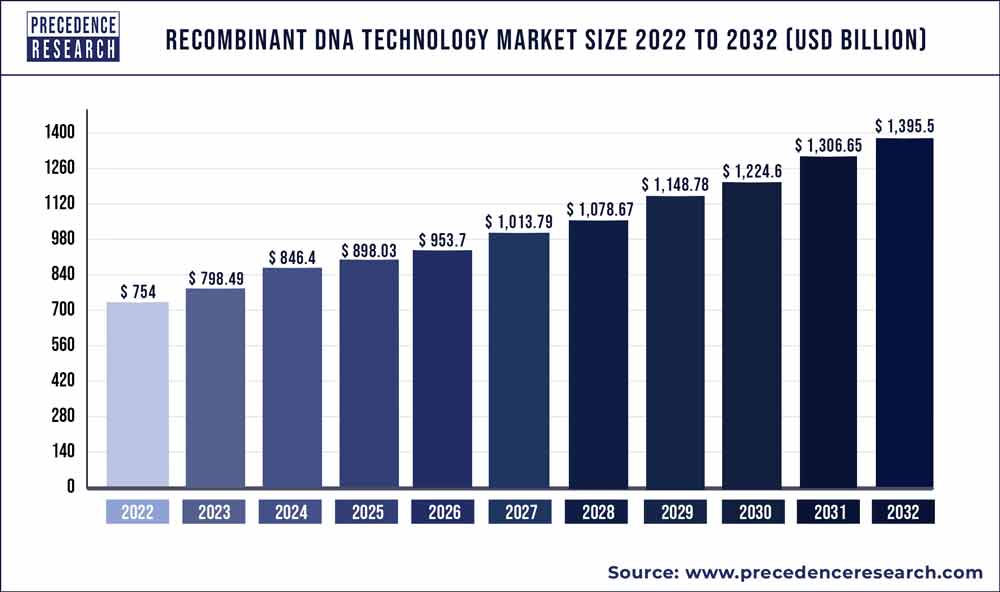

The value of the global recombinant DNA technology market is expected to exceed USD 1079 billion by 2030 at a compound annual growth rate of over 5.09 percent, from an estimated USD 725 billion in 2022, according to Canada-based Precedence Research.

- North America accounted largest revenue share of around 51% in 2021

- In 2021, the Europe region garnered a market share of around 24%

The recombinant DNA technology is the manipulation or the alteration of the sequences of the DNA in the human body or other organisms. These genetically modified organisms are able to have better surviving chances even in the worst conditions. Genetic modifications are able to provide better productivity when it comes to the agriculture. This technology has been used largely in the pharmaceutical and the medical industry.

The use of this technology is expected to grow in the coming years due to its use in biotechnology. The development of various vaccines through the use of this technology has created a great demand.

Recent Developments

- In order to prevent the infections that are caused by the hepatitis B virus and its subtypes, a vaccination was developed in the year 2022. VBI Vaccines Head introduced the vaccine in the market for the adults. PreHevbrio was launched by this organization in the US. This company also received an approval for the 3-antigen HBV vaccine in the year 2022. This vaccine will provide immunization against hepatitis B virus.

Recombinant DNA Technology Market Scope of the Report

| Report Attributes | Details |

| Market Size in 2021 | USD 725.14 Billion |

| Revenue Forecast by 2030 | USD 1079 Billion |

| CAGR | 5.09% from 2022 to 2030 |

| Largest Market | North America |

| Base Year | 2021 |

| Forecast Year | 2022 to 2030 |

Download Access to a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/1907

Recombinant DNA Technology Highlights

- By products, the medical segment is expected to have the largest market share due to the production of various vaccines and recombinant proteins with the use of genetic engineering. Increased use of this technology in crops is also expected to grow in the coming years period

- By components, the expression systems is expected to have a larger market share. Apart from the use of bacteria, mammals and the insects as expression systems there is also an increased use of plants in this technology.

- By application, the health and diseases segment is expected to have a dominant position during the forecast period. As there is a growing demand for various drugs and vaccines that help in the betterment of the health of the consumers the market is expected to grow in the coming years period apart from the use of this technology in the manufacturing of drugs used for human beings there is also a growing demand for the use of this technology in treating animals.

- Increased population is expected to drive the market growth for this technology in improvement of the crops. The pharmaceutical and biotechnology industry will have and as lated growth in the coming years. There has been a growth in the expenditure made although development of various technologies that shall be helpful for the human beings in the coming years.

Regional snapshots

The North American region is expected to have a dominant position in the coming years period this region has had a largest market share 51% in 2021. This region is expected to generate maximum revenue as compared to the other regions across the globe. As many major market players are based in the United States this region is expected to be favorable for the growth of this technology.

The presence of the regulatory bodies or the authority for the approval of various products that make use of the technology are also present in the United States. This technology is used in developing crops that are of a genetically modified way. This technology is also used largely in the manufacturing of various biofuels and bio pesticides. Increased use of recombinant DNA technology gene therapy it’s also expected to help in the growth of the market in the coming years.

