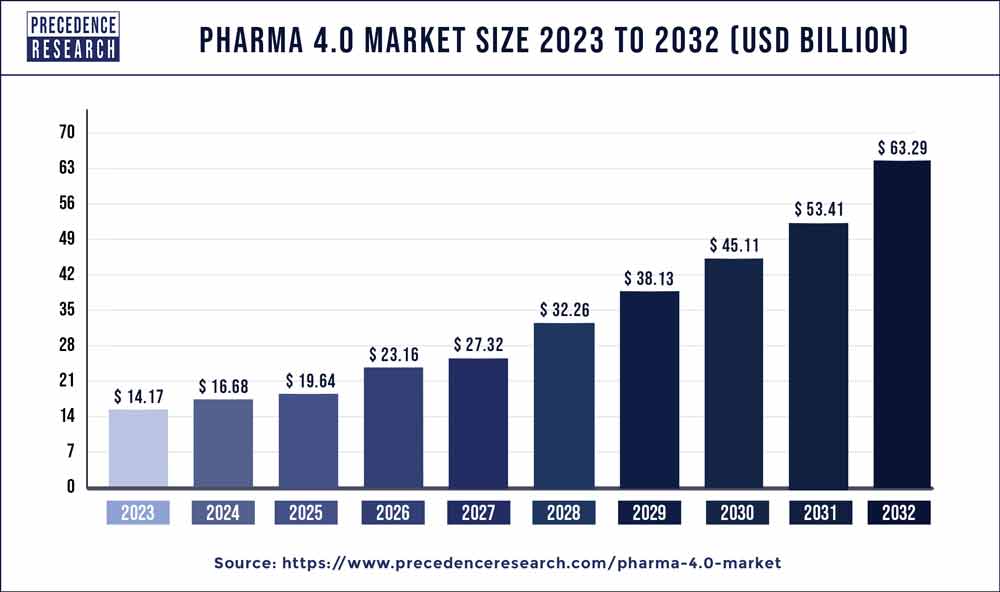

Pharma 4.0 Market Size to Cross USD 63.29 Billion By 2032

The global pharma 4.0 market size was calculated at USD 14.17 billion in 2023 and is projected to cross around USD 63.29 billion by 2032 with noteworthy a CAGR of 18.1% from 2024 to 2032.

Pharma 4.0, often referred to as Pharmaceutical 4.0, represents the integration of advanced technologies into the pharmaceutical industry to enhance efficiency, productivity, and patient outcomes. This paradigm shift leverages digitalization, automation, AI, big data analytics, and IoT to streamline processes across the pharmaceutical value chain—from drug discovery and development to manufacturing, distribution, and personalized patient care. Key aspects include smart manufacturing with real-time monitoring and predictive maintenance, digital twins for virtual simulations, and personalized medicine through data-driven insights. Pharma 4.0 aims to foster innovation, reduce time-to-market for new drugs, optimize supply chain logistics, and ultimately improve healthcare delivery with tailored therapies and enhanced patient safety.

Download the Sample Report ( Including Full TOC, List of Table & Figures, Chart): https://www.precedenceresearch.com/sample/3187

Key Points:

- North America dominated the market with the highest market share of 35.46% in 2023.

- Asia Pacific is expected to witness significant growth in the market during the predicted timeframe.

- By technology, the Internet of Things (IoT) segment captured the biggest revenue share of 44.70% in 2023.

- By application, manufacturing has held the largest market share of 54.61% in 2023.

- By end-user, the pharmaceutical companies segment dominated the market in 2023.

Technology Insights

Pharma 4.0 harnesses a suite of advanced technologies to redefine operations across the pharmaceutical industry. Internet of Things (IoT) plays a pivotal role by enabling real-time monitoring of manufacturing processes and equipment, thereby optimizing efficiency and minimizing downtime. Artificial Intelligence (AI) revolutionizes drug discovery and development through predictive analytics, accelerating the identification of potential drug candidates and optimizing clinical trial designs. Big data analytics processes vast amounts of data to uncover actionable insights, facilitating informed decision-making and enhancing supply chain management. Blockchain technology ensures transparency and traceability throughout the supply chain, from sourcing raw materials to delivering pharmaceutical products, thereby strengthening regulatory compliance and consumer trust.

