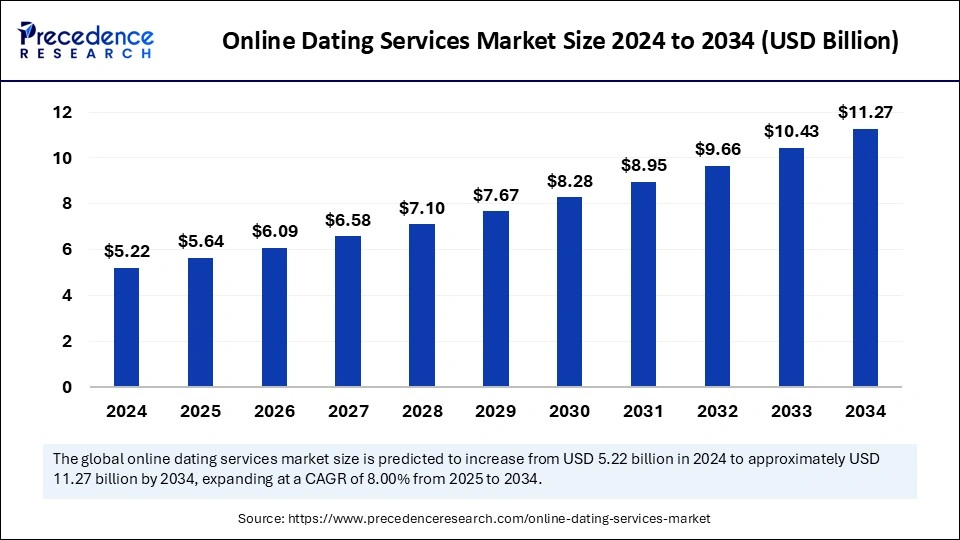

Online Dating Services Market is set to expand to USD 11.27 billion by 2034.

The online dating services market is poised for significant growth, rising from USD 5.22 billion in 2024 to an estimated USD 11.27 billion by 2034, with a projected CAGR of 8.00% during the forecast period.

Online Dating Services Market Key Insights

- North America dominated the online dating services market with the largest market share of 39% in 2024.

- Asia Pacific is anticipated to show fastest growth in the forecast period.

- By platform type, the mobile apps held the biggest share of the market in 2024.

- By platform type, the websites segment is seen to grow at a steady rate.

- By subscription model, the paid subscription segment generated the largest market share in 2024.

- By user, the younger individuals segment led the market in 2024.

- By service feature, the chat service segment held the largest share in 2024.

- By service feature, the video dating segment is seen to grow at the fastest rate during the forecast period.

The online dating services market is witnessing substantial growth, driven by increasing internet penetration, the widespread adoption of smartphones, and changing societal attitudes toward digital matchmaking. Online dating platforms provide users with convenient, technology-driven solutions to connect with potential partners based on shared interests, preferences, and compatibility algorithms. The industry has evolved significantly with the rise of AI-driven matchmaking, video-based interactions, and niche dating apps catering to specific demographics. As digital dating becomes more mainstream, the market is expected to expand, with innovative features enhancing user experience and engagement.

Sample Link: https://www.precedenceresearch.com/sample/5704

Market Drivers

Several key factors are fueling the growth of the online dating services market

- Growing Internet and Smartphone Usage – The rapid adoption of smartphones and high-speed internet has made online dating accessible to a broader audience worldwide.

- Shifting Social Norms and Acceptance – The stigma around online dating has diminished, with more people embracing digital platforms to find meaningful relationships.

- AI and Machine Learning Integration – Advanced algorithms, AI-powered matchmaking, and behavioral analytics have improved the efficiency of finding compatible matches.

- Increased Demand for Virtual Dating – Features like video calls, live streaming, and AI-powered conversation starters have made online dating more interactive and engaging.

- Rising Disposable Incomes – The willingness to pay for premium subscriptions and exclusive matchmaking services is increasing, contributing to market revenue.

Opportunities

The online dating services market presents multiple opportunities for growth

- Expansion in Emerging Markets – Developing countries with increasing smartphone penetration and changing social dynamics offer untapped potential.

- Niche and Specialized Dating Apps – The rise of platforms catering to specific communities (e.g., religious, LGBTQ+, professionals, pet lovers) is creating new market segments.

- Integration of Augmented Reality (AR) & Virtual Reality (VR) – Future dating experiences may include immersive virtual environments for better engagement.

- Enhanced Safety and Verification Features – Platforms that prioritize user safety with identity verification, AI-driven fraud detection, and background checks are gaining trust and attracting more users.

- Monetization Through Gamification & Social Features – Incorporating gaming elements, virtual gifts, and social networking features can boost user engagement and revenue.

Challenges

Despite its growth, the online dating industry faces some challenges

- Privacy and Data Security Concerns – With sensitive user information stored on dating platforms, data breaches and cyber threats pose significant risks.

- Fake Profiles and Catfishing – The presence of fake accounts, scammers, and misleading profiles affects user trust and retention.

- Competition and Market Saturation – The online dating space is highly competitive, with numerous platforms vying for user attention, making differentiation crucial.

- Regulatory and Ethical Issues – Concerns around user data protection, AI bias in matchmaking, and ethical use of personal data are becoming increasingly important.

- High Customer Acquisition Costs – Retaining users and converting free members into paying subscribers remains a challenge for dating platforms.

Regional Insights

- North America – The largest market for online dating services, driven by widespread digital adoption, disposable incomes, and acceptance of online relationships. The U.S. leads the industry with major players like Tinder, Bumble, and Match.com.

- Europe – A mature market with strong demand for niche and premium dating services. Countries like the UK, Germany, and France are key contributors to market growth.

- Asia-Pacific – The fastest-growing region, fueled by rising smartphone usage, increasing urbanization, and changing attitudes toward online dating in countries like India, China, and Japan.

- Latin America & Middle East & Africa – While adoption is still growing, cultural factors and internet access challenges affect the pace of expansion. However, the rise of localized dating apps is helping drive engagement.

Read Also: Automated Storage and Retrieval System Market

Market Companies

- Tinder

- Happn

- Match Group

- Zoosk

- Tantan

- Coffee Meets Bagel

- OkCupid

- Hinge

- Grindr