Nicotine Replacement Therapy Market Size, Report by 2033

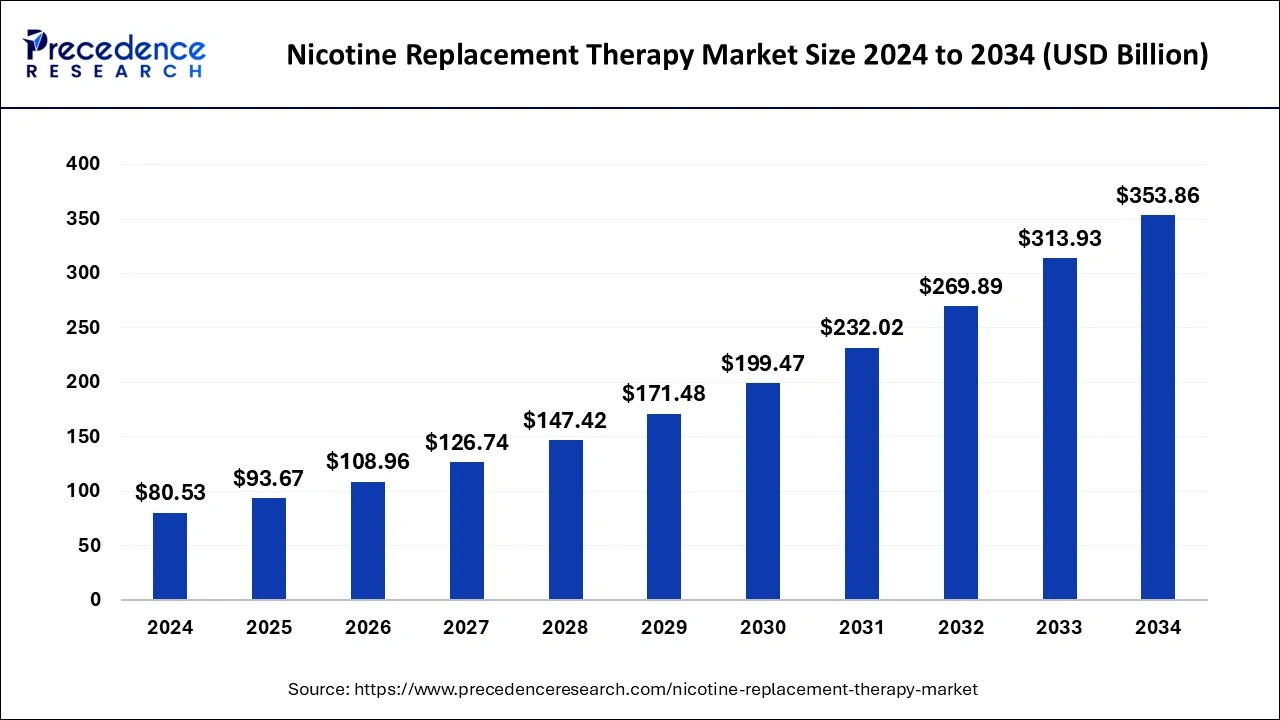

The global nicotine replacement therapy market size is expected to increase USD 313.93 billion by 2033 from USD 69.23 billion in 2023 with a CAGR of 16.32% between 2024 and 2033.

Key Points

- Asia Pacific led the market with the largest revenue share of 41% in 2023.

- North America is expected to attain the fastest rate of growth during the forecast period.

- By product, the e-cigarettes segment has generated more than 47% of revenue share in 2023.

- By product, the heat-not-burn tobacco products segment is expected to expand at a soldi CAGR of 19.13% during the forecast period.

- By distribution channel, the offline segment has held the biggest revenue share of 82% in 2023.

- By distribution channel, the online segment is projected to grow with the highest CAGR of 19.42% during the forecast period

The Nicotine Replacement Therapy (NRT) market is a rapidly growing sector within the broader healthcare industry, driven by increasing awareness about the health risks associated with smoking and a growing number of smokers seeking to quit. NRT products, including patches, gum, lozenges, inhalers, and nasal sprays, provide smokers with a controlled dose of nicotine to ease withdrawal symptoms and cravings. The market is bolstered by government initiatives and public health campaigns promoting smoking cessation. Additionally, the availability of NRT products over-the-counter has made them more accessible to consumers. Technological advancements and the development of novel products, such as nicotine pouches and strips, are also contributing to market growth. However, challenges such as the rise of alternative cessation aids like e-cigarettes and concerns about the long-term efficacy and safety of NRT products may impact market dynamics. Overall, the NRT market is poised for continued expansion as efforts to reduce smoking prevalence and tobacco-related diseases intensify globally.

Download the Sample Report ( Including Full TOC, List of Table & Figures, Chart): https://www.precedenceresearch.com/sample/4573

Nicotine Replacement Therapy Market Companies

- Cipla Inc.

- Pfizer Inc.

- Fertin Pharma

- Philip Morris Products S.A.

- British American Tobacco plc

- Glenmark Pharmaceuticals

- Japan Tobacco Inc.

