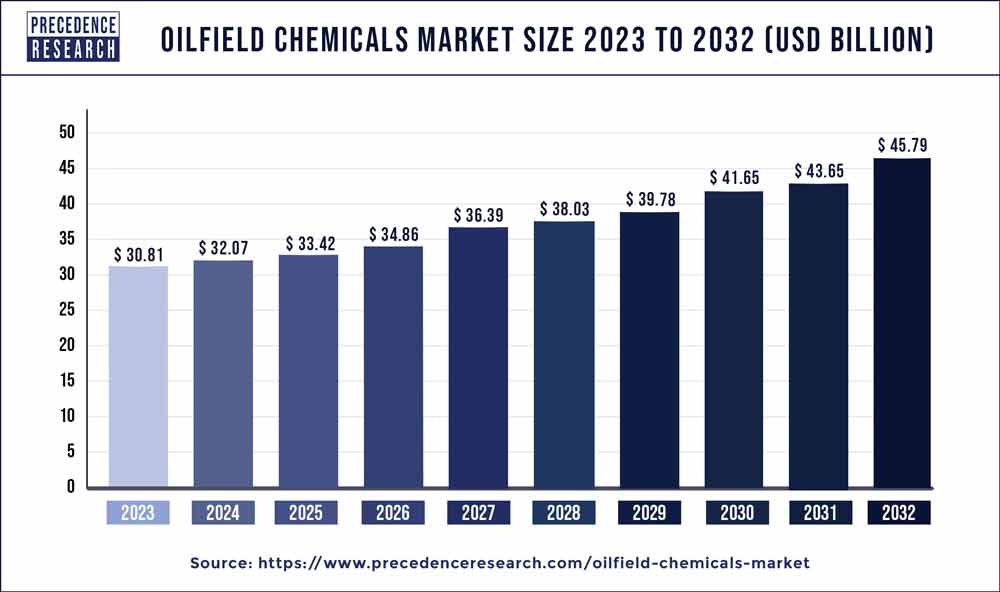

Oilfield Chemicals Market Size to Surpass USD 45.79 Bn By 2032

The global oilfield chemicals market size reached USD 30.81 billion in 2023 and is projected to cross around USD 45.79 billion by 2032, growing at a CAGR of 4.5% from 2024 to 2032. The oilfield chemicals market is an integral segment of the global chemicals industry, dedicated to the development and supply of specialty chemicals used in the exploration and production of oil and gas. These chemicals play a crucial role in enhancing the efficiency and safety of oil extraction and refining processes. They include a wide range of products such as drilling fluids, cementing chemicals, production chemicals, workover and completion chemicals, and enhanced oil recovery (EOR) chemicals. The market is driven by the increasing demand for energy, advancements in drilling technologies, and the need for efficient and environmentally friendly chemical solutions.

- According to Reuters, after the Russia-Ukraine war, Russia is back on track in 2023 for the production of crude oil. Russia’s output in the industry is 9.6 million barrels per day.

- As per Enerdata, the US produced 1.3% more crude oil in 2021 (which accounts for 17% of world output). Russia overtook Saudi Arabia as the second-largest crude oil producer in the world, with a production increase of almost 1.5%. The Middle East (+1.6%), led by Iran (+17.6%) despite sanctions, North America (+2.5%), including +5.9% in Canada, the CIS (+1.8%), and Asia (+3.3%) all saw increases in oil output.

- In November 2022, the oil output of Canada reached an all-time high of 4794.00 BBL/D/1K.

Key Points

- Middle East and Africa led the global market with the highest market share of 39.51% in 2023.

- North America generated more than 26.53% of revenue share in 2023.

- By Product, the biocides modifiers segment is estimated to hold the highest market share of 21.20% in 2023.

- By Application, the production chemicals segment is expected to grow at a remarkable CAGR of 5% during the forecast period.

- By Location, the onshore segment captured the biggest revenue share of 70.15% in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/3075

Regional Insights

- The U.S. oilfield chemicals market size was USD 5.71 billion in 2023 and is predicted to be worth USD 8.29 billion by 2032, growing at a CAGR of 4.2% from 2024 to 2032.

The Oilfield Chemicals Market exhibits notable regional variations, driven by differences in oil and gas exploration and production activities, technological advancements, and economic conditions. North America holds a significant share due to its extensive shale gas and tight oil operations, particularly in the United States and Canada. The Middle East and Africa are also prominent regions, with countries like Saudi Arabia, UAE, and Nigeria being major oil producers investing heavily in advanced oilfield chemicals to enhance extraction efficiency and output. In Asia-Pacific, countries such as China and India are experiencing growing demand for oilfield chemicals driven by their increasing energy needs and expanding oil exploration activities. Latin America, led by Brazil and Venezuela, showcases moderate growth, supported by ongoing offshore drilling projects. Europe, while more focused on renewable energy, still maintains a steady demand for oilfield chemicals, particularly in countries like Norway and the UK, which have established oil and gas sectors. Each region’s unique market dynamics and regulatory landscapes shape the growth and application of oilfield chemicals globally.

Oilfield Chemicals Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 30.81 Billion |

| Market Size by 2032 | USD 45.79 Billion |

| Growth Rate from 2024 to 2032 | CAGR of 4.5% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2032 |

| Segments Covered | By Product, By Application, and By Location |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Oilfield Chemicals Market Segments

Product Outlook

The oilfield chemicals market encompasses a diverse array of products crucial for various stages of oil and gas exploration, drilling, production, and maintenance. Drilling fluids are essential for lubricating drill bits, controlling pressures, and stabilizing well walls, available in water-based, oil-based, and synthetic forms. Cementing chemicals ensure casing support and prevent fluid migration with additives like accelerators and dispersants. Stimulation chemicals, including acids and biocides, enhance hydrocarbon flow via processes like fracking and acidizing. Production chemicals such as corrosion inhibitors and demulsifiers optimize recovery and flow maintenance. Enhanced oil recovery (EOR) chemicals like polymers and surfactants facilitate increased extraction efficiency, while workover and completion fluids aid in maintaining well integrity and efficiency.

