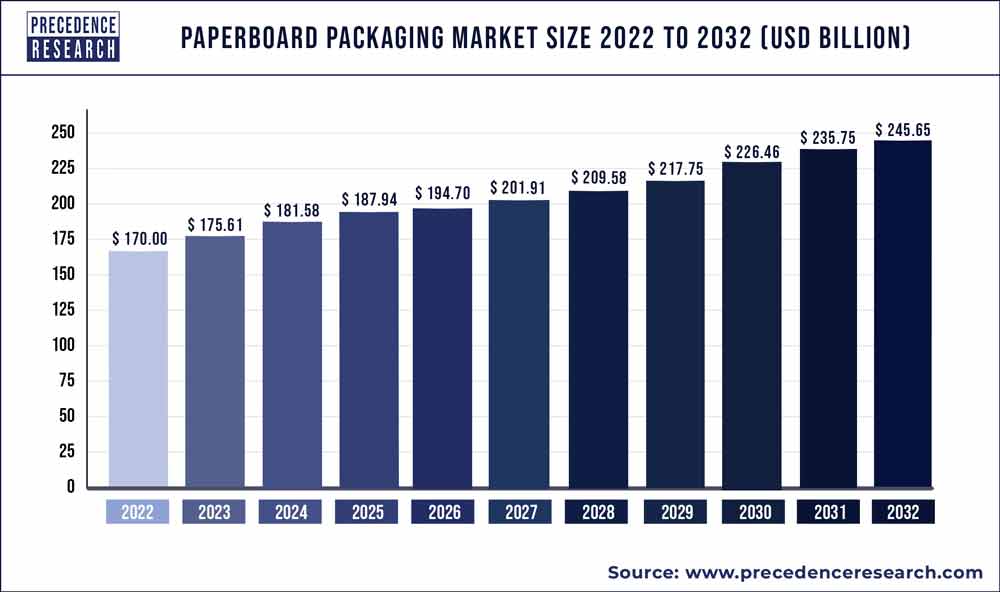

Paperboard Packaging Market Hits US$ 206.5 Billion in Market Value By 2030

According to Precedence Research, The paperboard packaging market size garnered US$ 147.28 billion in 2021 and is expected to generate US$ 206.5 billion by 2030, manifesting a CAGR of 3.5% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The paperboard packaging market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Paperboard packaging comes in a variety of grades, each with its own set of characteristics that make it suited for a variety of packaging applications. Paperboard can be readily cut and moulded, is lightweight, and is utilised in packaging because to its strength. It is a thick paper-based substance that is utilised in packaging applications. Wood pulp is the basic ingredient used to make paperboard. Paperboard is recycled in big quantities to help minimise deforestation and trash.

Download the FREE Sample Report (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1346

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers, novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the major players in the global paperboard packaging market include:

- Nippon Paper Industries Co., Ltd.

- Stora Enso

- South African Pulp & Paper Industries

- Mondi plc

- ITC Limited

- Smurfit Kappa Group

- Oji Holding Corporation

- International Paper Group

- Svenska Cellulosa Aktiebolaget

Paperboard Packaging Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Crucial factors accountable for market growth are:

- The expansion of the e-commerce business

- Consumers rising worries about the environmental impact of packaging wastes

- Growth in food packaging and ever-increasing need for corrugated packaging

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Paperboard Packaging Market Report Highlights

- Based on raw materials, the recycling sector accounted for almost half of the market in 2020, owing to the fact that it can be recycled as fiber and utilized to produce new paperboard goods.

- Solid unbleached board (SUB) is the most dominating segment in the paperboard packaging market. SUB (Solid Unbleached Board) is a type of boxboard manufactured from unbleached chemical pulp. It is often offered with two or three layers of color coatings.

- Food and beverages have emerged as the leading application sector in the pape

Paperboard Packaging Market Dynamics

Driver – The food and beverage sector are the most important end-user of paperboard packaging, accounting for more than half of the global market share. The food and beverage sector mostly uses coated unbleached boards for beverage packaging and corrugated container boards for fruit, vegetable, and food product packaging. The increasing popularity of frozen meals is expected to stimulate demand for folding carton packaging. Changes in lifestyle and an increasing youthful population drive up demand for branded and packaged goods. According to the Flexible Packaging Association, the beverage industry accounts for about half of the packaging market in the United States. Currently, more than 30% of Americans order meals twice a week, and this figure is predicted to rise by 3% in the coming years.

Restraint – Intense rivalry among paper and paperboard packaging producers is a major factor limiting market expansion. Furthermore, the industry’s present fragmentation as a result of rising concentration of small and medium size producers and converters is a significant factor acting as a limitation on the growth of the worldwide paper and paperboard packaging market.