- Imperial Brands plc

- Johnson & Johnson Private Limited

Product Insights

The Nicotine Replacement Therapy (NRT) market encompasses a variety of product segments designed to aid individuals in quitting smoking by delivering controlled doses of nicotine without the harmful toxins found in tobacco smoke. Nicotine gum, patches, lozenges, inhalers, and nasal sprays are among the primary forms of NRT available. Nicotine gum offers a discreet and portable option, allowing users to manage cravings by chewing and releasing nicotine gradually. Patches, on the other hand, adhere to the skin and deliver a steady supply of nicotine throughout the day, making them convenient for users who prefer a once-daily application. Nicotine lozenges dissolve in the mouth, providing a discreet alternative to gum, while inhalers and nasal sprays deliver nicotine via inhalation or nasal absorption, appealing to users who seek rapid relief from cravings.

Distribution Channel Insights

In terms of distribution channels, NRT products are widely available through pharmacies, drug stores, online retailers, healthcare providers, and in some cases, retail chains and supermarkets. Pharmacies and drug stores serve as key outlets where consumers can purchase NRT products over-the-counter (OTC), often receiving guidance from pharmacists on usage and effectiveness. Online retailers have become increasingly popular for purchasing NRT products, offering convenience and discretion with home delivery options. Healthcare providers play a critical role by prescribing NRT as part of comprehensive smoking cessation programs, ensuring personalized treatment plans and monitoring for effective outcomes. Retail chains and supermarkets provide additional accessibility for consumers seeking NRT alongside their regular shopping needs, while specialty health stores may offer a curated selection of NRT options with expert advice on smoking cessation strategies. These diverse distribution channels cater to varying consumer preferences and regulatory requirements, contributing to the accessibility and adoption of NRT products in supporting smoking cessation efforts globally.

Nicotine Replacement Therapy Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 313.93 Billion |

| Market Size in 2023 | USD 69.23 Billion |

| Market Size in 2024 | USD 80.53 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 16.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Nicotine Replacement Therapy Market Dynamics

Driven

The Nicotine Replacement Therapy (NRT) market is driven by several key factors. Firstly, increasing awareness about the health risks associated with smoking tobacco products has led to a growing demand for smoking cessation aids like NRT. Governments and health organizations worldwide are promoting smoking cessation programs, thereby boosting the adoption of NRT products. Additionally, advancements in product formulations, such as the availability of various delivery methods like patches, gums, lozenges, and inhalers, have widened consumer choices and improved efficacy, further propelling market growth.

Opportunities

Opportunities in the NRT market are abundant, particularly with the rising adoption of e-cigarettes and vaping as alternatives to traditional smoking. Many users of these products eventually seek NRT to quit nicotine altogether, expanding the potential consumer base. Moreover, increasing disposable incomes and healthcare expenditures in emerging economies present significant growth opportunities for NRT manufacturers. The development of personalized and digital health solutions for smoking cessation also opens doors for innovative products and services in the market.

Challenges

However, the NRT market faces several challenges. One of the primary obstacles is the perceived efficacy of NRT products compared to other smoking cessation methods, such as prescription medications or behavioral therapies. Public misconceptions about the safety and effectiveness of NRT may deter potential users. Regulatory challenges and varying product approvals across different regions can also hinder market growth and product accessibility. Furthermore, the presence of counterfeit products in some markets poses risks to consumer safety and trust, necessitating stringent regulatory oversight and quality control measures by manufacturers and authorities alike. Addressing these challenges will be crucial for sustained growth and innovation in the NRT market.

Read Also: AI Powered Storage Market Size to Worth USD 217.34 Bn by 2033

Recent Developments

- In May 2024, Ventus Medical LTD announced that it had submitted ‘ENHALE’ for UK Marketing Authorization. ENHALE is a next-generation smoking alternative product for tobacco product users.

- In May 2024, Ryze Nicotine Gums announced a partnership with 100 Days. This partnership is being done to launch nicotine gums in several flavors, such as mint, saunf, fruit, pudina, and paan, in the Indian market.

- In February 2024, Spring Health partnered with 2Morrow. This partnership is done to launch a new smoking cessation program in the U.S.

- In January 2024, Lupin launched Varenicline tablets. Varenicline tablet is an FDA-approved therapy for chain smokers.

- In October 2023, BC Cancer’s Smoking Cessation Program launched a Nicotine Replacement Therapy (NRT) program to help cancer patients quit smoking.

- In October 2023, Japan Tobacco launched Ploom X Advanced. Ploom X Advanced is an advanced heated tobacco device that helps reduce the risk potential among cigarette smokers.

- In July 2023, Pines Health Services launched a new nicotine replacement therapy program for helping patients of Caribou to quit smoking.

Segments Covered in the Report

By Product

- Nicotine Replacement Therapy

- Inhalers

- Gum

- Transdermal Patches

- Sublingual Tablets

- Lozenges

- Others

- Heat-not-burn Tobacco Products

- E-cigarettes

By Distribution Channel

- Online

- Offline

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4573