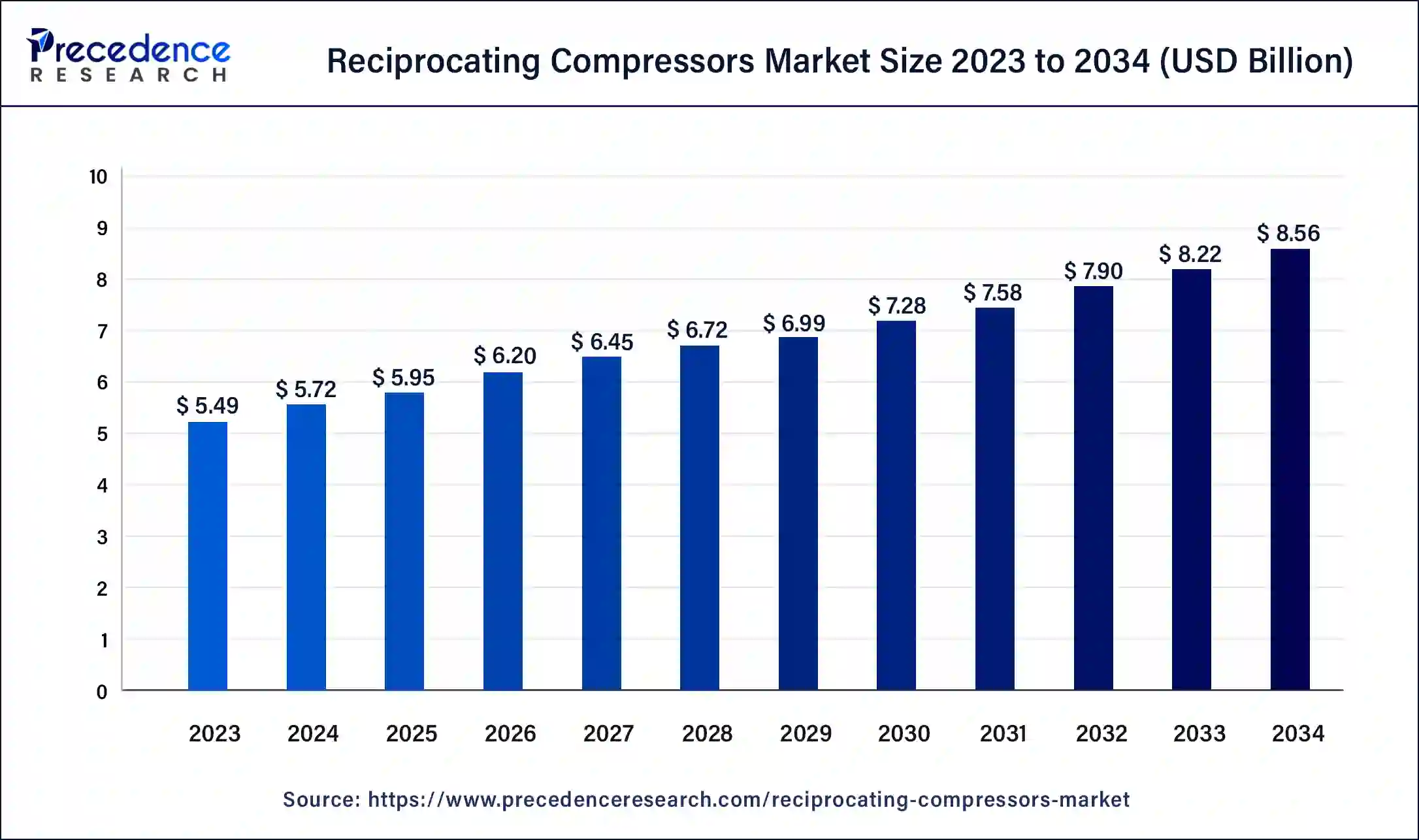

Reciprocating Compressors Market Size to Achive USD 8.56 Bn by 2034

The global reciprocating compressors market size accounted for USD 5.72 billion in 2024 and is predicted to achieve around USD 8.56 billion by 2034, at a CAGR of 4.12% over the forecast period 2024 to 2034.

The reciprocating compressors market plays a crucial role in various industries, including oil & gas, chemical, petrochemical, and food & beverage. These compressors are widely used for their ability to handle high pressures and offer flexibility across a range of capacities. Reciprocating compressors work by using a piston-driven mechanism to compress gas, making them suitable for tasks where continuous, heavy-duty compression is required. The market is growing steadily, driven by the rising demand for efficient and reliable compression systems, especially in developing economies where industrial activities are expanding. Technological advancements have led to the development of more energy-efficient and low-maintenance compressors, which further boosts market demand.

Reciprocating Compressors Market Key Insights

- Asia Pacific dominated the reciprocating compressors market with the highest market share of 42% in 2023.

