Ophthalmic Packaging Market Size, Share, Report By 2032

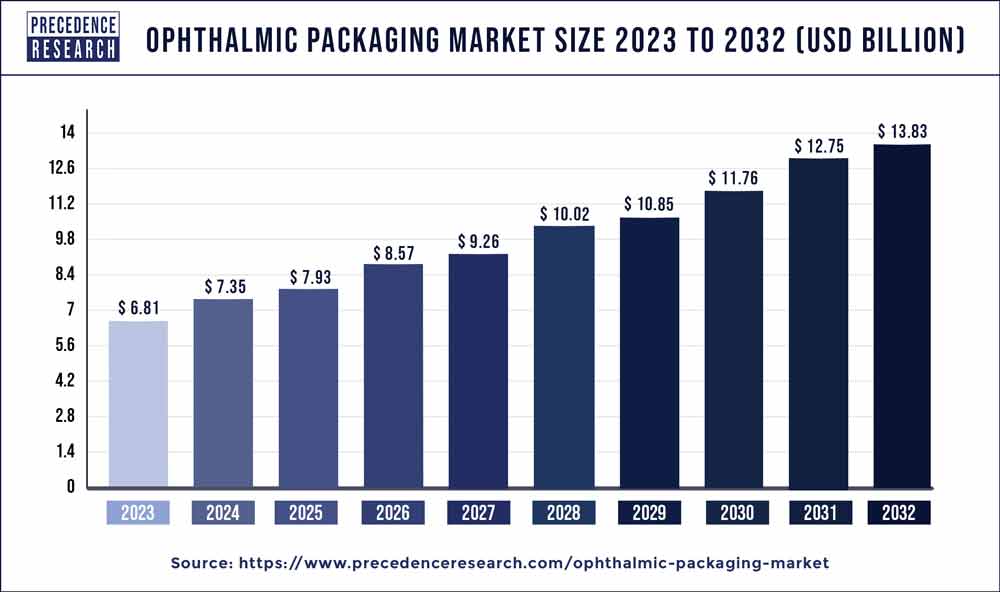

The global ophthalmic packaging market size surpassed USD 6.81 billion in 2023 and is predicted to be worth around USD 13.83 billion by 2032 with a noteworthy CAGR of 8.2% from 2024 to 2032. The Identity and Ophthalmic Packaging market encompasses a range of products and services crucial to the pharmaceutical and healthcare sectors. Identity packaging involves the design and production of packaging materials that ensure product authenticity, security, and compliance with regulatory standards. This segment is pivotal in safeguarding pharmaceutical products against counterfeiting and ensuring traceability throughout the supply chain. Ophthalmic packaging, on the other hand, focuses specifically on packaging solutions tailored to the needs of eye care products, including medications, lenses, and surgical instruments. These packaging solutions must meet stringent requirements for sterility, safety, and ease of use.

Key Points:

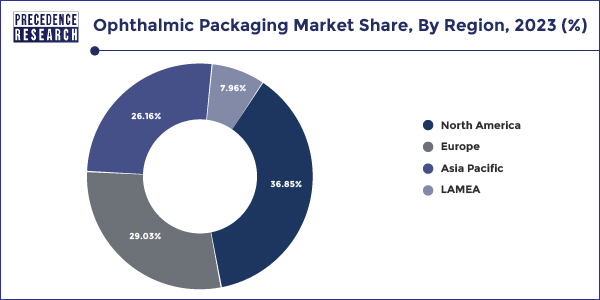

- North America generated more than 36.85% of revenue share in 2023.

- Asia Pacific is expected to expand at the fastest CAGR from 2024 to 2032.

- By Application, the prescription segment registered more than 56.89% of revenue share in 2023.

- By Material, the plastic segment recorded the biggest market share of around 53.84% in 2023.

Download the Sample Report ( Including Full TOC, List of Table & Figures, Chart): https://www.precedenceresearch.com/sample/3072

Regional Insights

- The U.S. Ophthalmic Packaging market size was valued at USD 1.55 billion in 2023 and is expected to reach USD 2.99 billion by 2032, growing at a CAGR of 7.5% from 2024 to 2032.

