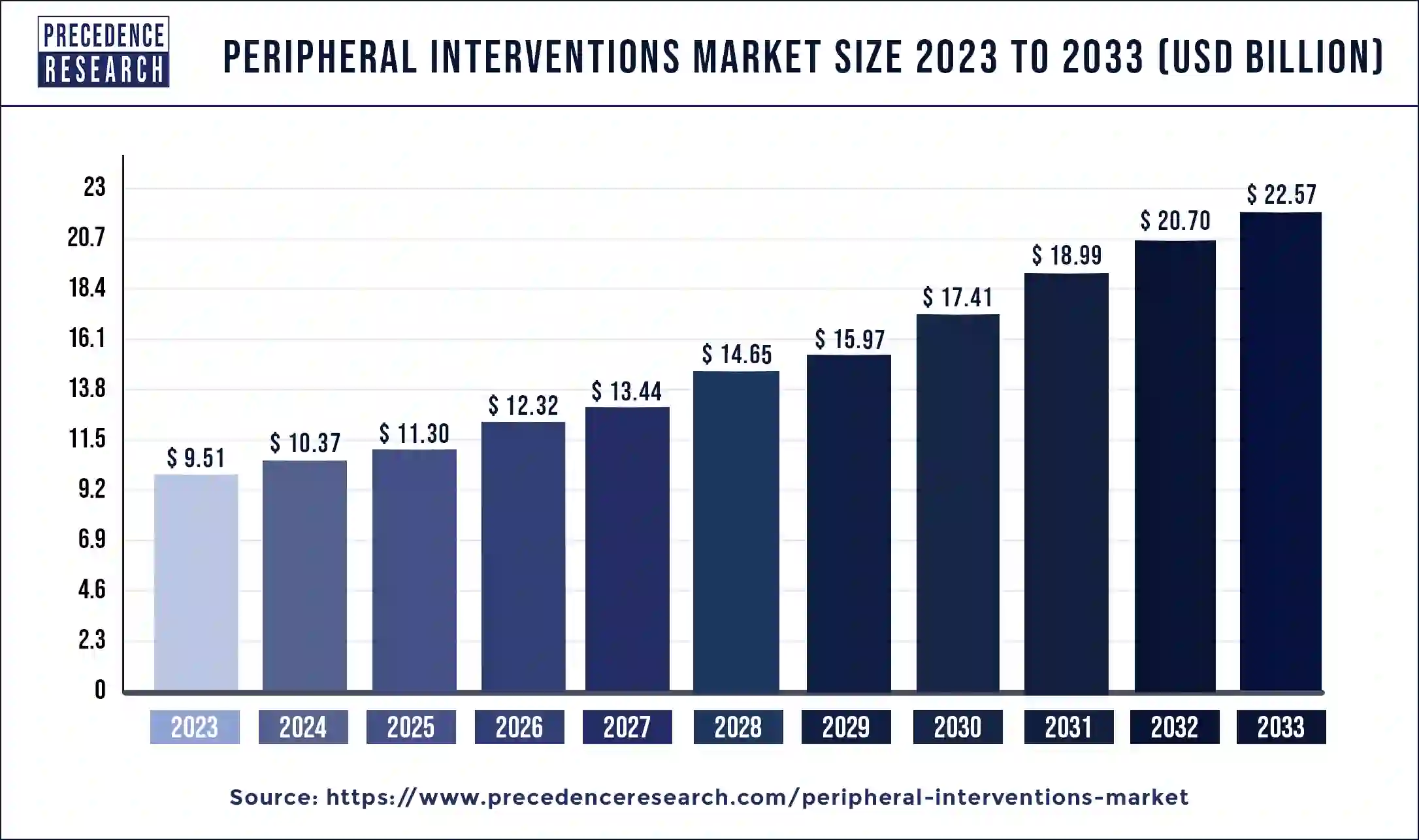

Peripheral Interventions Market Size to Worth USD 22.57 Bn by 2033

The global peripheral interventions market size is expected to increase USD 9.51 billion by 2033 from USD 22.57 billion in 2023 with a CAGR of 9.03% between 2024 and 2033.

Key Points

- The North America peripheral interventions market size is exhibited at USD 3.42 billion in 2023 and is expected to attain around USD 8.24 billion by 2033, poised to grow at a CAGR of 9.19% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 36% in 2023.

- Asia- Pacific is the fastest growing in the peripheral interventions market during the forecast period.

- By type, the catheters segment dominated the market in 2023.

- By type, the stents segment shows a notable growth in the peripheral interventions market during the forecast period.

- By application, the peripheral artery disease segment dominated the market in 2023.

- By application, the venous thromboembolism segment is the fastest growing in the peripheral interventions market during the forecast period.

- By end- user, the hospitals segment dominated the peripheral interventions market.

- By end- user, the ambulatory surgical centers segment shows a significant growth in the peripheral interventions market during the forecast period.

The peripheral interventions market encompasses a broad range of medical procedures and devices aimed at treating diseases and conditions affecting peripheral arteries and veins outside the heart and brain. These interventions are crucial for addressing peripheral vascular diseases (PVD), which include conditions like peripheral artery disease (PAD), deep vein thrombosis (DVT), and varicose veins. The market for peripheral interventions is driven by the increasing prevalence of these diseases, advancements in minimally invasive techniques, and the rising aging population globally.

