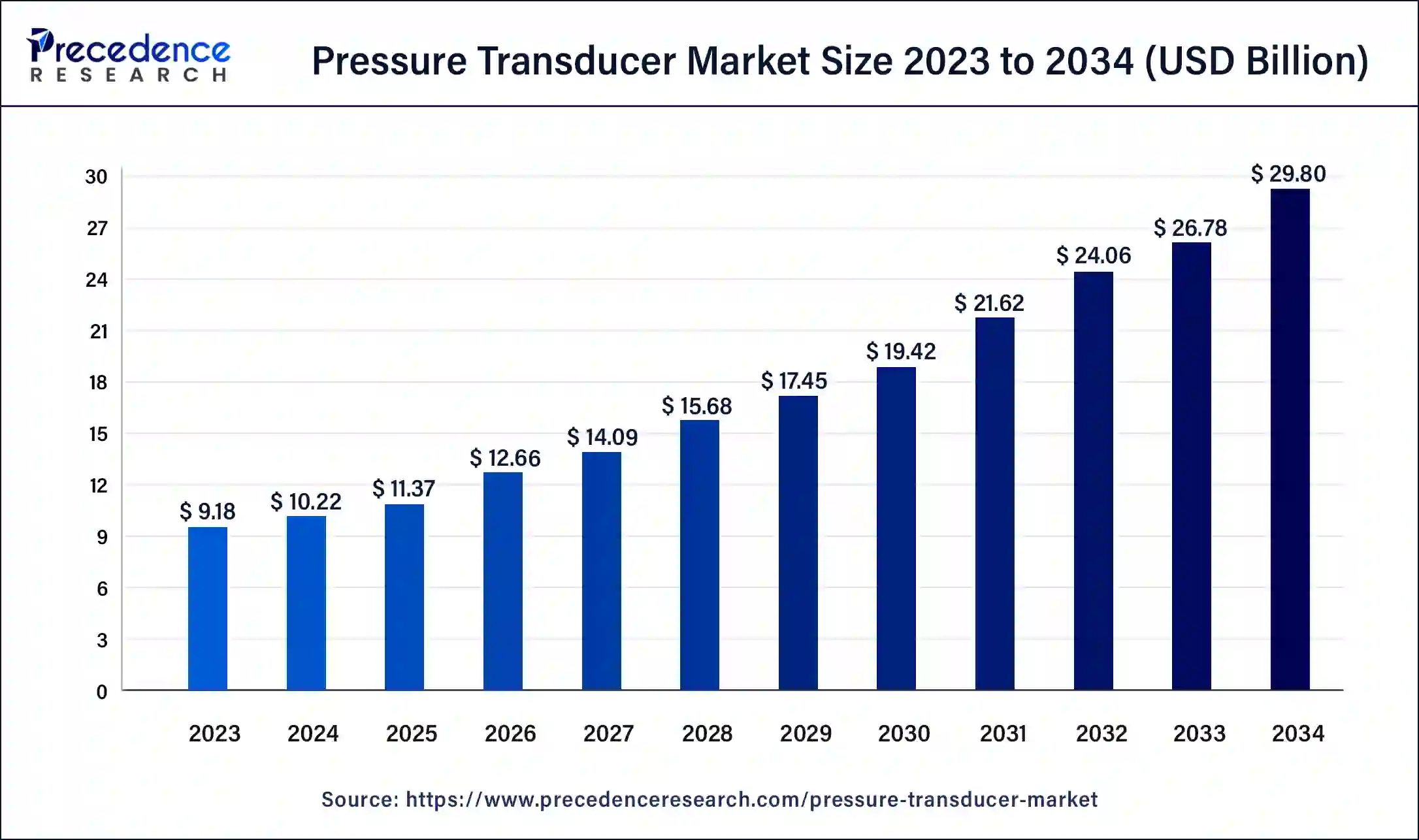

Pressure Transducer Market Size to Attain USD 29.80 Bn by 2034

The global pressure transducer market size is estimated to be USD 10.22 billion in 2024 and is expected to be worth around USD 29.80 billion by 2034, growing at a CAGR of 11.30% from 2024 to 2034.

The Pressure Transducer Market is poised for steady growth, driven by its extensive applications across various industries including automotive, healthcare, aerospace, and industrial manufacturing. Pressure transducers, which convert pressure into an electrical signal, play a critical role in monitoring and controlling pressure in complex systems. These devices are essential for ensuring precision, safety, and efficiency in processes where pressure measurement is crucial. With the increasing adoption of automation and the rise in industrial processes, the demand for accurate and reliable pressure sensors is on the rise. The market is seeing advancements in sensor technologies, such as MEMS (Micro-Electro-Mechanical Systems) and wireless pressure transducers, catering to the need for compact, low-power, and highly sensitive devices.

Pressure Transducer Market Key Takeaways

- North America accounted for the biggest market share of 38% in 2023.

- Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034.