The Ophthalmic Packaging Market is witnessing significant growth globally, driven by increasing prevalence of eye disorders and rising demand for effective pharmaceutical and medical devices. North America holds a substantial share in the market, attributed to advanced healthcare infrastructure, high healthcare expenditure, and robust regulatory framework ensuring product quality and safety. Europe follows closely, supported by a growing elderly population and advancements in healthcare technologies.

The Asia-Pacific region is expected to experience rapid growth, fueled by rising healthcare expenditure, increasing awareness about eye health, and expanding access to healthcare facilities in countries like China and India. Latin America and the Middle East & Africa regions are also emerging markets, with improving healthcare infrastructure and growing healthcare investments contributing to market expansion. Overall, the Ophthalmic Packaging Market is poised for continued growth across these regions, driven by technological advancements and increasing healthcare awareness.

Ophthalmic Packaging Market Trends

- Increased Demand for Sustainable Packaging: There is a growing emphasis on sustainable packaging solutions within the ophthalmic sector. Manufacturers are exploring materials that are recyclable, biodegradable, and reduce overall environmental impact.

- Advancements in Material Technology: Innovations in packaging materials are focused on enhancing product protection, shelf-life extension, and compatibility with sensitive ophthalmic products such as eye drops and contact lenses. Barrier properties, light protection, and moisture resistance are key considerations.

- Customized Packaging Solutions: With the diversity in ophthalmic products like eye drops, contact lenses, and lens care solutions, there is a trend towards customized packaging solutions. These cater to specific product requirements, dosage forms, and consumer convenience.

- Safety and Compliance: There is an increasing focus on packaging safety and compliance with regulatory standards. Packaging solutions must ensure product integrity, tamper-evidence, and child-resistant features where necessary.

- Innovative Designs for Consumer Convenience: Packaging designs are evolving to enhance user experience and convenience. This includes user-friendly dispensing mechanisms, single-dose packaging, and compact formats suitable for travel.

Ophthalmic Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2032 | CAGR of 8.2% |

| Market Size in 2023 | USD 6.81 Billion |

| Market Size by 2032 | USD 13.83 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2032 |

| Segments Covered | By Material, By Product Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Material Outlook

The Ophthalmic Packaging Market, categorized by material, encompasses a range of substances tailored to meet the unique requirements of eye care products. Primary materials include plastics, glass, and metals. Plastics, owing to their versatility and cost-effectiveness, dominate the market. They are favored for their ability to mold into various shapes and sizes, ensuring compatibility with different types of ophthalmic products such as eye drops, contact lenses, and ointments. Glass remains crucial for its superior barrier properties, preserving product integrity by shielding against moisture and gases, thus maintaining efficacy and safety. Metals like aluminum are utilized for their lightness and protective properties, particularly in packaging solutions requiring durability and protection against external factors.

Product Type Outlook

In terms of product types, the Ophthalmic Packaging Market is segmented into bottles, containers, vials, ampoules, and others. Bottles are prominently used for storing solutions and suspensions, offering ease of dispensing and secure closures to prevent contamination. Containers cater to larger volumes and are designed for bulk storage and distribution of ophthalmic products. Vials and ampoules provide single-dose packaging solutions, ensuring sterility and precise dosage administration, crucial for medications and sensitive formulations. The market also includes specialized packaging like blister packs and unit dose packaging, offering convenience, tamper resistance, and extended shelf life for products such as contact lenses and eye ointments.

Application Outlook

The application segment of the Ophthalmic Packaging Market focuses on various end-uses, including pharmaceuticals, medical devices, and consumer eyecare products. Pharmaceutical applications dominate, driven by the growing prevalence of eye disorders and the increasing demand for effective treatments. Packaging solutions in this segment prioritize safety, compliance with regulatory standards, and patient convenience. Medical devices encompass a wide array of products such as contact lenses and intraocular lenses, demanding packaging that ensures sterility, durability, and ease of use. Consumer eyecare products, including solutions for contact lenses and over-the-counter eye drops, require packaging solutions that emphasize user-friendliness, portability, and product preservation.

