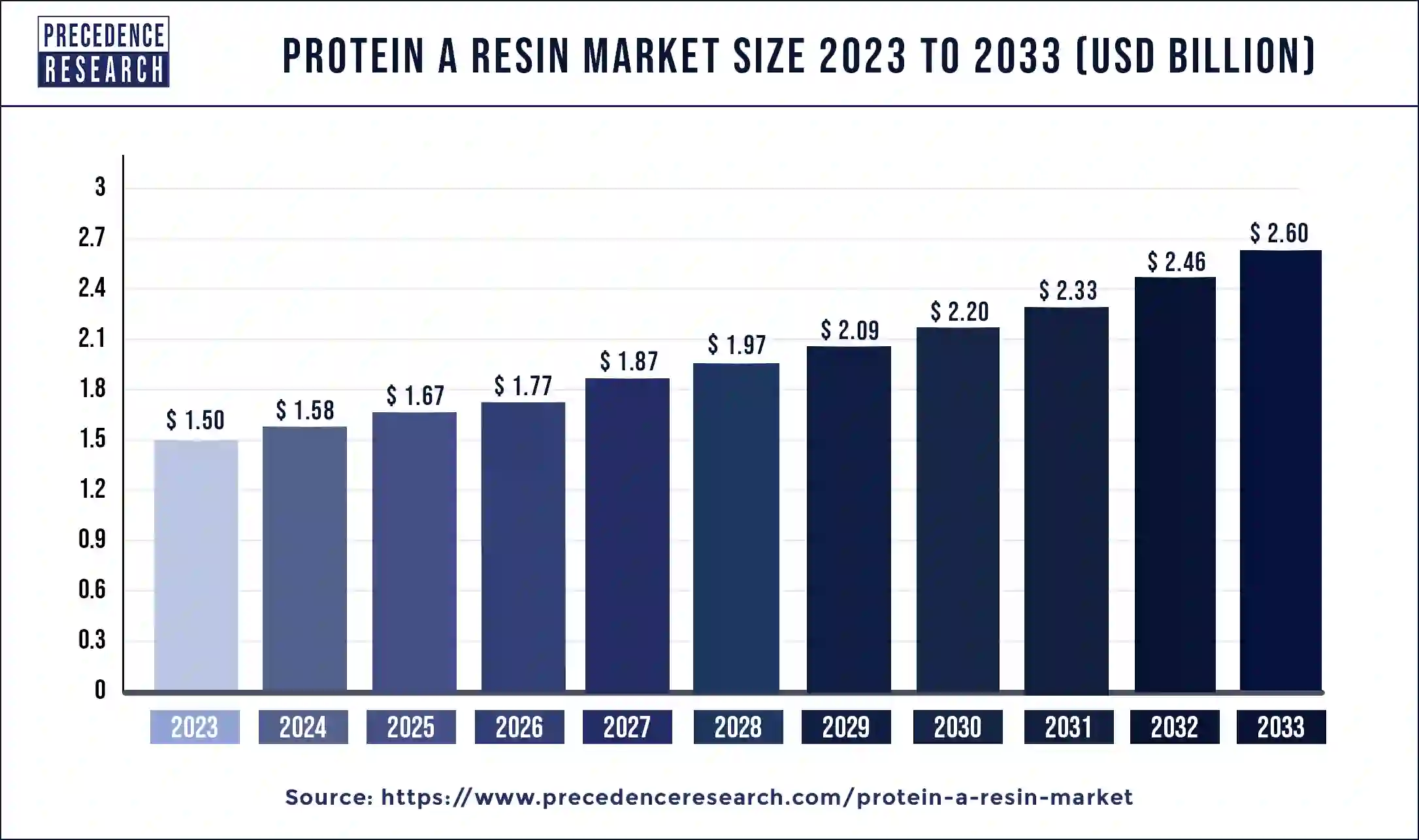

Protein A Resins Market Size to Surpass USD 2.60 Billion By 2033

The global protein A resins market size surpassed USD 1.50 billion in 2023 and is projected to worth be around USD 2.60 billion by 2033, growing at a CAGR of 5.65% from 2024 to 2033.

