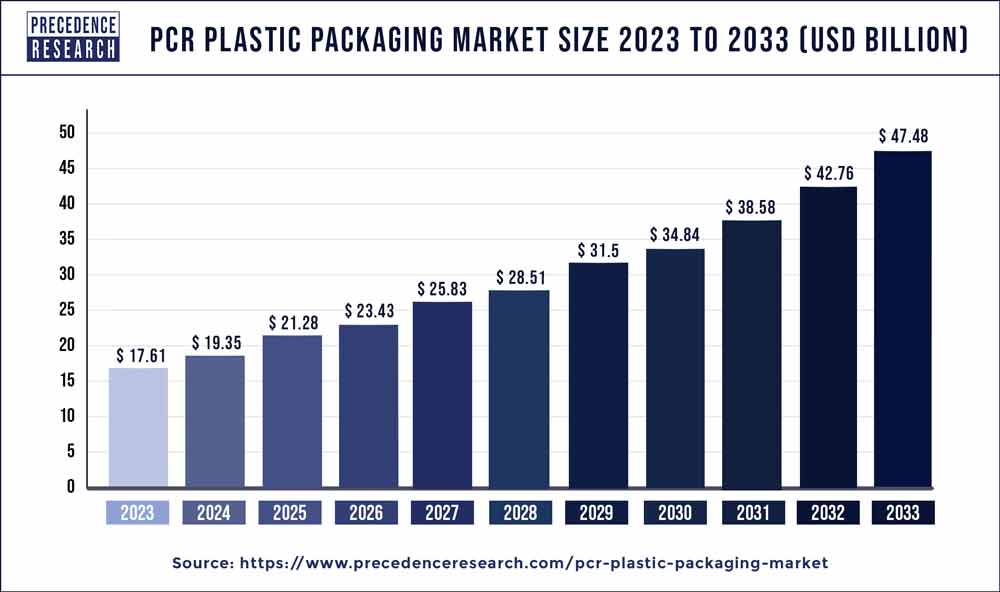

PCR Plastic Packaging Market Size to Worth USD 47.48 Bn By 2033

The global PCR plastic packaging market size was calculated at USD 17.61 billion in 2023 and is projected to be worth around USD 47.48 billion by 2033 with a notable CAGR of 10.49% from 2024 to 2033.

The PCR (Post-Consumer Recycled) Plastic Packaging Market is witnessing significant growth driven by increasing environmental awareness and sustainability initiatives across industries. PCR plastics are derived from recycled materials, typically sourced from discarded consumer products like bottles, containers, and packaging materials. These materials are processed and reused to create new packaging solutions, reducing dependency on virgin plastics and minimizing environmental impact. The market is expanding as companies adopt PCR plastics to meet regulatory requirements, consumer demand for eco-friendly products, and corporate sustainability goals. Innovations in recycling technologies and government regulations promoting recycling practices further contribute to the market’s growth, making PCR plastic packaging a pivotal component in the shift towards a circular economy.

Download the Sample Report ( Including Full TOC, List of Table & Figures, Chart): https://www.precedenceresearch.com/sample/3476

PCR Plastic Packaging Market Statistics

- North America held the largest share of the market at 35.68% in 2023.

- Asia Pacific is observed to witness a rapid pace of expansion during the forecast period.

- By Material, the PET segment held the dominating share of 33% in 2023.

- By Material, the PVC segment is expected to witness growth at a significant CAGR during the projected timeframe.

- By Product, the bottle segment held the largest share of 42.78% in 2023.

- By End-user, in 2023, the food and beverages segment held the largest share of 57.18% in the PCR plastic packaging market.

- By End-user, the cosmetic segment is expected to witness growth at a significant CAGR during the projected timeframe.

