Plastic Contract Manufacturing Market Size, Share and Growth 2022-2030

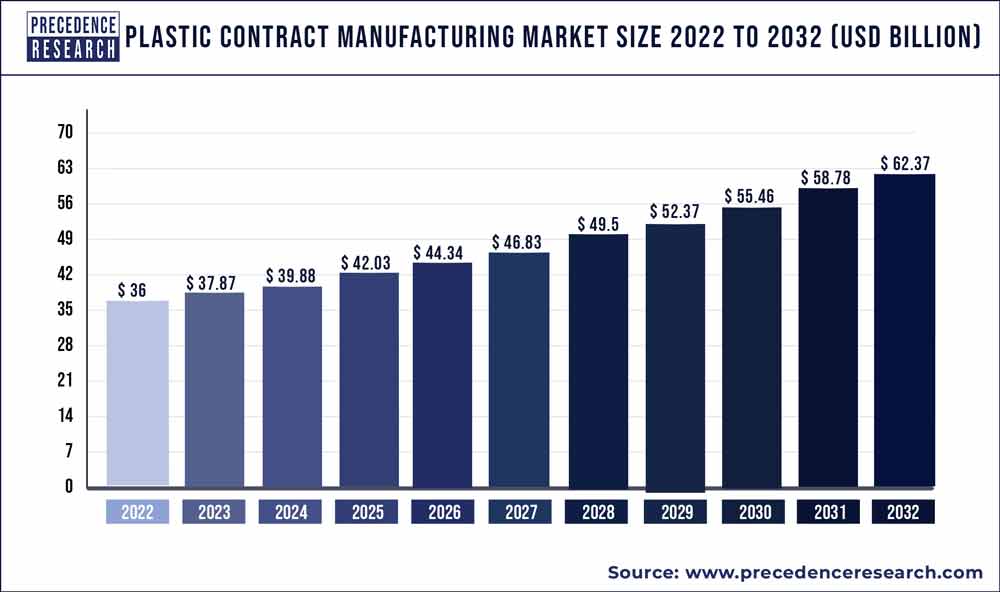

The plastic contract manufacturing market size was valued approximately at US$ 34.02 billion in 2021 and is projected to reach US$ 56.45 billion by 2030, registering a CAGR of 5.8%.

The base year for the study has been considered 2021, the historic year 2017 and 2020, and the forecast period considered is from 2022 to 2030. The plastic contract manufacturing market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

The plastic contract manufacturing allows for faster component manufacture and improves the producer’s supply chain performance. The contract manufacturing systems works on the basis of demand flow. As a result, the contract manufacturers collaborate with original equipment manufacturers to smooth out demand fluctuations, resulting in consistent manufacturing and efficient supply chain management. The organizations that use contract manufacturing save money since they do not have to invest in a new production site, equipment, and labors.

Furthermore, contract manufacturers’ experience and technical understanding enable the development of high-quality goods. The medical equipment is increasingly made up of plastics. As a result, increased demand for medical equipment has resulted from the rise of the domestic healthcare industry, which is attributed to lower costs as compared to critical care units and hospitals.

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1614

Plastic Contract Manufacturing Market Estimations Y-O-Y:

| Market Size Was Valued In 2021 | US$ 34.02 Billion |

| Market Size Is Projected to Reach By 2022 | US$ 35.45 Billion |

| Market Size Is Projected to Reach By 2030 | US$ 56.45 Billion |

| Compound Annual Growth Rate (CAGR) from 2022 to 2030 | 5.8% |

Plastic Contract Manufacturing Market – Report Highlights

- Based on the product, the polypropylene segment is the fastest growing segment in the global plastic contract manufacturing market. The polypropylene is a synthetic resin made from propylene polymerization. The polypropylene is a polyolefin resin that is molded or extruded into a variety of plastic items that require flexibility, light weight, toughness, and heat resistance.

- Europe is the fastest growing region in the plastic contract manufacturing market. Europe region is the world’s greatest producer and consumer of plastics. The increased disposable income and population expansion in the region have resulted in increased domestic demand for electronic equipment, which is likely to drive the growth of the plastic contract manufacturing market.

- Asia-Pacific region is the largest segment for plastic contract manufacturing market in terms of region. The manufacturing sector in the Asia-Pacific region is influenced by abundant raw material availability, moderately priced labor costs, land availability, and significant domestic demand.

Plastic Contract Manufacturing Market Scope

| Report Coverage | Details |

| Market Size by 2030 | USD 56.45 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 5.8% |

| Asia Pacifc Market Share in 2021 | 44.5% |

| Polypropylene Segment Market Share in 2021 | 35% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Product, Application, Geography |

Market Dynamics

Drivers

Low overhead costs

The plastic manufacturing involves various processes starting from production to sales. The raw material is a main component for the plastic manufacturing. Apart from that, labor and equipment also include in the manufacturing process of plastic. To avoid such expenses, plastic manufacturers have started outsourcing the process to the third party.