The European region is also expected to hold a good position in the coming years. The ability of better infrastructure for research and development activities in the North American region and the European region are expected to drive the market growth in the coming years.

As there has been an increase in the amount of investments made by the governments of various nations across the North American region and the European region the quality of various health care facilities is expected to improve during the forecast period. Increase in the number of collaborations and the penetration in the developing nations is expected to provide better opportunities for growth in the coming years.

Recombinant DNA Technology Market Dynamics

Drivers

As far as we know growing demand and good adoption of the biopesticides which are manufactured using the recombinant DNA technology and the use of genetically modified crops the market for recombinant DNA technology is expected to grow well in the coming years. Increased use of this technology for the treatment of the chronic diseases is also expected to drive the market growth in the coming years.

The products developed through the use of this technology have proven effectiveness which is expected to garner larger market in the coming years. As that has been a great demand for improving the output or the production capacity of the recombinant protein it will be a major driving factor for the growth of the market during the forecast.

Increase research and development has provided with many drugs for the treatment of various diseases and these drugs are receiving approval from the Food and Drug administration of the United States. The approval for various drugs through the FDA has created a sense of safety in the consumers and all of these reasons are expected to be the major driving factors for the growth of the market in the coming years

Also Read: Cold Chain Logistics Market Size USD 801.26 Bn by 2030

Restraints

The increased use of genetic engineering or the recombinant DNA technology in gene therapy has a few risks. The rules and regulations which are associated with the approval of these therapies happen to be extremely stringent. And this happens to be a major restraint in the growth of the market. The major market players are currently seeking ways for producing or having genetically engineered products that may pass and get the approval of the regulatory authority.

Opportunities

In order to capture a large number of markets the North American and the European regions are +-focusing on expanding their business to the remote locations. The focus on entering remote markets will provide better opportunities for growth. It will also provide affordable infrastructure which will be extremely beneficial in the research activities.

Challenges

One of those challenges faced by this market is the gene pollution. There is also a growing concern due to various allergies or reactions caused due to the use of this technology in the manufacturing of various pharmaceutical compounds. There is also an increased risk of cross contamination which may affect the environment in a negative manner. Increased use of this technology in genetic modification because many ecological disasters in the coming years.

Key market players

- Pfizer

- Sanofi

- New England Biolabs

- GlaxoSmithKline plc

- GenScript

- Thermo Fisher Scientific, Inc.

- Biogen, Inc.

- Merck & Co., Inc.

- Profacgen

- Amgen, Inc.

- Monsanto Company

Segments covered in the report

By Product

- Medical

- Therapeutic Agent

- Human Protein

- Vaccines

- Non-Medical

- Biotech Crops

- Specialty Chemicals

- Others

By Component

- Expression System

- Mammalian

- Bacteria

- Yeast

- Baculovirus/Insect

- Cloning Vector

By Application

- Health and disease

- Human

- Animal

- Food and Agriculture

- Environment

- Others

By End User

- Pharmaceutical and biotechnology companies

- Research institutes

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Why should you invest in this report?

If you are aiming to enter the global recombinant DNA technology market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for recombinant DNA technology are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2022-2030 so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Recombinant DNA Technology Market

5.1. COVID-19 Landscape: Recombinant DNA Technology Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Recombinant DNA Technology Market, By Product

8.1. Recombinant DNA Technology Market, by Product, 2022-2030

8.1.1. Medical

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Non-Medical

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Recombinant DNA Technology Market, By Component

9.1. Recombinant DNA Technology Market, by Component e, 2022-2030

9.1.1. Expression System

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Cloning Vector

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Recombinant DNA Technology Market, By Application

10.1. Recombinant DNA Technology Market, by Application, 2022-2030

10.1.1. Health and disease

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Food and Agriculture

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Environment

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Recombinant DNA Technology Market, By End User

11.1. Recombinant DNA Technology Market, by End User, 2022-2030

11.1.1. Pharmaceutical and biotechnology companies

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Research institutes

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Others

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Recombinant DNA Technology Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.4. Market Revenue and Forecast, by End User (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End User (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End User (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.4. Market Revenue and Forecast, by End User (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End User (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End User (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End User (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End User (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.4. Market Revenue and Forecast, by End User (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End User (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End User (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End User (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End User (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.4. Market Revenue and Forecast, by End User (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End User (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End User (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End User (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Component (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End User (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.4. Market Revenue and Forecast, by End User (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End User (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Component (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End User (2017-2030)

Chapter 13. Company Profiles

13.1. Pfizer

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sanofi

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. New England Biolabs

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. GlaxoSmithKline plc

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. GenScript

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Thermo Fisher Scientific, Inc

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Biogen, Inc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Merck & Co., Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Profacgen

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Amgen, Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1907

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com