Key Points

- By region, North America led the protein A resins market with the largest market share of 42% in 2023.

- By region, Asia Pacific is expected to witness the fastest growth rate in the market during the forecast period.

- By application, the antibody purification segment dominated the protein A resins market in 2023 with market share of 60%.

- By product, the recombinant protein A segment had the largest share of around 58% in 20223.

- By matrix type, the agarose-based matrix segment dominated the market in 2023 with market share of 42.3%.

- By end-user, the pharmaceutical & biopharmaceutical companies segment dominated the market in 2023 with market share of 59%.

Protein A resins are an essential component in the field of biotechnology and pharmaceuticals, playing a crucial role in the purification of monoclonal antibodies (mAbs) and other biologics. The global market for Protein A resins has witnessed significant growth in recent years, driven by the increasing demand for biopharmaceuticals, advancements in protein purification technologies, and expanding applications in therapeutic and diagnostic areas.

Get a Sample: https://www.precedenceresearch.com/sample/4063

Growth Factors:

Several factors contribute to the growth of the Protein A resins market. Firstly, the rising prevalence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases has fueled the demand for biopharmaceuticals, including monoclonal antibodies. Protein A resins are indispensable in the downstream processing of these biologics, driving the market growth.

Moreover, technological advancements in protein purification techniques, such as improved chromatography resins and automated systems, have enhanced the efficiency, speed, and scalability of biologics manufacturing. This has led to increased adoption of Protein A resins by biopharmaceutical companies, contract manufacturing organizations (CMOs), and research institutions.

Additionally, the growing investments in research and development (R&D) by biopharmaceutical companies and academic institutions to develop novel biologics and biosimilars have bolstered the demand for Protein A resins. The expansion of biologics pipelines, coupled with the increasing outsourcing of bioprocessing activities, further drives the market growth.

Region Insights:

The Protein A resins market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates the market, owing to the presence of a well-established biopharmaceutical industry, favorable regulatory environment, and high healthcare expenditure. The United States, in particular, accounts for a significant share of the global Protein A resins market due to the presence of major biopharmaceutical companies and research institutions.

Europe is also a key region for the Protein A resins market, driven by the robust biotechnology sector, increasing investments in R&D, and supportive government initiatives. Countries such as Germany, the United Kingdom, and Switzerland are major contributors to the region’s market growth.

Asia-Pacific is poised to witness rapid growth in the Protein A resins market, fueled by the expanding biopharmaceutical industry, growing investments in healthcare infrastructure, and rising demand for biologics in emerging economies such as China, India, and South Korea. Moreover, initiatives to promote biotechnology innovation and attract foreign investments further stimulate market growth in the region.

Protein A Resins Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.65% |

| Global Market Size in 2023 | USD 1.50 Billion |

| Global Market Size in 2024 | USD 1.58 Billion |

| Global Market Size by 2033 | USD 2.60 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Product, By Matrix Type, By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Protein A Resins Market Dynamics

Drivers:

Several drivers propel the growth of the Protein A resins market. One of the primary drivers is the increasing adoption of biopharmaceuticals for the treatment of various diseases, including cancer, autoimmune disorders, and infectious diseases. Monoclonal antibodies, in particular, have gained prominence due to their specificity, efficacy, and reduced side effects compared to traditional small-molecule drugs.

Furthermore, the growing trend towards personalized medicine and targeted therapies has spurred the development of biologics tailored to individual patient needs. Protein A resins play a vital role in the purification of these biologics, driving their demand in the market.

Additionally, the expanding biopharmaceutical pipelines, driven by advancements in biotechnology and genomics, create a growing need for efficient and scalable protein purification technologies. Protein A resins offer high binding capacity, selectivity, and purity, making them a preferred choice for downstream processing in biologics manufacturing.

