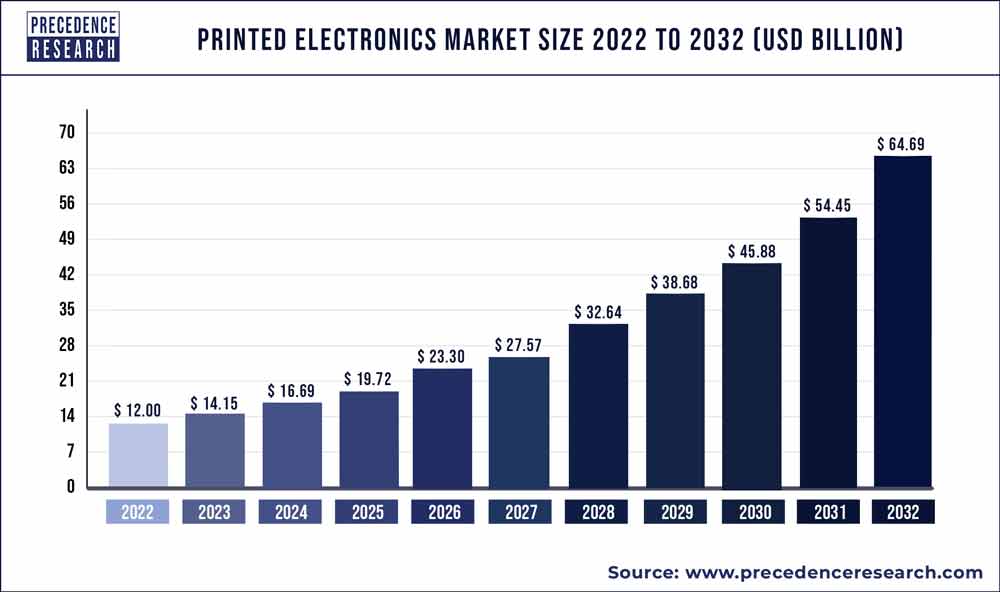

Printed Electronics Market to Garner $44.4 Billion, Globally, By 2030

According to the industry experts, The printed electronics market garnered $ 10 billion in 2021 and is expected to generate $ 44.4 billion by 2030, manifesting a CAGR of 18.5% from 2021 to 2030. The report contains 150+ pages with detailed analysis.

The base year for the study has been considered 2021, the historic year 2019 and 2020, the forecast period considered is from 2021 to 2030. The printed electronics market is analyzed on the basis of value (US$ Million), volume (Unit), and price (US$/Unit).

Printed electronics are electronic devices created utilizing carbon-based compound inks, inkjet printers, and flexography, gravure, and screen-printing methods on substrates such as foil, paper, glass, and fabric polymers. Wearable electronics, flexible keyboards, electronic skin patches, biosensors, display units, organic light emitting diode (OLEDs), and photovoltaic cells are some of the most often used printed electronics. Printed electronics are more environmentally friendly, lightweight, flexible, cost-effective, and have lower power requirements than traditional electronics. As a result, they’re used in a wide range of industries, including aircraft, automotive, healthcare, and consumer electronics.

Download the Sample Pages of this Report for Better Understanding (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1357

Printed Electronics Market Scope

This market report studies market dynamics, status and outlook especially in North America, Europe and Asia-Pacific, Latin America, the Middle East and Africa. This research report offers scenario and forecast (revenue/volume), and categorizes the market by key players and various segment. This report also studies global market prominence, competitive landscape, market share, growth rates market dynamics such as drivers, restraints and opportunities, and distributors and sales channels.

This research study also integrates Industry Chain analysis and Porter’s Five Forces Analysis. Further, this report offers a competitive scenario that comprises collaborations, market concentration rate and expansions, mergers & acquisitions undertaken by companies.

Crucial factors accountable for market growth are:

- Rapid growth in the use of IoT devices.

- Surge in demand for improved OLED displays and printed RFID devices.

- Growth of automobile industry drives the printed electronics market.

Printed Electronics Report Highlights

- The Inks material segment accounted largest revenue share in 2020.

- The screen-printing technology segment of the market is estimated to lead the market with a market share of more than in 2020.

- The aerospace and defense end use segment of the Printed Electronics Market is estimated to dominate the market contributing a remarkable market share in 2020.

- By Geography, Asia Pacific is expected to lead the market contributing largest revenue share in 2020 owing to increased investments in R&D activities connected to printed electronics in the region.

Printed Electronics Market Dynamics

Driver – The primary end-user of printed electronics is the automobile and transportation industries. Because of their thinness, robustness, and flexibility, printed electronic goods are frequently employed in the automotive industry. Touch control technology and smart surfaces have also become commonplace in car interior interfacing. As a result, market participants are incorporating technology and design improvements into their offers. These factors are estimated to drive the market growth. For instance, in May 2021 Quad Industries (Belgium) developed and manufactured a versatile and durable capacitive touch sensor (printed sensors) as well as in-mold electronics (IME) to improve innovation in automobile interior and exterior surfaces. The conductive ink sensor is used in vehicle HMI applications such as HVAC controls, steering wheel controls, and overhead panels.

