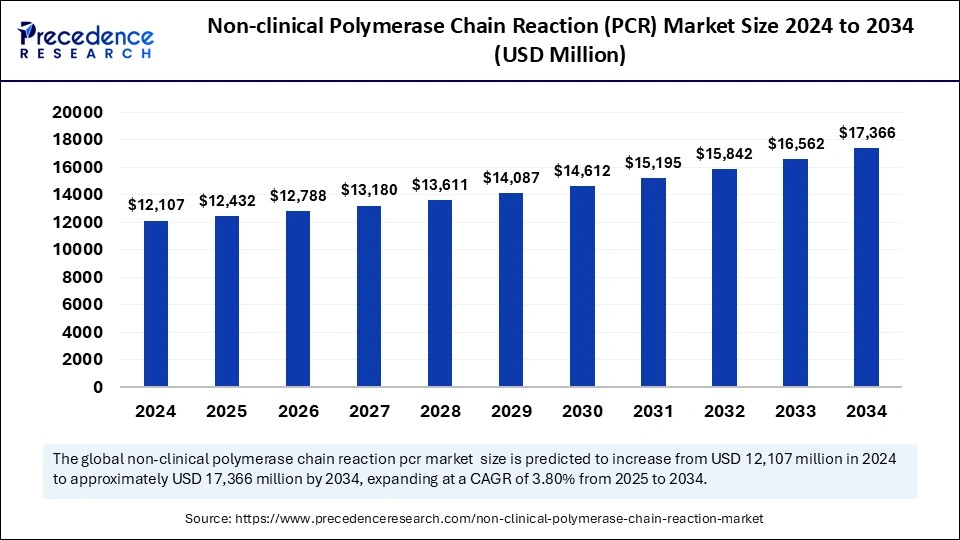

The Non-Clinical PCR Market is forecasted to hit USD 17,366 million by 2034.

The non-clinical PCR market is expected to grow from USD 12,106.50 million in 2024 to approximately USD 17,366 million by 2034, with a CAGR of 3.80% between 2025 and 2034.

Non-Clinical PCR Market Key Insights

- North America dominated the global market by holding 39.23% of market share in 2024.

- Asia Pacific is expected to grow at a CAGR of 4.7% between 2025 and 2034.

- By application area, the basic research segment held the major market share of 35.94% in 2024.

- By application area, the pharmaceutical research segment is anticipated to grow at a CAGR of 4.4% between 2025 and 2034.

- By product type, the reagents and consumables segment captured the largest market share of 56.25% in 2024.

- By product type, the instrumentation segment is expected to grow at a CAGR of 3.7% over the projected period.

- By end-use, the pharmaceutical and biotechnology companies segment held the largest market share of 33.82% in 2024.

- By end-use, the academic and research institutes segment is growing at a CAGR of 3.3% during the predicted timeframe.

Polymerase Chain Reaction (PCR) technology has long been a cornerstone of molecular biology, primarily used in clinical diagnostics, research, and forensic applications. However, its role in non-clinical settings has been expanding significantly, contributing to the growth of the non-clinical PCR market. Non-clinical PCR refers to applications beyond direct patient diagnostics, such as environmental monitoring, food safety testing, forensic sciences, veterinary research, agricultural biotechnology, and industrial testing.

As of 2024, the non-clinical PCR market was estimated at approximately USD 12,106.50 million, and it is projected to reach around USD 17,366 million by 2034, growing at a CAGR of 3.80% from 2025 to 2034. This steady expansion is fueled by increasing applications of PCR in non-clinical research, regulatory compliance requirements in industries like food safety and environmental monitoring, and technological advancements that make PCR more efficient and accessible.

With the rising importance of DNA and RNA-based analysis across various sectors, the demand for PCR solutions is surging. The increasing need for contamination detection in food production, pathogen screening in agriculture, and quality control in industrial bioprocessing is expected to sustain market growth over the coming decade.

Sample Link: https://www.precedenceresearch.com/sample/5708

Market Drivers

Several factors are driving the growth of the non-clinical PCR market, including:

Expanding Applications in Food Safety and Environmental Testing

PCR technology plays a crucial role in ensuring food safety by detecting foodborne pathogens such as E. coli, Salmonella, and Listeria. Regulatory agencies worldwide, such as the FDA, EFSA, and WHO, have stringent guidelines for food manufacturers to comply with safety standards, necessitating the adoption of PCR-based testing solutions.

Similarly, environmental monitoring is gaining momentum as concerns over microbial contamination in water bodies, soil, and air increase. PCR allows for rapid identification of harmful pathogens and contaminants, helping industries comply with environmental safety regulations.

