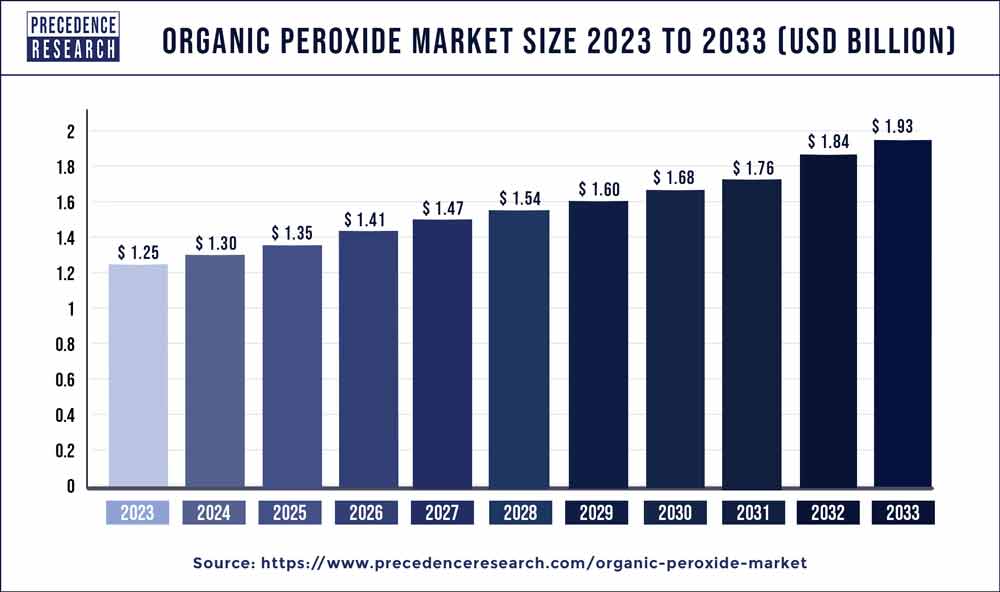

The global organic peroxide market size surpassed USD 1.25 billion in 2023 and is expected to hit around USD 1.93 billion by 2033, growing at a CAGR of 4.50% from 2024 to 2033.

Key Takeaways

- North America dominated the organic peroxide market with a 40% share in 2023.

- Asia-Pacific is expected to witness growth at a CAGR of 7.8% during the forecast period.

- By product, the diacetyl peroxide segment held the largest share of 41% in the market in 2023.

- By product, the ketone peroxide segment is expected to grow at a significant rate of 6.7% during the forecast period.

- By application, the paper and textiles segment held the largest share of 36% in the market.

- By application, the polymer segment is expected to grow at a notable rate of 7.3% during the forecast period.

The organic peroxide market is witnessing steady growth globally, driven by increasing demand from various end-use industries such as plastics, rubber, pharmaceuticals, and cosmetics. Organic peroxides are versatile chemicals widely used as initiators, catalysts, cross-linking agents, and bleaching agents in various industrial processes. They are known for their ability to initiate polymerization reactions, making them essential in the production of polymers and other organic compounds. The market for organic peroxides is characterized by intense competition among key players, technological advancements, and stringent regulatory frameworks governing their production and usage.

Get a Sample: https://www.precedenceresearch.com/sample/3748

Growth Factors:

Several factors contribute to the growth of the organic peroxide market. One significant factor is the increasing demand for polymers and plastics across various industries, including automotive, construction, and packaging. Organic peroxides play a crucial role in polymerization processes, enabling the production of high-quality plastics with desirable properties such as strength, durability, and thermal stability. Moreover, the growing emphasis on sustainable and eco-friendly materials has led to the development of bio-based organic peroxides, further driving market growth.

Additionally, the expansion of end-use industries such as cosmetics, pharmaceuticals, and textiles is fueling the demand for organic peroxides. These chemicals find applications in the production of pharmaceutical intermediates, cosmetics formulations, and textile bleaching agents, among others. Furthermore, technological advancements in organic peroxide formulations and manufacturing processes are enhancing their efficiency, safety, and environmental sustainability, thereby contributing to market growth.

Organic Peroxide Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 1.25 Billion |

| Global Market Size by 2033 | USD 1.93 Billion |

| U.S. Market Size in 2023 | USD 350 Million |

| U.S. Market Size by 2033 | USD 550 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Organic Peroxide Market Dynamics

Drivers:

Several drivers are propelling the growth of the organic peroxide market. One key driver is the increasing adoption of organic peroxides in the production of specialty polymers and advanced materials with tailored properties. These materials find extensive applications in high-performance industries such as aerospace, electronics, and healthcare, driving the demand for organic peroxides. Moreover, the rising investments in research and development activities aimed at developing novel organic peroxide formulations and applications are expected to create lucrative opportunities for market players.

