lower power consumption, making them ideal for IoT applications where energy efficiency and reliability are paramount.

Additionally, the automotive industry is increasingly incorporating advanced driver assistance systems (ADAS), infotainment systems, and autonomous driving features into vehicles, leading to a growing need for reliable and high-performance memory solutions. Next-generation memories offer the durability, speed, and non-volatility required for automotive applications, driving their adoption in this sector.

Restraints:

Despite the promising growth prospects, the next-generation memory market faces several challenges and restraints. One significant restraint is the high cost of manufacturing next-generation memory chips. The development and production of these advanced memory technologies require significant investments in research, development, and manufacturing infrastructure, which can drive up the overall cost of the memory chips.

Furthermore, the compatibility issues between next-generation memory technologies and existing infrastructure pose a challenge to widespread adoption. Integrating new memory solutions into existing systems and platforms may require modifications or upgrades, leading to additional costs and complexities for end-users.

Moreover, the slower pace of standardization and mass production compared to established memory technologies like DRAM and NAND flash could hinder the market growth of next-generation memories. Lack of industry standards and limited availability of compatible hardware and software ecosystems may delay the adoption of these new memory technologies in mainstream applications.

Additionally, concerns regarding the reliability and durability of next-generation memory solutions, particularly in mission-critical applications, could act as a restraint on market growth. End-users may hesitate to adopt new memory technologies without sufficient evidence of their long-term reliability and performance under various operating conditions.

Opportunities:

Despite the challenges, the next-generation memory market presents significant opportunities for growth and innovation. One key opportunity lies in the development of niche markets and specialized applications that can benefit from the unique characteristics of next-generation memories. Industries such as aerospace, defense, healthcare, and gaming have specific requirements for high-performance, reliable, and low-power memory solutions, creating opportunities for next-generation memory vendors to cater to these markets.

Moreover, the increasing focus on edge computing and IoT deployments presents an opportunity for next-generation memory technologies to play a crucial role in enabling real-time data processing and analysis at the network edge. These applications require memory solutions that can provide fast access to data while minimizing latency and power consumption, making next-generation memories an attractive choice for edge computing environments.

Furthermore, ongoing research and development efforts aimed at improving the performance, scalability, and cost-effectiveness of next-generation memory technologies present opportunities for innovation and differentiation among market players. Collaborations between semiconductor companies, research institutions, and industry partners can accelerate the development and commercialization of advanced memory solutions, driving market growth and competitiveness.

Additionally, the growing demand for data storage and processing in cloud computing environments presents opportunities for next-generation memory technologies to address the scalability and performance challenges faced by data centers. By offering higher densities, faster access times, and lower power consumption compared to traditional memory solutions, next-generation memories can help data center operators optimize their infrastructure and reduce operational costs.

Read Also: AI in Food Market Size, Trends, Share, Trend, Report by 2033

Recent Developments

- In April 2023, SK Hynix Inc. of South Korea achieved a significant industry milestone by developing a 12-layer HBM31 product with a memory capacity of 24 gigabytes (GB), marking the largest capacity in the industry. This achievement represented a 50% increase in memory capacity compared to the previous product, following the company’s mass production of the world’s first HBM3 in June 2022.

- In May 2022, Everspin Technologies Inc. based in the United States introduced the STT-MRAM EMxxLX xSPI Family, featuring densities ranging from 8 Mbit up to 64 Mbit.

- In March 2022, Fujitsu Semiconductor Memory Solution Limited in Japan launched a 12Mbit ReRAM (Resistive Random Access Memory) known as MB85AS12MT, representing the highest density in Fujitsu’s ReRAM product family. The MB85AS12MT is a non-volatile memory with a 12Mbit memory density and operates within a wide power supply voltage range from 1.6V to 3.6V.

Next Generation Memory Market Companies

- Micron Technology, Inc. (United States)

- Samsung Electronics Co., Ltd. (South Korea)

- SK Hynix Inc. (South Korea)

- Intel Corporation (United States)

- Western Digital Corporation (United States)

- Toshiba Memory Corporation (Japan)

- Fujitsu Ltd. (Japan)

- Adesto Technologies Corporation (United States)

- Crossbar Inc. (United States)

- Everspin Technologies Inc. (United States)

- Viking Technology (United States)

- Avalanche Technology Inc. (United States)

- Spin Memory Inc. (United States)

- Nantero Inc. (United States)

- Cypress Semiconductor Corporation (United States

Segments Covered in the Report

By Technology

- Non-volatile Memory

- Volatile Memory

By Wafer Size

- 200 mm

- 300 mm

By Application

- Consumer Electronics

- Enterprise Storage

- Automotive & Transportation

- Military & Aerospace

- Industrial

- Telecommunications

- Energy & Power

- Healthcare

- Agricultural

- Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/