- North America is predicted to grow at a CAGR of 3.03% during the forecast period.

- By type, the stationary segment has held a biggest market share of 58% in 2023.

- By type, the portable segment is anticipated to grow at a CAGR of 4.52% during the coming years.

- By lubrication, the oil-free segment contributed the largest market share of 63% in 2023.

- By stage type, the multi-stage segment dominated the market globally in 2023.

- By acting type, the double-acting segment dominated the reciprocating compressors market in 2023.

- By end-user, the manufacturing segment led the market in 2023.

Reciprocating Compressors Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.56 Billion |

| Market Size in 2024 | USD 5.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.12% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Lubrication, Stage Type, Acting Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Reciprocating Compressors Market Dynamics

Market Drivers

One of the major drivers for the reciprocating compressors market is the increasing demand from the oil & gas sector, particularly for natural gas transportation and storage. The growth in industrialization, especially in emerging economies, has created a surge in demand for reliable compressors in industries such as chemicals, petrochemicals, and power generation. Additionally, the increased focus on energy efficiency and reducing emissions is pushing manufacturers to develop more advanced, energy-efficient reciprocating compressors. The expansion of gas-based power plants and the rise in natural gas production also contribute to the growing demand for these compressors.

Market Restraints

Despite the positive outlook, the market faces several restraints. Reciprocating compressors tend to be bulky and require frequent maintenance, which can be costly. They are also less suitable for applications requiring continuous compression, which can limit their use in certain sectors. Additionally, the market is witnessing increased competition from alternative compressor technologies like centrifugal and rotary screw compressors, which offer lower maintenance requirements and are better suited for continuous operations. These factors pose challenges for market growth, particularly in sectors that prioritize operational efficiency and lower maintenance costs.

Market Opportunities

There are significant opportunities in the reciprocating compressors market, particularly in the developing regions where industrialization is growing rapidly. The increasing focus on natural gas as a cleaner energy source is expected to boost the demand for gas compression, thus driving the market. Furthermore, innovations in compressor technologies, such as the development of oil-free compressors and advancements in digital monitoring and control systems, present opportunities for manufacturers to cater to more specialized and demanding applications. The trend towards sustainability and energy efficiency in industries also presents an opportunity for the development of eco-friendly compressors with low emissions.

Regional Insights

In terms of regional insights, Asia-Pacific dominates the reciprocating compressors market, driven by the rapid industrialization and urbanization in countries like China and India. These countries are seeing a rise in oil & gas exploration activities, as well as increased infrastructure development, leading to high demand for reciprocating compressors. North America is another key market, particularly with its strong oil & gas industry, and its ongoing investments in natural gas infrastructure. The region’s well-established chemical and petrochemical sectors also support demand. Europe is expected to witness moderate growth due to stringent environmental regulations, pushing the adoption of energy-efficient systems. The Middle East and Africa region is anticipated to see growth as well, particularly due to oil & gas activities and the rising need for gas compression in power generation and transportation.

Read Also: Pressure Transducer Market Size to Attain USD 29.80 Bn by 2034

Reciprocating Compressors Market Companies

- Ariel Corporation

- Atlas Copco

- Burckhardt Compression Ag

- Gardner Denver Holdings Inc.

- GE Company

- IHI Corporation Ltd.

- Siemens AG

- Mitsui E&S Holdings Co., Ltd.

- Howden Group Ltd.

- Mayekawa Mfg. Co, Ltd.

Recent Developments

- In May 2024, SIAD Group company’s SIAD Macchine Impianti launched the 550-bar, oil-free, high-pressure hydrogen compressor, specially produced for the transportation and hydrogen refueling station industries. The company said it is a sustainable mobility supply chain.

- In April 2024, Frascold, an Italian compressor manufacturer, launched the TK HD series, the latest product in the transcritical CO2 (R744) semi-hermetic reciprocating compressors. The new product is available in 34 models and offers refrigeration capacities between 3.7 and 72kW with the selection of one or two motors with a power range from 3 to 50HP.

- In June 2024, Hitachi Industrial Equipment Systems Co., Ltd. announced the launch of the “Predictive Diagnosis Service” for the factory equipment. The equipment uses machine learning algorithms for detecting and analyzing the data through remote monitoring and combines the knowledge accumulated by the Hitachi Industrial Equipment Systems maintenance staff to prevent and detect abnormalities in the system that may result in equipment stoppages in advance.

Segments Covered in the Report

By Type

- Portable

- Stationary

By Lubrication

- Oil-free

- Oil Filled

By Stage Type

- Single Stage

- Multi-stage

By Acting Type

- Single Acting

- Double Acting

- Diaphragm

By End-user

- Oil & Gas

- Pharmaceutical

- Chemical Plants

- Refrigeration Plants

- Manufacturing

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344