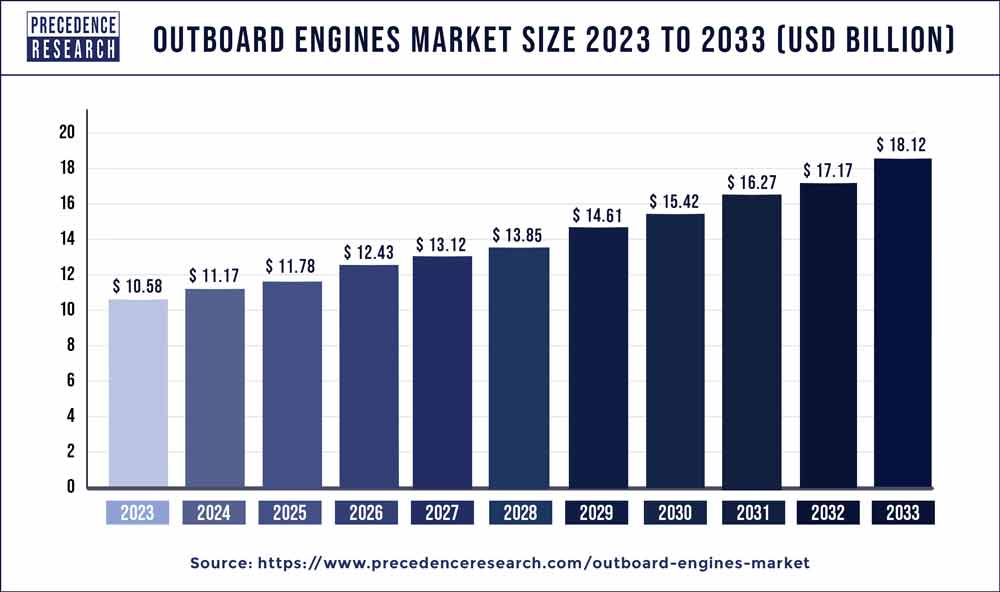

Outboard Engines Market Size to Attain USD 18.12 Bn by 2033

The global outboard engines market size was valued at USD 10.58 billion in 2023 and is projected to hit around USD 18.12 billion by 2033, growing at a CAGR of 5.53% from 2024 to 2033.

Key Points

- In 2023, North America held the largest share of the global outboard engines market.

- Asia Pacific is observed to be the fastest-growing region during the forecast period.

- By engine type, the 2-stroke segment held the largest share in the outboard engines market in 2023.

- By ignition type, the electric segment held the largest share of the market in 2023.

- By fuel type, the diesel segment held the largest market share in 2023.

- By application, the commercial segment held the largest share of the market.

The outboard engines market is witnessing significant growth driven by various factors such as increasing demand for recreational boating activities, rising popularity of water sports, and growing maritime tourism across the globe. Outboard engines, which are propulsion systems mounted on the outside of a boat, play a crucial role in powering various types of watercraft, including small boats, fishing vessels, yachts, and pontoons. These engines offer advantages such as portability, ease of maintenance, and fuel efficiency, making them a preferred choice among boat owners and manufacturers.

Get a Sample: https://www.precedenceresearch.com/sample/3907

Growth Factors

List of Contents

ToggleSeveral factors contribute to the growth of the outboard engines market. One of the key drivers is the expanding recreational boating industry, fueled by rising disposable incomes and increasing participation in leisure activities worldwide. Additionally, technological advancements in outboard engine design, such as the development of lightweight and high-performance engines with lower emissions, are attracting more consumers. Furthermore, the growing trend of boat repowering, where older engines are replaced with newer, more efficient models, is driving market growth.

Outboard Engines Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.53% |

| Global Market Size in 2023 | USD 10.58 Billion |

| Global Market Size by 2033 | USD 18.12 Billion |

| U.S. Market Size in 2023 | USD 4.28 Billion |

| U.S. Market Size by 2033 | USD 7.34 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Engine Type, By Ignition Type, By Fuel Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Region Insight:

The outboard engines market exhibits a diverse regional landscape, with significant opportunities across various geographical regions. North America dominates the market, owing to the high demand for recreational boating and water sports in countries like the United States and Canada. Europe also holds a substantial share, with countries such as Italy, France, and the UK driving market growth. In the Asia Pacific region, countries like Australia, Japan, and China are witnessing increased demand for outboard engines due to the rising popularity of boating and marine tourism activities.

Trends:

Several trends are shaping the outboard engines market. One prominent trend is the increasing adoption of electric outboard engines, driven by environmental concerns and government regulations aimed at reducing emissions from marine vessels. Electric outboard engines offer quiet operation, zero emissions, and lower operating costs compared to traditional gasoline engines, making them an attractive option for eco-conscious consumers. Another trend is the integration of advanced digital technology, such as GPS navigation systems, touchscreen displays, and smartphone connectivity, into outboard engine controls, enhancing user experience and convenience.

Read Also: Medical Furniture Market Size to Hit USD 19.50 Bn by 2033

Recent Developments

- In October 2023, The HD Hyundai Heavy Industries Engine & Machinery Division (HHI-EMD) declared it would bring a four-stroke, pure-gas marine engine idea to the market by 2025. The engine will be powered by hydrogen.

- In May 2022, Volvo Penta, Marell Boats, and Hurtigruten Svalbard launched a hybrid-electric vessel. The helm-to-propeller Volvo Penta twin D4-320 DPI Aquamatic hybrid-electric solution powers the vessel.

Competitive Landscape:

The outboard engines market is highly competitive, with several key players competing for market share through product innovation, strategic partnerships, and expansion into emerging markets. Major companies such as Yamaha Motor Co., Ltd., Mercury Marine, Suzuki Motor Corporation, and Honda Motor Co., Ltd., are investing in research and development to launch advanced outboard engine models with improved performance and efficiency. Additionally, partnerships between outboard engine manufacturers and boat builders are becoming increasingly common, as integrated propulsion solutions offer seamless compatibility and enhanced performance for consumers. Overall, the competitive landscape of the outboard engines market is dynamic and characterized by continuous technological advancements and strategic collaborations.

Outboard Engines Market Companies

- Yamaha Motor Co. Ltd.

- Honda Marine.

- Suzuki Motor Corporation.

- Tohatsu Corporation.

- Brunswick Corporation.

Segment Covered in the Report

By Engine Type

- 2 – Stroke

- 4 – Stroke

By Ignition Type

- Electric

- Manual

By Fuel Type

- Diesel

- Gasoline

- Electric

By Application

- Commercial

- Recreational

- Military

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/