Opportunities:

The Protein A resins market presents several opportunities for manufacturers, suppliers, and other stakeholders. With the increasing demand for biopharmaceuticals and biologics, there is a growing need for innovative and cost-effective protein purification solutions. Manufacturers can capitalize on this opportunity by developing novel Protein A resins with improved performance characteristics, such as higher binding capacity, faster kinetics, and enhanced stability.

Moreover, there is a growing trend towards the development of biosimilars and biobetters, driven by the expiration of patents for originator biologics and the need to reduce healthcare costs. This presents an opportunity for suppliers of Protein A resins to collaborate with biosimilar developers and contract manufacturers to provide customized purification solutions and support the efficient production of biosimilars.

Furthermore, expanding applications of Protein A resins beyond monoclonal antibody purification, such as the purification of antibody-drug conjugates (ADCs), bispecific antibodies, and fusion proteins, present new growth avenues for market players. By diversifying their product portfolios and targeting niche applications, manufacturers can capitalize on emerging opportunities in the market.

Challenges:

Despite the favorable growth prospects, the Protein A resins market faces several challenges that could hinder its expansion. One of the primary challenges is the high cost associated with Protein A resins, which can contribute significantly to the overall production costs of biologics. Manufacturers and biopharmaceutical companies are continuously seeking ways to reduce production costs through process optimization, alternative purification methods, and the development of cost-effective Protein A resins.

Moreover, the limited availability of raw materials and production capacity constraints pose challenges to meeting the growing demand for Protein A resins. Fluctuations in raw material prices, supply chain disruptions, and geopolitical factors can impact the availability and affordability of Protein A resins, affecting market dynamics.

Additionally, concerns related to product quality, consistency, and regulatory compliance remain key challenges for manufacturers of Protein A resins. Ensuring the reproducibility and robustness of purification processes, maintaining product purity and integrity, and complying with stringent regulatory requirements are essential for market success and customer satisfaction.

Read Also: Cosmetovigilance Market Size to Reach USD 17.60 Bn by 2033

Recent Developments

- In March 2024, Ultomiris received an approval from the United States for the long-term C5 complement inhibitor for the diagnostics of geriatric patients having anti-aquaporin-4 (AQP4) antibody-positive (Ab+) neuromyelitis optica spectrum disorder.

- In March 2024, Merck, a leading player in the life science technology company expanded its M LabTM Collaboration Center in Shanghai, China, it is the organization’s biggest in the global network of 10 interconnected labs. The investment worth € 14 million was added for the new biology application lab an upstream application lab and a process development training center to its M LabTM Collaboration Center in Shanghai.

- In April 2024, BioArctic AB collaborated with Eisai and announced the organization submitted the supplemental Biologics License Application (sBLA) for its drug Leqembi to the United States Food and Drug Administration (FDA).

- In April 2024, the US FDA approved and authorized the latest antibody drug named Pemgarda marketed by the biotech Invivyd, to protect immunocompromised individuals from COVID-19.

- In April 2024, Kemp Proteins LLC, a leading company in gene-to-protein services and monoclonal antibody development announced the strategic collaboration with the Columbia Biosciences of Frederick, Maryland.

- In April 2024, Sino Biological introduced a series of in vitro bioassay services for maintaining antibody drug development projects. Sino Biological offers different reagents and a range of n vitro efficacy evaluation services for meeting the demand for testing practices and trends.

Protein A Resins Market Companies

- GE Healthcare

- Merck Millipore

- PerkinElmer, Inc.

- GenScript Biotech Corp.

- Agilent Technologies

- Repligen Corp.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Abcam PLC.

- Novasep Holdings SAS

Segments Covered in the Report

By Application

- Antibody purification

- Immunoprecipitation

By Product

- Recombinant protein A

- Natural protein A

By Matrix Type

- Agarose-based matrix

- Glass or silica gel-based matrix

- Organic polymer-based matrix

By End-user

- Pharmaceutical & Biopharmaceutical Companies

- Clinical research laboratories

- Academic research institutes

- Contract research organization

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/