- By technology, the piezoresistive strain gauge segment dominated the market in 2023.

- By technology, the capacitance segment is anticipated to be the fastest-growing during the forecast period.

- By pressure type, the absolute pressure segment dominated the pressure transducer market in 2023.

- By pressure type, the gauge pressure segment is expected to be the fastest-growing during the forecast period.

- By end-use, the automotive segment dominated the pressure transducer market in 2023.

- By end-use, the industrial segment is anticipated to be the fastest-growing during the forecast period.

Pressure Transducer Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 29.80 Billion |

| Market Size in 2024 | USD 10.22 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.30% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Pressure Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Pressure Transducer Market Dynamics

Drivers

One of the key drivers of the pressure transducer market is the growing demand from the automotive industry, where these sensors are used for various applications including fuel injection systems, transmission control, and tire pressure monitoring systems (TPMS). With the increasing focus on fuel efficiency, emissions control, and vehicle safety, the adoption of pressure transducers in this sector is expanding. Additionally, the rise in industrial automation and the integration of IoT in manufacturing processes are further propelling the market growth. Pressure transducers are also gaining traction in the healthcare sector, particularly in medical devices such as ventilators, blood pressure monitors, and anesthesia machines, where accurate pressure measurement is vital.

Restraints

Despite the positive outlook, certain restraints are impeding the growth of the pressure transducer market. One major challenge is the high cost associated with advanced pressure transducers, particularly in applications that require high accuracy and stability under extreme conditions. This makes it difficult for small- and medium-sized enterprises (SMEs) to adopt these technologies. Additionally, the complexity of calibration and maintenance of pressure transducers can limit their usage in some industries, where specialized personnel are required to ensure proper functioning. Furthermore, the presence of alternative technologies, such as optical pressure sensors, which offer higher precision in specific applications, poses a challenge to the widespread adoption of traditional pressure transducers.

Opportunities

The pressure transducer market offers significant opportunities, particularly with the ongoing advancements in wireless sensing technology and the growing adoption of IoT-based systems in various industries. The development of wireless and miniaturized pressure transducers opens up new applications in areas such as wearable devices, remote monitoring, and smart cities. Moreover, the increasing emphasis on environmental sustainability and energy efficiency is expected to drive the demand for pressure transducers in renewable energy applications such as wind turbines, where pressure monitoring is critical for optimizing performance and reducing downtime. The expansion of healthcare infrastructure, particularly in emerging economies, also presents growth opportunities for pressure transducers in medical devices and equipment.

Regional Insights

From a regional perspective, North America holds a dominant share in the global pressure transducer market, driven by the presence of leading manufacturers and the high demand for advanced sensing technologies in the automotive and healthcare sectors. The U.S., in particular, is a significant contributor to market growth due to its robust automotive industry and extensive use of pressure transducers in industrial automation. Europe also represents a substantial market, with countries like Germany and the U.K. being key players in automotive manufacturing and industrial automation.

The Asia-Pacific region is expected to witness the fastest growth during the forecast period, fueled by rapid industrialization, urbanization, and the increasing adoption of automation in countries like China, Japan, and India. The growing demand for consumer electronics, automotive, and healthcare solutions in this region is driving the need for pressure transducers. Additionally, government initiatives to promote smart manufacturing and the expansion of healthcare infrastructure in emerging economies further bolster the market in this region.

Read Also: Self-Rising Flour Market Size to Touch USD 1,853.82 Mn by 2034

Pressure Transducer Market Companies

- ABB Ltd.

- NXP Semiconductors

- Robert Bosch GmbH

- Panasonic Corporation

- Validyne Engineering

- Honeywell International Inc. (US)

- Kulite Semiconductor Products, Inc.

- Setra Systems, Inc. (Fortive)

- Sensata Technologies, Inc.

- ControlAir, Inc.

- TE Connectivity (Switzerland)

- Amphenol Corporation (US)

- Emerson Electric Co. (US)

- Setra System, Inc.

- Omicron System Pvt Ltd.

- MICRO SENSOR CO., LTD

- Kistler Instrument, Corp.

- IFM Electronic GmbH

- Yokogawa Electric Corporation

- Endress + Hauser

- Wika Group

- Schneider Electric SE

- TE Connectivity

- Siemens AG

- Anfield Sensors Inc.

- Amphenol Corporation

Recent Developments

- In September 2022, a new ‘Pressure Transducer’ with a classic 2088 head that can be used in a harsh or humid environment for a long time for oil, air, and water was launched by the online shop supplying a high range of industrial automation products company, ATO.com.

- In May 2024, the SCP09 pressure sensor with OEM pin configuration, a reliable and versatile solution for hydraulic applications, was launched by a global leader in motion and control technologies, Parker Hannifin.

Segments Covered in the Report

By Technology

- Piezoresistive Strain Gauge

- Capacitance

- Others

By Pressure Type

- Absolute Pressure

- Gauge Pressure

- Differential Pressure

By End-use

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Oil & Gas

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344