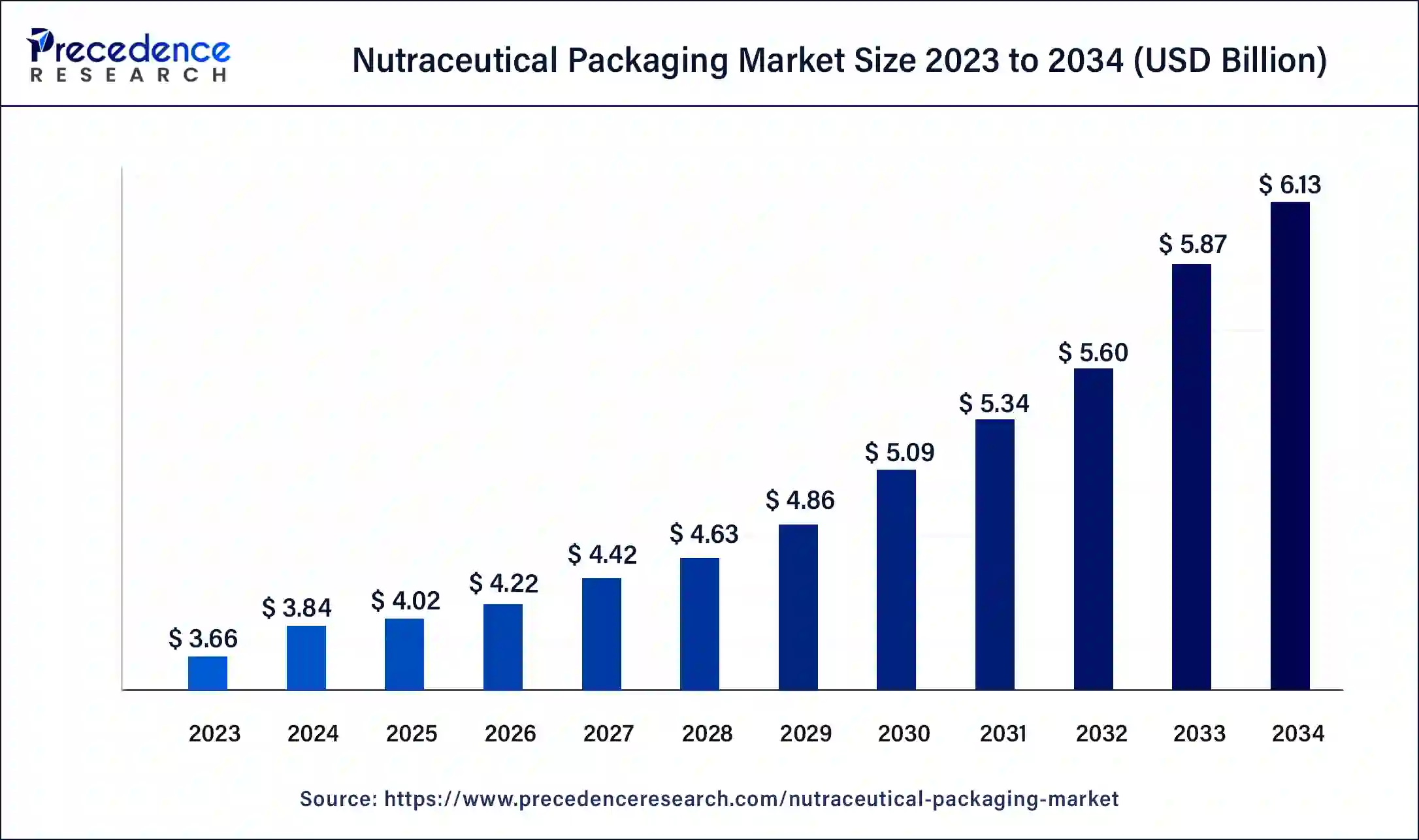

Nutraceutical Packaging Market Size to Cross USD 5.86 Bn by 2033

The global nutraceutical packaging market size surpassed USD 3.66 billion in 2023 and is anticipated to be worth around USD 5.86 billion by 2033, growing at a CAGR of 4.83% from 2024 to 2033.

Key Points

- North America dominated the market with the largest market share of 53% in 2023.

- Europe is expected to grow with the highest CAGR in the market during the forecast period.

- By packaging type, the bottles and jars segment has generated more than 36% of market share in 2023.

- By packaging type, the bags & pouches segment is expected to grow to the highest CAGR in the market during the forecast period.

- By Product, the dietary supplement segment has contributed more than 41% of market share in 2023.

- By Product, the functional foods segment is expected to grow to the highest CAGR in the market by product during the forecast period.

- By material, the glass segment is expected to grow to the highest CAGR in the market during the forecast period.

The nutraceutical packaging market is a dynamic sector within the broader packaging industry, characterized by the packaging of nutraceutical products such as dietary supplements, functional foods, and beverages. Nutraceuticals, which encompass a wide range of products aimed at promoting health and well-being, have experienced growing popularity in recent years due to increasing consumer awareness of the importance of nutrition in maintaining overall health. As a result, the demand for innovative and effective packaging solutions for nutraceutical products has also surged. The nutraceutical packaging market comprises various types of packaging materials and formats designed to preserve the quality, freshness, and efficacy of these products while also meeting regulatory requirements and consumer preferences.