PCR Plastic Packaging Market Segments

Material Insights

The PCR (Post-Consumer Recycled) Plastic Packaging Market is segmented by the type of recycled materials used, with PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), LDPE (Low-Density Polyethylene), PP (Polypropylene), and other resin types being prominent. PET is widely used in bottles and containers across industries such as beverages and personal care, while HDPE finds applications in rigid packaging for food and non-food items. LDPE is favored for flexible packaging like bags and films in food and agriculture, and PP is versatile in applications from food containers to consumer goods packaging. Other resins like PS (Polystyrene) and PVC (Polyvinyl Chloride) serve niche markets, each offering specific properties suited to different packaging requirements.

Product Insights

The PCR Plastic Packaging Market offers a diverse array of packaging products tailored to various applications: Bottles and containers are extensively used across beverages, personal care, pharmaceuticals, and household chemicals. Bags and films provide flexible packaging solutions for food, agriculture, and industrial products. Jars, tubs, and trays cater to cosmetics, personal care items, and specialty foods. Pouches are increasingly popular for snacks, beverages, and personal care products due to their convenience and sustainability. Other packaging formats include clamshells, blister packs, and custom-designed containers, each fulfilling specific packaging needs and enhancing product appeal on shelves.

Global PCR Plastic Packaging Market, By Product, 2021-2023 (USD Million)

| Product | 2021 | 2022 | 2023 |

| Bottles | 6,133.7 | 6,775.0 | 7,491.4 |

| Trays | 4,728.6 | 5,237.8 | 5,807.9 |

| Pouches | 3,475.5 | 3,845.0 | 4,258.3 |

By End-User

The PCR Plastic Packaging Market serves a wide range of industries and end-users seeking sustainable packaging solutions. In the food and beverage sector, PCR plastics package beverages, sauces, condiments, dairy products, and ready-to-eat meals. Personal care and cosmetics utilize PCR plastics for lotions, creams, shampoos, and beauty products, emphasizing eco-friendly packaging to appeal to environmentally conscious consumers. Pharmaceuticals rely on PCR plastics for packaging drugs, vitamins, medical supplies, and over-the-counter products, ensuring safety and compliance with regulatory standards. Household chemicals packaging includes PCR plastics for cleaning agents, detergents, and soaps, addressing consumer demands for safe, recyclable packaging options. Additionally, industries such as automotive, electronics, and industrial products use PCR plastics for protective and functional packaging, supporting sustainability initiatives across diverse sectors.

Regional Insights

The PCR (Post-Consumer Recycled) Plastic Packaging Market is witnessing growth across various regions globally, driven by increasing environmental concerns and regulatory pressures to reduce plastic waste. North America and Europe are prominent regions in this market, characterized by stringent environmental regulations and a strong emphasis on sustainability initiatives. These regions are witnessing significant adoption of PCR plastic packaging across industries such as food and beverage, personal care, and pharmaceuticals. In Asia-Pacific, rapid industrialization and urbanization are fueling the demand for sustainable packaging solutions, contributing to the market’s expansion. Additionally, initiatives promoting recycling and circular economy practices in countries like China and India are further propelling market growth in the region. Overall, the global PCR plastic packaging market is poised to expand as consumers and businesses alike prioritize eco-friendly packaging solutions to mitigate environmental impact.

- The U.S. PCR plastic packaging market size was valued at USD 5.7 billion in 2023 and is expected to reach USD 14.6 billion by 2033, growing at a CAGR of 9.93% from 2024 to 2033.

PCR Plastic Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.49% |

| Market Size in 2023 | USD 17.61 Billion |

| Market Size by 2033 | USD 47.48 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Product, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

PCR Plastic Packaging Market Trends

- Rising Demand for Sustainable Packaging: Consumers are increasingly aware of environmental issues and are favoring products packaged in PCR plastics. This trend is pushing manufacturers to incorporate more recycled content into their packaging solutions.

- Regulatory Push: Governments and regulatory bodies worldwide are implementing stricter regulations aimed at reducing plastic waste and promoting recycling. This has compelled industries to adopt PCR plastics to meet sustainability targets and comply with regulations.

- Technological Advancements: Innovations in recycling technologies have improved the quality and availability of PCR plastics. Manufacturers are investing in advanced recycling processes to enhance the properties of recycled plastics, making them more suitable for packaging applications.