Technological Advancements in PCR Methods

Recent innovations in PCR techniques, such as real-time PCR (qPCR) and digital PCR (dPCR), have significantly enhanced sensitivity, accuracy, and speed. These advancements enable broader adoption of PCR in non-clinical applications, allowing industries to conduct more precise testing and research. Digital PCR, in particular, is revolutionizing quantitative analysis by providing absolute nucleic acid quantification, making it ideal for environmental and forensic applications.

Growing Demand in Agricultural and Veterinary Research

PCR has become a vital tool in agricultural biotechnology and veterinary diagnostics, where it is used for pathogen detection, genetic modification analysis, and livestock disease monitoring. As the agriculture industry increasingly adopts molecular diagnostic techniques to enhance crop yield and prevent disease outbreaks, the demand for PCR solutions continues to rise.

Increasing Use in Forensic Science and Biodefense

Law enforcement and forensic laboratories are leveraging PCR for DNA profiling, genetic fingerprinting, and criminal investigations. Additionally, PCR plays a critical role in biodefense and biosecurity by detecting biothreat agents such as anthrax and other harmful pathogens. Governments and security agencies worldwide are investing in PCR-based surveillance systems to combat bioterrorism threats.

Opportunities

1. Integration of AI and Automation in PCR Workflows

Artificial intelligence (AI) and automation are transforming the PCR landscape by enhancing data analysis, reducing human error, and optimizing workflow efficiency. The integration of AI-powered software in PCR data interpretation allows industries to achieve higher accuracy in pathogen detection, genetic analysis, and contamination monitoring. Automated PCR systems also enable high-throughput testing, benefiting food safety labs, environmental agencies, and forensic departments.

2. Expansion in Emerging Markets

Developing economies in Asia-Pacific, Latin America, and the Middle East are witnessing a growing demand for PCR technology. Increasing investments in research infrastructure, food safety regulations, and environmental monitoring programs present lucrative opportunities for PCR manufacturers and service providers.

3. Miniaturization and Point-of-Use PCR Systems

The development of portable and point-of-use PCR devices is opening new possibilities in various industries. Miniaturized PCR systems are particularly valuable for on-site environmental testing, food safety inspections, and rapid pathogen detection in agricultural fields. This trend is expected to drive adoption among businesses that require immediate and on-location DNA analysis.

Challenges

Despite promising growth, the non-clinical PCR market faces several challenges:

1. High Equipment and Operational Costs

PCR systems, particularly real-time PCR (qPCR) and digital PCR (dPCR) platforms, require significant investments. The cost of reagents, maintenance, and skilled personnel further adds to the operational expenses, making PCR adoption challenging for small-scale industries and research labs.

2. Stringent Regulatory Requirements

Regulatory bodies impose strict guidelines on PCR-based testing in food safety, environmental monitoring, and forensic science. Obtaining approvals and maintaining compliance with evolving standards can be time-consuming and expensive for businesses, affecting market adoption rates.

3. Risk of Cross-Contamination and False Positives

One of the major technical challenges of PCR-based applications is the risk of cross-contamination, leading to false positives or unreliable results. Ensuring proper handling, sample preparation, and laboratory conditions is crucial for accurate testing, which can be a limiting factor for widespread implementation in field applications.

Regional Insights

The non-clinical PCR market varies across different regions based on industrial demand, regulatory policies, and technological advancements:

1. North America

North America dominates the market, accounting for a significant share due to advanced research facilities, stringent regulatory standards, and high adoption of PCR in food safety and forensic applications. The United States and Canada have well-established food safety laws and environmental protection programs, driving demand for PCR-based monitoring solutions.

2. Europe

Europe is another key market, particularly in Germany, the UK, and France, where PCR is extensively used in forensic science, agricultural biotechnology, and pathogen detection in food industries. The European Food Safety Authority (EFSA) mandates strict food safety testing, encouraging PCR adoption in food and beverage industries.

3. Asia-Pacific

The Asia-Pacific region is expected to witness the fastest growth, driven by rapid industrialization, increasing food safety concerns, and rising investment in biotechnology research. Countries like China, India, and Japan are expanding their PCR-based testing capabilities in environmental monitoring, agriculture, and veterinary research.

4. Latin America and Middle East & Africa

Although these regions currently have a smaller market share, growing government initiatives for food safety and environmental protection are boosting PCR adoption. Brazil, South Africa, and the UAE are emerging as potential markets for non-clinical PCR applications.

Read Also: Melt Electrowriting Technology Market

Market Companies

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Bioer Technology Co., Ltd.

- Bio-Rad Laboratories, Inc.

- Eppendorf AG

- Promega Corporation

- Qiagen N.V.

- Roche Diagnostics

- Takara Bio USA, Inc.