Pulp and Paper – Potential Solutions for 2022-30

The global pulp and paper market size was estimated at USD 351.5 billion in 2021Paper and pulp is an important wood-based industry across globe. The industry is crucial to the socio-economic and ecologically sustainable growth of society.

The pulp and paper market of the global market is substantial and expanding. Production of pulp and paper has increased globally and will do so soon. Most of the pulp and paper mills are situated close to significant waterways and have access to a plentiful, consistent supply of water.

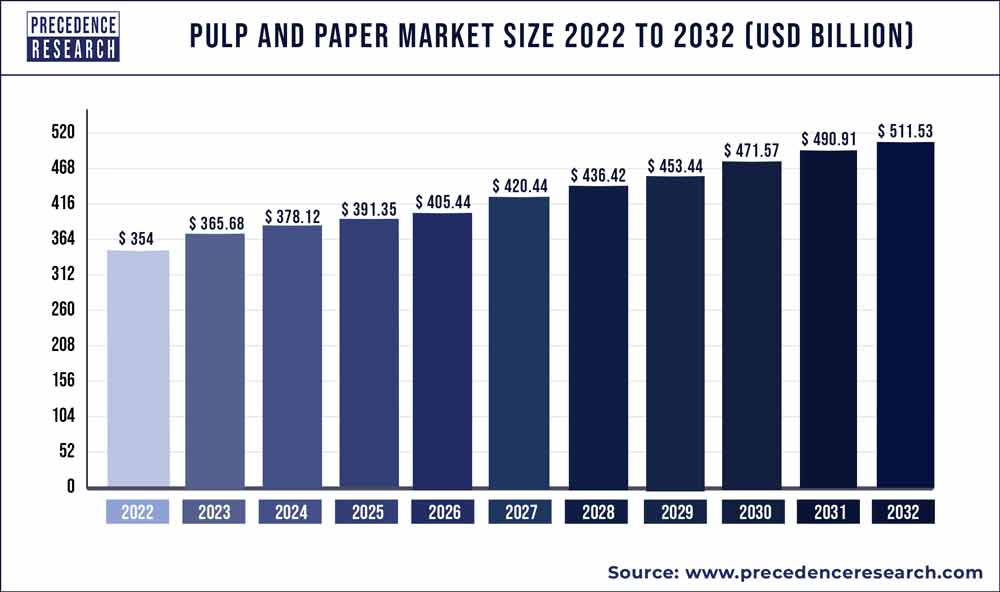

The value of the global pulp and paper market is expected to exceed USD 380.12 billion by 2030 at a compound annual growth rate of over 4 percent, from an estimated USD 354.57 billion in 2022, according to Canada-based Precedence Research.

Pulp and Paper Market Key Takeaway

- Asia Pacific pulp and paper market was valued at USD 173.86 billion in 2021

- The wrapping & packaging segment accounted market share of 52.4% in 2021

- The pulping process segment is growing at a registered CAGR of around 3.4% from 2022 to 2030

- The packaging segment is expected to grow at a CAGR of 4.9% from 2022 to 2030

- The Asia-Pacific region accounted largest revenue share 38% in 2021

Download Access to a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/1836

Pulp and Paper Market Scope

| Report Coverage | Details |

| Market Size by 2030 | USD 380.12 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 4% |

| Asia Pacific Market Share in 2021 | 38% |

| Wrapping & Packaging Segment Market Share in 2021 | 52.4% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Raw Material, Manufacturing Process, End Use, Category, Geography |

Pulp and Paper Market Highlights

- On the basis of raw material used, the wood-based segment hold the major share in the pulp and paper market. Wood pulp is the most often utilized component in the production of all sorts of high-quality paper. The worldwide wood pulp market is expanding as a result of rising consumer demand for tissue paper products as well as increased demand from the paper sector. Moreover, the growing problem of water scarcity and the usage of practical personal care and hygiene products in homes, workplaces, and commercial establishments are rising the market. It is also projected that the development of private label brands and innovations in paper industry will fuel the expansion of the global pulp and paper industry.