Read Also: Oilfield Chemicals Market Size to Surpass USD 45.79 Bn By 2032

Ophthalmic Packaging Market Dynamics

Drivers

Several factors drive growth in the Identity and Ophthalmic Packaging market. Firstly, stringent regulatory requirements worldwide necessitate the adoption of advanced packaging solutions to ensure product safety and compliance. This regulatory landscape encourages pharmaceutical companies to invest in secure and traceable packaging technologies, boosting market demand. Secondly, rising global healthcare expenditures and the increasing prevalence of chronic eye diseases drive the demand for specialized ophthalmic products, thereby fueling the growth of ophthalmic packaging solutions. Thirdly, technological advancements in packaging materials and designs, such as smart packaging and anti-counterfeiting technologies, further propel market expansion by enhancing product protection and consumer safety.

Opportunities

The Identity and Ophthalmic Packaging market presents several opportunities for innovation and market expansion. There is a growing demand for sustainable packaging solutions within the pharmaceutical and healthcare sectors, driven by environmental concerns and regulatory pressures. Companies that develop recyclable, biodegradable, or reusable packaging options stand to capitalize on this trend. Moreover, the integration of digital technologies, such as QR codes and RFID tags, into packaging designs offers opportunities for enhanced supply chain visibility and consumer engagement. Additionally, the expansion of healthcare access in emerging markets presents untapped opportunities for identity and ophthalmic packaging providers to cater to growing pharmaceutical demand in these regions.

Challenges

Despite robust growth prospects, the Identity and Ophthalmic Packaging market faces several challenges. One significant challenge is the high initial investment required for implementing advanced packaging technologies and maintaining regulatory compliance. This can pose barriers to entry for smaller players and startups in the market. Moreover, the complexity of regulatory standards across different geographies presents a challenge for multinational pharmaceutical companies aiming to streamline their packaging operations globally. Another challenge is the constant evolution of counterfeit techniques, which necessitates continuous innovation in anti-counterfeiting technologies to stay ahead of illicit practices. Lastly, fluctuating raw material costs and supply chain disruptions can impact the profitability and operational efficiency of identity and ophthalmic packaging manufacturers.

Recent Development:

- In July 2021, by opening an office in Baldwin, Wisconsin, Nolato expanded its geographic reach. The business would increase its manufacturing and storage capabilities to meet the demands of medical products as a result of this development. The extension was also designed to support the manufacturing of diagnostic tools and components for pharmaceutical drugs.

- In August 2021, a unique healthcare lidding technology was revealed by Amcor. Combination goods, which have two or more controlled components, would take advantage of the technology.

- In October 2020, DropControl, the most modern type of drug dispenser, was introduced by Gerresheimer. In an ophthalmic context, this solution is appropriate for medications with an exceptionally low solids content.

- In September 2021, Amcor collaborated with Michigan State University’s Department of Packaging and contributed $10 million to build a pipeline for a more environmentally friendly packaging sector.

- In August 2021, the BD COR System has been made available in the United States by Becton Dickinson (BD). This completely autonomous diagnostic technology raises the bar for diagnosing infections and diseases.

Ophthalmic Packaging Market Companies

- Amcor

- West Pharmaceutical Services, Inc.

- Gerresheimer AG

- SCHOTT AG

- AptarGroup, Inc.

- Akorn, Inc.

- Johnson & Johnson Vision

- Mitotech, SA

- Bausch & Lomb Incorporated

- AERIE PHARMACEUTICALS, INC.

- Novartis AG

- Merck Sharp & Dohme Corp.

- Bayer AG

- F. Hoffmann-La Roche Ltd.

- ALLERGAN

- Santen Pharmaceutical Co.

- Teva Pharmaceutical Industries Ltd.