- Brand Commitments to Sustainability: Many brands across various sectors, including food and beverage, cosmetics, and personal care, are committing to sustainable packaging goals. This includes using PCR plastics as part of their sustainability strategies to appeal to environmentally conscious consumers.

- Supply Chain Integration: Integration of PCR plastics into the supply chain is becoming more streamlined. This includes collaboration among stakeholders such as raw material suppliers, packaging manufacturers, and recyclers to ensure a steady supply of high-quality PCR plastics.

Read Also: U.S. Concierge Medicine Market Size, Trends, Report By 2032

PCR Plastic Packaging Market Dynamics

Driver

The PCR (Post-Consumer Recycled) plastic packaging market is driven by several key factors, primarily centered around sustainability and environmental consciousness. As consumer awareness regarding environmental impact grows, there is an increasing preference for packaging materials that minimize carbon footprint and promote recycling. PCR plastics fulfill this demand by utilizing recycled materials, thereby reducing the need for virgin plastic production and diverting waste from landfills. This aspect not only appeals to environmentally conscious consumers but also aligns with corporate sustainability goals, driving adoption across various industries.

Opportunities

Opportunities in the PCR plastic packaging market are abundant, especially as regulatory frameworks and policies worldwide increasingly favor sustainable practices. Governments and regulatory bodies are implementing measures to incentivize the use of recycled materials and discourage single-use plastics. This creates a favorable environment for businesses investing in PCR plastic packaging solutions, as they can capitalize on subsidies, tax breaks, and favorable market conditions. Moreover, companies can enhance their brand reputation by demonstrating commitment to sustainability, attracting eco-conscious consumers and gaining a competitive edge in the market.

Challenges

However, the market also faces several challenges that need to be addressed for sustained growth. One significant challenge is ensuring consistent and high-quality supply of PCR plastics. Variability in feedstock quality and contamination issues can affect the performance and aesthetics of recycled packaging materials. Addressing these challenges requires investment in advanced recycling technologies and processes that can maintain quality standards while increasing recycling rates. Additionally, the cost of PCR plastics can sometimes be higher compared to virgin plastics, impacting profit margins for businesses. Overcoming cost barriers through economies of scale and technological advancements will be crucial for broader adoption and competitiveness in the market.

Read Also: U.S. Concierge Medicine Market Size, Trends, Report By 2032

Recent Developments

- In 2022, the Design4Circularity initiative, comprising Clariant, Siegwerk, Borealis, and Beiersdorf, has successfully created a transparent personal care bottle crafted entirely from 100% post-consumer recyclate (PCR). This innovative bottle design incorporates a printed drinkable full body shrink sleeve for distinctive branding and product differentiation. This collaborative effort within the personal care industry is focused on crafting circular packaging solutions that meticulously consider every stage of the development process. The primary objectives of this initiative are to advance sustainable packaging by reducing plastic waste, minimizing the reliance on virgin plastic materials, and mitigating the environmental impact associated with plastic production.

- In 2022, Cascades, the prominent paper products and packaging company headquartered in Canada, introduced a range of packaging solutions that are entirely composed of post-consumer recycled (PCR) materials. Among their innovations is a 100% recycled PET (RPET) food tray, designed with ingenuity to seamlessly integrate with the existing packaging equipment used by food processors and retailers. Cascades proudly shared that they have committed substantial resources, investing more than USD 23 million, in the development of these 100% RPET packaging solutions.

PCR Plastic Packaging Market Companies

- Berry Global Group, Inc.

- Amcor Limited

- Plastipak Holdings, Inc.

- Sealed Air Corporation

- Mondi Group

- Sonoco Products Company

- Huhtamäki Oyj

- DS Smith Plc

- Winpak Ltd.

- Silgan Holdings Inc.

- Coveris Holdings S.A.

- Printpack, Inc.

- Greif, Inc.

- Constantia Flexibles Group GmbH

- ProAmpac Holdings, Inc.