Furthermore, the growing awareness regarding the benefits of organic peroxides, such as their ability to improve the performance and durability of end products, is driving their adoption across various industries. Additionally, the expanding automotive industry, particularly in emerging economies, is driving the demand for organic peroxides used in the production of automotive components, adhesives, and coatings. Moreover, stringent regulations promoting the use of organic peroxides as eco-friendly alternatives to conventional chemical initiators are bolstering market growth.

Restraints:

Despite the favorable growth prospects, the organic peroxide market faces certain restraints that may hinder its growth trajectory. One significant restraint is the volatility in raw material prices, particularly for key feedstocks such as hydrocarbons and oxygen derivatives. Fluctuations in raw material prices can significantly impact the production costs of organic peroxides, thereby affecting their affordability and market competitiveness. Moreover, the stringent regulatory requirements governing the production, storage, handling, and transportation of organic peroxides pose challenges for market players in terms of compliance and operational costs.

Additionally, concerns regarding the safety and handling of organic peroxides, which are highly reactive and can pose risks of fire, explosion, and environmental hazards, represent a significant restraint for market growth. Ensuring proper storage, handling, and transportation of organic peroxides require substantial investments in infrastructure, training, and safety measures, which can increase operational costs for manufacturers and end-users. Furthermore, the limited availability of skilled labor and technical expertise in handling organic peroxides may hamper market growth in certain regions.

Opportunities:

Despite the challenges, the organic peroxide market offers significant opportunities for growth and expansion. One notable opportunity lies in the development of bio-based organic peroxides derived from renewable feedstocks such as biomass and agricultural residues. The growing focus on sustainability and environmental conservation is driving the demand for bio-based alternatives to conventional chemicals, creating opportunities for manufacturers to innovate and develop eco-friendly organic peroxide formulations.

Moreover, the rapid industrialization and urbanization in emerging economies present lucrative opportunities for market players to expand their presence and tap into new markets. The growing demand for polymers, plastics, and specialty chemicals in sectors such as construction, automotive, and consumer goods is expected to drive the demand for organic peroxides in these regions. Additionally, strategic collaborations, partnerships, and mergers and acquisitions can enable companies to strengthen their market position, enhance their product portfolios, and capitalize on emerging opportunities.

Furthermore, advancements in process technologies and manufacturing techniques are expected to drive efficiency improvements and cost reductions in the production of organic peroxides, making them more affordable and accessible to end-users. Moreover, the increasing investments in research and development activities aimed at exploring new applications and formulations for organic peroxides are expected to unlock new growth opportunities in niche markets such as electronics, healthcare, and energy storage.

Read Also: Internet Data Center Market Size to hit USD 138.80 Bn by 2033

Recent Developments

- In October 2022, Arkema (France) expanded its partnership with Univar Solutions, Weber & Schaer, and Dolder for the distribution of its organic peroxides. Arkema intended to expand its business in the European plastics cross-linking and rubber markets, and meet customer needs globally.

- In October 2022, Arkema (France) declared that the company would reorganize the distribution of its Luperox and Retic organic peroxide, with Weber and Schaer, The Dolder firm, and Univar Solutions, for the crosslinking market in several European countries as of January 1st, 2023.

- In June 2020, Nouryon (Netherlands) completed the expansion of organic peroxide in Brazil. The expansion has doubled the capacity of the manufacturing facility.

Organic Peroxide Market Companies

- Akzo Nobel N.V. (Netherlands)

- Arkema S.A. (France)

- United Initiators (Germany)

- Nouryon (Netherlands)

- NOF Corporation (Japan)

- Pergan GmbH (Germany)

- Lanzhou Auxiliary Agent Plant Co., Ltd. (China)

- Solvay SA (Belgium)

- Chinasun Specialty Products Co., Ltd. (China)

- Hansoo Chemical Co., Ltd. (South Korea)

- Shaoxing Shangyu Shaofeng Chem Co., Ltd. (China)

- Jiangsu Yuanyang Pharmaceutical Co., Ltd. (China)

- MEGA S.p.A. (Italy)

- Plasti Pigments Pvt. Ltd. (India)

- NOF Europe GmbH (Germany)

Segments Covered in the Report

By Product

- Diacyl peroxide

- Ketone peroxide

- Percarbonates

- Dialkyl peroxide

- Hydro-peroxide

- Peroxy ketals

- Peroxyesters

By Application

- Polymer

- Chemicals & plastics

- Coatings, adhesives & elastomers

- Paper & textiles

- Detergents

- Personal care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/