Opportunity – The government’s efforts to minimize plastic will open up new chances for the paperboard packaging business. The government is encouraging paper recycling, which will help the environment. For example, the government announces the Plastic Waste Management Amendment Rules, 2021, which limit the use of some single-use plastic goods by 2022. The thickness of plastic carry bags increased from 50 to 75 millimeters on September 30, 2021, and to 120 microns on December 31, 2022. Such regulations will have an influence on the expansion of businesses in the paperboard packaging industry.

Paper and paperboard have had a renaissance, spurred by anti-plastic sentiment and a growing worldwide need for built-in recyclability. Paper is not only a naturally renewable, recyclable, and biodegradable material; it can also add value to packaging by giving it a “natural” appearance in an increasingly eco-conscious consumer market. For example, in the UK introduction of the JUST water brand, a product packaged in 54% paper, 28% plant-based plastic, 3% aluminum, and 15% protective plastic film (with a sugarcane cap), paper is used to lower the total plastic percentage, hence enhancing the pack’s overall renewability.

Challenges – The unpredictability of raw material availability will provide a challenge to sectors that rely on paperboard packaging. The demand for paperboard packaging is increasing, but the supply is insufficient. End-users such as bioenergy firms are expanding their demand for household wood supplies. Increasing the sustainable mobilization of wood and developing new technologies for further optimizing the added value from raw materials through cascading use of wood (cascading contributes to greater resource efficiency and, as a result, reduces pressure on the environment) would aid in matching wood supply and demand.

The rising volume of recovered paper exports to non-European nations may potentially put a strain on supplies. The rise in European energy prices, along with the rise in gas prices in North America, has put the sector at a global competitive disadvantage. Energy, environmental, and transportation policy will all have a big impact on the sector’s future. A strong regulatory framework is essential for long-term growth and investor confidence.

Recent Developments

- September 2020 – Mondi PLC teamed with BIOhof Kirchweidach, a Bavarian organic farm, to create a sustainable packaging solution for 500g packets of tomatoes on the vine to be delivered to PENNY stores operated by major German retailer REWE Group. The project’s goal is to replace the existing packaging, which contained 2.5 g of plastic film each box, with a recyclable and plastic-free alternative.

- DS Smith just installed an EFI Nozomi C18000 Plus digital printer at its Lisbon factory in January 2021. The new technology will enable the supply of 100 percent bespoke, sustainable packaging with photographic printing quality and reduced delivery times, as well as image revisions within the same order.

Regional Snapshots

The Asia Pacific paperboard packaging market produced the most revenue in the worldwide paperboard packaging market, and this trend is expected to continue during the forecast period. The United States government imposed a 10% tax on Chinese folding cartons in 2018, with the levy set to rise to 25% in January 2019. However, in December 2018, the US and China agreed to a temporary delay of any tariff increases. Tariff increases are projected to promote local manufacturing and hasten the shift to flexible packaging types. This is likely to boost market growth throughout the forecast period.

North America is the fastest expanding market for paperboard packaging materials, with a slew of companies present. In 2018, North America consumed 74.21 million metric tonnes of paper and paperboard. According to FAO and UNECE data, this is the case.

Paperboard Packaging Market Segments Covered

By Raw Material

- Fresh Source

- Wood pulp

- Others

- Recycled Waste Paper

By Product

- Boxboard

- Folding boxboard (FBB)

- Solid unbleached board (SUB)

- Solid bleached board (SBB)

- White lined chipboard (WLC)

- Containerboard

By Application

- Food & beverages

- Non-durable goods

- Durable goods

- Medical

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Research Objective

- To provide a comprehensive analysis of the paperboard packaging industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global paperboard packaging market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the paperboard packaging

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Paperboard Packaging Market

5.1. COVID-19 Landscape: Paperboard Packaging Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Paperboard Packaging Market, By Product

8.1. Paperboard Packaging Market, by Product Type, 2021-2030

8.1.1. Boxboard

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Containerboard

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Paperboard Packaging Market, By Application

9.1. Paperboard Packaging Market, by Application, 2021-2030

9.1.1. Food & beverages

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Non-durable goods

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Durable goods

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Medical

9.1.4.1. Market Revenue and Forecast (2019-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Paperboard Packaging Market, By Raw Material

10.1. Paperboard Packaging Market, by Raw Material, 2021-2030

10.1.1. Fresh Source (Wood pulp, Others)

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Recycled Waste Paper

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Paperboard Packaging Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.4.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.5.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.4.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.5.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.6.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.7.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.4.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.5.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.6.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.7.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.4.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.5.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.6.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.7.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.4.3. Market Revenue and Forecast, by Raw Material (2019-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.5.3. Market Revenue and Forecast, by Raw Material (2019-2030)

Chapter 12. Company Profiles

12.1. Nippon Paper Industries Co., Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Stora Enso

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. South African Pulp & Paper Industries

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Mondi plc

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ITC Limited

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Smurfit Kappa Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Oji Holding Corporation

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. International Paper Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Svenska Cellulosa Aktiebolaget

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s paperboard packaging market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1346

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com