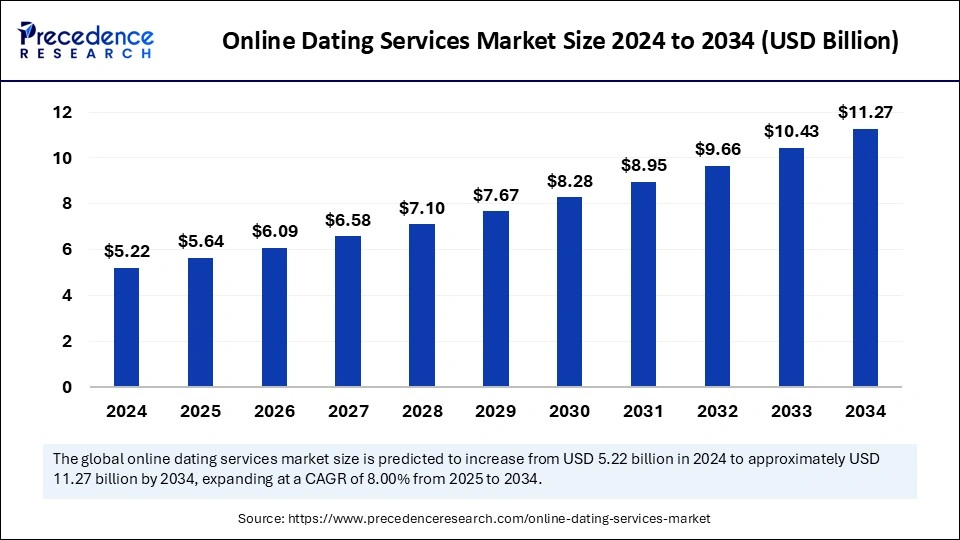

Online Dating Services Market Size to Hit $11.27B by 2034

Global online dating services market to hit USD 11.27 billion by 2034, increasing from USD 5.22 billion in 2024, with a steady CAGR of 8.00% over the forecast period.

Online Dating Services Market Key Takeaways

List of Contents

ToggleNorth America led the online dating services market with a 39% share in 2024.

Asia Pacific is expected to grow rapidly over the forecast period.

Mobile apps held the largest market share by platform type in 2024.

The websites segment is projected to maintain steady growth.

The paid subscription model generated the highest market revenue in 2024.

Younger individuals formed the largest user base in 2024.

Chat services dominated the market by service feature in 2024.

The video dating segment is anticipated to expand at the fastest rate.

Online Dating Services Market Overview

The online dating services market is expanding at a rapid pace, driven by increasing digitalization, changing social dynamics, and the growing acceptance of technology-based relationship platforms. Online dating platforms offer a convenient way for individuals to connect and establish relationships across geographies. These platforms provide a variety of services, ranging from casual dating and long-term relationships to niche matchmaking and social networking.

As internet connectivity improves globally and smartphone penetration continues to rise, the accessibility of online dating services has increased significantly. Furthermore, the adoption of AI-driven algorithms and data analytics has transformed the matchmaking process, offering users highly personalized and compatible matches. The COVID-19 pandemic accelerated the adoption of virtual dating solutions, with many platforms introducing innovative features to cater to the evolving needs of users.

Market Drivers

Increasing Digital Adoption and Smartphone Usage: The proliferation of smartphones and affordable internet connectivity has enabled users to access online dating platforms conveniently, driving market growth.

Growing Acceptance of Online Dating as a Social Norm: Changing societal attitudes toward online dating have reduced stigma, making it a widely accepted means of meeting potential partners.

Advancements in AI and Machine Learning: AI and machine learning technologies have revolutionized matchmaking by analyzing user behavior, preferences, and interactions to deliver highly personalized matches.

Introduction of Innovative Virtual Dating Features: The adoption of virtual dating features, such as video calls, interactive games, and real-time chats, has enhanced user engagement and satisfaction.

Increased Demand for Niche and Specialized Dating Platforms: Consumers are gravitating toward niche dating platforms that cater to specific interests, communities, and lifestyles, offering a more personalized dating experience.

Online Dating Services Market Opportunities

Expansion into Untapped Demographics and Markets: Platforms can explore untapped demographics such as older adults and diverse cultural groups, expanding their user base and driving market growth.

Development of AI-Based Relationship Coaching Services: Integrating AI-powered relationship coaching features can provide users with personalized advice and suggestions to enhance their dating experience.

Growing Demand for Gamified Dating Experiences: The incorporation of gamification elements in dating platforms can enhance user engagement and retention by creating a more interactive and enjoyable experience.

Localization and Cultural Adaptation of Dating Platforms: Customizing dating platforms to align with local cultures, languages, and preferences can facilitate greater adoption in emerging markets.

Introduction of Blockchain-Based Security Solutions: Implementing blockchain technology can enhance data security, transparency, and user trust, addressing concerns related to data privacy and authenticity.

Online Dating Services Market Challenges

Concerns About User Safety and Data Privacy: Ensuring the security of user data and protecting against privacy breaches remain critical challenges for online dating platforms.

High Competition and Market Saturation: The online dating services market is highly competitive, with numerous platforms vying for user attention. Differentiating offerings and retaining users is a constant challenge.

Difficulty in Building Long-Term User Engagement: Maintaining long-term user engagement requires continuous innovation and the introduction of compelling features to prevent churn.

Challenges in Moderating Content and Preventing Misconduct: Platforms must implement robust moderation mechanisms to prevent inappropriate behavior, fake profiles, and harassment.

Cultural and Regulatory Barriers in Certain Regions: Online dating platforms must navigate cultural sensitivities and regulatory complexities when expanding into diverse markets.

Regional Insights

North America: North America leads the online dating services market, with a large user base and high adoption rates. The US remains the largest contributor to regional growth, driven by technological advancements and a culturally accepting environment.

Europe: Europe is witnessing significant growth in online dating adoption, with countries such as the UK, Germany, and France embracing virtual relationship platforms. The region is characterized by the increasing popularity of niche and specialized dating services.

Asia-Pacific: The Asia-Pacific region is experiencing rapid market growth due to rising internet penetration, increasing smartphone usage, and changing social attitudes. China, India, and Japan are emerging as key markets for online dating platforms.

Latin America: Latin America is an emerging market with growing demand for online dating services. Countries such as Brazil and Mexico are witnessing increased adoption, fueled by improved digital connectivity.

Middle East and Africa: The Middle East and Africa region is gradually adopting online dating services, with urbanization and digital transformation creating growth opportunities for dating platforms.

Recent Developments

March 2025: A prominent dating app introduced a feature that uses AI to predict relationship compatibility based on user interactions and preferences, enhancing the matchmaking process.

January 2025: A leading online dating platform launched a gamified dating experience that includes virtual challenges and interactive events to boost user engagement.

Online Dating Services Market Companies

- Tinder

- Happn

- Match Group

- Zoosk

- Tantan

- Coffee Meets Bagel

- OkCupid

- Hinge

- Grindr

- Badoo

- Plenty of Fish

- eHarmony

- Pure

- Bumbl

Segments Covered in the Report

By Platform Type

- Mobile Apps

- Websites

- Social Media

By Subscription Model

- Free

- Freemium

- Paid

By User

- Younger Adults

- Older Adults

By Service Features

- Video Dating

- Chat Services

- Matching Algorithms

By Regional

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Ready for more? Dive into the full experience on our website!