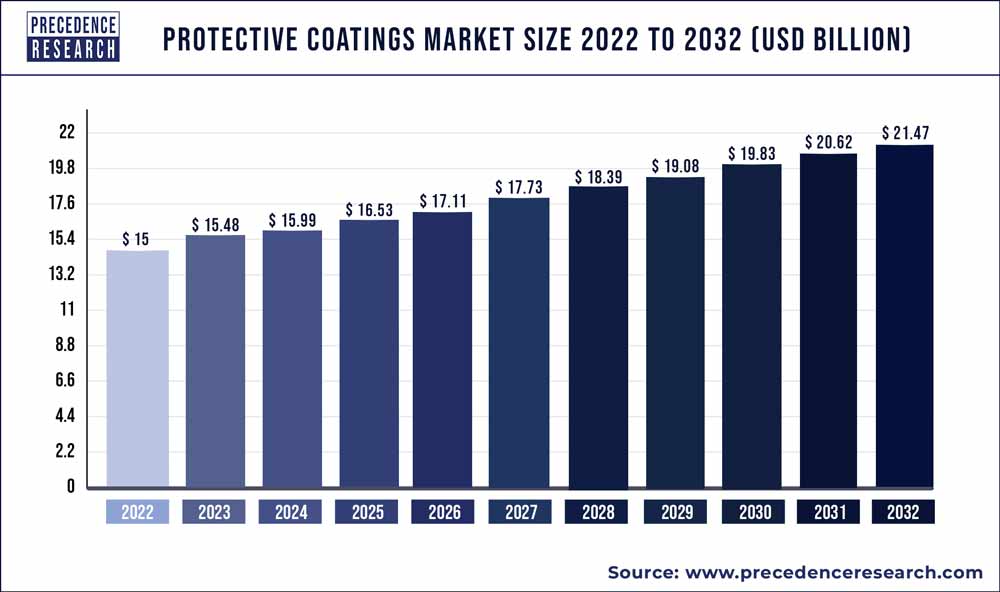

The global protective coatings market size is expected to reach USD 21.7 billion by 2030, manifesting at a CAGR of 4.04% from 2022 to 2030.

- Asia Pacific protective coatings market was valued at USD 5.1 billion in 2021

- By end user, the infrastructure & construction segment registered the highest revenue share of over 28% in 2021.

Download Access to a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/1925

Coatings play a significant role in the protection of assets in the industrial, commercial, and architectural markets. Coatings are generally understood to be a thin layer of solid substance applied to a surface to improve its functional, aesthetic, or protective qualities. They are a liquid, liquefiable, or mastic mixture, more particularly, that when applied to a surface hardens into a protective, ornamental, or useful adhering film. To prevent corrosion of the substrate, protective coatings are put on a surface.

Additionally, protective coatings are utilized in the civil construction and infrastructure sector for flooring, wood finishes, interior and external walls, bridges, swimming pools, doors, and ceilings. Increased investments in infrastructure development and increased renovation of older buildings are two variables that operate as important market growth drivers.

Protective Coatings Market Scope

| Report Coverage | Details |

| Market Size in 2022 | USD 15.81 Billion |

| Market Size by 2030 | USD 21.7 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 4.04% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

Protective Coatings Market Report Highlights

- On the basis of formulating technology, the solvent based segment is the leading segment and is expected to make the largest contribution to the protective coatings market. They are used extensively. The use of organic solvents made it considerably simpler to apply paint, allow it to cure, and create an even, long-lasting paint coat. However, as the solvents evaporate, they release Volatile Organic Compounds (VOCs), which smell bad and are hazardous to the environment. In humid conditions, coatings with a solvent base are advantageous. When opposed to water-based coatings, which perform worse in humid settings, solvent-based coatings require a lot less time to dry. Liquidizing agents, which are a component of solvent-based coatings, hasten drying time by a chemical reaction with ambient oxygen. Because of their nature, solvent-based coatings are simple to apply in a humid environment and at various temperatures.

- On the basis of resin type, the epoxy segment had the largest market share and is anticipated to keep growing during the projection period. The capacity of epoxy coatings to endure intense temperatures makes them highly valued. Epoxy also has the benefit of drying quickly, minimizing production pauses while the coating cures. Epoxy is also resistant to exposure to chemicals, all types of leaks, and surface scratches. This prevents the coating from deteriorating and needing maintenance.

- On the basis of end use industry, the infrastructure and construction segment is expected to be the largest segment. Preventing structures against solvents, dust, fungi, corrosion, humidity, and other threats that could compromise their stability and operation is the main goal of protective coatings. In addition to offering waterproofing solutions, protective coatings help stop water leaks. Buildings, dams, wells, bridges, floors, wood finishes, and external and interior walls may all function in demanding situations and circumstances attributable to protective coatings that act as a protective barrier.