Restraint – The major restraining factor that will negatively impact the growth of the Printed Electronics Market includes the high cost involved in installing the printing system for electronic components.

Opportunity – Flexible displays, smart labelling, smart sensors, and active clothing have all benefited from the advent of printed electronics, which have made it easier to create low-cost, high-performance electronic goods. They have also made it easier to incorporate new features into current electrical products. These factors are anticipated to provide huge opportunities for the market growth. For instance, On 27th July 2021, Molex, a worldwide electronics company and connectivity pioneer, stated today that it has made significant progress in its Industry 4.0 and digital manufacturing projects. These advancements, as well as the addition of Flexible Automation Modules (FAMs), extend Molex’s Industrial Automation Solutions (IAS4.0) by enabling supply chain stakeholders to create software-defined machines, robots, and production lines that can meet the growing demand for connected, secure, scalable, and efficient operations.

Challenges – Printed electronics refers to a variety of printing technologies and materials that can be employed in a variety of sectors. When using printed electronics, the user must be well-versed in various areas, including substrate and material selection, printing pattern selection, hardware integration, and software creation. For smart building applications, for example, combining printed sensors, displays, circuits, and other electrical components remains difficult.

Recent Developments

- On 8th September 2021, Molex, a worldwide electronics pioneer and connection inventor, today announced the findings of a global study of industrial stakeholders to determine the top trends and technologies influencing the future of mobile devices. Mobile-device form factors, disruptive features, and innovations will continue to evolve in 2026, influencing smartphones, smart wearables, and other mobile devices, according to the survey’s findings.

- On 11th February 2021, DuPont Interconnect Solutions, a division of DuPont Electronics & Industrial, said today that its $220 million Circleville expansion project will be finished in the second half of 2021. The investment will increase manufacturing of Kapton polyimide film and Pyralux flexible circuit materials, ensuring a reliable supply to meet rising worldwide demand in the automotive, consumer electronics, telecommunications, high-performance industrial, and defense markets.

- On 1st March 2021, NovaCentrix announced the most up-to-date soldering technology for flexible, printed electronics.

Regional Snapshots

The Asia Pacific region dominates the printed electronics market contributing a largest market share in 2020 and is expected to witness significant growth during the forecast period owing to increased investments in R&D activities connected to printed electronics in the region, as well as large-scale manufacture of electronic components. For instance, On 11th June 2021, Nissha Co., Ltd. has begun renting out friction and shear force sensor evaluation kits. Friction and shear force sensors sense force in three directions, including friction and shear forces delivered horizontally as well as vertically applied force. Friction and shear force sensors from Nissha are light and flexible, yet they can detect forces applied in three directions at several sites at the same time. They’re used for a variety of things, including touch sensors in robotic hands and input device interfaces.

Browse Healthcare Research Reports @ https://www.marketstatsnews.com/healthcare/

Key Players/Manufacturers

This report also provides detailed company profiles of the key market players. This research report also highlights the competitive landscape of the printed electronics market and ranks noticeable companies as per their occurrence in diverse regions across the globe and crucial developments initiated by them in the market space. This research study also tracks and evaluates competitive developments, such as collaborations, partnerships, and agreements, mergers and acquisitions; novel product introductions and developments, promotion strategies and Research and Development (R&D) activities in the marketplace. The competitive profiling of these players includes business and financial overview, gross margin, production, sales, and recent developments which can aid in assessing competition in the market.

Some of the prominent players in the global printed electronics market include:

Samsung Electronics Co., Ltd., LG Display Co., Ltd., Molex LLC, Agfa-Gevaert Group, Palo Alto Research Center Incorporated (PARC), DuPont de Nemours, Inc., Nissha Co., Ltd., BASF, NovaCentrix, and E Ink Holdings Inc.

Market Segments Covered

By Material

- Ink

- Substrate

By Technology

- Inkjet

- Screen

- Gravure

- Flexographic

By Device

- Display

- Photovoltaic

- Lighting

- RFID

- Others

By End Use

- Automotive & Transportation

- Healthcare

- Consumer Electronics

- Aerospace & Defense

- Construction & Architecture

- Retail & Packaging

- Other End-use Industries

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Research Objective

- To provide a comprehensive analysis of the printed electronics industry and its sub-segments in the global market, thereby providing a detailed structure of the industry

- To provide detailed insights into factors driving and restraining the growth of this global market

- To provide a distribution chain analysis/value chain for the this market

- To estimate the market size of the global printed electronics market where 2019 would be the historical period, 2020 shall be the base year, and 2020 to 2027 will be the forecast period for the study