- On the basis of manufacturing process, the pulping process segment has the biggest market share in the pulp and paper industry. The goal of the pulping process is to remove lignin without sacrificing fiber strength, releasing the fibers and getting rid of contaminants that could lead to future disintegration of the paper.

- On the basis of end use industry, the packaging segment is expected to maintain its dominance in the coming years. The most environment friendly and recyclable packaging material currently on the market is paper. Due to growing environmental concerns, producers as well as customers are choosing more environmentally friendly paper packaging options. Packaging made of paper and paperboard are more palatable to customers than plastic since they are more sustainable and biodegradable.

- Paper and paperboard packaging are recyclable, reusable, energy-efficient, and resource-conserving, among other attributes that make them environmentally beneficial. Therefore, the environmental advantages of paper and paperboard containers will encourage businesses in numerous industries, including retail, to embrace these products, which will propel the global paper and paperboard container and packaging market.

Pulp and Paper Market Dynamics

Drivers

The most environmentally friendly and recyclable packaging material currently on the market is paper. Due to growing environmental concerns, producers as well as customers are choosing more environmentally friendly paper packaging options. Leading food, cosmetics, and FMCG industries work closely with paper producers to develop cutting-edge paper packaging solutions in order to fulfil their sustainability goals.

For instance, as part of the company’s promise to make all of its packaging recyclable by the end of 2025, L’Oreal Group and Albea Group debuted paper-based cosmetic tubes in 2019. Nestle SA also began to introduce its products in recyclable paper packaging in 2019. During the anticipated term, this is anticipated to support the expansion of the pulp and paper industry.

Several foreign governments have established a number of rules regarding the use of traditional plastics in an effort to develop a sustainable means of being environmentally friendly. And as a feasible and affordable alternative to plastic bags, the demand for paper bags has soared. Retailers, supermarkets, and storage vendors are more likely to accept paper-based packaging as a result of all these rules and regulations.

Also Read: Recombinant DNA Technology – The Demand and the Way Forward

Restraints

Forest-sourced wood is heavily used by the paper industry. The Food and Agriculture Organization estimates that there was a net loss of 33 million hectares of forest between 2000 and 2015. Additionally, authoritarian governments enforced stringent restrictions on the use of wood from forested areas.

Additionally, the production of an A4-size paper sheet requires about 20 liters of water, making pulp and paper one of the industries with the highest water consumption rates overall. Consequently, ensuring ongoing raw material and resource supply is a critical problem for the growth of the market due to increasing deforestation and the water crisis.

Opportunities

For some consumers, the availability of recycled pulp and paper items is a cope. As a result, recyclable products are more prevalent. This has been difficult because some products had coatings that were difficult to recycle and waterproof. The usage of recyclable protective coatings is currently being promoted, and this trend will only grow in the coming years. The European Union is now involved in the plastic packaging industry as a result of the growing concern over the amount of packaging that cannot be recycled. Future potential for pulp and paper are vast.

The expansion of food delivery services is associated with growth in the thermal market. Particularly, there is a boom in third-party delivery service providers as well as a rise in the number of eateries that offer delivery choices. As a result, there is now and will continue to be a need for thermal packaging. There will be a booming thermal industry in pulp and paper as long as people anticipate having hot food delivered to their homes quickly.

Challenges

The printing industry is evolving, and many publishing companies have replaced previously printed volumes with electronic ones. E-books, online newspapers, and magazines dominate their respective markets, while directories, catalogues, and brochures also have electronic alternatives.

As more transactions take place electronically, demand for cash and checks is decreasing, and advertising spending is expanding into new media, such as the internet. These factors, together with the ongoing development of social networking, are a factor in the declining sales of a number of print products, including periodicals, catalogues, novels, and more.

Key market players

- International Paper

- Georgia-Pacific Corporation

- Nine Dragon Paper (Holdings) Ltd.

- Stora Enso Oyj (Helsinki, Finland)

- Sappi Limited

- Kimberly-Clark Corporation

- UPM-KymmeneOyj

- Svenska CellulosaAktiebolaget (SCA)

- Oji Holding Corporation

- Nippon Paper Industries Co., Ltd.