Get a Sample: https://www.precedenceresearch.com/sample/4042

Growth Factors:

Several factors are driving the growth of the nutraceutical packaging market. Firstly, the rising consumer interest in preventive healthcare and wellness-oriented lifestyles has fueled demand for nutraceutical products, thereby stimulating the need for specialized packaging solutions. Additionally, advancements in packaging technologies have enabled the development of packaging materials and formats that enhance the shelf life, stability, and portability of nutraceutical products, further driving market growth. Moreover, the increasing adoption of e-commerce platforms for purchasing nutraceuticals has created opportunities for packaging companies to innovate and optimize packaging designs for online retail channels.

Region Insights:

The nutraceutical packaging market exhibits regional variations influenced by factors such as consumer preferences, regulatory frameworks, and economic conditions. North America and Europe are prominent regions in the nutraceutical packaging market, driven by the presence of a health-conscious consumer base and a well-established nutraceutical industry. In these regions, stringent regulations regarding product labeling and safety contribute to the demand for high-quality packaging solutions. Asia Pacific is emerging as a lucrative market for nutraceutical packaging, fueled by rapid urbanization, changing dietary habits, and increasing disposable incomes in countries such as China, India, and Japan. Latin America and the Middle East & Africa regions also present growth opportunities due to rising consumer awareness of health and wellness trends.

Nutraceutical Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.83% |

| Global Market Size in 2023 | USD 3.66 Billion |

| Global Market Size by 2024 | USD 3.84 Billion |

| Global Market Size by 2033 | USD 5.86 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Packaging Type, By Product, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Nutraceutical Packaging Market Dynamics

Drivers:

Several key drivers are propelling the growth of the nutraceutical packaging market. One significant driver is the growing aging population worldwide, which has led to increased demand for nutraceutical products targeting age-related health concerns such as joint health, cognitive function, and cardiovascular health. Furthermore, the prevalence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders has spurred consumer interest in functional foods and dietary supplements, driving demand for nutraceutical packaging. Additionally, the expansion of distribution channels, including online retail platforms and specialty stores, has created avenues for market growth by increasing accessibility to nutraceutical products.

Opportunities:

The nutraceutical packaging market presents several opportunities for innovation and diversification. One such opportunity lies in the development of sustainable packaging solutions that align with the growing environmental consciousness among consumers. Biodegradable and recyclable packaging materials, as well as eco-friendly packaging designs, are gaining traction as companies seek to reduce their carbon footprint and appeal to environmentally conscious consumers. Moreover, the customization and personalization of packaging to cater to specific consumer segments or product formulations offer opportunities for differentiation and market expansion. Additionally, partnerships and collaborations between packaging companies, nutraceutical manufacturers, and technology providers can drive innovation and address evolving consumer needs.

Challenges:

Despite the growth prospects, the nutraceutical packaging market faces several challenges that need to be addressed for sustainable growth. One challenge is the complex regulatory landscape governing the labeling and packaging of nutraceutical products, which varies across different regions and countries. Compliance with regulatory requirements necessitates thorough understanding and adaptation of packaging designs and materials, which can increase operational costs and time-to-market. Another challenge is the need to balance product protection and preservation with sustainability objectives, as packaging materials that extend shelf life and maintain product quality may not always align with environmental sustainability goals. Additionally, the competitive landscape and price sensitivity in the nutraceutical industry pose challenges for packaging companies to differentiate their offerings while maintaining cost competitiveness.

Read Also: Flywheel Energy Storage Market Size to Surpass USD 1.77 Bn by 2033

Recent Developments

- In February 2024, NBi FlexPack launched its flexible packaging manufacturer, producing custom solutions. Its products are made in the U.S. to allow for quick turnaround times for shipping in the U.S.

- In February 2024, Innovia Films, a leading material science pioneer that manufactures polyolefin film materials for labels and packaging, announced the extension of its product range for floatable polyolefin shrink films. The new film is a low-density white film made from polyolefin (WAPO) that maintains floatability when printed.

- In November 2023, SIG, a leading systems and solutions provider for aseptic packaging, announced the introduction of state-of-the-art filling machines for F&B leaders and startups in the India, Middle East, and Africa region.

- In September 2023, Amcor released the blog on ‘How Regulations and Needs Differentiate OTC and Dietary Supplement Packaging Selection Processes.’ This blog includes OTC packaging regulations and recommendations, drivers behind dietary supplement packaging, and compliant packaging solutions for dietary supplements and OTC drugs from Amcor.

Nutraceutical Packaging Market Companies

- Alpha Packaging

- Amcor Limited

- Gerresheimer AG

- Mondi Plc.

- RPC Group

- Graham Packaging Company

- Sonoco Products Company

- Constantia Flexible Group GmbH

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Flex-pack

- Innovia Film

- Law Print & Packaging Management Ltd.

- American Nutritional Corporation

- Wasdell Packaging Group

- PontEurope

- Arizona Nutritional Supplements LLC

- Comar

- Medifilm AG

- Origin Pharma Packaging

- CSB Nutrition Corporation

- Nutra Solutions

Segments Covered in the Reports

By Packaging Type

- Bottles and Jars

- Bags and Pouches

- Cartons

- Stick Packs

- Blister Packs

- Other

By Product

- Dietary Supplements

- Functional Foods

- Herbal Products

- Isolated Nutrient Supplements

- Other

By Material

- Plastic

- Glass

- Metal

- Paper and paperboard

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/