Pulse Ingredients Market Size to Worth USD 29.67 Bn By 2033

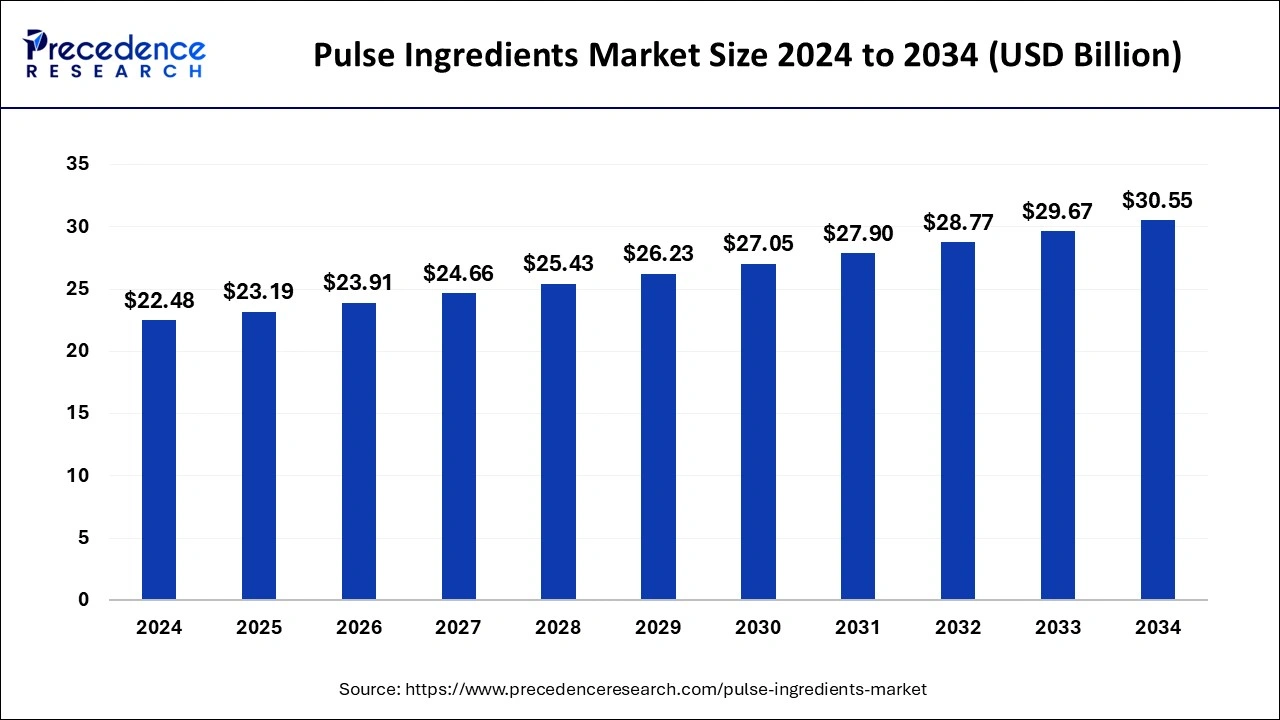

The global pulse ingredients market size is expected to increase USD 29.67 billion by 2033 from USD 21.80 billion in 2023 with a CAGR of 3.13% between 2024 and 2033.

Key Points

- Asia Pacific dominated with the largest revenue share of 34% in 2023.

- By source, the chickpeas segment has held a biggest revenue share of 37% revenue share in 2023.

- By application, the food & beverages segment has held a major revenue share of 45% in 2023.

- By type, the pulse flour segment has contributed more than 36% in 2023.

- By type, the pulse protein segment is expected to grow fastest during the forecast period.

The pulse ingredients market encompasses a diverse range of products derived from pulses such as lentils, chickpeas, peas, and beans. These ingredients are valued for their nutritional benefits, sustainability, and versatility in various food applications. Pulse ingredients are rich sources of protein, fiber, vitamins, and minerals, making them increasingly popular among health-conscious consumers seeking plant-based alternatives. The market is driven by growing awareness of plant-based diets, rising demand for clean label ingredients, and advancements in processing technologies that enhance the functionality and appeal of pulse ingredients in food and beverage formulations.

Get a Sample: https://www.precedenceresearch.com/sample/4454

Growth Factors:

The pulse ingredients market is experiencing robust growth driven by several key factors. Firstly, the increasing adoption of vegetarian and vegan diets globally has propelled demand for plant-based protein sources like pulses. Pulses are recognized for their high protein content, which appeals to consumers looking to reduce meat consumption without compromising on nutritional intake. Moreover, the sustainability aspect of pulses, including their ability to fix nitrogen in soil and reduce greenhouse gas emissions compared to animal protein sources, has further bolstered their popularity.

Advancements in processing techniques have also expanded the application potential of pulse ingredients. Technologies such as micronization, extrusion, and fractionation have improved the functionality, flavor profile, and texture of pulse-derived products, making them suitable for a wider range of food and beverage applications. This has opened up new opportunities in sectors such as bakery, snacks, meat analogues, and nutritional supplements, driving market growth.

