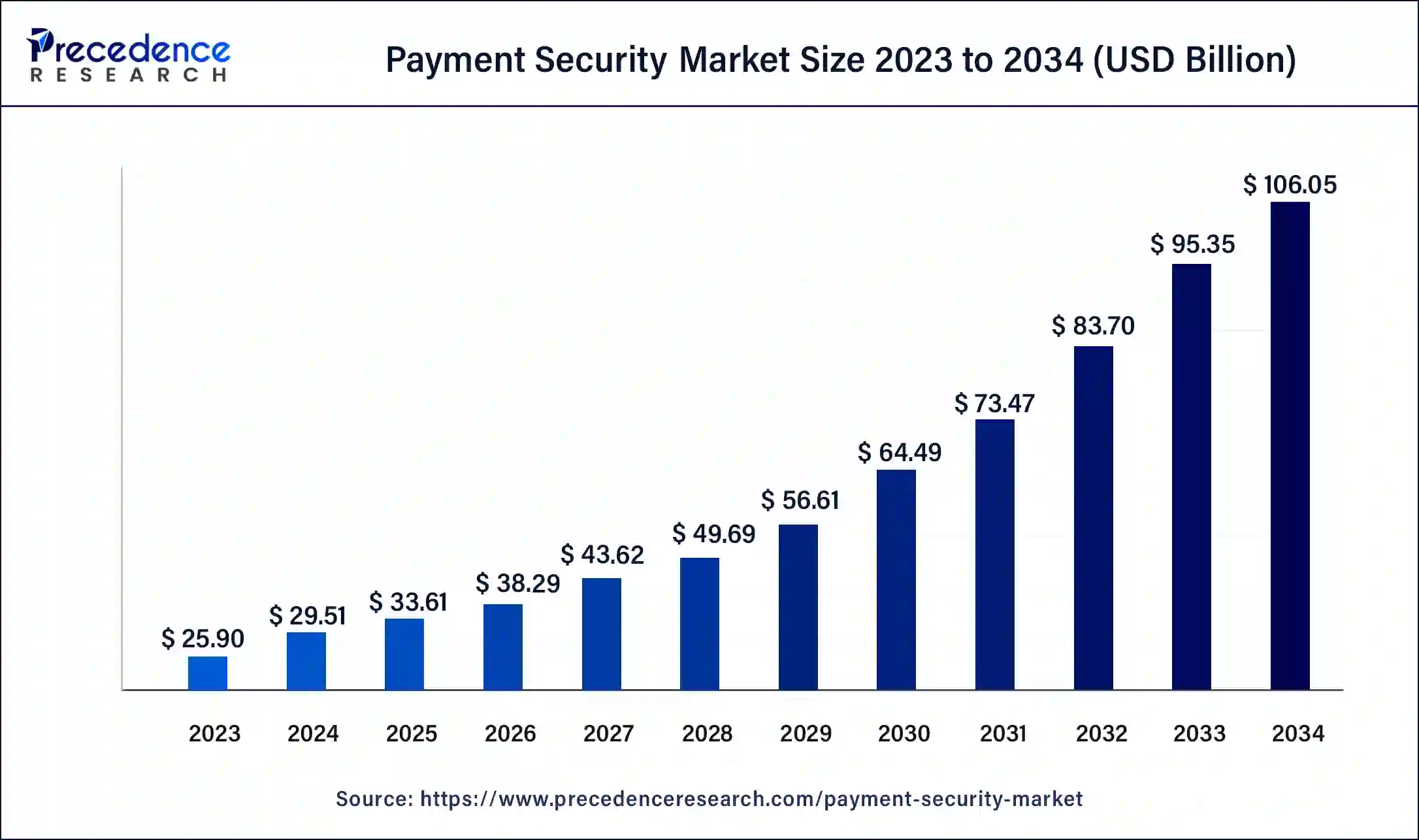

The global payment security market size is expected to increase USD 95.35 billion by 2033 from USD 25.90 billion in 2023 with a CAGR of 13.92% between 2024 and 2033.

Key Points

- The North America payment security market size accounted for USD 9.32 billion in 2023 and is expected to attain around USD 34.80 billion by 2033, poised to grow at a CAGR of 14.08% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 36% in 2023.

- Asia Pacific is the fastest-growing region in the market.

- By solution, the fraud detection & prevention segment has held the biggest revenue share of 53% in 2023.

- By solution, the tokenization segment is expected to register significant growth over the projected period.

- By platform, the PoS-based/mobile-based segment has generated more than 59% of revenue share in 2023.

- By platform, the web-based segment is expected to grow at a significant rate during the forecast period.

- By organization, the large enterprises segment has contributed more than 69% of revenue share in 2023.

- By organization, the small & medium-sized enterprises (SMEs) segment is expected to register significant growth during the forecast period.

- By application, the retail & e-commerce segment accounted more than 28% of revenue share in 2023.