Regional Snapshots

Asia-Pacific held dominant position and has largest share of protective coatings market. It is anticipated to increase rapidly during the forecast period as a result of significant infrastructure improvements. The region includes nations at various stages of economic development. Protective Coatings are used in a variety of end-use industries, including Civil Building & Infrastructure and Marine, which is primarily responsible for the region’s growth.

Due to rising government spending in infrastructure development projects, it is projected that infrastructure and building will increase in developing Asia Pacific countries like China and India. Among other things, these projects involve building bridges, trains, airports, and more. Hence, this region is expected to grow at highest rate.

Protective Coatings Market Dynamics

Drivers

On a massive scale, it is predicted that putting the existing corrosion management strategies into practice might result in yearly cost savings of between 15 and 35 percent. Depending on the type of environment they are exposed to, metals have a natural tendency to shift to a low energy state and so seek to form oxides, hydroxides, carbonates, sulfides, and other compounds.

Lightweight metals have become the material of choice in many industries. In the automotive, aerospace, and consumer goods industries, aluminum, titanium, and now even magnesium, have become essential materials. Due to their wide availability, exceptional strength-to-weight ratios, and versatility, they are a preferred solution for product engineers all over the world. Hence, increase in corrosion concerns in various end use industries is fueling the growth of the market across globe.

Restraints

Protective coatings are expensive, and the cost of producing them is rising along with the cost of energy. The price of raw materials has increased as a result of increasing crude oil prices and shifting foreign exchange rates. The cost of the raw materials used to make protective coatings varies greatly. The least costly of them is acrylic. The priciest kind of protective coatings are epoxies. Manufacturers must pay additional costs owing to increasing energy taxes on top of the pricing of raw materials, which leads to greater operational expense and lower margins of profit.

Also Read: Industrial Alcohol Market Dynamics

Opportunities

In addition to extending the lifespan of the current substrates, protective coatings are applied. There are systems that operate continuously in several sectors. A few of these involve the usage of harsh materials or exposure to changing climatic conditions. As a result, the equipment’s structure degrades or the process becomes less efficient, leading to the shutdown of the plant or a halt in all operations.

Protective coatings aid in averting these problems, saving on the expense of equipment repair and shutdown. Because seawater is corrosive, the marine industry is vulnerable to damage to boats, ships, and docks. In the marine industry, coatings like waterproofing coats and joints & crack filler coats are frequently utilised for maintenance. Hence, increasing demand for maintenance for existing substrates are becoming a boom in the market.

Challenges

Manufacturers have been forced to create products with low volatile organic compounds (VOCs), high solid content, and fewer toxic biocides as a result of increasingly strict rules limiting the use of protective coatings. REACH, Green Seal, the Solvent Emissions Directive (SED), and the Biocidal Products Directive (BPD) are tough environmental laws that regulate chemical registration, evaluation, authorization, and restraint as well as the emission of volatile organic compounds and hazardous air pollutants (hazardous air pollutants).

This has caused technical issues with the application of solvent-based coatings. The industries are changing their practices to employ more ecologically friendly coatings as a result of these laws. Development of new products that abide by these strict restrictions and make it profitable for industries, however, is a challenge. Hence, creation of affordable items while observing tight environmental restrictions that limit the market growth.

Recent Developments

- With COSCO shipping, Hong Kong’s top shipping company, Jotun has formed a joint venture. Both sides benefit from this enterprise in equal measure. The business combines Jotun’s cutting-edge, high-performance coatings technology with its infrastructure, industry, and knowledge, while Jotun retains its coveted COSCO reputation in China, the company’s most important market.

Why should you invest in this report?

If you are aiming to enter the global protective coatings market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for protective coatings are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030 so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Market Key Players:

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Jotun

- Akzo Nobel N.V.

- Kansal Paint Co., Ltd.

- Sika AG

- The Chemours Company

- Dulux Protective Coatings

- Oasis Paints

- Wacker Chemie AG

- Henkel AG & Co. KGaA

- NIPSEA GROUP

- Berger Paints

- Sherwin-Williams

- Hempel

Market Segmentations

By Formulating Technology

- Solvent based

- Water based

- Powder coatings

By Resin Type

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc

By End Use

- Infrastructure

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Commercial Real Estate

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Industrial Plants and Facilities

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Oil & Gas

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Power

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

- Mining

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Polyester

- Others

By Application

- Abrasion Resistance

- Chemical Resistance

- Fire Protection

- Heat Resistance

- Corrosion Resistance

- Pipe Coatings

- Tank Linings

- Others

Regions Covered

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1925

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com