Region Insights:

The pulse ingredients market exhibits regional variations influenced by dietary habits, agriculture practices, and economic factors. North America and Europe lead in consumption due to the strong presence of health-conscious consumers and established food processing industries. These regions also prioritize sustainable sourcing practices, contributing to the adoption of pulse ingredients. In Asia-Pacific, countries like India and China are significant producers and consumers of pulses, contributing to a robust market for pulse ingredients driven by traditional cuisines and increasing health awareness.

Latin America and Africa are emerging regions in the pulse ingredients market, characterized by growing agricultural production of pulses and rising awareness of their nutritional benefits. These regions offer potential growth opportunities as global food manufacturers seek to diversify sourcing and cater to local tastes and preferences.

Pulse Ingredients Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 21.80 Billion |

| Market Size in 2024 | USD 22.48 Billion |

| Market Size by 2033 | USD 29.67 Billion |

| Market Growth Rate | CAGR of 3.13% from 2024 to 2033 |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Source, Application, Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pulse Ingredients Market Dynamics

Drivers:

Several drivers propel the pulse ingredients market forward. Increasing consumer awareness of health and wellness benefits associated with pulses, such as cholesterol reduction and weight management, drives demand. Additionally, regulatory support for sustainable agricultural practices and clean label ingredients encourages food manufacturers to incorporate pulse ingredients into their products.

The versatility of pulse ingredients in various food applications is another significant driver. Pulses can be used to enhance the nutritional profile of products like bread, pasta, snacks, and beverages while providing functional benefits such as improved texture, binding properties, and extended shelf life. As consumer preferences shift towards natural, minimally processed foods, pulse ingredients offer a viable solution for formulators seeking to meet these demands.

Opportunities:

The pulse ingredients market is ripe with opportunities for growth and innovation. Expansion into new product categories such as plant-based meat alternatives and gluten-free products presents avenues for market players to capitalize on shifting dietary preferences. Moreover, the development of value-added pulse ingredients, including concentrates, isolates, and flours with enhanced nutritional profiles and functional properties, opens doors to premium market segments.

Collaborations between food manufacturers and agricultural stakeholders to improve pulse cultivation practices and ensure a sustainable supply chain present opportunities to strengthen market position and meet evolving consumer expectations for transparency and ethical sourcing. Furthermore, the emergence of online retail platforms and direct-to-consumer channels provides avenues to reach a broader audience and educate consumers about the benefits of pulse ingredients.

Challenges:

Despite the promising growth prospects, the pulse ingredients market faces several challenges. Variability in crop yields due to environmental factors and susceptibility to pests and diseases pose risks to supply chain stability and pricing. Additionally, the need for significant investments in research and development to innovate new processing technologies and improve sensory attributes such as taste and texture presents challenges for market players.

Consumer perception and acceptance of pulse-based products in certain regions remain a barrier to market expansion. Educating consumers about the nutritional benefits and culinary versatility of pulse ingredients is crucial to overcoming resistance and fostering widespread adoption. Moreover, navigating regulatory requirements and ensuring compliance with food safety standards across different markets adds complexity and operational costs for manufacturers operating on a global scale.

Read Also: Healthcare Interoperability Solutions Market Size, Growth, Report 2033

Recent Developments

- In February 2024, Protein Industries Canada declared that it will be investing in the development of novel ingredients and consumer food choices. As part of the experiment, Big Mountain Foods, Danone Canada, and Old Dutch will substitute several conventional ingredients and processing aids in their respective products with novel oat and pulse ingredients developed by Avena Foods. As a result, customers will have access to additional options, such as allergy-friendly substitutes.

- In January 2024, The National Agricultural Cooperative Marketing Federation of India and the National Cooperative Consumers’ Federation of India (NCCF) will be able to buy tur dal (pigeon pea) directly from registered farmers thanks to a portal that the Indian government launched in an effort to make the country’s pulse supply self-sufficient. The Indian Home Minister opened the webpage. It will make it easier to register, buy, and pay farmers directly for their Tur Dal. He added that India won’t need to import any pulses by January 2028.

- In June 2023, Banza announced the launch of frozen waffles made with chickpeas.

- In June 2023, Kraft Heinz announced the introduction of chickpea-based vegan cheese slices. The business and AI brand NotCo have teamed to introduce a line of vegan cheese slices.

Pulse Ingredients Market Companies

- Roquette Freres

- ADM

- Emsland Group

- The Scoular Company

- Anchor Ingredients

- Batory Foods

- Dakota Ingredients

- Cargill

- Diefenbaker Spice & Pulse

- Cosucra

- Vestkorn

- AM Nutrition

- Avena Foods

- HUA THAI

- Aminola

- Herba Ingredients

- NutriPea

- Ebro Ingredients

- Ingredion Inc.

- Emsland Group

- Coscura; Puris

- Axiom Foods, Inc.

- AGT Food & Ingredients

Segments Covered in the Report

By Source

- Lentils

- Peas

- Chickpeas

- Beans

By Application

- Food & Beverage

- Feed

- Others

By Type

- Pulse Flour

- Pulse Starch

- Pulse Protein

- Pulse Fiber & Grits

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/