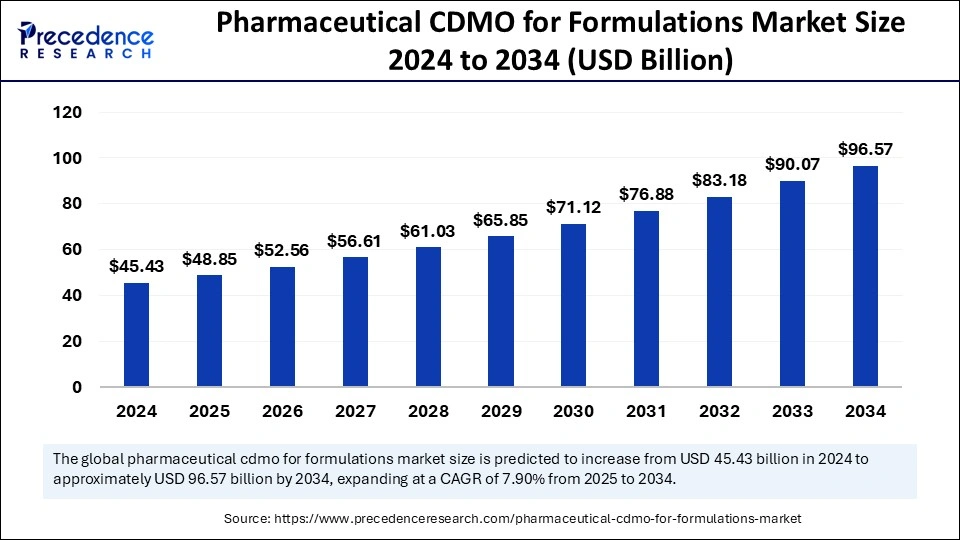

Pharmaceutical CDMO for Formulations Market Size to Hit USD 96.57 Bn by 2034

Pharmaceutical CDMO for formulations market forecast shows growth from USD 45.43 Bn in 2024 to USD 96.57 Bn by 2034, driven by a CAGR of 7.90%.

Pharmaceutical CDMO for Formulations Market Key Takeaways

- Asia Pacific led the pharmaceutical CDMO for formulations market with the largest market share of 42% in 2024.

- Europe is expected to grow at a notable CAGR of 8.40% during the forecasted years.

- By dosage form, the oral solids segment held the biggest market share of 40% in 2024.

- By dosage form, the injectables segment is projected to grow at a solid CAGR of 8.31% over the forecast period.

- By therapeutic area, the oncology segment contributed the biggest market share of 23% in 2024.

- By therapeutic area, the infectious diseases segment is expanding at a healthy CAGR of 8.02% in the forecast period.

- By end user, the pharmaceutical companies segment contributed the highest market share of 55% in 2024.

- By end user, the biopharmaceutical companies segment is expected to expand at a considerable CAGR of 8.17% over the forecast period.

Pharmaceutical CDMO for Formulations Market Overview

The pharmaceutical contract development and manufacturing organization (CDMO) for formulations market is experiencing significant growth driven by the increasing complexity of drug formulations and the rising demand for outsourcing in the pharmaceutical industry.

CDMOs play a crucial role in providing end-to-end services, including drug formulation development, manufacturing, and packaging for pharmaceutical companies. The market is witnessing a surge in demand as pharmaceutical companies seek to reduce operational costs, streamline production processes, and accelerate time-to-market.

The growing prevalence of chronic diseases and the increasing adoption of personalized medicine have led to a rise in complex drug formulations that require specialized expertise and advanced technologies. CDMOs offer flexible and scalable solutions, allowing pharmaceutical companies to focus on their core competencies while ensuring regulatory compliance and high-quality product delivery. The increasing trend of small and mid-sized pharmaceutical companies outsourcing their formulation development and manufacturing processes is further driving the market’s growth.

Pharmaceutical CDMO for Formulations Market Drivers

The primary driver of the pharmaceutical CDMO for formulations market is the rising complexity of drug formulations that require specialized expertise and cutting-edge technologies. The growing focus on biologics, biosimilars, and personalized medicines has created a need for advanced formulation capabilities that many pharmaceutical companies prefer to outsource to CDMOs.

The increasing pressure to accelerate time-to-market and reduce production costs is compelling pharmaceutical companies to partner with CDMOs that offer integrated solutions for formulation development and manufacturing.