The plastic contract manufacturers help to reduce overhead costs associated to the manufacturing. In addition, the contract manufacturer also helps to reduce cost of post manufacturing service. Many of the plastic contract manufacturers also provides sales service. As a result, the low overhead costs are driving the growth of the global plastic contract manufacturing market over the projected period.

Restraints

Intellectual property risks

In the contract manufacturing industry, as in every industry, there will always be those with malicious intentions. While it is unusual, contract manufacturers have been known to steal intellectual property or sell private firm information to third parties or competitors. In some circumstances, the contract manufacturer will steal sensitive company data and use it to create its own brand.

Unfortunately, if a brand or company possesses vital knowledge about another company in the same niche or industry, it might utilize it to establish itself as a worthy competitor or rival. This has resulted in the demise of several businesses. As a result, the intellectual property risks are hindering the growth of the global plastic contract manufacturing market over the projection period.

Read Also: Care Management Solutions Market To Grow At A CAGR Of 11.4%

Opportunities

Scalability of products

Its difficult to scale product as a startup and small firm with limited resources. The contract manufacturers are more than capable of scaling the products because they have additional resources. If there is spike in demand or a seasonal reduction in demand, the contract manufactures can quickly scale production to meet the needs. With these adaptive tactics, the companies are able to push their products to new heights while maintaining control over demand fluctuations. Thus, this factor is creating lucrative opportunities for the growth of the global plastic contract manufacturing market.

Challenges

Lack of control

When manufacturing is outsourced, a certain amount of control is lost. Despite the fact that this loss of control is usually only an issue when something goes wrong, there are several procedures that may be taken to minimize this specific disadvantage. The contracting with a manufacturer that is not difficult to visit in person is probably the best way to relieve concerns about the loss of control. All the decisions are taken by contract manufacturers itself. The main market player is not involved in any type of the manufacturing process. As a result, lack of control is a major challenge for the growth of the plastic contract manufacturing market during the forecast period.

Some of the prominent players in the global plastic contract manufacturing market include:

- McClarin Plastics LLC

- EVCO Plastics

- C&J Industries

- Genesis Plastics Welding

- Plastikon Industries Inc.

- PTI Engineered Plastics Inc.

- Mack Molding

- Natech Plastics Inc.

- Rosti Group AB Inc.

- Baytech Plastics

Segments Covered in the Report

By Product

- Polypropylene

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene

- Polystyrene

- Others

By Application

- Medical

- Aerospace & Defense

- Automotive

- Consumer Goods & Appliances

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Plastic Contract Manufacturing Market

5.1. COVID-19 Landscape: Plastic Contract Manufacturing Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Plastic Contract Manufacturing Market, By Product

8.1. Plastic Contract Manufacturing Market, by Product Type, 2022-2030

8.1.1. Polypropylene

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Acrylonitrile Butadiene Styrene (ABS)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Polyethylene

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Polystyrene

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Plastic Contract Manufacturing Market, By Application

9.1. Plastic Contract Manufacturing Market, by Application, 2022-2030

9.1.1. Medical

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Aerospace & Defense

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Automotive

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Consumer Goods & Appliances

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Plastic Contract Manufacturing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. McClarin Plastics LLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. EVCO Plastics

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. C&J Industries

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Genesis Plastics Welding

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Plastikon Industries Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. PTI Engineered Plastics Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Mack Molding

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Natech Plastics Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rosti Group AB Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Baytech Plastics

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s plastic contract manufacturing market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1614

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://precedenceresearchnews.wordpress.com

Frequently Asked Questions:

[sc_fs_multi_faq headline-0=”h6″ question-0=”What is the current size of plastic contract manufacturing market?” answer-0=”According to Precedence Research, the global plastic contract manufacturing market size was reached at US$ 34.02 billion in 2021 and is anticipated to rake US$ 56.45 billion by 2030. ” image-0=”” headline-1=”h6″ question-1=”What will be the CAGR of global plastic contract manufacturing market?” answer-1=”The global plastic contract manufacturing market is expected to reach at a CAGR of 5.8% over the forecast period 2022 to 2030. ” image-1=”” headline-2=”h6″ question-2=”Who are the major players operating in the plastic contract manufacturing market?” answer-2=”The major players operating in the plastic contract manufacturing market are McClarin Plastics LLC, EVCO Plastics, C&J Industries, Genesis Plastics Welding, Plastikon Industries Inc., PTI Engineered Plastics Inc., Mack Molding, Natech Plastics Inc., Rosti Group AB Inc., and Baytech Plastics. ” image-2=”” headline-3=”h6″ question-3=”Which are the driving factors of the plastic contract manufacturing market?” answer-3=”The expansion of the global plastic contract manufacturing market is being driven by the surge in the demand for electronic products such as wearables, smartphones, and smartwatches as well as an increase in disposable income. ” image-3=”” headline-4=”h6″ question-4=”Which region will lead the global plastic contract manufacturing market?” answer-4=”Asia-Pacific region will lead the plastic contract manufacturing market over the forecast period 2022 to 2030 ” image-4=”” count=”5″ html=”true” css_class=””]