- By application, the education segment shows significant growth during the forecast period.

The Payment Security Market encompasses a range of technologies and solutions aimed at safeguarding electronic transactions and preventing unauthorized access to sensitive financial data. With the rapid growth of e-commerce and digital payments, ensuring the security of payment processes has become paramount for businesses and consumers alike. This market includes various tools such as encryption, tokenization, fraud detection systems, and authentication mechanisms to mitigate risks associated with online transactions.

Growth Factors

Several factors contribute to the growth of the Payment Security Market. Firstly, the continuous evolution of cyber threats and the increasing sophistication of cybercriminals drive the demand for robust payment security solutions. Additionally, the growing adoption of digital payment methods, including mobile payments and e-wallets, further fuels the expansion of this market. Moreover, stringent regulatory requirements and compliance standards imposed by governments and regulatory bodies compel organizations to invest in advanced payment security technologies to avoid hefty fines and reputational damage.

Region Insights:

The Payment Security Market exhibits significant regional variations influenced by factors such as technological infrastructure, regulatory frameworks, and consumer preferences. North America dominates the market due to the widespread adoption of digital payment systems and the presence of key market players. Europe follows closely, propelled by stringent data protection regulations such as GDPR (General Data Protection Regulation). Meanwhile, the Asia-Pacific region presents immense growth opportunities fueled by rapid urbanization, increasing internet penetration, and the proliferation of smartphones.

Payment Security Market Scope

| Report Coverage | Details |

| Payment Security Market Size in 2023 | USD 25.90 Billion |

| Payment Security Market Size in 2024 | USD 29.51Billion |

| Payment Security Market Size by 2033 | USD 95.35 Billion |

| Payment Security Market Growth Rate | CAGR of 13.92% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Solution, Platform, Organization, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Payment Security Market Dynamics

Drivers:

Key drivers shaping the Payment Security Market include the rising instances of data breaches and cyberattacks targeting financial institutions and online retailers. Moreover, the growing consumer awareness regarding data privacy and security concerns prompts businesses to prioritize investments in robust payment security solutions. Additionally, the shift towards contactless payments and the integration of biometric authentication technologies contribute to market growth by enhancing transaction security and user convenience.

Opportunities:

The Payment Security Market is ripe with opportunities driven by technological advancements and emerging trends. The adoption of artificial intelligence (AI) and machine learning (ML) algorithms presents opportunities for developing more effective fraud detection and prevention systems. Furthermore, the increasing use of blockchain technology in payment processes offers decentralized and secure transaction solutions, opening new avenues for innovation and market expansion. Moreover, the rise of omnichannel retailing and the proliferation of Internet of Things (IoT) devices create opportunities for implementing seamless and secure payment experiences across various touchpoints.

Challenges:

Despite its growth prospects, the Payment Security Market faces several challenges. One of the primary challenges is the constant cat-and-mouse game with cybercriminals who continually devise new techniques to exploit vulnerabilities in payment systems. Moreover, balancing stringent security measures with seamless user experience poses a challenge for businesses striving to maintain security without compromising convenience. Additionally, the complexity of integrating payment security solutions across diverse platforms and legacy systems presents implementation challenges for organizations, requiring substantial investments in infrastructure and expertise. Lastly, regulatory compliance requirements vary across jurisdictions, posing challenges for multinational companies operating in multiple markets.

Read Also: Personal Mobility Devices Market Size, Share, Report by 2033

Payment Security Market Recent Developments

- In March 2023, Paytech Ingenico announced the acquisition of software-based POS solutions provider Phos, extending its offering for merchant payment acceptance via smartphone, where payment security is mainly focused. As per the information detailed in the press release, the strategic purchase of Phos marks an additional step in Ingenico’s evolution toward software-driven services.

- In July 2022, TokenEx, a cloud tokenization and payment optimization provider, collaborated with Visa, a prominent digital payment solutions provider, to become an authorized cloud-based network tokenization partner for Visa. As part of its partnership with Visa, TokenEx selected Token ID, a solution that caters to regional payment systems, financial institutions, merchants, clearinghouses, and various stakeholders within the payment ecosystem.

- In June 2022, Ingenico ePayments, Worldline appointed Nigel Lee as APAC Senior Vice President for the Terminals, Solutions & Services Global Business Line.

Payment Security Market Companies

- Elavon Inc.

- Ingenico

- Utimaco Management GmbH

- Shift4 Payments Inc.

- Mastercard

- Intelligent Payment Solutions Pvt Ltd.

- TokenEx, LLC

- Paypal Holdings, Inc.

- Bluefin Payment Systems

- Visa Inc.

Segments Covered in the Report

By Solution

- Encryption

- Tokenization

- Fraud Detection & Prevention

By Platform

- Web-based

- PoS based/Mobile based

By Organization

- Small & Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Application

- Retail & E-commerce

- Travel & Hospitality

- Healthcare

- Telecom & IT

- Education

- Media & Entertainment

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/