Application Outlook

Applications of oilfield chemicals span the entire oil and gas lifecycle, addressing specific challenges at each stage. In drilling, chemicals stabilize boreholes and facilitate cuttings removal, crucial for efficient operations. Cementing operations modify slurry properties to ensure wellbore integrity and prevent interformational fluid migration. Stimulation chemicals enhance reservoir permeability, boosting hydrocarbon flow during production phases. Production chemicals manage scale formation, corrosion, and emulsions to optimize production rates and infrastructure longevity. EOR applications utilize chemicals to maximize recovery from mature fields, employing techniques like polymer and surfactant flooding. Well completion and workover operations rely on chemicals to prepare wells for production and conduct maintenance, ensuring ongoing operational efficiency.

Location Outlook

Global Oilfield Chemicals Market, By Location, 2020-2023 (USD Million)

| By Location | 2020 | 2021 | 2022 | 2023 |

| Onshore | 19,284.0 | 20,011.8 | 20,787.1 | 21,613.2 |

| Offshore | 8,264.6 | 8,556.1 | 8,866.4 | 9,196.8 |

Geographically, the oilfield chemicals market is shaped by global distribution of oil and gas reserves and production activities. North America leads with substantial shale gas and tight oil production, supported by advanced oilfield services and robust exploration. The Middle East & Africa house significant reserves, with countries like Saudi Arabia and Nigeria playing pivotal roles in global production. Asia-Pacific’s burgeoning energy demand drives exploration activities in countries like China and India. Europe, focused on maximizing production from mature North Sea fields, relies heavily on advanced oilfield technologies. Latin America, including Brazil and Mexico, showcases vibrant offshore and onshore production sectors. Rest of the World regions, featuring emerging exploration projects, contribute to global oilfield chemicals demand with growing unconventional reserves and development initiatives. Each region’s unique energy landscape influences market dynamics, technological advancements, and strategic imperatives for industry stakeholders.

Read Also: Pharma 4.0 Market Size to Cross USD 63.29 Billion By 2032

Oilfield Chemicals Market Dynamics

Drivers

The primary driver of the oilfield chemicals market is the rising global demand for energy, which necessitates increased oil and gas exploration and production activities. As conventional oil reserves decline, the industry is shifting towards unconventional sources such as shale gas and deepwater drilling, which require advanced chemical solutions. Technological advancements in drilling and extraction processes, including hydraulic fracturing and horizontal drilling, have further boosted the demand for oilfield chemicals. Additionally, the emphasis on improving operational efficiency and reducing production costs has led to the adoption of specialty chemicals that enhance well performance and longevity. Environmental regulations and the need for sustainable practices also drive the market, prompting the development of eco-friendly and biodegradable oilfield chemicals.

Opportunities

The oilfield chemicals market presents numerous opportunities for growth and innovation. One significant opportunity lies in the development of advanced chemical formulations tailored for specific geological conditions and extraction techniques. Companies can capitalize on the increasing focus on sustainability by creating green and biodegradable chemicals that minimize environmental impact. The expanding exploration activities in untapped regions, particularly in offshore and deepwater reserves, offer lucrative prospects for market players. Furthermore, the integration of digital technologies and data analytics in oilfield operations provides an opportunity to enhance the effectiveness of chemical applications, optimize resource utilization, and improve overall productivity. Collaborations and partnerships with oilfield service companies and exploration firms can also open new avenues for market expansion.

Challenges

Despite the promising growth prospects, the oilfield chemicals market faces several challenges. Fluctuating crude oil prices can impact the profitability of oil exploration and production activities, thereby affecting the demand for oilfield chemicals. Stringent environmental regulations and the need to comply with safety standards pose significant challenges, requiring continuous investment in research and development to create compliant products. The market is also characterized by high competition, with numerous established players and new entrants vying for market share. This competitive landscape necessitates constant innovation and differentiation to maintain a competitive edge. Additionally, the logistical complexities associated with transporting and storing hazardous chemicals, along with the volatility of raw material prices, add to the challenges faced by market participants.

Recent Developments

- In March 2022, the transaction that resulted in DL Chemical Co., Ltd. acquiring Kraton was announced by Kraton Corporation, a top manufacturer of specialty polymers and high-value bio-based products generated from byproducts of pine wood pulping. By utilizing DL Chemicals’ production abilities, market presence in Asia, and financial strength, the combination enables Kraton to increase its worldwide reach and fund more investments in market-beating sustainable innovation. The combination also makes DL Chemical and Kraton’s aim of dominating the world of specialty chemicals a reality soon.

- In March 2022, in Saudi Arabia, Halliburton announced the launch of the Halliburton Chemical Reaction Plant, which will produce a wide range of chemicals for use along the entire oil & gas value chain.

Oilfield Chemicals Market Companies

- SMC Global

- BASF SE

- Solvay

- BERRYMAN CHEMICAL

- Thermax Limited

- Oilfield Chemicals

- SVS Chemical Corporation LLP

- SEATEX LLC

- Kemira

- Hawkins

- Chemiphase

- SicagenChem

- SAHARA Middle East Petroleum Services, Ltd.