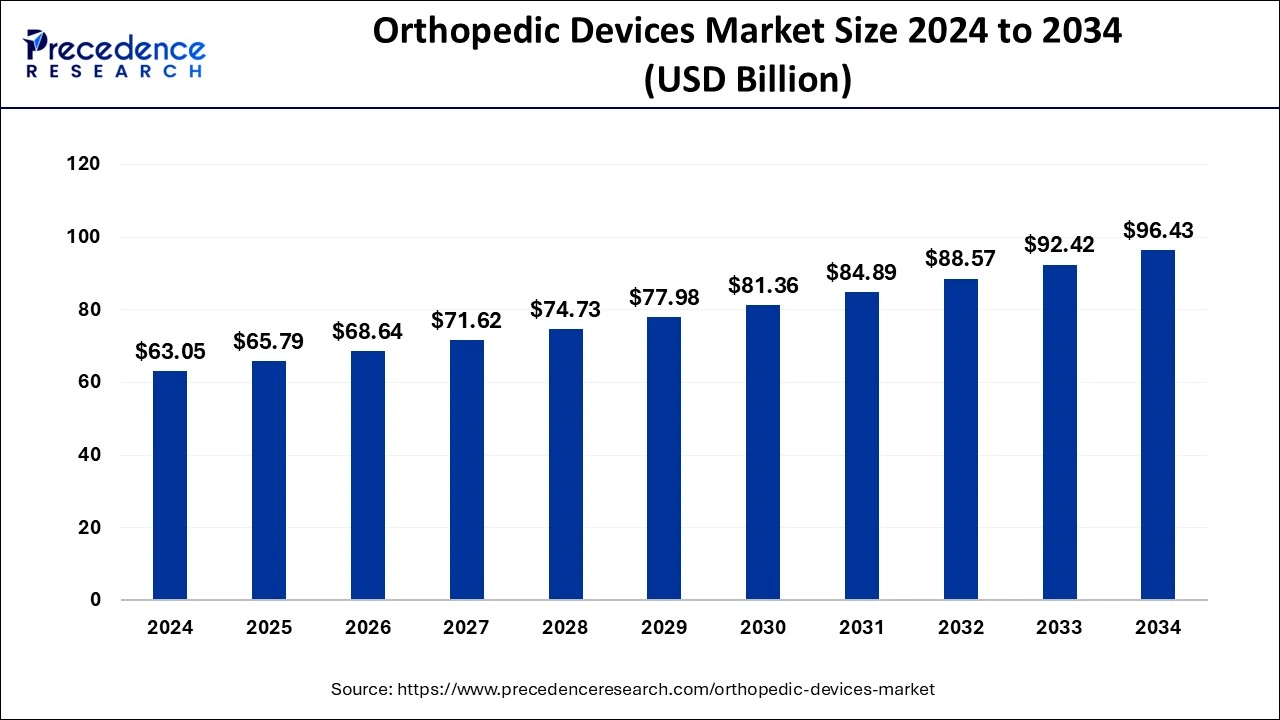

Orthopedic Devices Market to Reach USD 96.43 Bn by 2034

The global orthopedic devices market was valued at USD 65.79 billion in 2024 and is projected to reach USD 96.43 billion by 2034, growing at a CAGR of 4.34%.

The global orthopedic devices market is experiencing steady growth, driven by the increasing prevalence of musculoskeletal disorders and the aging population. North America holds the largest market share, accounting for 46% in 2024, due to advanced healthcare infrastructure and high demand for orthopedic treatments. Asia Pacific is expected to grow at the fastest rate over the next decade, supported by rising healthcare access and growing awareness in emerging markets. The knee orthopedic devices segment leads in terms of application, while surgical devices account for the largest share of products. These trends highlight a promising future for the orthopedic devices market.

Orthopedic Devices Market Key Insights

- North America dominated the global market with a 46% market share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- The knee orthopedic devices segment had the highest market share by application in 2024.

- The surgical devices segment captured the largest market share by product in 2024.