Application Insights

In drug discovery and development, Pharma 4.0 integrates AI-driven algorithms to expedite the identification of novel drug candidates and predict their efficacy and safety profiles. Computational modeling and simulations streamline research processes, reducing time and costs associated with traditional methods. In manufacturing, IoT-enabled devices and AI-powered analytics enhance operational efficiency by providing real-time insights into production processes and enabling predictive maintenance of equipment. Digital twins and advanced robotics further optimize manufacturing operations, ensuring consistent product quality and regulatory compliance. Supply chain management benefits from digital platforms that enhance visibility, traceability, and compliance across global operations, improving efficiency and reducing risks associated with counterfeit products and supply disruptions.

End-User Insights

Pharma 4.0 adoption spans across pharmaceutical companies, contract research organizations (CROs), and regulatory bodies. Pharmaceutical companies leverage advanced technologies to innovate drug development processes, improve manufacturing efficiency, and meet stringent regulatory requirements. CROs benefit from AI-driven insights that optimize clinical trial design, patient recruitment, and data management, thereby accelerating the development of new therapies. Regulatory bodies increasingly adopt digital platforms to streamline regulatory approvals, ensure compliance with safety and quality standards, and enhance pharmacovigilance efforts to protect patient welfare. The integration of Pharma 4.0 technologies across these stakeholders fosters collaboration, innovation, and the delivery of personalized healthcare solutions that meet the evolving needs of patients worldwide.

Regional Insights

Pharma 4.0, also known as the pharmaceutical industry’s response to Industry 4.0 principles, is witnessing significant regional growth dynamics globally. North America leads the charge, driven by advanced healthcare infrastructure, robust regulatory frameworks, and substantial investments in digital transformation. Europe follows closely, leveraging its strong pharmaceutical sector and emphasis on technological integration to enhance production efficiency and drug development processes. In Asia-Pacific, rapid industrialization and increasing healthcare expenditures are fostering Pharma 4.0 adoption, particularly in countries like China and India. These regions are embracing innovations such as AI, IoT, and big data analytics to optimize manufacturing processes, improve supply chain management, and accelerate drug discovery, marking a transformative shift towards more agile and responsive pharmaceutical operations globally.

Pharma 4.0 Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 14.17 Billion |

| Market Size by 2032 | USD 63.29 Billion |

| Growth Rate from 2024 to 2032 | CAGR of 18.1% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2023 To 2032 |

| Segments Covered | By Technology, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharma 4.0 Market Dynamics:

Pharma 4.0 Market Trends

- Digital Transformation: The industry is undergoing a significant digital transformation, leveraging technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and Internet of Things (IoT) to improve efficiency, quality, and decision-making processes.

- Data-Driven Insights: Pharma companies are increasingly utilizing real-time data analytics to optimize manufacturing processes, supply chain management, and personalized medicine approaches. This enables better forecasting, inventory management, and personalized treatment options.

- Smart Manufacturing: Implementation of smart manufacturing practices using automation, robotics, and advanced analytics to enhance production efficiency, reduce operational costs, and ensure regulatory compliance.

- Personalized Medicine: Advances in genomics, proteomics, and digital health technologies are facilitating the development of personalized therapies and treatments tailored to individual patient characteristics. This includes precision medicine approaches that target specific patient populations based on genetic, environmental, and lifestyle factors.

- Regulatory Compliance and Quality Assurance: Integration of digital technologies to ensure compliance with stringent regulatory requirements and enhance quality assurance processes across the pharmaceutical value chain. This includes real-time monitoring, traceability, and documentation of manufacturing processes.