Additionally, the growing prevalence of chronic diseases, coupled with the rising demand for novel drug delivery systems, is driving the need for innovative formulation technologies. Regulatory requirements are becoming more stringent, prompting pharmaceutical companies to collaborate with CDMOs that can ensure compliance with global quality standards and regulatory guidelines.

Pharmaceutical CDMO for Formulations Market Opportunities

The pharmaceutical CDMO for formulations market offers numerous opportunities for growth, particularly in the development of complex formulations and innovative drug delivery systems. The increasing demand for biologics, biosimilars, and cell and gene therapies presents a lucrative opportunity for CDMOs with expertise in advanced formulations. The growing trend of personalized medicine and targeted therapies is driving the need for specialized formulation services that can cater to the unique requirements of individual patients.

Furthermore, the rising adoption of digital technologies and artificial intelligence in drug formulation and manufacturing is creating opportunities for CDMOs to enhance their service offerings. Expanding their capabilities in high-potency active pharmaceutical ingredients (HPAPIs), controlled-release formulations, and combination products will allow CDMOs to capture a larger share of the growing market.

Pharmaceutical CDMO for Formulations Market Challenges

Despite the promising growth prospects, the pharmaceutical CDMO for formulations market faces several challenges that could impede its progress. Regulatory complexities and the need to comply with varying regulatory standards across different regions pose a significant challenge for CDMOs operating in the global market.

Ensuring consistent quality and maintaining compliance with Good Manufacturing Practices (GMP) is critical but can be resource-intensive and time-consuming. The high cost of adopting advanced technologies and maintaining state-of-the-art manufacturing facilities adds to the operational challenges faced by CDMOs.

Moreover, the increasing competition in the CDMO space, coupled with the growing demand for faster turnaround times and cost efficiency, places additional pressure on service providers to deliver high-quality solutions within tight timelines.

Pharmaceutical CDMO for Formulations Market Regional Insights

North America dominates the pharmaceutical CDMO for formulations market, driven by the presence of leading pharmaceutical companies, a strong regulatory framework, and a well-established healthcare infrastructure. The United States is the largest market in the region, with a high demand for formulation services due to the increasing complexity of drug development and the growing focus on biologics and specialty pharmaceuticals. Europe is another significant market, with countries such as Germany, the United Kingdom, and France leading the adoption of CDMO services.

The Asia Pacific region is witnessing rapid growth, fueled by the expansion of the pharmaceutical industry in countries such as China and India, where cost-effective manufacturing solutions and a skilled workforce are attracting pharmaceutical companies. Latin America and the Middle East & Africa are emerging markets, with increasing investments in pharmaceutical infrastructure and a growing demand for formulation services.

Pharmaceutical CDMO for Formulations Market Recent Developments

Recent developments in the pharmaceutical CDMO for formulations market include strategic collaborations, acquisitions, and investments aimed at expanding service offerings and enhancing manufacturing capabilities. Leading CDMOs are investing in advanced technologies such as continuous manufacturing, nanotechnology, and bioavailability enhancement to cater to the growing demand for complex formulations.

The integration of digital platforms and artificial intelligence is enabling CDMOs to optimize formulation processes and enhance product quality. Partnerships between CDMOs and pharmaceutical companies are facilitating the development of novel drug delivery systems and personalized therapies. Additionally, CDMOs are expanding their global footprint through the establishment of state-of-the-art facilities in emerging markets to meet the increasing demand for formulation services.

Pharmaceutical CDMO for Formulations Market Companies

- Lonza

- Thermo Fisher Scientific, Inc.

- Recipharm AB

- Laboratory Corporation of America Holdings (LabCorp)

- Catalent, Inc.

- WuXi AppTec, Inc.

- Piramal Pharma Solutions

- Siegfried Holding AG

- CordenPharma International

- Cambrex Corporation

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- EuroAPI

- Hovione

- Curia

Segments Covered in the Report

By Dosage Form

- Oral Solids

- Oral Liquids

- Injectables

- Topicals

- Inhalation Products

- Transdermal And Patches

- Others

By Therapeutic Area

- Oncology

- Cardiology

- Central Nervous System

- Gastroenterology

- Infectious Diseases

- Endocrinology (Diabetes, Hormonal Therapy)

By End User

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!