Orthopedic Devices Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 63.05 Billion |

| Market Size in 2025 | USD 65.79 Billion |

| Market Size by 2034 | USD 96.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.34% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Region Type |

Market Drivers

The orthopedic devices market is primarily driven by the increasing prevalence of musculoskeletal disorders, particularly due to aging populations globally. As the elderly population grows, the demand for orthopedic treatments, including joint replacements and spinal surgeries, continues to rise. Additionally, advances in medical technology and the development of minimally invasive surgical techniques are making orthopedic procedures safer, more effective, and less painful, which further stimulates market growth. Rising awareness of bone health and the importance of early diagnosis also play a significant role in driving demand. Furthermore, the expanding healthcare infrastructure, especially in emerging economies, is facilitating better access to orthopedic treatments, contributing to the market’s expansion.

Opportunities

- Increasing demand for orthopedic procedures due to aging populations.

- Advancements in minimally invasive surgeries and robotic-assisted surgeries.

- Growing adoption of 3D printing technology for customized orthopedic devices.

- Expansion of healthcare infrastructure in emerging economies creating new market prospects.

- Rising awareness around bone health and musculoskeletal disorders driving preventive care.

- Growth in sports-related injuries leading to higher demand for orthopedic devices.

Challenges

- High cost of advanced orthopedic devices and treatments limiting access in developing regions.

- Stringent regulatory approvals and standards delaying product launches.

- Risk of complications and infections related to orthopedic surgeries affecting patient outcomes.

- Intense competition among market players, leading to pricing pressures.

- Lack of skilled healthcare professionals to perform complex orthopedic procedures in some regions.

Regional Insights

North America dominates the global orthopedic devices market, accounting for the largest share in 2024 due to its advanced healthcare infrastructure, high healthcare spending, and strong demand for orthopedic procedures driven by an aging population. The region’s sophisticated medical technology and established reimbursement policies also contribute to its market leadership.

Asia Pacific, on the other hand, is poised for the fastest growth from 2025 to 2034. This growth is attributed to the increasing healthcare access, rising disposable incomes, and growing awareness of musculoskeletal health in emerging economies like China and India. Europe holds a significant share as well, with a high prevalence of orthopedic conditions and advanced healthcare systems supporting market expansion. However, the growth rate in Europe is expected to be slower compared to the rapidly expanding markets in Asia Pacific.

Read Also: Fresh Food Packaging Market Size Analysis 2022 To 2030

Market Companies

- Medtronic

- Zimmer Biomet

- MicroPort Scientific Corporation (Wright Medical Group)

- DJO Global

- ConforMIS

- NuVasive

- Globus Medical

Recent Developments

Recent developments in the orthopedic devices market have been marked by technological advancements and a shift towards patient-centered care. The adoption of 3D printing technology is revolutionizing the production of personalized implants and prosthetics, enabling more precise and tailored solutions for patients. This technology is contributing to better surgical outcomes and faster recovery times. Additionally, the use of robotic-assisted surgeries is gaining traction, enhancing precision during procedures, reducing invasiveness, and shortening recovery periods. Companies are also investing in biologic-based devices, exploring the use of stem cells, tissue engineering, and growth factors to accelerate healing and improve joint function. In parallel, there is a growing emphasis on developing affordable, cost-effective orthopedic solutions, particularly in emerging markets where healthcare access is expanding. Moreover, advancements in minimally invasive surgery techniques continue to improve patient outcomes by reducing trauma, shortening hospital stays, and speeding up recovery, further driving the adoption of orthopedic devices worldwide.

Segments Covered in the Report

By Product Type

- Joint Reconstruction

- Knee Replacement

- Revision Knee Replacement Implants

- Total Knee Replacement Implant

- Partial Knee Replacement Implant

- Elbow & Shoulder Replacement

- Hip Replacement

- Hip Resurfacing Implant

- Total Hip Replacement Implant

- Partial Hip Replacement Implant

- Revision Hip Replacement Implant

- Others

- Knee Replacement

- Orthopedic Prosthetics

- Upper Extremity Orthopedic Prosthetics

- Lower Extremity Orthopedic Prosthetics

- Spinal Devices

- Spinal Non-fusion Devices

- Spinal Fusion Devices

- Trauma Fixation

- Nails and Rods

- Metal Plates & Screws

- Pins/Wires

- Others

- Arthroscopy Devices

- Orthopedic Accessories

- Removal systems

- Bone cement

- Casting system

- Orthopedic Braces and Supports

- Upper Extremity Braces and Supports

- Low Extremity Braces and Supports

- Others

By End-user

- Ambulatory Surgical Centers

- Hospitals

- Orthopedic Clinics

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America