- To provide strategic profiling of key companies (manufacturers and distributors) present across the globe, and comprehensively analyze their competitiveness/competitive landscape in this market

- To analyze the global market in four main geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To provide country-wise market value analysis for various segments of the printed electronics

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Printed Electronics Market

5.1. COVID-19 Landscape: Printed Electronics Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Printed Electronics Market, By Material

8.1. Printed Electronics Market, by Material Type, 2021-2030

8.1.1. Ink

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Substrate

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Printed Electronics Market, By Technology

9.1. Printed Electronics Market, by Technology, 2021-2030

9.1.1. Inkjet

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Screen

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Gravure

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Flexographic

9.1.4.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Printed Electronics Market, By Device Type

10.1. Printed Electronics Market, by Device Type, 2021-2030

10.1.1. Display

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Photovoltaic

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Lighting

10.1.3.1. Market Revenue and Forecast (2019-2030)

10.1.4. RFID

10.1.4.1. Market Revenue and Forecast (2019-2030)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Printed Electronics Market, By End Use Type

11.1. Printed Electronics Market, by End Use Type, 2021-2030

11.1.1. Automotive & Transportation

11.1.1.1. Market Revenue and Forecast (2019-2030)

11.1.2. Healthcare

11.1.2.1. Market Revenue and Forecast (2019-2030)

11.1.3. Consumer Electronics

11.1.3.1. Market Revenue and Forecast (2019-2030)

11.1.4. Aerospace & Defense

11.1.4.1. Market Revenue and Forecast (2019-2030)

11.1.5. Construction & Architecture

11.1.5.1. Market Revenue and Forecast (2019-2030)

11.1.6. Retail & Packaging

11.1.6.1. Market Revenue and Forecast (2019-2030)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2019-2030)

Chapter 12. Global Printed Electronics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Material (2019-2030)

12.1.2. Market Revenue and Forecast, by Technology (2019-2030)

12.1.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.1.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.1.5.2. Market Revenue and Forecast, by Technology (2019-2030)

12.1.5.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.1.5.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.1.6.2. Market Revenue and Forecast, by Technology (2019-2030)

12.1.6.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.1.6.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.2. Market Revenue and Forecast, by Technology (2019-2030)

12.2.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.2.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.5.2. Market Revenue and Forecast, by Technology (2019-2030)

12.2.5.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.2.5.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.6.2. Market Revenue and Forecast, by Technology (2019-2030)

12.2.6.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.2.6.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.7.2. Market Revenue and Forecast, by Technology (2019-2030)

12.2.7.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.2.7.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Material (2019-2030)

12.2.8.2. Market Revenue and Forecast, by Technology (2019-2030)

12.2.8.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.2.8.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.2. Market Revenue and Forecast, by Technology (2019-2030)

12.3.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.3.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.5.2. Market Revenue and Forecast, by Technology (2019-2030)

12.3.5.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.3.5.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.6.2. Market Revenue and Forecast, by Technology (2019-2030)

12.3.6.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.3.6.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.7.2. Market Revenue and Forecast, by Technology (2019-2030)

12.3.7.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.3.7.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Material (2019-2030)

12.3.8.2. Market Revenue and Forecast, by Technology (2019-2030)

12.3.8.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.3.8.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.2. Market Revenue and Forecast, by Technology (2019-2030)

12.4.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.4.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.5.2. Market Revenue and Forecast, by Technology (2019-2030)

12.4.5.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.4.5.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.6.2. Market Revenue and Forecast, by Technology (2019-2030)

12.4.6.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.4.6.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.7.2. Market Revenue and Forecast, by Technology (2019-2030)

12.4.7.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.4.7.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Material (2019-2030)

12.4.8.2. Market Revenue and Forecast, by Technology (2019-2030)

12.4.8.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.4.8.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.5.2. Market Revenue and Forecast, by Technology (2019-2030)

12.5.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.5.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Material (2019-2030)

12.5.5.2. Market Revenue and Forecast, by Technology (2019-2030)

12.5.5.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.5.5.4. Market Revenue and Forecast, by End Use Type (2019-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Material (2019-2030)

12.5.6.2. Market Revenue and Forecast, by Technology (2019-2030)

12.5.6.3. Market Revenue and Forecast, by Device Type (2019-2030)

12.5.6.4. Market Revenue and Forecast, by End Use Type (2019-2030)

Chapter 13. Company Profiles

13.1. Samsung Electronics Co., Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. LG Display Co., Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Molex LLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Agfa-Gevaert Group

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Palo Alto Research Center Incorporated (PARC)

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. DuPont de Nemours, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Nissha Co., Ltd.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. BASF

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. NovaCentrix

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. E Ink Holdings Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Why Buy this Report?

The purpose of Precedence Research’s printed electronics market study is to provide stakeholders with a detailed picture of potential barriers and untapped opportunities. The report contains exclusive information to assist businesses in making informed decisions about how to maintain growth throughout the assessment period.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1357

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com