- The Smurfit Kappa Group

- WestRock

Segments covered in the report

By Raw Material

- Wood-Based

- Agro Based

- Recycled Fibre Based

By Manufacturing Process

- Pulping Process

- Chemical Pulping

- Chemi-Mechanical Pulping

- Others

- Bleaching Process

- Chlorine Bleaching

- Elemental Chlorine Free (ECF) Bleaching

- Total Chlorine Free (TCF) Bleaching

- Others

By End Use Industry

- Packaging

- Healthcare

- Food & Beverages

- Personal Care

- Other

- Printing

- Commercial Printing

- Packaging Printing

- Publication Printing

- Building and Construction

- Residential

- Commercial

- Industrial

- Infrastructural

- Others

By Category

- Wrapping & Packaging

- Printing & Writing

- Sanitary

- News Print

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pulp and Paper Market

5.1. COVID-19 Landscape: Pulp and Paper Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pulp and Paper Market, By Raw Material

8.1. Pulp and Paper Market, by Raw Material, 2022-2030

8.1.1. Wood-Based

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Agro Based

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Recycled Fibre Based

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Pulp and Paper Market, By Manufacturing Process

9.1. Pulp and Paper Market, by Manufacturing Process, 2022-2030

9.1.1. Pulping Process

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Bleaching Process

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Pulp and Paper Market, By End Use

10.1. Pulp and Paper Market, by End Use, 2022-2030

10.1.1. Packaging

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Printing

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Building and Construction

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Pulp and Paper Market, By Category

11.1. Pulp and Paper Market, by Category, 2022-2030

11.1.1. Wrapping & Packaging

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Printing & Writing

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Sanitary

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. News Print

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Pulp and Paper Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.1.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.1.3. Market Revenue and Forecast, by End Use (2017-2030)

12.1.4. Market Revenue and Forecast, by Category (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.1.5.3. Market Revenue and Forecast, by End Use (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Category (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.1.6.3. Market Revenue and Forecast, by End Use (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Category (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.2.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.2.3. Market Revenue and Forecast, by End Use (2017-2030)

12.2.4. Market Revenue and Forecast, by Category (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.2.5.3. Market Revenue and Forecast, by End Use (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Category (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.2.6.3. Market Revenue and Forecast, by End Use (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Category (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.2.7.3. Market Revenue and Forecast, by End Use (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Category (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.2.8.3. Market Revenue and Forecast, by End Use (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Category (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.3.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.3.3. Market Revenue and Forecast, by End Use (2017-2030)

12.3.4. Market Revenue and Forecast, by Category (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.3.5.3. Market Revenue and Forecast, by End Use (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Category (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.3.6.3. Market Revenue and Forecast, by End Use (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Category (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.3.7.3. Market Revenue and Forecast, by End Use (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Category (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.3.8.3. Market Revenue and Forecast, by End Use (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Category (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.4.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.4.3. Market Revenue and Forecast, by End Use (2017-2030)

12.4.4. Market Revenue and Forecast, by Category (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.4.5.3. Market Revenue and Forecast, by End Use (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Category (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.4.6.3. Market Revenue and Forecast, by End Use (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Category (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.4.7.3. Market Revenue and Forecast, by End Use (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Category (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.4.8.3. Market Revenue and Forecast, by End Use (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Category (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.5.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.5.3. Market Revenue and Forecast, by End Use (2017-2030)

12.5.4. Market Revenue and Forecast, by Category (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.5.5.3. Market Revenue and Forecast, by End Use (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Category (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Raw Material (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Manufacturing Process (2017-2030)

12.5.6.3. Market Revenue and Forecast, by End Use (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Category (2017-2030)

Chapter 13. Company Profiles

13.1. International Paper

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Georgia-Pacific Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Nine Dragon Paper (Holdings) Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Stora Enso Oyj (Helsinki, Finland)

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Sappi Limited

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Kimberly-Clark Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. UPM-KymmeneOyj

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Svenska CellulosaAktiebolaget (SCA)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Oji Holding Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Nippon Paper Industries Co., Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Why should you invest in this report?

If you are aiming to enter the global pulp and paper market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for pulp and paper are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030 so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1836

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com