Get a Sample: https://www.precedenceresearch.com/sample/4463

Growth Factors

Several key factors contribute to the growth of the peripheral interventions market. Firstly, the growing incidence of lifestyle-related diseases such as diabetes and obesity has led to an increased prevalence of peripheral artery disease (PAD). This demographic trend is a significant driver as PAD often necessitates interventional treatments to restore blood flow to the extremities and prevent complications like amputation. Moreover, technological advancements in imaging modalities, catheter-based interventions, and stent technologies have expanded the treatment options available to physicians, improving patient outcomes and reducing recovery times. Additionally, the rising preference for minimally invasive procedures over traditional surgeries has spurred market growth, driven by benefits such as shorter hospital stays, faster recovery, and reduced healthcare costs.

Trends

Several trends are shaping the peripheral interventions market. One prominent trend is the development of drug-coated balloons (DCBs) and drug-eluting stents (DES), which are designed to deliver medications directly to the diseased vessel wall. These innovations aim to reduce restenosis rates and improve long-term outcomes compared to conventional devices. Another trend is the increasing adoption of robotics and artificial intelligence (AI) in peripheral interventions, enabling more precise and efficient procedures. Moreover, there is a growing focus on patient-centered care and personalized medicine, with efforts to tailor treatments based on individual patient characteristics and disease severity.

Region Insights

Geographically, North America and Europe dominate the peripheral interventions market due to well-established healthcare infrastructure, high healthcare expenditure, and early adoption of advanced medical technologies. In North America, the United States leads in market size, driven by a large patient pool, high prevalence of cardiovascular diseases, and supportive reimbursement policies. Meanwhile, Asia-Pacific is experiencing rapid market growth attributed to improving healthcare access, rising awareness about cardiovascular health, and economic development driving healthcare infrastructure investments. Emerging markets in Latin America and the Middle East are also showing promise with increasing healthcare spending and growing awareness of minimally invasive treatments.

Peripheral Interventions Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 9.51 Billion |

| Market Size in 2024 | USD 10.37 Billion |

| Market Size by 2033 | USD 22.57 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 9.03% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Peripheral Interventions Market Dynamics

Drivers

Several drivers propel the peripheral interventions market forward. Population aging is a significant driver as elderly individuals are more prone to vascular diseases that require intervention. Moreover, the increasing prevalence of risk factors such as smoking, diabetes, and hypertension contributes to the growing incidence of peripheral artery disease globally. Additionally, advancements in imaging technologies such as ultrasound, CT angiography, and MRI have enhanced diagnostic accuracy, facilitating early detection and intervention. Furthermore, collaborative efforts among healthcare providers, researchers, and industry players to innovate new technologies and expand treatment options continue to drive market growth.

Opportunities

The peripheral interventions market presents several opportunities for growth and innovation. One notable opportunity lies in expanding indications for existing devices and technologies to treat a broader range of peripheral vascular diseases. For instance, ongoing research is exploring the application of peripheral interventions in conditions beyond arterial diseases, such as venous disorders and lymphatic disorders. Furthermore, there is a growing opportunity in developing economies where healthcare infrastructure is improving, and there is an increasing demand for affordable, effective medical interventions. Moreover, advancements in materials science and bioengineering present opportunities for developing next-generation devices with improved biocompatibility and durability.

Challenges

Despite the promising growth prospects, the peripheral interventions market faces several challenges. One significant challenge is the high cost associated with advanced technologies and devices, which may limit their adoption in certain healthcare settings or regions with constrained healthcare budgets. Moreover, regulatory hurdles and varying approval processes across different regions can delay market entry for new products, impacting market growth. Additionally, there are challenges related to physician training and expertise in performing complex interventional procedures, especially in emerging markets where skill gaps may exist. Lastly, concerns regarding long-term durability and efficacy of newer technologies such as DCBs and DES continue to be areas of scrutiny and research.

Read Also: Age-related Macular Degeneration Treatment Market Size, Share, Report By 2033

Peripheral Interventions Market Companies

- Biotronik SE & Co. KG

- Teleflex Incorporated

- Abbott Laboratories

- Boston Scientific Corporation

- Cook Medical

- W. L. Gore & Associates Inc

- Cardinal Health Inc

- Angio Dynamics Inc

- Medtronic

- B. Braun Melsungen AG

- Terumo Corporation

- Becton Dickinson and Company

Recent Developments

- In February 2024, the next-generation intermediate catheter with TruCourse, CEREGLIDE 71 Intermediate Catheter, has been launched by CERENOVUS, Inc., a Johnson & Johnson MedTech division. It is intended for the revascularization of individuals experiencing acute ischemic stroke.

- In June 2023, Blue Medical Devices, a Wellinq group company headquartered in Helmond, the Netherlands, has been acquired by Translumina, a leader in the global market for interventional cardiovascular medical devices with manufacturing facilities in Germany and India. The company was founded in 2013 and manufactures a cutting-edge assortment of balloon catheters, such as Drug-Coated Balloons (DCB) and other specialty balloons for intricate cardiac procedures.

Segments Covered in the Report

By Product

- Catheters

- Sheath

- Stents

- Bare Metal Stents

- Drug-eluting Stents

- Guide Wires

- Atherectomy Devices

- Embolic Devices

- IVC Filters

By Application

- Peripheral Artery Disease

- Venous Thromboembolism

- Others

By End-use

- Hospitals

- Catheterization Laboratories

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/