Pharma 4.0 Market Dynamics

Drivers:

Pharma 4.0 is driven by several key factors. Firstly, there is a growing demand for personalized medicine and treatments, which require flexible and agile manufacturing processes enabled by digital technologies. These technologies enable pharmaceutical companies to optimize production schedules, reduce waste, and customize drug formulations to meet individual patient needs.

Secondly, the need for stringent regulatory compliance and quality assurance drives adoption. Technologies such as real-time monitoring and predictive analytics help ensure compliance with regulatory standards and enhance product quality throughout the manufacturing process. This is particularly crucial in reducing batch failures and ensuring consistent product quality.

Thirdly, rising healthcare costs and the need for cost-effective solutions propel the adoption of Pharma 4.0. Automation and robotics streamline manufacturing processes, reducing operational costs and minimizing human error. Additionally, advanced analytics provide insights that optimize inventory management and supply chain logistics, further driving cost efficiencies.

Opportunities:

Pharma 4.0 presents significant opportunities for innovation and growth. One key opportunity lies in enhanced R&D productivity. AI and machine learning algorithms analyze vast amounts of data to identify potential drug candidates faster and more accurately. This accelerates the drug discovery and development process, reducing time to market for new therapies.

Another opportunity is in improving patient outcomes through digital therapeutics and connected devices. IoT-enabled devices can monitor patient adherence to medication regimens and provide real-time feedback to healthcare providers, enabling personalized treatment plans and improving patient engagement.

Furthermore, Pharma 4.0 opens doors to new business models and partnerships. Collaborations between pharmaceutical companies and technology providers foster innovation in areas such as virtual clinical trials, telemedicine, and remote patient monitoring. These partnerships can lead to novel healthcare delivery models that enhance access to medicines and improve patient care globally.

Challenges:

Despite its potential benefits, Pharma 4.0 also faces several challenges. One major challenge is data privacy and security. The integration of IoT devices and digital platforms increases the risk of cyber threats and data breaches. Pharmaceutical companies must implement robust cybersecurity measures to protect sensitive patient information and intellectual property.

Additionally, there is a challenge in workforce readiness and skills development. The transition to Pharma 4.0 requires a workforce skilled in data analytics, AI, and automation technologies. Companies need to invest in training and upskilling programs to ensure their employees can effectively operate and maintain these advanced systems.

Another challenge is the complexity of integrating new technologies with existing infrastructure. Legacy systems and equipment may not be compatible with digital platforms and IoT devices, requiring substantial investments in upgrades and system integration. This integration process can be time-consuming and costly, impacting the pace of adoption for some pharmaceutical companies.

Read Also: PCR Plastic Packaging Market Size to Worth USD 47.48 Bn By 2033

Recent Developments:

- In July 2023, Lupin’s fully owned subsidiary in Germany Hormosan Pharma GmbH announced the launch of Luforbec 100/6 (beclometasone 100 µg / formoterol 6 µg), it is a metered dose inhaler with the fixed combination for the treatment of chronic obstructive pulmonary disease (COPD) and adult asthma in Germany.

- In July 2023, privately owned Angelini Industries Angelini Pharma announced the launch of an initiative designed “LIFE-GREENAPI,” manufactured to pharma production practices with low environmental impact.

- In June 2023, a leading provider of lifecycle services and system validation “Valspec” was a key partner in Genentech’s Clinical Supply Center (CSC) project, which is recently awarded the Facility of the Year 2023 Pharma 4.0™ Category Winner Award by ISPE®. Valspec innovated the testing matrix based on user needs and collaboration with the Automation, Equipment C&Q, System Owners, and QA project teams to take approval.

Pharma 4.0 Market Companies

- Microsoft Corporation

- Oracle Corporation

- ABB

- Honeywell International Inc.

- Cisco Systems, Inc.

- Siemens Healthcare GmbH

- GE Healthcare

- IBM Corporation

- Amazon Web Services, Inc.